🔋A World Of Hert

Early or wrong? The Hertz EV strategy was a costly blunder.

If you enjoy, press the heart button on this article! I would greatly appreciate it :)

After Hertz was restructured in 2021, the company saw the EV trend as a way to differentiate itself in the rental car market. The company could pioneer adopting the new technology and win over consumers. While the company has more issues than just EVs, this blunder has been the icing on top for a failing rental car company.

In 2021, Hertz announced it would buy 100,000 cars from Tesla. Later, they announced a plan to purchase 175,000 from Ford and 65,000 from Polestar. As I mentioned in It Hertz, the company not only abandoned this plan but began selling off its EV fleet which comprised 11% of its total vehicles, they abandoned their CEO who devised the plan.

While touted to be cheaper to maintain, from a business perspective, the company cited maintenance costs to be doubled for their EV vehicles. So far it is accurate to call their EV strategy a blunder since it has cost them $245 million in losses in 2023. Even though the company had plans to initiate an EV charging station buildout of their own, it was not enough. Since then, losses are estimated to be $1 billion.

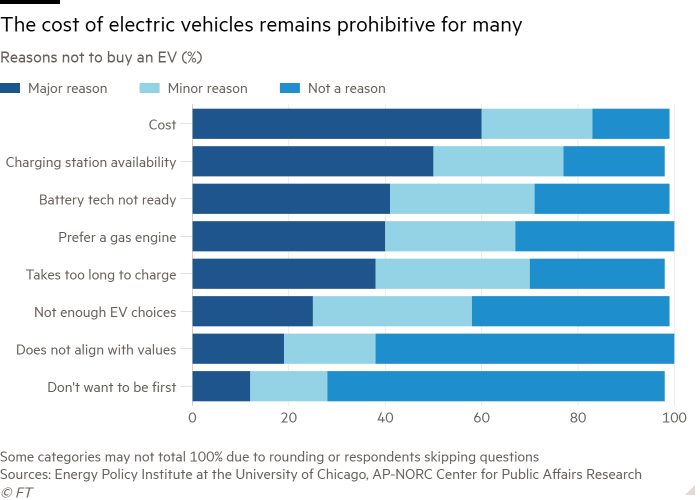

Without the ability to charge at home, it can be hard for a busy rental car customer to find the time to charge the vehicle, especially before they need to return it. On top of this, the EV charging network situation has been conducive to the widespread adoption of EVs. Charging infrastructure is the second largest contention for potential EV buyers, as I mentioned during In Need Of A Charge. Of all the potential issues with EVs like cost, range, or safety, charging infrastructure is the easiest to solve. With allocated government subsidies not even helping the buildout, this issue continues to be a major roadblock for the technology.

Hertz has had additional problems post-bankruptcy. Even without the EV losses, they would have lost money in 2023. They are dealing with $270 million in bond interest that they now need to pay back to bondholders. Further, in 2022 courts ruled they had to pay $168 million after they falsely reported rental cars stolen which resulted in penalties and jail for certain customers.

Hertz lost ~$450 million in Q2 2024 and will sell an additional 30,000 EVs on top of the 20,000 they already sold. The company has raised $1 billion through debt offerings (considered a junk bond/low quality) to continue operations and hopes to return to profitability. Other rental car companies have been showing profits, which adds to the humiliation for Hertz.

Where Hertz, which has been renting cars since the days of the Model T, was once the world’s largest rental car company, in 2023 its revenue was 22% less than its publicly held rival Avis Budget. - CNN Business

Hertz is in a world of hurt. Company mismanagement has resulted in COVID-era bankruptcy that other rental car companies endured. The company has faced legal issues on multiple fronts adding to losses. The icing on top was an aggressive and pre-mature EV adoption strategy that did not propel the company but merely set it back further. Perhaps one day EVs will be the future, but today is not that day. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.