🔋Enemy Of The State

If seizing Russia's gold is fine because they are the enemy, what do you call your own citizens?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Responsibility or betrayal? Depends on who you ask. As I mentioned last week, the US and its allies seized 300 billion of Russian reserve assets because they did not agree with the invasion of Ukraine. This is similar to freezing gold liabilities held in US vaults that were assets from nations around the world. Instead of a sequel into crypto land, today we stay focused on the yellow rock.

We find ourselves in a time of relative peace and prosperity. No world wars are ongoing and the last economic depression was in 2008. In the grand scheme, even the pandemic was a blip on the radar as far as economic growth and stock market returns are concerned. We should not grow complacent about the risks associated with these events, not just the events themselves but also the reactions to them.

To most archaic history today, the Great Depression was the greatest economic struggle the United States has ever had to face. Just as we can compare the rise of populism today to that era, the response function of governments should not be neglected in our takeaways of history.

Central banks “learned their lesson” from the Great Depression in that the US should step in more aggressively to accommodate lending and economic stimulus to the economy. The conclusion from the Great Depression was that hoarding (aka savings) was to blame for the prolonged economic hardship. Only if people remained confident and spent money and took out loans would the economic wheels keep turning and the government should have been more active in stimulating this. I agree with the contrarian Austrian School of Economics that this was the wrong lesson to take away from that period, see the Great Depression.

A heretic I may sound, but Franklin Roosevelt (FDR) was not the savior of the depression as he is painted, but merely an authoritarian who prolonged the depression (see article linked above). But as the Depression grew to 4 years old, authorities started to become enlightened by the modern way of economic thinking and the disgust for savings. 1933 was one disgraceful day in a line of many attacks on monetary freedom over the last 100 years.

On April 5, 1933, FDR signed Executive Order 6102 that citizens must hand over their gold possessions to the government or face 10 years in prison, a $10,000 fine ($243,000 today), or both. This must have come as quite a shock for people at the time. Gold was a staple form of savings for many people back then in a time where savings was valued much more than today. To say this was a monumental event is an understatement.

To support the US seizing Russia’s assets is justified because they are a bad actor is an argument that has weight, but is likely a moral hazard with unimagined repercussions in my estimation. But not only has the US done this to its enemies, it has done the same thing to its allies in 1971, and even its own citizens in 1933. 1933 was truly a devastating blow to personal freedom all in the name of protecting and saving the economy that the government ruined in the first place.

With power comes great responsibility. But with power, comes the great ability of coercion. The US may have been able to get away with these acts due to its power on the world stage, but they certainly leave a mark on those affected. Don’t be so naive to history that the government could out of nowhere seize anyone's assets they don’t like, even their citizens since it’s been done before.

Like I said last week, one of the advantages the US has in maintaining confidence in the world reserve currency and monetary hegemon status is its physical assets, regardless of whether its tie to currency has been severed. Officially, the US has by far the most gold holdings of any country at 8,134 tonnes, over twice Germany in second. Russia and China both hold ~2,300 tonnes each.

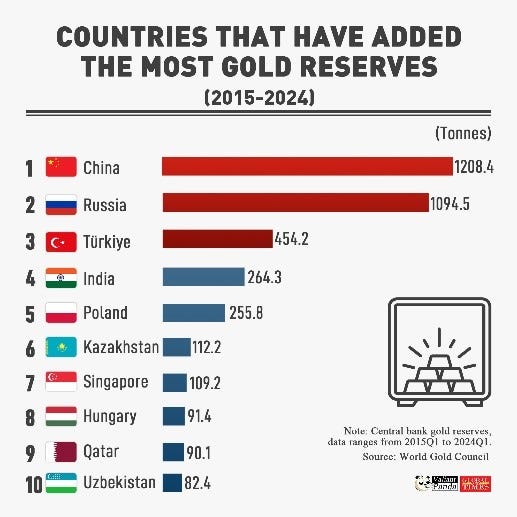

With the seizure of Russian assets abroad, you may have guessed that they would try to increase assets that cannot be seized. While electronic dollar liabilities can be wiped away with a few clicks, the US would have to invade to take away the gold held in non-western vaults. These sanctions by the US already have consequences, as you can see the countries that have added the most gold reserves in recent years. These countries likely want to protect their own interests and/or hedge some of their exposure to financial risk faced by Russia. Unsurprisingly China and Russia lead the list and have been hoarding up gold like crazy.

So what though, China would still have to quadruple its gold holdings to even match the US, right… right?

Many Gold experts suggest China has more gold than these figures suggest, actually closer to 30,000 tonnes. This issue is that the vast gold supply is held by the public, corporations, and private banks in China. The trouble is estimating the percentage held by the government, ranging from 10-55%. This places the estimated gold held by the Chinese government at 10,000-30,000 tonnes among gold analysts.

The US has reserve currency and the largest military so I am not suggesting any radical changes are happening, but simply that these countries have more reserves than they are letting on. You can bet Russia has more gold reserves than they are letting on to be confident in their invasion of Ukraine. Especially after the asset seizure, these countries are hoarding real money as a hedge against Western influence.

There are multiple ramifications of this behavior, especially if the US is caught sleeping. If the BRICS nations attempt to release their own form of trade under a different currency or backed by real assets however likely that is, they are in a prime position to be the major players after dwarfing the US’s gold reserves. It could also be significant if there are any moves to move back to a physical asset tie someday after a global financial calamity and debt collapse.

Things are very different in China than in the US. While the US has a record of taking its citizens’ gold, China encourages citizens to buy gold. Further, buying stocks is riskier there and capital controls limit foreign asset purchases. Real estate has been an attractive asset class but has been going through brutal deflation over the last few years. This leaves citizens to put money in banks as deposits, bonds, or gold.

China is a market with real demand for physical gold. Here in the US, citizens don’t really buy gold, but paper contracts with gold claims are traded all the time. Some gold analysts have observed suspicious behavior with gold contracts and deliveries at major banking institutions. This could imply gold price suppression, even at the request of the US government to keep confidence in the dollar. Market manipulation or not, there is a premium between the Shanghai gold exchange and those of London and New York.

I leave you with a warning that the US could not only try to seize digital assets like bank reserves or money tied up in CBDC/crypto but even physical assets like in 1933. They are willing to do it to their enemies, and they have even done it to protect you against yourself in the past. I also suggest that gold is a much more desired asset than anyone is letting on. Major economies like China, Russia, and India are hoarding gold like never before and not making a fuss about it. At the same time, recession/debt risks increase in the US by the month which could cause a swatch of money printing to try to remedy the pain. These monetary responses and physical gold trading at premiums suggest gold could be a good asset to own for the coming years.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.