🔋Activate Arbitrage

Battery storage is not used for what you think, but this can change.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

It is no secret that variable energy sources such as wind and solar raise concerns about power generation and energy reliability. Predictions range from the grid being unable to handle more than 20% renewables to it being an improvement to the current system. I’ve discussed some of my hypotheses on how the grids can reasonably handle this.

I wrote that there are three compelling solutions or mitigations to this problem; storage, control, and Bitcoin. Storage via batteries is self-evident while control includes campaigns or policies to shift energy demand to other parts of the day and Bitcoin to monetize the cheap electricity during the day. There may be conflict as as a campaign to shift EV charging demand during the day at workplaces for example could be at odds with the projected revenues of a commercial battery storage project (as will be more obvious below).

There are two main types of grid battery storage, in front of the meter (FTM) and behind the meter (BTM). FTM is more on the grid/utility side while BTM is residential and commercial applications. The largest advantage of adding a large-scale BESS to the grid is to store energy for the night and when the wind dies down. Often called the duck curve, net electricity demand has much higher variation as more renewables are added to the grid. The shaded regions indicate the regions in which BESS could arbitrage.

There are several uses for battery storage including frequency regulation, ramping, arbitrage, load following, and more. The most obvious is arbitrage, due to lower prices during the day and higher at night. A BESS would buy electricity at extremely low market prices to charge the batteries and discharge them at high market prices later. While this is the most obvious and most cited reason to add BESS, it isn’t the primary focus of BESS on the grid currently. Ramping and frequency regulation have to do with responding to grid disruptions and are the primary use cases which I will discuss more next week.

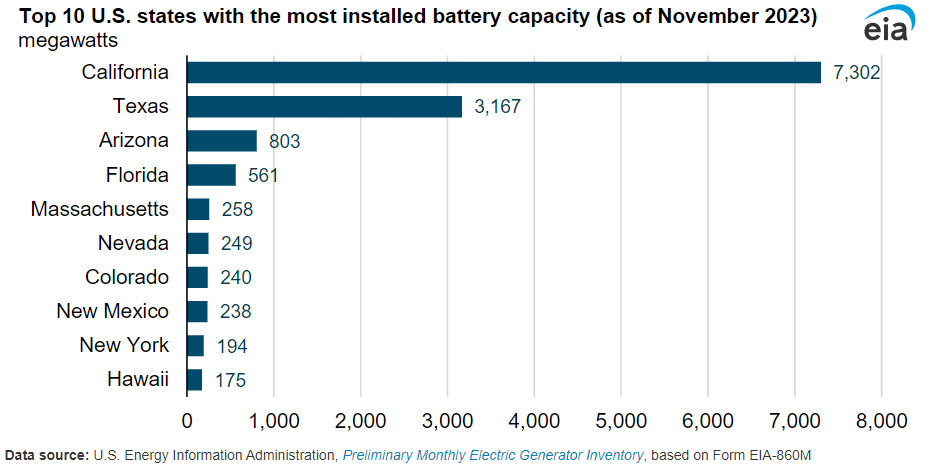

As the share of renewable energy continues to grow in the US grid, the duck curve intensifies and price volatility grows. It is likely more BESS will come online to capture the arbitrage increasing battery storage capacity in these areas. BESS operators are therefore incentivized to go to places with more grid disruptions and more price arbitrage (more renewables). It is no surprise that states with higher renewables have higher levels of BESS as well. Four of the five largest planned projects are coming to Texas in the next few years.

Overall, the market for BESS is growing and expected to stay on that trend just like renewables. This market remains very small compared to how much electricity is generated in the US. All of the battery storage is Li-ion technology which means it is dependent on supply chains in China and the price of the raw material inputs. It also implies that unless another technology takes over, it will compete for the same resources as batteries in electric vehicles even though the cell manufacturers may be different.

BESS operators can be compensated in several ways, including in the wholesale energy market, through bilateral contracts, or directly by the utility through a cost-of-service mechanism. This depends on where it is and what purpose it is being used for. One challenge for the sector is that in some jurisdictions, providing services across different compensation sources is restricted by regulation. Allowing these BESS owners to operate freely would help encourage more projects to come online by opening up versatility in their revenue stream.

The upfront cost of BESS remains a challenge and a hurdle to wider adoption. Longer duration costs are higher than in smaller packs and 4-hour systems are not projected to reach the 100$/kwh milestone any time soon. Learn about the cost breakdown here.

Battery storage isn’t expected to knock your socks off but it is growing alongside renewables at a respectable pace. While the technology is currently used primarily to stabilize the grid, it has the potential to have a much greater impact as more renewables are added. As wind in solar grows around the country, more BESS applications will make sense as the arbitrage opportunity in wholesale electricity prices manifests. This is seen clearly with the states hosting the highest renewables concentration regardless of political environment. The growth of this market is dependent on electricity prices, the growth of renewable energy, and the price of Li-ion batteries. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.