Are You Poor?

The real poverty line and what it means.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

Two weeks ago, Mike Green published an article on the Yes, I give a fig substack that garnered a lot of attention. Green has done extensive work on passive investing, which I have covered and agree is distorting asset prices higher. His piece, Part 1: My Life Is a Lie, argues that the poverty benchmark is flawed and wrong, the real poverty line is ~$140,000 for a family with two kids, and that there is a “valley of death” where people are penalized for making more money.

The poverty line today is $32,000 and is measured by multiplying basic food costs by three. This benchmark was created in 1963, when food accounted for ~33% of expenses, whereas today it accounts for only ~6%. A lot has changed since, including an explosion in healthcare, education, and housing costs. Further, the standard model for one working parent and one stay-at-home parent shifted to both adults working. This becomes a tradeoff as now the family has to pay for outside childcare, a new cost added to the calculation.

The next argument is that the real poverty line for a family with 2 kids is $140,000. This is shockingly high, which is why the article garnered so much attention. The issue I have with his estimation is that he comes to that number in two ways: first by adding up the national average data for various budget costs (i.e, childcare, housing, food, transportation, health care, other, taxes), and second by looking at costs in a New Jersey town. First, if we want the poverty line and not the average line, costs will be lower for people looking for the absolute cheapest things they can find. Second, the NJ town he chose had incomes and costs well above the national average. While he is certainly correct that the current poverty line is high, I am skeptical that it is $140,000 high.

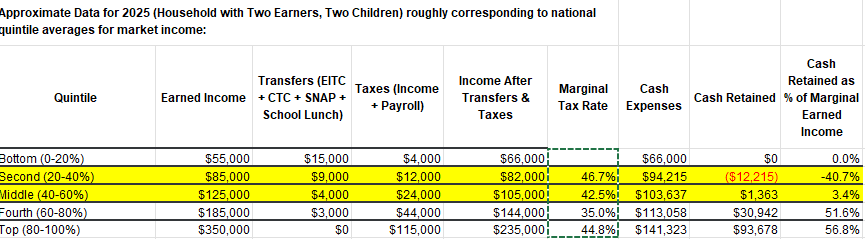

Lastly, the “valley of death” occurs when families no longer qualify for government support. This happens at $45,000 for healthcare and $65,000 for childcare. In these instances, a family that receives a raise is burdened with new costs that exceed their extra income. In his follow-up piece clarifying his argument, he includes data for another city, implying the average is ~$94,000. Regardless of the correct number, the “valley of death” is shown nicely in his figure. Calculating the cash expenses is the crucial piece, but according to him, as the earned income increases, the cash retained is negative and flat until you reach the fourth quintile of earned income (~$144,000). A family does not save money until this point, so what is the incentive to work harder and earn more income?

The median household income in the US is $83,000. For my calculation, I’ll find a city close to this number itself and use the MIT living wage website. A few cities that fit are Fayetteville, AR, Rochester, NY, Fort Collins, CO, and Omaha, NE, among many more. For Omaha, NE, the median household income is a bit lower at $73,000. This is okay, as it will make my number a more conservative estimate. For 2 adults in Omaha, both working with two kids, the living wage according to this site is $111,371 (bottom right). This is probably closer to the poverty line for 2 working parents with 2 kids.

The first thing you notice is that kids are expensive. A single parent with one kid needs to earn an extra $33,000 to get by ($79k income). Another kid is an additional $21,000 for a $100,000 total income needed.

If the family is together, the spouse can handle childcare, so the additional cost to have a child is only $12,000 ($75k income). Another kid is an additional $8,000 for a $83,000 total.

If the family is together and both working, the childcare expense goes up, but there are two wage earners. Many young people today are not having kids yet, and their minimum living household wage is $63,000. If they have a kid, their needed income goes up $26,000 to $89,000. A second child is another $21,000 for a total income needed of $111,000.

$111k is the bare minimum wage as calculated by this MIT website. This is higher than the median national and city household incomes, which clearly poses an issue. People cannot afford to have kids. If one has a pretty good job, they may be able to afford for the spouse not to work. They will need an above-average job to support kids and a stay-at-home mom in this city. Unfortunately, that is hard to come by, as above-average jobs often are located in higher cost-of-living cities, which may offset the wage increase.

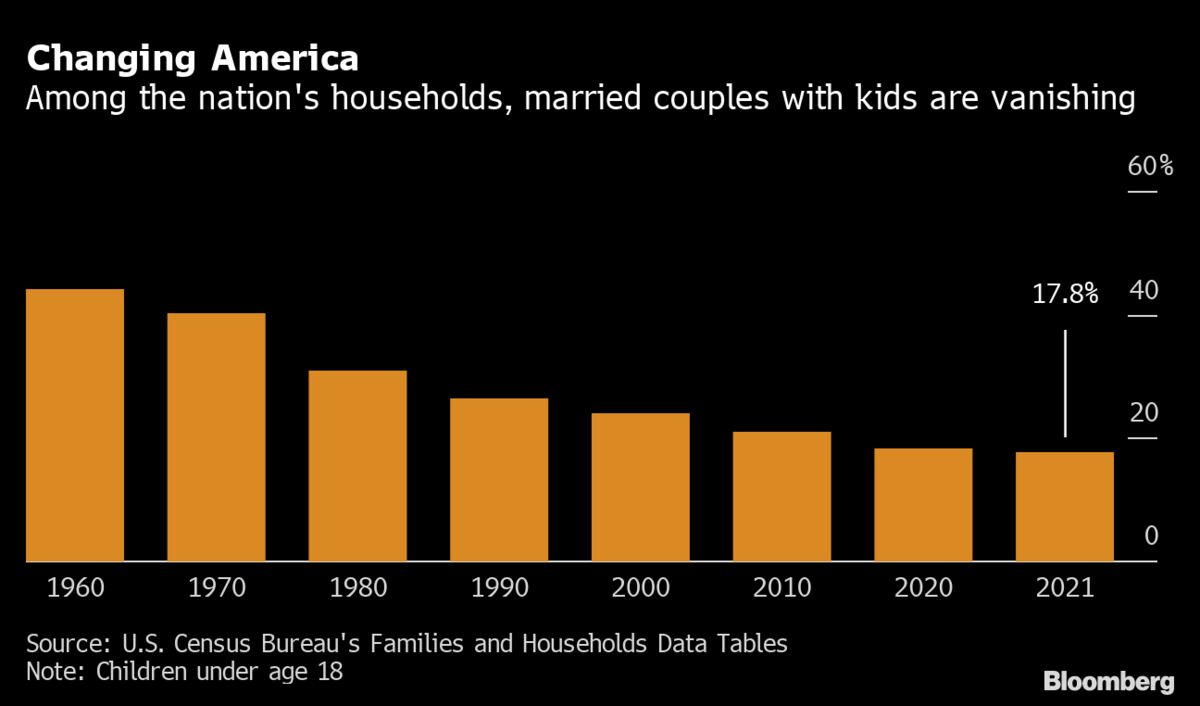

If the other spouse works, it is not even that much better, as the figures to have kids are above the median household incomes. It will be hard for everyone to agree on the exact poverty line, but the consequences are clear. Young people will choose not to have kids out of necessity, which is already happening. Married couples with kids have been on a steady decline from over 40% to below 20%.

Some other talking points include asset values and boomer wealth transfer. Will boomer parents leave their immense wealth to their kids and help bridge the gap? More likely, it gets absorbed in healthcare costs later in life, and not as much is actually passed down.

If your stock and house value go up, does it help? Working-class folks statistically own no stocks, and if they own a house that appreciates significantly compared to their wage, they are now trapped since other houses are also expensive. A house isn’t really an asset if you need it to live in. Plus, since all their new wealth will just go towards a new house if they move, nothing in their balance sheet will have materially changed.

The last critique is that these minimum values are inflated due to people’s expectations of how they should live. If people lived within their means, spent less, didn’t care about keeping up with the Joneses on social media, and lived like their grandparents, they would be totally fine. This is definitely a fair critique, but one I believe only goes so far. Even if it is true, why should we all of a sudden accept a worse standard of living? The point of working is to create a better life for your kids, not for them to live in smaller houses, and get worse benefits and way of life.

This piece isn’t to provide you with the reason why this happened or the solutions, which I can dive into another time, but merely to show the problem and provide my input on a recently hot topic.

The poverty line clearly isn’t $32,000, and it likely isn’t $140,000 either. To me, it’s probably $100-111k for the median city for a family with 2 kids, or $46k for a single person with no kids. The point about the “valley of death” holds, as those in poverty can earn nearly $60k in welfare benefits, meaning they are worse off earning higher wages unless they can escape and earn well above average incomes. The obvious natural consequence is a lower birthrate and fewer kids, which we are seeing. I think the cost of living is the prime driver of this phenomenon, and it’s nice to put some numbers to the observation. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

My wife and I tried to move back to CA in 2018--we both grew up there and missed the ocean. We thought housing would start backing down in price so we rented an apartment and worked, both making a decent middle income wage, while perusing the housing market. Interestingly, being above the poverty line, we ended up paying so much for healthcare, housing, and healthcare that we could have taken less stressful $10/hr jobs and taken government subsidies to have the same income. That "Valley of Death" is real!