🔋Crude Awakening Pt. 2

The far-reaching consequences of the 1973 oil crisis and the connections/differences to the world today.

This is part 2 of a 3 part series on the 1970s and how the environment of that time compares/contrasts to what we are going through today. More importantly, what does it mean for the world moving forward in terms of the economy, energy policy, and more. If you enjoy, press the heart button above or below I would greatly appreciate it! :)

Last week I discussed the geopolitical environment and historical backdrop that defined the early 1970s and subsequent energy crisis. It will provide some good context to make more sense of this article. If you haven’t read it yet, check it out here. Analysts are right in a lot of ways to compare today to the early 1970s, but there are big differences. In this article I will discuss the key macroeconomic and policy consequences from the inflationary period during the early 1970s and mid-post oil crisis and how they compare/contrast to today.

The energy crisis and rising oil prices of today are not as bad or not as bad yet as what was seen in the 1970s, especially in the US. Both now and in the past, the energy crises occurred following wars and particularly wars in which sides have been taken by third parties. Today, the US supplies Ukraine with aid from the side while Russia invades Ukraine with troops. Connections instantly arise between the the nuclear threat during the cold war and today. The war, while certainly exacerbating issues arising today including food and energy shortages worldwide, was merely the hand that let the cat out of the bag it was going to inevitably get out of [1,2].

Today, the largest issues have arisen in Europe due to the proximity and dependence on Russian energy. The first area of contrast is that the embargo of oil in the 70s was an involuntary event, whereas today it is a voluntary event for the US and other major European nations as sanctions in response to Russia invading Ukraine. The war is a deep and nuanced topic that I will not get into depth on here. While I personally do not want anyone to be at war, I will not project any morality onto the situation, but rather point out the policies and aspects of the energy situation unfolding for various nations. My point, regardless of the justification or lack thereof for Russia’s invasion of Ukraine, the sanctions on Russian energy that are comparable in some sense to the OPEC embargo in 1973 are a self imposed detriment from an energy perspective in contrast to an external action. In today’s case, Europe did not completely remove Russian oil and gas initially as they were dependent, however sabotage has now has left them effectively cut off in an external event similar to that of the 70s.

So OPEC placed an oil embargo on the US whos oil production was diminishing, oil prices were skyrocketing, and inflation is the number one issue on the mind of the consumer. So how did the consumer of the time fare? First, a quote from Britannica,

With the global capitalist economy already experiencing difficulties, these actions precipitated a steep recession accompanied by rising inflation.

This time period is the most famous historical example of stagflation, which is loosely defined by elevated levels of inflation amidst a recession. This is the second comparison to today, as fears and debates about recession are also lively today. We have already seen two consecutive quarters of negative GDP which has a 100% track record of being a recession, however the US government has declared we are not in a recession. In reality, a recession is officially defined along a number of parameters in ~1 year retrospect by a different organization. Practically speaking, we are undoubtedly seeing economic slowdown which warrants the comparison regardless of the technicality.

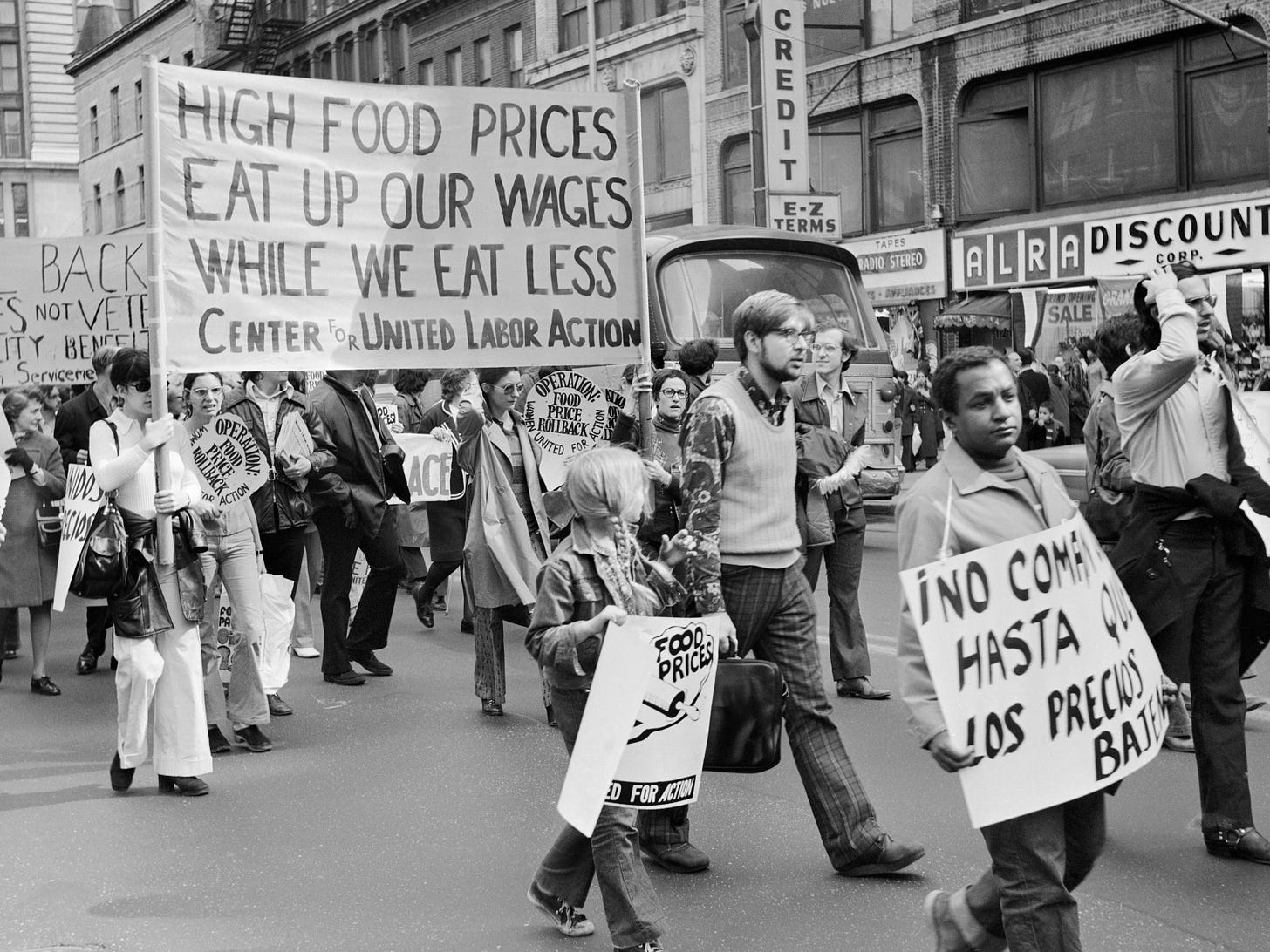

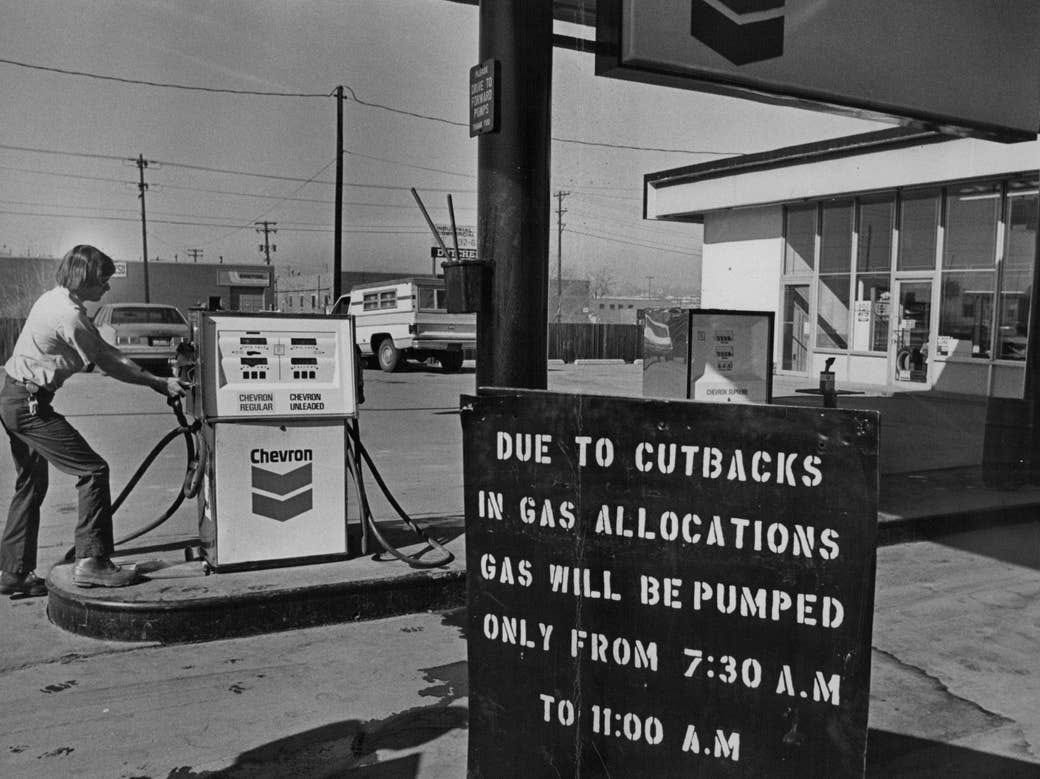

In this environment, Americans cut down on heating and electricity, gasoline shortages ran rampant, consumption habits changed toward less fuel consumption, and wealth deteriorated as savings were eroded through inflation and the stock market had its worst performance since the great depression. Inflation became psychological, as opposed to just a temporary phenomena due to a one time disturbance.

As the crisis unfolded, a slew of reactionary government policy/suggestions followed [3,4]. Gasoline and electricity rationing, restrictions on weekend driving/gasoline sales, times square lights turned off, banning of Christmas lights, a 55mph speed limit maximum, bans on oil exports, windfall profits taxes, trucker strikes, violence, development of the strategic petroleum reserve, daylight savings time, fuel conservation campaigns, and vehicle fuel economy standards. Europe was variably hit with effects based on their geopolitical stance, but certain counties banned transpiration on weekends, had rationing of energy supplies, and the Netherlands even imposed prison sentences for going over the electricity ration.

While today’s energy issues are being seen more throughout Europe than in the US, the comparisons still apply, especially in an even more globalized world. Today the Eifel tower is shut off at times in a similar manner to the 70s. Across Europe now, energy is being rationed before winter, gasoline prices are surging, and even the price of coal, wood, and other sources of energy are becoming issues. Perhaps the most obvious comparison for the US is the increased cost of gasoline that has impacted consumers which has been a big political talking point considering the mid-term US elections in November.

Furthermore, development of the strategic petroleum reserve (SPR) was in reaction to the energy crisis in 1973 and for emergency and wartime use in times of crisis in the future. This stands out today, as the US is currently withdrawing from the SPR at an unprecedented rate. Oil prices went up ~4x in 1973 and only ~70% from the start of 2022 to the recent peak in June. Where would oil prices have been if it wasn’t for the draining of the SPR and China’s covid lockdowns hampering a significant amount of demand?

In the 70s, instead of letting higher market prices naturally encourage investment and exploration of new oil projects in the US, a price control program was instituted to encourage new oil production in the US. It promoted new oil discoveries by setting the old oil price lower than new. This brought old oil off the market worsening the scarcity while subsequently discouraging alternative energy sources [5].

Price controls are a free market’s nightmare, thereby distorting the price signals that guide human actions and behaviors. These controls are being floated around today, as Europe wanted to cap the price of Russian oil as a two for one sanction and domestic benefit. Unfortunately, even if a policy such as this could be effective in practice, it is no longer possible due to the sabotage of the Nordstream 1&2 pipelines from Russia to Europe. Subsidies are a similar form of price controls enacted by the US in the recent infrastructure and inflation reduction act. Not saying the outcomes and features of the policies are necessarily bad, I think that the incentives they provide are dangerous to long term economic and energy prosperity by sending false signals to the market and dis-incentivizing the market participants from finding optimal solutions in its vast collective wisdom compared to the wisdom of the government in its constrained knowledge and capability.

Back to the 70s. The stagflation of the time changed mindsets and is put nicely here from ThoughtCo,

Labor contracts increasingly came to include automatic cost-of-living clauses, and the government began to peg some payments, such as those for Social Security, to the Consumer Price Index, the best-known gauge of inflation.

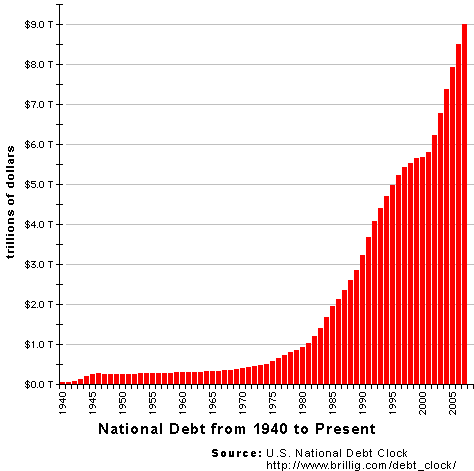

While these practices helped workers and retirees cope with inflation, they perpetuated inflation. The government's ever-rising need for funds swelled the budget deficit and led to greater government borrowing, which in turn pushed up interest rates and increased costs for businesses and consumers even further. With energy costs and interest rates high, business investment languished and unemployment rose to uncomfortable levels.

While government payment adjustments helped the consumer in the short term, it contributed to inflation through a wage-price spiral and further perpetuated the recession. In fact, government bailouts do nothing to solve the root cause of the problems as laid out in the case from the 70s. The government debt spiral has grown incredibly since we severed out tie to the gold standard in 1971 (devaluation of the dollar contributed to OPEC declaring the oil embargo in the first place). This can be seen in the chart below, showing the federal deficient over the years.

Across the world, in response to the acute energy shortages we have been seeing over the past year, a few European governments have instituted energy bailouts for consumers who are increasingly frantic and unable to pay energy bills. In a similar fashion to the policies in the 70s, energy bailouts merely defer the cost to the federal government. This in fact artificially subsidizes the demand that would’ve otherwise been destroyed to at least in part push the market balance toward equilibrium.

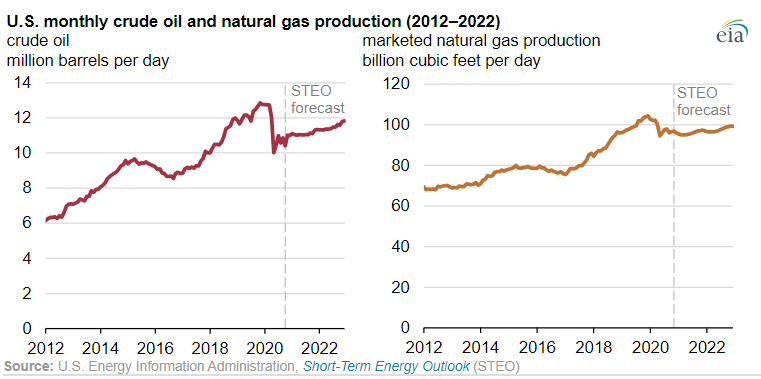

Just like the 70s when investment and production of oil had hit a peak and was dwindling, the low/volatile energy prices and the climate change movement have urged us in a similar position. Investment and production of fossil fuels in the US has been stagnating and has put the US in a similar position of awkward dependence on foreign nations for critical energy inputs, including recent moves to remove sanctions on Venezuelan oil, implore OPEC+ to reconsider cutting production, and not promote any domestic investment in the space. To contrast the 70s, the US is far more energy independent and has far less dependence on the country of import (today Russia, not OPEC) which does bode better for the US to face the challenges associated with sanctioning Russian oil/gas supplies.

With consequences of OPEC using oil as weapon and many policies that followed in the 70s, it is easy to criticize looking back in history as we know what followed. Had I been in that position I can’t say I would have guided the country any better. What is most interesting to uncover though is how many of the issues both then and today began by government mistakes and other factors prior to the “official” starts of the crisis (oil embargo and Russia’s invasion) and the propensity to reach for the same policies that failed in the past. That being said, we can learn from causal and logical pathways then and now, so that we may have a better idea of what is to come. For more on what this means and what to expect moving forward, subscribe and stay tuned for next week’s article.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.