🔋1 Year Of Better Batteries

What's going on with solar prices, nutrition advice, nuclear waste, and consumer price inflation?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Hello everyone, thank you all for joining me through Better Batteries this year. It’s been a fantastic journey for me so far and I’m thrilled to see it going well. I genuinely enjoy doing the research and writing about various topics relating to batteries and the energy industry, stretching as far as materials mining and processing, government policies, electric vehicles, economics, history, and more! I had no idea if the project would gain any ground but together, this newsletter has grown from zero to almost 600 subscribers! Thank you so much! If you enjoyed any of my articles from year one, consider telling someone else who may be interested.

While I’m tremendously grateful to have more people around to read my work, I am not satisfied. My goal is to improve my writing, research, and content to provide more value to my readers in the year to come whether it be more topics, deeper insights, and/or better quality. Maybe we can reach a greater audience too.

Each weekly article tends to have a singular focus and message which varies from week to week, sometimes broken up into multi-part series. This week I will introduce a different style of article. To start of year two, here are some seemingly random mini topics that have caught my eye recently, but haven’t warranted full articles in themselves. Enjoy!

Solar Prices

Bloomberg reports that polysilicon prices continue to tick lower. Inflation had taken a stranglehold on solar materials just like a prices in many other industries. Is this price action *truly* positive for the industry though? Certainly lower prices bring in some new demand for the product, but falling prices could in fact be a sign of reduced demand for solar projects. US solar instillations fell 23% this year, in part due to supply issues and concerns about origin of the solar cells. Lower demand means lower prices. Another driving factor for the price of a product are input costs. In China where ~80% of polysilicon is produced, the input costs are largely oil and coal which have seen similar decreasing prices in the back half of 2022. Combine this with potentially enhanced output from China after reopening and the polysilicon price action is doing what you would expect.

Other factors could be global demand slowing in general during recession-like or slowing economic conditions. Based on PMI as seen below, which is a very general indicator of global economic activity, the economy is indeed slowing.

The Manufacturing ISM Report On Business is based on data compiled from purchasing and supply executives nationwide. A PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining.

Generally, prices tend to fall in recession and if we get one in 2023 this could be another vital factor to contend with. I would reckon the price of polysilicon would follow suit during such a condition. If the economy remains robust and China reopening spurs higher demand in general causing energy prices to rise again, this may be a headwind against the low cost of solar though. It will be an interesting year ahead.

Nuclear Waste

Nuclear waste is probably the biggest fear for the general publics about nuclear energy. I’ve talked to people adamant that the danger and containment outweighs any positives that may come. Many times people aren’t aware of the small size of nuclear fuel rods, how little waste has been generated so far, or how safe nuclear waste can be if the right protocols are followed. Don’t just take my word for it, take a read through the above twitter thread from an expert in the field. Here’s a response to the widespread seen clip of geopolitical expert Peter Zeihan talking about nuclear energy as well.

“Healthy” Food

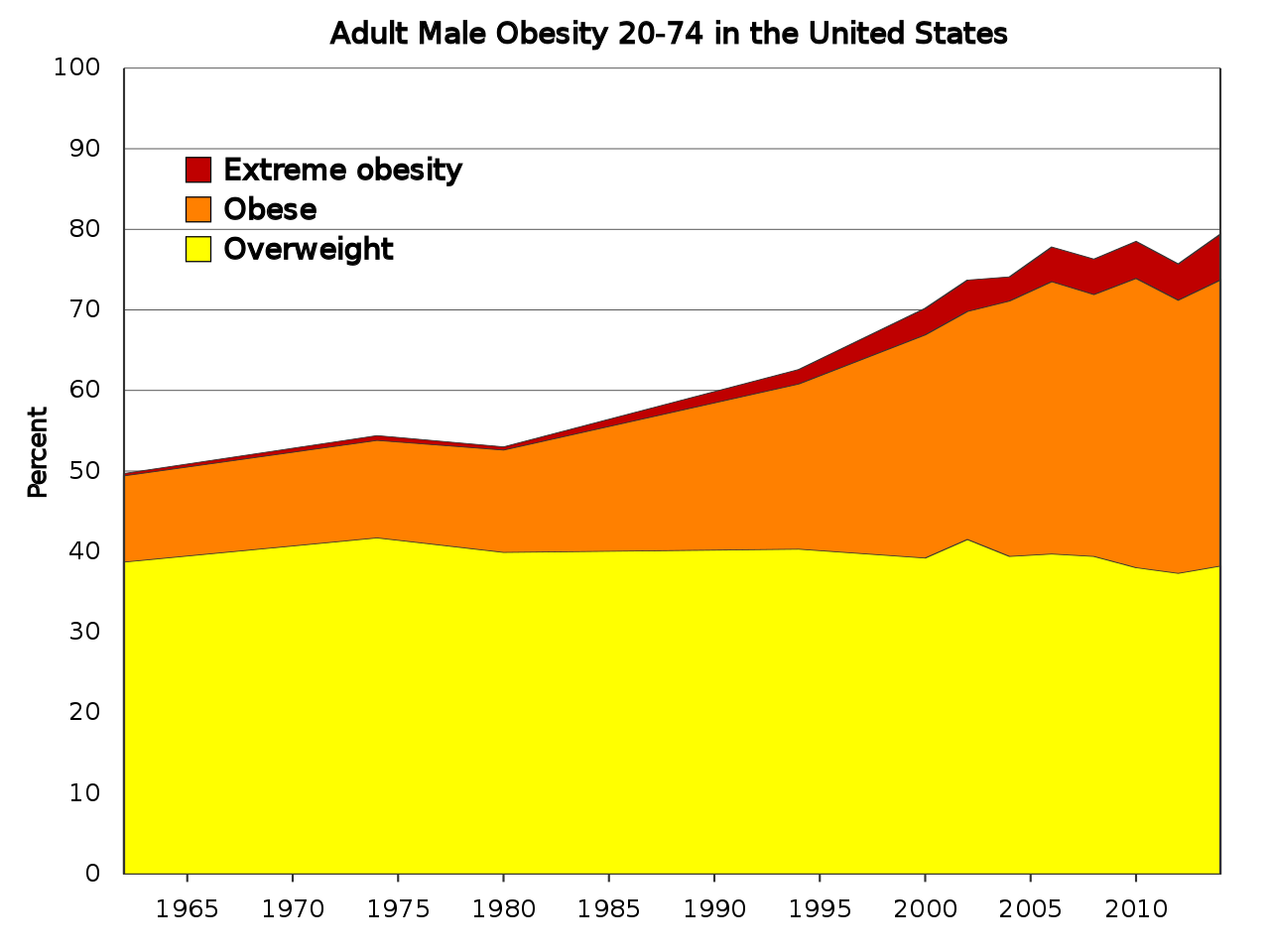

While little to do with batteries or energy, worth noting is this guidance on nutrition. I urge you to open and look at the whole figure. The government officially lists sugary cereals and fake eggs with industrial seed oils ahead of many staples like steak and eggs. It actually has an interesting track record of messing with diet going back to the 30s when subsidies for sugar producers began, and more recently with various food pyramids that have come out over the years. Even “sham” studies that have been disproven since have been carried out over the years to discourage the consumption of certain food groups like meat on the basis of heart disease and cancers. Many of these narratives are still consensus today. While I don’t care what you or other people eat, the failure of these nutrition polices can be seen quite evidently in the following figure.

Consumer Price Index (CPI)

Consumer price index is the estimate of the cost of living over time. It is generally seen as the best indicator of inflation that we have, even if flawed. It is interesting to note that CPI (aka inflation) wasn’t a concern for a significant period of time before we were born. Specific countries like Germany, Venezuela, and even going back to the Roman Empire have experienced hyperinflation, however the US has experienced stable CPI from inception until roughly WWI. What changed? There are lines drawn at 1913 and 1971, which correspond to the creation of the Federal Reserve Bank and when the dollar’s peg to gold was broken.

Prior to 1913 dollars had to be tied to gold with a stable value. If inflationary wars were to be funded, it was always followed by forced austerity to revert to the mean. That capital was drained from other productive uses and used for war. Since we are not on the gold standard anymore and the US can lend itself infinite money, wars drag on and the cost of the spending is placed on savers in the form of inflation instead of the government in the form of financial austerity.

If you are new here, you may often see me question many government policies. Not from a political perspective or even the aims of the bills, but merely the unintended downstream consequences that increasing the money supply without a corresponding increase in real productivity. In addition, the power that possesses the issuer of the money historically drives the collapse of the currency with a 100% “success” rate.

See you next week!

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.