🔋Are You Going to Pay for That?

The price of Li-ion batteries has stopped decreasing and we could even see them go up?

Were you watching the super bowl or the commercials? I won’t judge either way, but one thing I noticed was a bunch of electric vehicle (EV) commercials. GM, BMW, Hyundai, Kia, Polestar, and Nissan featured EVs in their ads. This came as no surprise as last week I discussed that almost all of the major car companies have released or announced plans for EVs. Most have aggressive plans to phase out a significant portion of their legacy internal combustion engine vehicles. I made reference that there are challenges that may effect these big name brands with their plans to electrify their vehicle fleets, one of which being battery price.

Demand

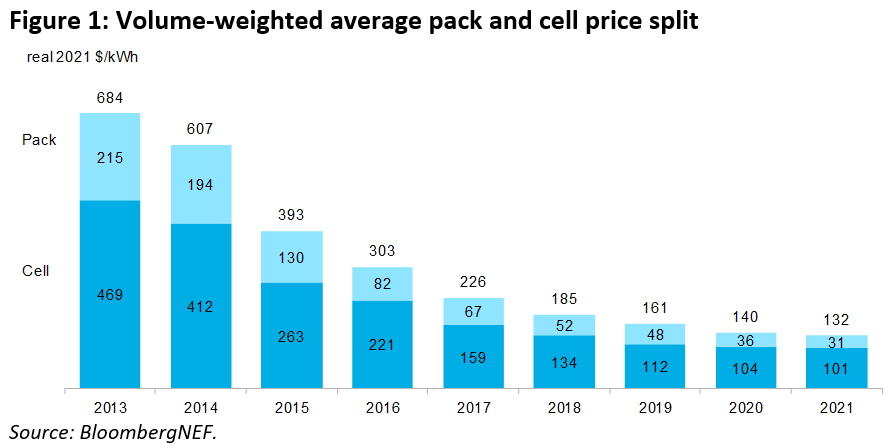

Lithium ion batteries (LIBs) make up a large portion of the cost of producing an EV meaning it is of upmost importance to keep cost low to maintain margins. The price of a LIB pack has been declining at an impressive rate over the last eight years. The main driving forces behind this is the improvements in cell designs, mass production capability, and increase supply of materials allocated to batteries. The technological advancements continue to approach the theoretical maximum for LIB technology and the rate of price decrease has slowed down as well.

The cost of batteries is an enormous input cost for storing wind/solar energy on the grid level as that energy needs to be stored during calm periods and darkness. Even if other storage technology can take over for LIBs on the grid level, the demand for EVs which are definitely dependent on LIBs will be increasing and persist. This demand can be seen in a report from the World Bank where they projected 2050 demand for raw materials of renewable energy sources, many of which are used in batteries. At larger production volumes for cells, material cost become the driving cost factor. The efficacy of EV rollout and economic viability of such plans will be largely dependent on raw material input costs of battery materials.

If increase in demand outpaces increase in supply it will spur an increase in price. These raw material costs would impact the downstream batteries that they are used in. Take lithium as an example, the price has appreciated between 2-3x since December of 2020 alone. It is difficult to know what the future price action will be, but we know that demand will continue to rise if car companies keep their word. Prices need to stay sufficiently high for new miners to come online to mine in an economically viable fashion, but stay low enough for car companies to maintain their vision for an electrified future that relies on LIBs. This is a fine balance to keep an eye on.

Supply

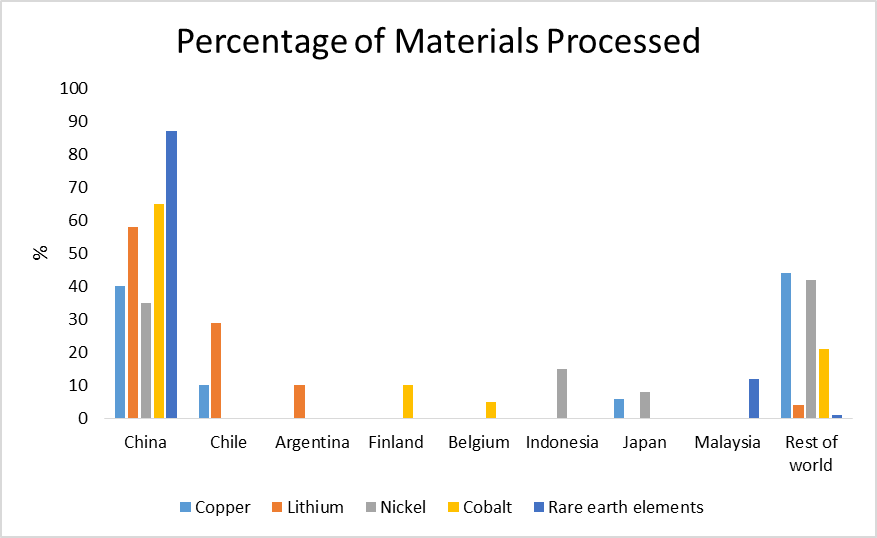

I’m sure you’ve heard a lot about supply chain issues over the last year which also impact prices of batteries. Less than optimal efficiency, poor throughput of materials, delays, unproductive working time, and higher shipping costs could increase the cost of LIBs. Everyone would like to bolster these supply chain issues. One way is to build large cell manufacturing facilities or gigafactories. Car companies are pouring billions into these facilities to improve their own cell production. One issue is that the cell materials still have to come from somewhere. In a previous piece I reference a graphic that shows the critical material mining locations worldwide. Even with the decentralization of the raw materials, the refinement is the next step in the puzzle. The current fact is that China is responsible for most of the mineral refining capacity for LIBs as seen below. Even with relocating cell production domestically, that doesn’t solve the reliance on China for material refinement. Cooperation and trade is a wonderful tool, however challenges can arise geopolitically and it is a risk factor in general to rely too heavily in one place regardless of the endeavor. For lithium specifically, the dominant suppliers of lithium carbonate are overwhelmingly Chile (mines lithium themselves) and China (mostly mined in Australia).

If batteries are to play an integral or even meaningful part of our energy future, it would be wise not to be reliant on a foreign rival in the geopolitical realm for our energy (the white house said as much in their report which you can see here).

Furthermore, Ryan Petersen discusses how many of the logistical supply chain bottlenecks are avoidable and have tangible solutions (you can find him on twitter here). He rented boats and visited the ports of Los Angeles and Long Beach (two largest US ports), identified the problems, and proposed various solutions to alleviate the throughput issues. An example is how the queue of ships waiting to unload is larger than ever, but these ships offshore don’t even count in the official tally of ships waiting at the port. This means that by the books they aren’t even there, masking that there is a huge issue.

Opening new supply of raw materials would be the logical solution to meet the growing lithium demand. In the US this is actually already proposed to open a lithium mine in Nevada, but has met heavy resistance from other environmental groups ironically enough. Mining doesn’t depend on how much material is in the earth, it depends on the cost to get it out. New technologies in mining could reduce the cost of extraction, just like new technology in cell manufacturing or designs could reduce costs of finished cells.

Recycling

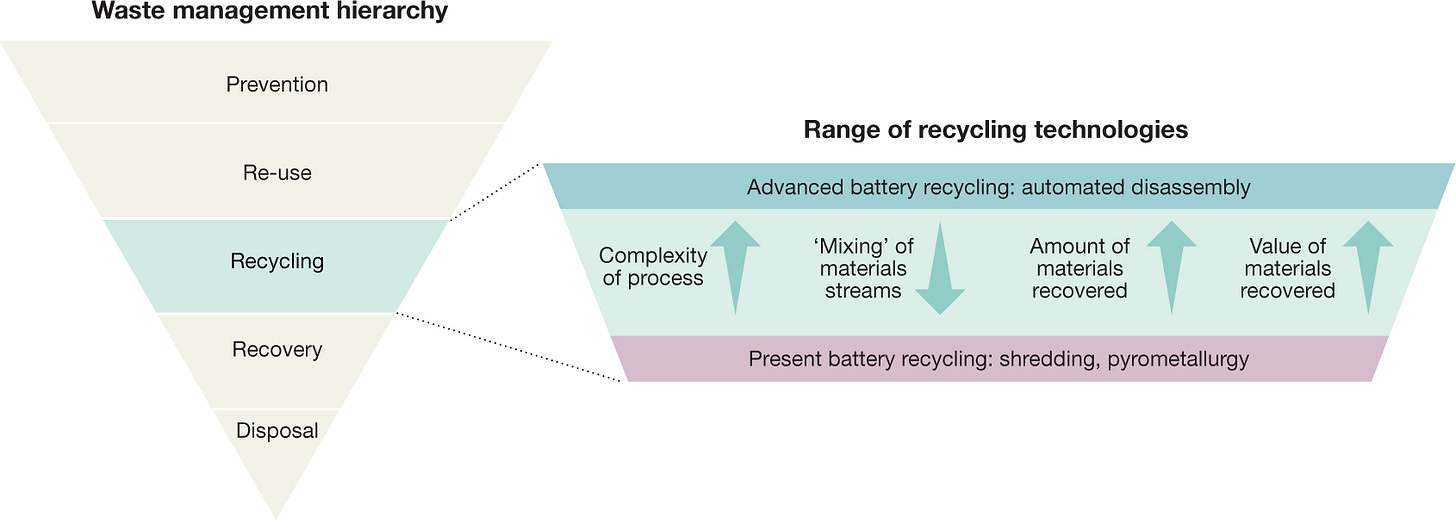

A key feature that I have yet to mention is the recycling of battery cells and materials. Many applications could utilize recycled battery cells which could alleviate some of the demand for new battery materials in turn reducing the price. Recycling LIBs is actually the third tier down the waste management hierarchy as seen in the Nature article from Harper et al. Before recycling the cells that no longer meet the performance criteria for EVs or other selective applications, they can be re-used in other less stringent applications before being recycled further down the list.

The market for battery recycling is still young, but growing fast. Ascend Elements (formerly battery resources) is a company that is opening a large facility in Georgia for battery recycling that can process 30,000 metric tons of Li-ion scrap material each year. They can refine this back into the raw material inputs in a cost effective way, and then sell the materials back to cell manufacturers. Additionally, Li-cycle is another LIB recycling company building a facility in New York as well as pairing with other cell manufacturing facilities and estimates to process roughly 50,000 metric tons of material. Redwood materials is a Nevada LIB recycler with big plans to transform these old cells into ready to use raw materials and has partnered with Ford and Panasonic/Tesla. Intercalation Station has a piece called, LFP Batteries Reveal Recyclers' Shaky Foundations where they discuss some of the challenges with recycling. They include less incentive to recycle lithium iron phosphate batteries since the raw materials are less valuable (iron instead of cobalt, manganese, and nickel) as well as cell manufactures not considering recycling and disassembly when producing cells. They also discuss a few potential solutions and companies that are thinking about this issue.

Thoughts

As part of the infrastructure bill, the white house announced plans to approve the lithium mine in Nevada, grants to battery recycling facilities, and plans to increase domestic mining and processing of key battery materials. These programs will help secure domestic battery production and subsidize costs of producing batteries as well. It will increase supply of lithium and perhaps other battery materials through mines and domestic processing while decreasing demand for new battery materials through the recycling process. These factors both would help lower price for LIBs.

This is all fine and dandy if you think making EVs is the fast track to reducing carbon emissions. The problem is currently most EVs would be powered through the grid which is powered mainly through fossil fuels. This seems like building the plane wings before the engine. Transportation is a large component of emissions, but so is the grid. It is just shifting the emissions to another location so long is the grid is not renewable. Natural gas is much cleaner than coal, nuclear much cleaner still, both of which are much higher energy density than wind/solar and are effective ways to reduce emissions for the grid. LIBs could be utilized for grid storage of wind/solar energy, however this would burden all the issues discussed in this piece even further and increase LIB prices and negatively impact reduction of emissions.

In a piece by Volts called, Rooftop solar and home batteries make a clean grid vastly more affordable, he discussed the potential for wind/solar to make energy cheaper though a decentralized energy network. Roberts discusses how for wind/solar to be most effective, the grid would need to be boosted such that we could transmit electricity across the country much more easily. He discussed transmission in detail here and here. The white house has made transmission lines a piece in the infrastructure bill passed last year. Finding alternative long duration energy storage solutions is important to keep costs of storing solar/wind energy down and keeping the demand off of LIBs. If LIBs can stay out of this market entirely, that would help keep costs down.

Inflation is another tale of this issue that has less to do with the energy aspects, but every bit to do with price. The infrastructure bill allocating money to batteries is likely to spur supply increase and decrease in demand for new materials like I mentioned, but also have a not so convenient counter point. Government spending (issuing new credit increasing money supply) decreases purchasing power of the people in a non-trivial way. This economic concept is hidden from mainstream reporting, but hits people hard. If the money supply increase, the money you hold right now is worth less in real terms. Here is the m3 money supply, 40% of all money available today was created in the last two years.

Currently we are experiencing high prices in everything including energy. The reason for higher commodity costs has multiple causes and I cannot give you a comprehensive analysis why, but it would be amiss to deny that the emphasis on renewables decreases the incentive for oil producers to produce which subsequently decreases supply. Supply chain issues, geopolitical conflicts, increase in energy demand coming out of covid, and excessive monetary stimulus all play a role in the increased energy costs of today as well. This matters to the price of a LIB because it takes a lot of energy to make LIBs from raw material mining and processing, material synthesis, and cell assembly. If the energy input cost is higher, you can expect that the output cost will be as well. With the non-transitory inflation being in large part due to excessive government spending (which the federal reserve and government can’t admit without losing credibility), this will likely be an issue facing battery prices for some time as long as energy prices remain high and inflation persists.

Talking about the price of LIBs is a complex undertaking with multiple factors. Most important is things to remember is that increases in demand like EV sales targets and LIBs for the grid would increase price, while decreases in demand through recycling and shoring up the supply chain would consequently decrease price. On the supply side, the more miners there are producing battery materials there are, the lower the raw material price goes, whereas supply shocks increase price. Government spending and intervention does not come without consequences to the price of LIBs as well, often with unintended consequences. The price of LIBs will certainly cause some pain, prosperity, or perhaps a little of both to EV manufacturers over the coming decade with their big plans so we shall see.

-Grayson

Please like and comment to let me know what you think. Join me by signing up below.

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com