🔋Diamond In The Rough pt. 1

Incoming supply/demand imbalance in graphite production - the primary anode material for Li-ion batteries.

Help me out and press the heart button above or below I would greatly appreciate it!

Ever get that smudge from pencils on your hand during a test? Oh you use pens don’t you… Well either way that is graphite and it is a big issue for the green movement regarding renewables and batteries. The demand for graphite is set to explode with the planned increase of electric vehicles (EV) over the coming years. Graphite is the key component for Li-ion battery anodes and expected to increase my multitudes in consumption. A Li-ion battery for an EV is 8.2 wt% graphite which is a significant chunk of the overall mix. Hoarding pencils expecting a monster investment return is not my point and this is not investment advice lol…

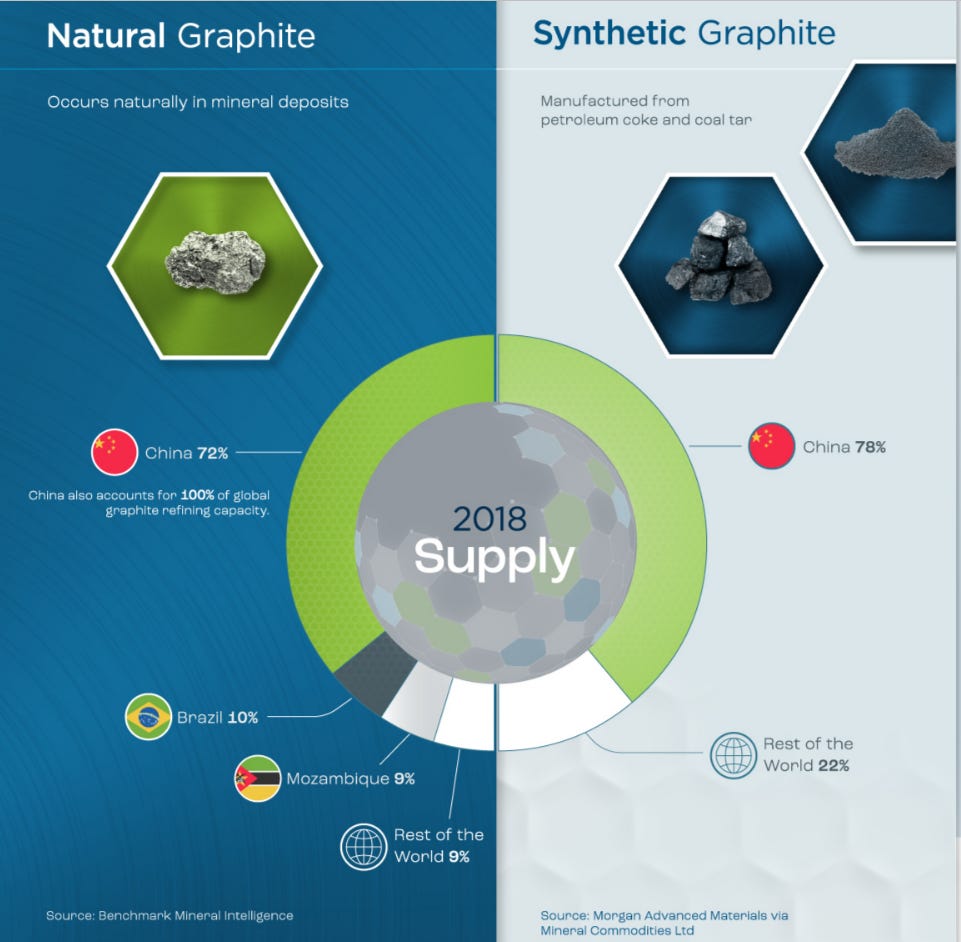

That’s because batteries don’t just need any old graphite. They need high purities which have historically come from synthetic graphite, but increasingly from natural graphite due to improvements in purification and modification. The supply of graphite is controlled by China who dominated the mining and processing of the material. This is a common theme among battery metals. Not only are the materials in short supply relative to the incoming demand by 2030, but the processing of vital cathode and anode materials runs overwhelmingly through China. This is a large counterparty risk especially if we are going to be placing so much of our economy and energy security into Li-ion batteries. Our source of key materials would be further exacerbated into a full blown issue if tensions increase geopolitically in the future.

Supply and demand imbalances are represented in prices and graphite has seen a noticeable increase in price over the last two years. Prices reflect a market full of millions of decisions and in the case of commodities take into account years of investment and psychology. A portion of the short term price action is due to recent supply chain issues that are seen across the board, however I am of the belief that structural inflation in energy and commodities will be an inconvenient trend in the decade to come.

For graphite specifically, to match the demand that is expected from electrifying vehicles around the world, supply in the form of mining and processing operations will have to be built to match. Benchmark Mineral Intelligence estimates that new supply will be brought online (see new mining operations here), but at a deficit to the expected demand. Their current projections show a 8Mt graphite shortage to grow by 2040.

This is a massive difference on top of similar issues with the other battery metals such as Lithium. Much of the imbalance is due to the White House’s EV targets which I discuss along with lithium and a more realistic way to reduce transportation emissions with less cost in Shooting For The Moon, Not Landing With The Stars. Something will have to give. Even with all of the new mining projects announced and executive DPA orders, benchmark projects this absurd market imbalance. There are two ways this plays could play out.

First is that prices get really high and as the saying goes, “the best cure for high prices is high prices.” This assumes a free market is functioning where demand would naturally subside. Then if you speculate a changing political environment that is less favorable for EVs and renewables, then this also likely lowers demand. So higher battery price would naturally hamper demand for increasingly expensive EVs because people decide they cannot afford it and the cost to reach the EV target may be too great.

Option two would be that the higher battery costs are simply subsidized by the government which would likely be justified under the climate change crisis. Any climate alarmists or modern monetary theorists may see this as simply a good and easy option, and is certainly where we are headed in the current political climate. Monetary inflation is a primary cause of price inflation, which has been largely forgotten in the recent years due to deglobalization and technological advancement. If the government foots the bill so that they can reach their 2030 EV targets, they would print more money to pay for it (tax receipts alone do not cover the budget of government entitlements + spending). This printed money alongside reshoring of many industries is an inflationary pulse that would raise prices for the average consumer. Inflation can be thought of as a redistribution of wealth from the savings of the people to battery miners/producers to make EVs, making life more expensive the process. We are also seeing signs of slowing economic conditions which could lead to a stagnation of innovation in some respects as well (sometimes hard times/recessions stimulate great innovation though).

Maybe this is a moral enough endeavor for it to be accepted and I’m certainly not the judge of that, but these supply/demand imbalances are going to spur some harsh realizations and hard decisions in the future. The reality facing us is there are consequences regardless of what path we take, I just hope reasonable decisions prevail that can better society.

More of my thoughts on how things could be made worse by bringing in more inflation and malinvestment can be seen in my The Real Climate Catastrophe series.

Next week I will discuss in greater detail the issues of graphite as an anode material as it pertains to reducing emissions, the consideration of batteries as a green technology, and the alternatives that could solve it.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Thanks, Grayson. A nice, succinct introduction to the significance of graphite for LIBs and EVs. Based on the current supply/demand forecasts above (BMI), am I right in concluding that the current forecast is for a deficit in supply from around 2027? What are your thoughts on graphite market pricing in the meantime? I am an investor and once upon a time, an R&D scientist (physics, explosives for the mining industry). I am trying to determine how best to put a few $$ into graphite. At the moment I would just be throwing darts! (I am heavily invested in lithium already.) Thanks again.