🔋Don't Be Crude

The mismatch between IEA and OPEC oil demand projections continues to widen. Who is closer to the truth?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

If you could see into the future there would be many possibilities with that kind of power. You could make a lot of money, prepare for future outcomes, and have more confidence in your decisions. Of course, no one has this power, but people try their best to predict and guess what will happen next.

Making large forward-looking predictions about global markets is difficult, especially in commodities. The most traded commodity in the world is crude oil, with 29.5 billion barrels produced in 2022. The market size for oil is a whopping 2.1 trillion dollars, dwarfing copper, iron, and gold combined. Oil is often called the lifeblood of the economy. Nearly everything requires oil including transportation, industrial power, electricity, large machinery, consumer products, petrochemicals, fertilizer, and more.

Oil demand is what ultimately determines how much companies drill. Oil is tied to the economy because the more manufacturing and transportation take place, the more oil is needed. Based on this demand and the present production/supply, the price of oil manifests. Recently, concerns over climate change via the push toward renewable energy and electric vehicles have led many to believe the days of fossil fuels are numbered.

Mixed Messages

Predicting oil demand is a tall task considering the market size and the global distribution of production. Oil is produced all over the earth, with large segments in North America, Russia, the Middle East, China, and Brazil. Fray not, because the International Energy Agency (IEA) is up to the task. With many large countries around the globe contributing to the organization, the IEA publishes a yearly World Energy Outlook, one of the foremost predictions for global oil demand.

The IEA was founded after the 1973 oil crisis with the “intent to avoid future shocks by helping to ensure reliable energy supplies, promote energy efficiency, ensure energy security and encourage technological research and innovation.” Fast forward to 2022 and the organization officially added a new mandate to promote climate goals aiming to reach net zero emissions. While I don’t care that they do this, there is some skepticism about whether their data is still objective or if it has been tainted by ideology. Let’s take a look.

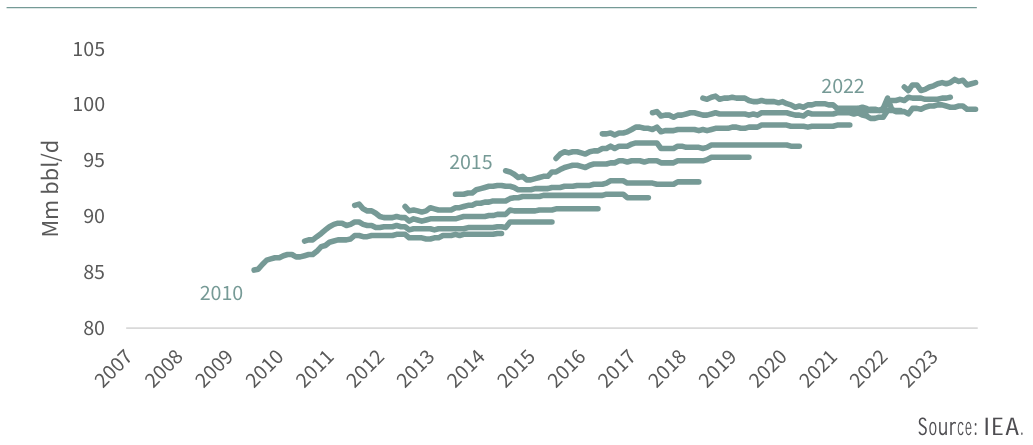

In 2023’s outlook, the IEA predicted that fossil fuel demand will peak before the end of the decade (less than 6 years left). Goehring & Rozencwajg show that the IEA oil demand estimates have been consistently wrong over the last 20 years. They have underestimated demand in 12 of the last 14 years. The IEA is hopeful and has been incorrectly predicting a faster replacement of oil with clean energy technologies and has been bearish oil much longer than their official net-zero mandate began.

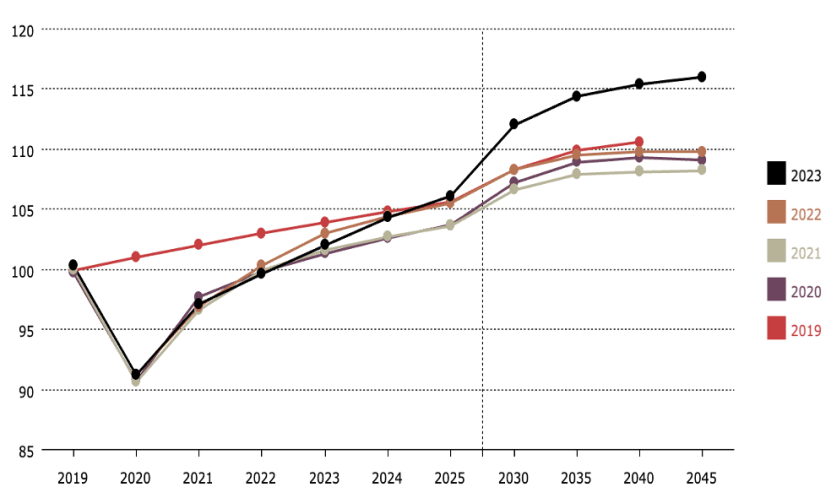

While the IEA consistently being wrong doesn’t necessarily prove they are ideologically biased, as they could just be bad at predictions. However, it certainly points in that direction considering their new climate-oriented mandate. To get a clearer sense, we can look at estimates from an organization that could be biased in the other direction. The Organization of the Petroleum Exporting Countries (OPEC) oversees oil trade in the Middle East and a few other nations like Russia. OPEC strongly disagrees with the IEA’s oil outlook and has adjusted its predictions to be even more bullish oil. OPEC now doesn’t have any peak oil predictions before 2045.

Who’s Right?

There are a few main areas where the discrepancies lie. One main prediction in the IEA data is that China will have less energy growth, switch off fossil fuels, and switch to a more service-based economy. Since China has been such a large global driver of demand growth over the last 20 years, their slowdown will have a large impact. Further, electric vehicle adoption has seen excellent growth thus far which will continue to displace oil used in the transportation sector.

In contrast, OPEC believes internal combustion engines will remain the leading technology for the foreseeable future. The IEA projects fuel demand will decrease while OPEC projects a large increase by 2045/2050. Further, OPEC suggests that demand increases from nations like India will more than offset declines from China baked into the IEA assumptions.

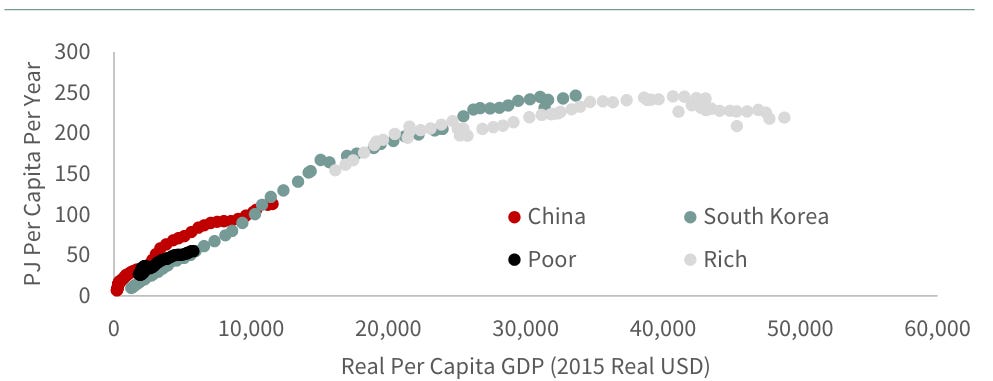

Another factor to consider is countries entering a phase of accelerated energy consumption. As nations get wealthier (real GDP per capita), they use a lot of energy as they grow. Once they are a “rich” country, the energy use plateaus. According to G&R, not only does China have more room before its energy use begins to flatten off, but 1/3rd of the world is in this middle-income region where they need much more energy as they grow. This middle-income region will be a source of new energy demand and you can bet most people will put climate goals behind newfound economic prosperity on their priority list. As I mentioned last week, energy efficiency does not solve this problem but merely encourages more energy use.

Conclusion

The IEA likely doesn’t care what anyone thinks, but some oil analysts have raised concerns that the Department of Energy has a strong connection to the IEA and significant funding may be coming from the US taxpayer. While just a claim, if they are putting out fraudulent information at the taxpayer’s expense, that is certainly not good. Assuming good faith, the vast differences between these estimates are at the very least puzzling.

Taking a look in history, 30 years ago fossil fuels were 77% of total energy and have not gone down as of 2022. As a percent of total energy, fossil fuels have only gone down 3% since 1950 (before that the percentage was even less since biomass made up a larger percentage of energy at that time). Cleaner energy sources are making up an increasing share of new electricity production and we shouldn’t fall prey to recency bias, but history shows how dominant fossil fuels are and that it will require rapid changes to observe the IEA path.

The IEA estimates are likely too optimistic for the energy transition, but is that a problem considering net zero is in their mandate? Since the IEA is influential among already wealthy nations, if companies invest less in new oil and gas on this information, this may sound like a win for their climate goals. However, over time this strategy could contribute to underinvestment and lower supply than the underestimated demand, especially from these new middle-income nations. With this, the oil price could increase making life more uncomfortable and delaying the energy transition by making production costs of renewables still dependent on fossil fuels more expensive.

It seems like some believe that higher oil prices are good for the energy transition. This could not be further from the truth. In theory, low oil prices signal that the demand for fossil fuels has decreased so much that it is not wanted, which would be a success for the current energy transition. Further, future oil demand also depends on the economic feasibility of electric vehicles which the IEA assumes will dominate going forward. Some think that high oil prices will be a catalyst to switch to EVs as it will help the cost parity between ICE and EV be reached. With higher input costs (oil prices), EVs will have commensurate price increases which is a factor often neglected.

To get to peak oil demand by 2030, less than 6 years away, is a longshot. Barring severe recession which could reduce all energy demand, the overall trend is higher energy demand over time, not less. This demand will be filled by whatever means necessary. Nations entering and growing within the middle-income regions like China and India show a clear preference for power over climate change. It would be unwise to bet against other nations behaving similarly and by extension the peak oil demand before 2030. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.