🔋Crude Awakening Pt. 1

Origin, cause, and conclusion of the 1973 oil crisis - paving the way to analyze the consequences at the time and implications for today's energy issues.

This is part 1 of a 3 part series on the 1970s and how the environment of that time compares/contrasts to what we are going through today. More importantly, what does it mean for the world moving forward in terms of the economy, energy policy, and more. If you enjoy, press the heart button above or below I would greatly appreciate it! :)

Inflation is the topic on everyone’s radar these days. Gasoline, eggs, rent, and commodities are all more expensive than a year ago. The federal reserve is talking tough on their ability to fight inflation through raising interest rates and quantitative tightening policies. Average people are feeling the burden on their cost of living, especially in Europe amid an energy crisis. The economy tends to be a primary driver of election results and approval ratings. It is debatable how much the inflation we have seen is directly tied to Biden in the US, but regardless, rising prices are a topic of upmost importance to voters regardless of political bias this year.

Due to the inflation we are seeing, many analysts have been drawing comparisons to other inflationary periods such as the 1970s. A lot has changed since 1970; type of music, internet, laws, etc. No comparison is one to one, but there are key lessons and implications of how events unfolded, political choices, and consequences that effect today that can help inform us about what is happening now and perhaps give us insight into what will happen next.

History Doesn't Repeat Itself, but It Often Rhymes – Mark Twain

The story really begins in 1971 when the convertibility of gold was “temporarily” suspended due to the US government effectively defaulting on their debt. Due to their large deficits in part because of the costs associated with the Vietnam war, the US was unable to make good on their good as gold promise of their dollars, and closed the gold window. The dollar from this point onward floated freely with no gold or any other backing. The consequences of fiat currencies throughout history, with the US no exception, is an insatiable preponderance to devalue the currency through monetary inflation and excess government spending.

Then in 1973, Saudi states led by Egypt and Syria invaded Israel in what is known as the Yom Kippur War to claim strategic lands such as the Suez Canal. The small middle-eastern conflict turned into a geopolitical event of massive significance when Russia and US began providing aid to opposing sides amid the backdrop of the cold war. Even after promising a “honorable” end to the war like how the conclusion of Vietnam was described by him, Nixon sent $2.2 billion in aid to Israel to help their war efforts in Operation Nickel Grass. It is worth noting that Israel only asked for $850 million in aid and the tide of the war had already shifted to Israel.

The importance of oil cannot be overstated, especially during this time period. The Organization of the Petroleum Exporting Countries (OPEC) was and still is an intergovernmental organization that oversees oil production and agreements in many of the middle eastern countries. OPEC was not happy with devaluation of dollars as oil profits in dollars were kept by OPEC and subsequently devalued as the US severed its tie to the gold standard. The US with its exorbitant privilege of world reserve currency and large military post WWII gave it the ability to devalue the currency to fund government spending beyond what it had as reserves. Printing money for the US did not result in hyperinflation like it does in many emerging markets as demand for dollars overseas for trade remained high, so new issuance was still highly valued.

Due to increasing foreign interference in the Yom Kippur War, the idea of an oil embargo (of which Saudi Arabia did not support) was tossed around as retaliation. The US-Israeli aid package through Operation Nickel Grass was the determining factor for OPEC to institute an oil embargo. What ultimately turned the tide of the Saudi leader could well have been the liberal aid package and a defiance of the “honorable” end to the war he was promised in his eyes.

Regardless, these factors led OPEC to announce an oil embargo on the US and other allies putting them into a crisis. This caused sharp increase in the price of oil in many major nations. In the US, the price of oil went up ~4x in real terms in that year alone.

Oil was the most important commodity at the time as energy is a core driver for economic progress and as technology necessitated new and more demanding uses. Combined with the cold war and the desire to make the US look like the dominant world superpower, it was paramount that a strong supply of the core inputs were accounted for. The problem was US production of crude oil had hit a local peak in 1970 (a level not seen again until the shale revolution in recent years). With rising demand and decreasing supply, the US relied more and more on oil imports. This led OPEC and the Arab states to have the importance they did.

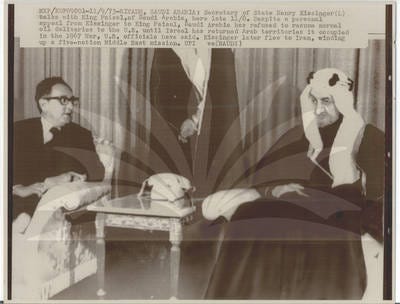

As seen above, one of the consequences of the embargo was a mostly permanent increase in the price of oil. In order to get out of the oil crisis brought about by the embargo, it was all hands on deck to try to procure a solution. The idea of a military intervention by the US was a non-zero possibility, but ultimately then Secretary of State Henry Kissinger had shown enough of an even-hand in peace talks as well as make a deal with Saudi Arabia in what is known as the petrodollar agreement. The deal was OPEC should continue selling oil to the US and allies denominated in dollars in exchange for military aid and protection. This is a debated topic and the specifics of any deal are debated. Arguments against suggest that it has been in Saudi Arabia’s best interest to do so to protect the value of their dollar denominated assets. The origin, legitimacy, and power of the petrodollar system is debated among historians and oil experts alike. Oil nonetheless is an extremely important commodity as cold war tensions reached nuclear standby proportions during the negotiations of peace for the war.

Furthermore, instead of the pseudo-gold backing from 1944-1971, now the dollar has a pseudo-oil backing in a way because of the denomination in dollars for oil importing countries. This consequences are a “deal” that has remained in tact to this day, as any oil importing countries need to have US denominated reserves to import oil or other commodities. This creates a large amount of demand for domestic US treasuries and is in the US’s best interest to maintain this power over the world.

US was not happy with the embargo, since it had deleterious consequences to the US economy and geopolitical status. Find out the consequences and responses to the oil crisis were in part 2 next week. Until then,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.