🔋A Tale Of Two Robbers

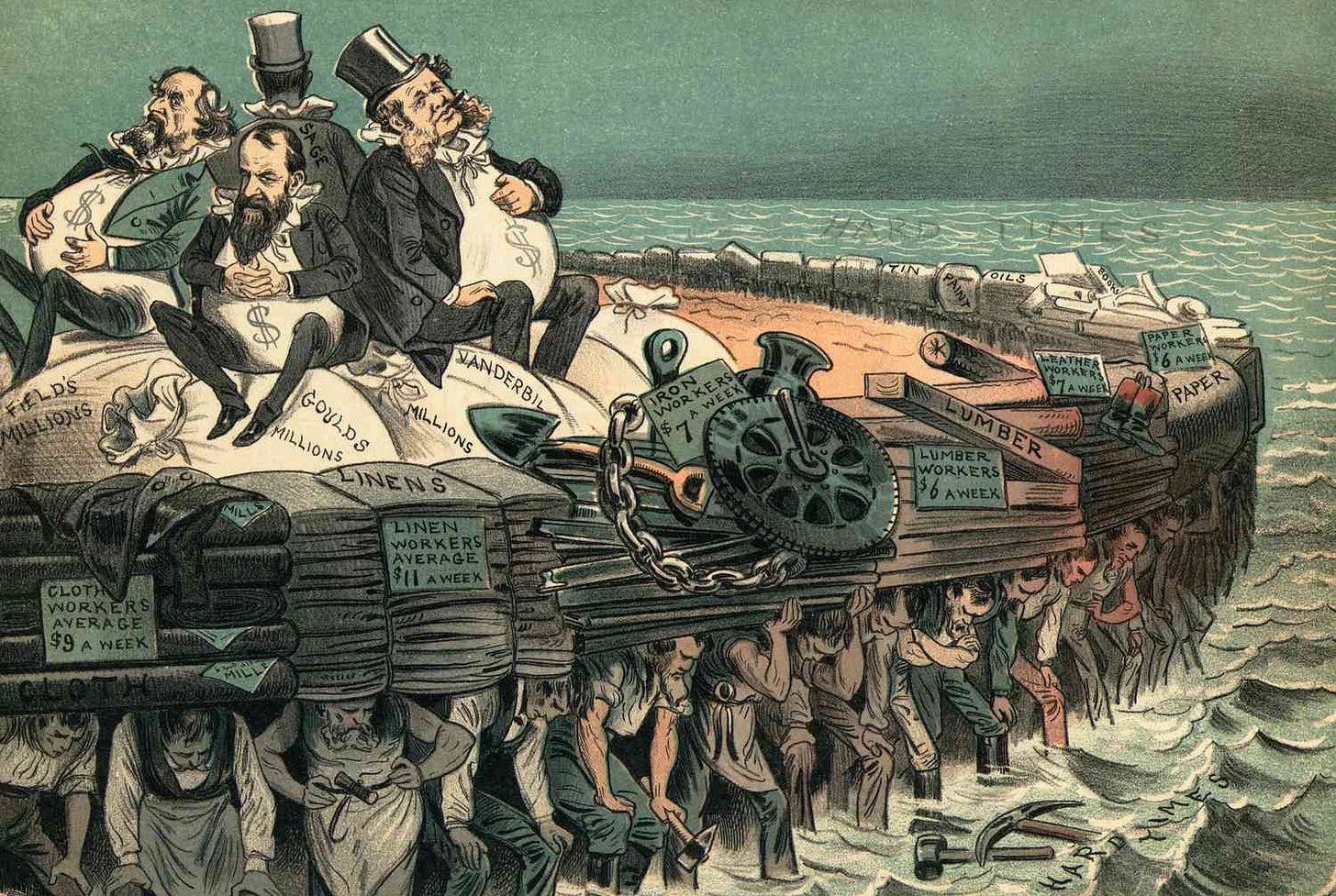

The rise in stakeholder theory has virtuous ambition but is fundamentally flawed. There is no better example than the late 19th-century robber barons.

Help me out and press the heart button, I would greatly appreciate it!

Stakeholder capitalism is all about delivering long-term, durable returns for shareholders. And transparency around your company’s planning for a net zero world is an important element of that. But it’s just one of many disclosures we and other investors ask companies to make. As stewards of our clients’ capital, we ask businesses to demonstrate how they’re going to deliver on their responsibility to shareholders, including through sound environmental, social, and governance practices and policies. - Blackrock

Last week I discussed the opposing capitalist philosophies, stockholder and stakeholder theory. The former posits that the role of a corporation is to return profits to stockholders within the law and without deceit, while the latter suggests the corporation has responsibility for far more than profits including things like suppliers, the environment, and the consumer. It is undeniable that stakeholder theory has grown substantially in prominence in recent years. While profit is always necessary for a corporation to stay alive, the extent to which other rules, constraints, and values are dominant is widely debated.

Stakeholder theory has a very compelling case for solving things like environmental damage, consumer harm, wealth divide, price gouging, and more which have all been issues over the years. While the moral judgments on the problems with capitalism are felt by most, it doesn’t mean that the alternatives are necessarily better. I am reminded of the famous Churchill quote.

Democracy is the worst form of Government except all those other forms that have been tried from time to time. - Winston Churchill

At its core, stakeholder theory is rooted in the concept that the free market, while advantageous, cannot be trusted to handle problems of scarcity of labor and capital with their relationship to environmental and social issues and long-run value creation. To be clear up front, I think this is utterly false and shortsighted. The problem is who is responsible for monitoring and solving every issue other than individuals in the free market? Governments?

Free Market

The free market price mechanism is the way to assign value. It considers all the capital, labor, supply, and demand inputs with simplicity through the consumer with prices. Consumers will purchase things that they assign value to whether it be smartphones or oil barrels. Stakeholder theory mentions that consumers may not purchase items from companies with blatant exploitation tactics which is one reason why corporations are responsible for considering consumer wellbeing. This though is a compelling argument for the the free market solution if you ask me. If a company is blatantly selling poor-quality boots because it increases its profits in the short term, consumers will look elsewhere for boots. Consumers may in mass boycott a company dumping pollutants into nearby water supplies. These are not sustainable business strategies, which will be reflected in the demand for those goods/services. Many regulation and taxation policies may result from impatience and the desire to control rather than letting the market solve the problem of exploitation on its own.

Perhaps there is no better example of the rise of stakeholder theory than in the late 19th century with the rise and fall of the robber barons. Carnegie, Rockefeller, Hill, and others became toxic monopolies in the eyes of many which resulted in the foundations of the anti-trust legislation of today. While some of these historical figures used exploitation at the expense of the taxpayer/consumer, many were entrepreneurs, sometimes of humble origins, who drastically improved the world and offered products at lower costs and better quality than ever before. Some were successful entrepreneurs who left the world fundamentally better. Ironically, their ability to keep offering cheaper and better products was often thwarted by laws and regulations under the guise of consumer protection.

A pure market entrepreneur, or capitalist, succeeds financially by selling a newer, better, or less expensive product on the free market without any government subsidies, direct or indirect. The key to his success as a capitalist is his ability to please the consumer, for in a capitalist society the consumer ultimately calls the economic shots. By contrast, a political entrepreneur succeeds primarily by influencing government to subsidize his business or industry, or to enact legislation or regulation that harms his competitors. - Mises Institute

Railroads

Railroads were a booming industry at the time. While Durant was taking advantage of government subsidies and “stressing speed, not workmanship” with the Union Pacific Railroad, Hill in the Great Northern Railroad was focused on quality and efficiency. Hill who grew up poor, worked obsessively to find the best routes through mountains, acted with the farmer’s and landowner’s interests in mind, and used quality materials that would last harsh winters. Durant on the other hand tried to please political leaders with extravagant dinners in exchange for subsidies, used cheap materials, often went way over cost, and even laid windy and extra-long tracks to get more of the per-mile government subsidies. One may say this story proves the stakeholder theory’s validity as Hill was very concerned about the landowners and community impacts. Perhaps, but maybe it is just the instinct of the good entrepreneur to naturally take these factors into account to deliver the best products and ensure the best long-term profits for the business. Hill’s Great Northern Railroad was the only US transcontinental railroad to never go bankrupt.

Since Hill was so successful and was offering lower rates, he had developed a clear competitive advantage which lumped him in with the robber barons of the time (a just name though to Durant and politicians for their exploitation schemes and subsidies). Eventually, the Commerce Act of 1887 and Hepburn Act of 1906 decreed a set price for railroads, undermining the competition of prices in the market, and hurting Hill’s business. By law, costs were raised under the pretense of consumer protection and various bureaucratic restrictions limited the effectiveness of the company.

Oil

The most famous robber baron was JD Rockefeller, a founder of Standard Oil. Coming from meager beginnings like Hill, he saved up to buy an oil refinery. He too became obsessed with making his business operate better and pioneered the practice of vertical integration. While sometimes it is advantageous to trade for products, there are advantages to being able to monitor the quality and security of inputs to products. The innovation did not stop there. His chemists were able to extract more useful kerosene than competitors and were the first to turn waste into useful products such as lubricants, paraffin wax, and Vaseline. Eventually, Standard Oil would tap into economies of scale in addition to their superior efficiency which allowed them to offer much lower costs than most competitors. To most consumers, cheaper products are a good thing and resulted in more people than ever getting access to the fossil fuel revolution. He was able to offer higher wages and even paid time off to his employees which rarely resulted in labor disputes.

Unable to compete, his competitors grew bitter. Companies and politicians searched for ways to level the playing field and used anti-trust regulation as the key to dismantling Standard Oil. Anti-trust regulation is supposed to protect consumers, but Standard Oil has been cutting costs for consumers for decades, raising quality, and helping other companies using oil products improve as well. The term “predatory pricing” was coined as ammo in the anti-trust lawsuit, which simply means that a company lowers prices too much that it undercuts competitors. While Standard Oil sopped up a large percentage of the oil market and was considered a monopoly, there is no evidence that this was bad for the market or consumers. There isn’t even evidence that predatory pricing is a viable business strategy. To drive home the point, Standard Oil’s market share fell from 88% to 64% by the time the lawsuit hit them showing the market was already solving the monopoly problem on its own. The lawsuit then split the business up and undermined the success they had earned. All the legislation did was stifle the vertical integration that made Standard Oil successful.

Stakeholder Theory Flaws

Robber - someone who steals, and Baron - stemming from British nobility are ironically not applicable to many of the robber barons of the late 19th century. Coming from meager upbringings, Hill and Rockefeller are just two examples of entrepreneurs who did not exploit the consumer, but made life inconceivably better for them. These heroes of the capitalist system should not be confused with the real robber barons of the time using the government's largesse to their advantage and consequently taking advantage of taxpayers and consumers in the process.

Stakeholder theory suggests that the corporation’s role is intertwined with the government and certain business practices are superior. Further, the community, suppliers, environment, and consumers must be explicitly taken into account. While it is virtuous to have the consumer and community in mind, the objective of making profits does not undermine that. It is precisely government intervention and exploitation through political means that causes issues in the capitalist system.

In both cases of Hill and Rockefeller, before involvement with the government was the best outcome for the consumers and landowners. Property owners famously defended their property with guns from the inconsiderate subsidized railroad companies but had good relations with Hill’s Great Northern Railroad. Until Standard Oil was torn apart, they provided cheaper and higher quality products which improved standards of living and supported the growth of other sectors of the economy. The profit motive of a corporation with a good entrepreneur does not need interaction with the government or to have guidelines for his business behavior. The good entrepreneur will support the community, environment, and consumers as part of the best long-term business strategy. Monopolies like Standard Oil naturally lose prominence as newer players enter the market and offer competitive advantages, negating the need for anti-trust legislation. If standard oil was a harmful monopoly, what do you call the cartelization of the oil industry for the government’s behest for the use in World War I which reduced US oil competitiveness and led to higher oil prices, less competition, inefficiency, waste, and corruption?

As far as the environment is concerned, being harmful to the environment and polluting in excess are not good strategies for profits in the long run. This will cause harm in communities and stir bad faith with consumers, who with the power in the free market, will let their values be heard and the bad companies will not do as well. Was it the free market that caused the horrific pollution from coal mines in Pittsburgh to get to unimaginable levels during the 1940s, or was it the seizure and subsidization of coal mines by the federal government for the war effort in WWII that delayed the market’s choice to switch to the cleaner-burning natural gas? I’ve also argued in the past that greenhouse gas emissions would be a negligible problem in the electricity sector today had it not been for government intervention.

Conclusion

Capitalism is the free and voluntary exchange of goods and services where the consumer has the power to choose which products to buy. Once the government is involved in economic matters, it uses coercion to attain certain means. People can scheme regulation, taxes, anti-trust lawsuits, and capital controls to their advantage politically if allowed to do so. This is the root of exploitation, not the free market.

Given free market capitalism, the consumer holds the power to choose the best products in terms of cost, utility, environmental impact, etc. The consumer holds the key to the corporation’s relationship with the environment, community, and consumer in the free market. Given the increasing stakeholder capitalism today, as seen by the cartelization of many industries like education, healthcare, pharmaceutical, and banking yields the consumer less power and choice over their purchases in practice. Holding corporations to set governance strategies that are determined to be best would limit new strategies like the vertical integration pioneered by Rockefeller. Setting specific subsidies, regulations, and taxes on corporations limits the innovation and solutions to many of the problems that the policies stem from or delay the market’s natural progression to cleaner and better goods/services. Protectionist import/export controls also give the consumer fewer choices and less power.

Consumers are the ultimate arbiter of power. A company’s success is determined by the quality and demand of the product. While stakeholder theory has a virtuous philosophy, it is flawed because of the distortions it causes in the market. The increasing prevalence of stakeholder theory reduces the power of the consumer and serves political entrepreneurs to a much greater degree than any of the groups it claims to support. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!