🔋Anarchy In Argentina

Free market politics are coming to Argentina - what economic implications could there be, especially for the booming lithium industry.

Help me out and press the heart button, I would greatly appreciate it!

Inflation has been on the minds of many Americans in the last few years. The Federal Reserve in the US has raised interest rates and is reducing the balance sheet through quantitative tightening to quell inflation. The efficacy of these policies over the long run, especially with record deficit spending coming from the legislative and executive parts of the government funded through the US treasury, may be questionable. Regardless, people have not been happy to experience an official CPI of 9.1% year-over-year at its peak in 2022. This of course is weak compared to the hyperinflation seen in many countries around the world.

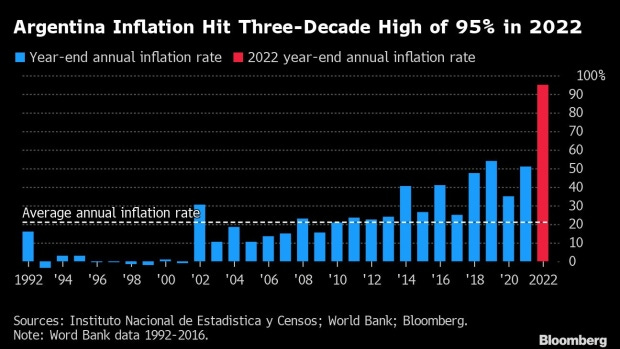

Argentina has been one of these countries experiencing hyperinflation, or at the very least severe inflation since the technical definition of hyperinflation can be debated. Since the turn of the century, Argentina has been experiencing official year-over-year inflation rates above 20% most years. At this rate, the purchasing power of $10,000 in savings would be worth less than half in just 5 years and practically worthless in 20. Official inflation has been on an upward trend and is well north of 100% year-over-year and 10% month-over-month here in 2023.

Levels like these manifest by people rushing to buy things because by next week they may not be able to afford anything with that money. People are not safe to hold onto their money, which is why people things like cryptocurrencies or precious metals if they remain legal. Even with inflation being a top concern, this way of life is unfathomable to people in the US and a luxury not afforded to those in Turkey, Argentina, Zimbabwe, Egypt, and more. Inflation is caused by increases in the money supply relative to the growth rate of the economy or by temporary supply shocks. This is roughly the quantity theory of money. While highlighting the importance of money supply which I’ve discussed before, it ignores changes in demand for money, related to the time value of money, which can be distorted through interest rate manipulation by the central bank and the stress from currency devaluation for example. It is worth noting other economic theories like Keynsian and Modern Monetary Theory do not worry about the supply of money as a primary factor for inflation.

Inflation like this manifests mostly from government intervention. A popular modern tactic is for the central bank to raise interest rates to disincentivize bank lending which can reduce inflation. In this case, Argentina’s interest rates are 133%, meaning bank lending is not the problem because there is naturally little lending in this environment. Both banks and consumers aren’t willing to take on loan risks due to uncertainty. Inflation here is caused by printing currency units on the federal level leading to excessive devaluation of the currency.

The share of federal spending as a percent of GDP(economic activity) is a further complication that George Gammon points out is often neglected. With the same increase in money supply, price levels (CPI) and real GDP could be vastly different depending on the share of government spending as a percentage of GDP. The higher the government spending as a share of GDP, the lower the real GDP or productivity of the economy. In general, everyone in the private sector tends to specialize and become experts in their field which leads them to be better allocators of money compared to the government who are not experts at anything. This is why government is less effective at directing the economy and the free market is more efficient than centrally planned economies.

This can be seen clearly in the change in GDP per capita for various countries over time. In the 1960s, Argentina was similar to many other now-developed economies. Wrought throughout its history with socialist or nationalist leaders who preferred to control the economy, Argentina fell behind other countries in the region and the rest of the world. As seen below, since the 1930s other countries in South America as well as the rest of the world outpaced it economically. Brazil and Chile both have better long-term track records than Argentina and Venezuela. It is also clear that China exploded higher once they opened up their economy more from 2000 on.

This brings us to now, with Javier Milei recently elected as president of Argentina. In stark contrast to the long line of predecessors, he is a firm believer in smaller government and less intervention in the economy. Milei is a crazy guy who campaigned with a chainsaw and openly discussed the numerous government positions he wants to abolish, does not mince words about his political rivals and other leaders, and even went on a show where he smashed a pinata of the Argentine central bank. It is clear that the politics in Argentina have not been working and the people have demanded radical change.

Once policies are in place, it is often challenging to undo them. Milei will have a hard time firing so much of the government and reducing spending that many sectors have come to rely on. If he gets his way, change may be brutal and likely cause economic hardship in the short term if he is aggressive. History shows that in the long run, smaller government intervention is good for the real productivity of the economy. Since becoming president, he has devalued the Argentine peso by 50% to more closely match reality since it is natural for authoritarian regimes to understate inflation. If went to Argentina you could not exchange pesos for the government-listed exchange rate anyway proving this phenomenon.

Investors are initially optimistic about companies in Argentina, with a composite of stocks jumping 25% upon his election. Argentina has a large service sector, but the largest other industries include agricultural processing, automobile and other manufacturing, textiles, energy, and mining. One of his other policies is dollarization, which could provide more stable money for its citizens, incentivize foreign investment into the country, and make trade easier and more competitive.

Being a part of the lithium triangle, this election may have implications for the battery industry as well. He is less likely to strike deals to form a “lithium OPEC” with neighbors or to fund battery manufacturing or mining projects through government funds. With that said, cutting taxes, labor laws, and regulations which are part of his mission may spur investment in mining and manufacturing sectors as they become more competitive. The lithium sector in Argentina is poised for growth, especially considering Chile’s nationalization of the lithium industry which I’ve discussed before. Companies mining in Chile have government involvement to contend with now. Argentina has less political friction and the potential now for lower costs which is important for mining companies. Nationalization, abundant reserves, and the election of Milei will result in a higher growth rate in the lithium sector out of Argentina than in Chile in my view.

If Milei can reduce government spending and use a more stable form of money, the inflation rate will come down as well, providing some relief to people which was erroneously promised by the IMF and past leaders. Milei has shown some support for Bitcoin but has elected to dollarize instead of making Bitcoin legal tender like El Salvador. There is still rightful skepticism of Milei and questions about whether his intentions are true. As I’ve discussed, many populist leaders change their tune once in power. If he can limit the size of the government, be true to his stated coals, and stop the money printing, the long-run trajectory for Argentina may be looking up. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!