🔋Dr. Copper Pt. 2

Copper prices surge amidst tariffs, but pricing in gold tells a different story.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

The performance of stock indexes over the last decade has put most asset classes and diversification strategies to shame. Metals other than gold may be more volatile, but the returns are not something you can rely on unless you are an expert trader. Recently, gold has been hitting new all-time highs, over $3000/oz, partially due to tariffs and funds flowing into the US. If you saw the scary GDPNow estimate of -2.8% last week, it turns out that was mostly due to gold imports skewing the data, and the GDP will not likely be negative.

Copper prices have been surging alongside gold lately. The threat of Trump's tariffs looms as companies try to secure supplies before costs increase. These concerns may be why copper and metals are surging, with buyers willing to pay a little more now before tariffs kick in. This may be shortsighted. It seems like Trump has been back and forth on tariffs. If you are one to pay close attention, it must be exhausting with them going back and forth nearly every day. This has led to some market uncertainty, but until share buybacks and passive money flows reverse, there is tremendous upward pressure on the market.

However, copper wasn’t nicknamed Dr. Copper for no reason. Is this economically sensitive metal giving us any real information, or is it just tariff noise? The economy is slowing, as seen with full-time employment, savings rates, and more. Does copper tell a different story?

The top copper-producing countries are Chile, Peru, China, the United States, and Congo. Unsurprisingly, the refinement in copper is dominated by China, with nearly five times as much refined copper production as the next highest, Chile. Copper prices surged post-pandemic with the massive economic stimulus and activity post-shutdown. With a brief pullback, copper price is now near all time highs once again.

Copper trends higher over time though, as resources dwindle, there becomes more worldwide demand, and currencies are devalued. One thing to note is that copper typically spikes before recessions, indicated by grey bars. The 70s, 80s, 2008, and 2020 recessions all were preceded by copper spikes. 1990 was delayed by a few years, and 2000 was the only recession not preceded by a copper spike. In each recession, metal prices drop quickly; as demand for the production of real goods declines, so does demand for raw materials.

This is a sign of whether we are in a recession/bear market or not. Metal prices tend to go down alongside stocks. Currently, both gold and copper are showing strength amidst weakness in stocks. They certainly aren’t leading to the downside if that is truly where we are headed.

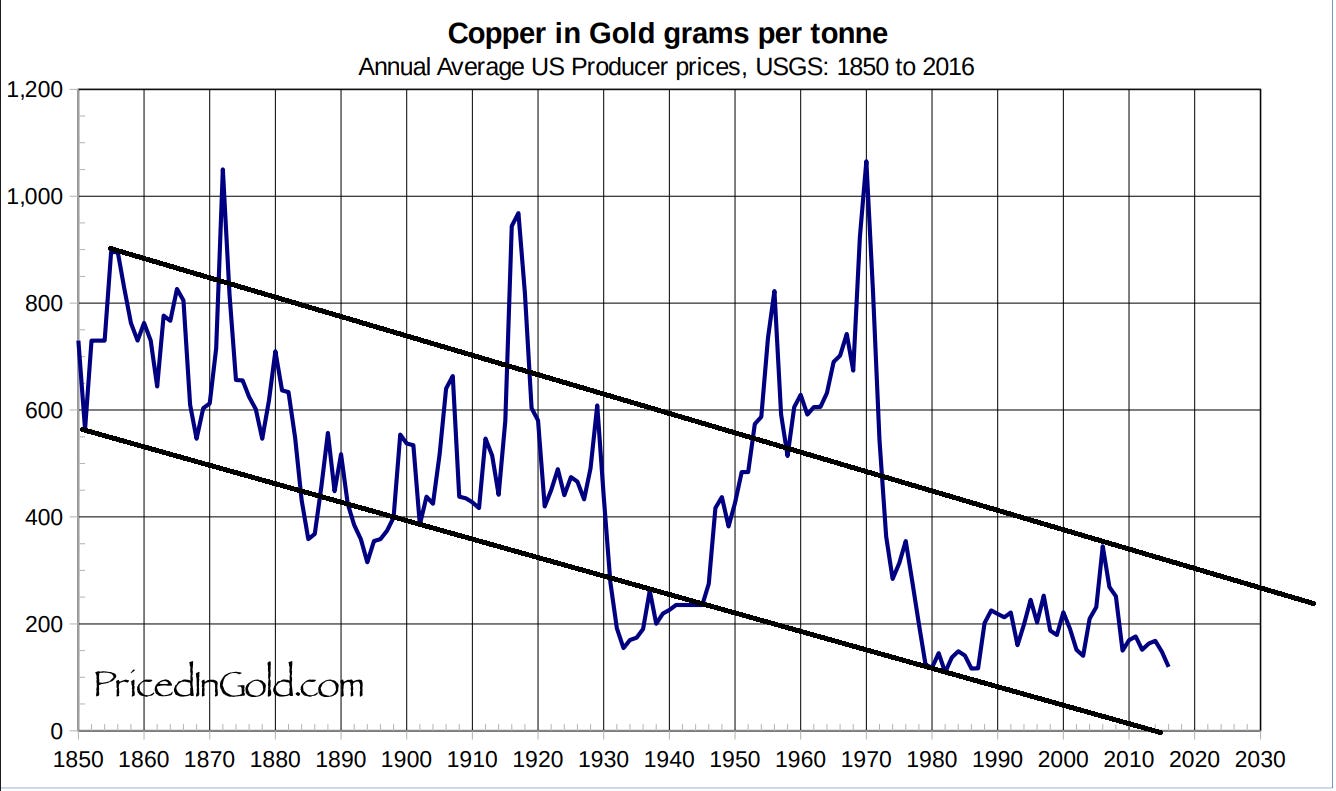

Another way to conceptualize copper is by pricing it in gold instead of dollars. In doing so, we see a trend of lower copper prices relative to a stable value asset. This implies increased production and mining techniques and/or less demand over time. Spikes above the trendline were due to explainable events. Railroads were in a bubble in 1873, WW1 caused dislocations in the 1910s, and gold prices were fixed from 1940-1970.

Currently, copper/gold is nearing its all time lows, and much further will likely send it to the bottom of the range. The bottom of the range is coincident with a weak US economy. The post-civil war period was ripe with multiple financial crises. The great depression and the early 1980s were also large economic downturns.

In 1929, copper was 24 cents/lb, but by 1933, it was down to 5 cents/lb. In 1971, when gold was allowed free market pricing like copper, the price rapidly stabilized over the coming years. Dr. Copper tells us what is happening to fundamental demand in the economy. If we break the 2008 and 1980 lows in copper/gold, we should be headed for recession and economic weakness. Building anything these days requires copper. Whether you price it in gold or dollars, it is still a good indicator of the underlying economy. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.