🔋Energiewild

The shutdown of the remaining German nuclear power plants is the culmination of a government unilateral in ideology causing outcomes antithetical to the slated objectives.

Press the heart button on this article, yes you! I would greatly appreciate it :)

Welcome to the latest episode of dunking on German energy policy. My last thoughts on the matter, where I go into more detail about the economic ramifications were back in November in a piece called This Is Fine.

This week Germany announced the closure of its remaining three nuclear powerplants. Their nuclear program began production all the way back in 1961. The country aims to be completely powered by renewable energy by 2035 and has already built out renewables at the fastest rate in the world. It is worth noting that the slated aims of this policy are reducing greenhouse gas emissions. Nuclear power is zero emission as well, but the green party in Germany are some of the most insistent anti-nuclear politicians in the world.

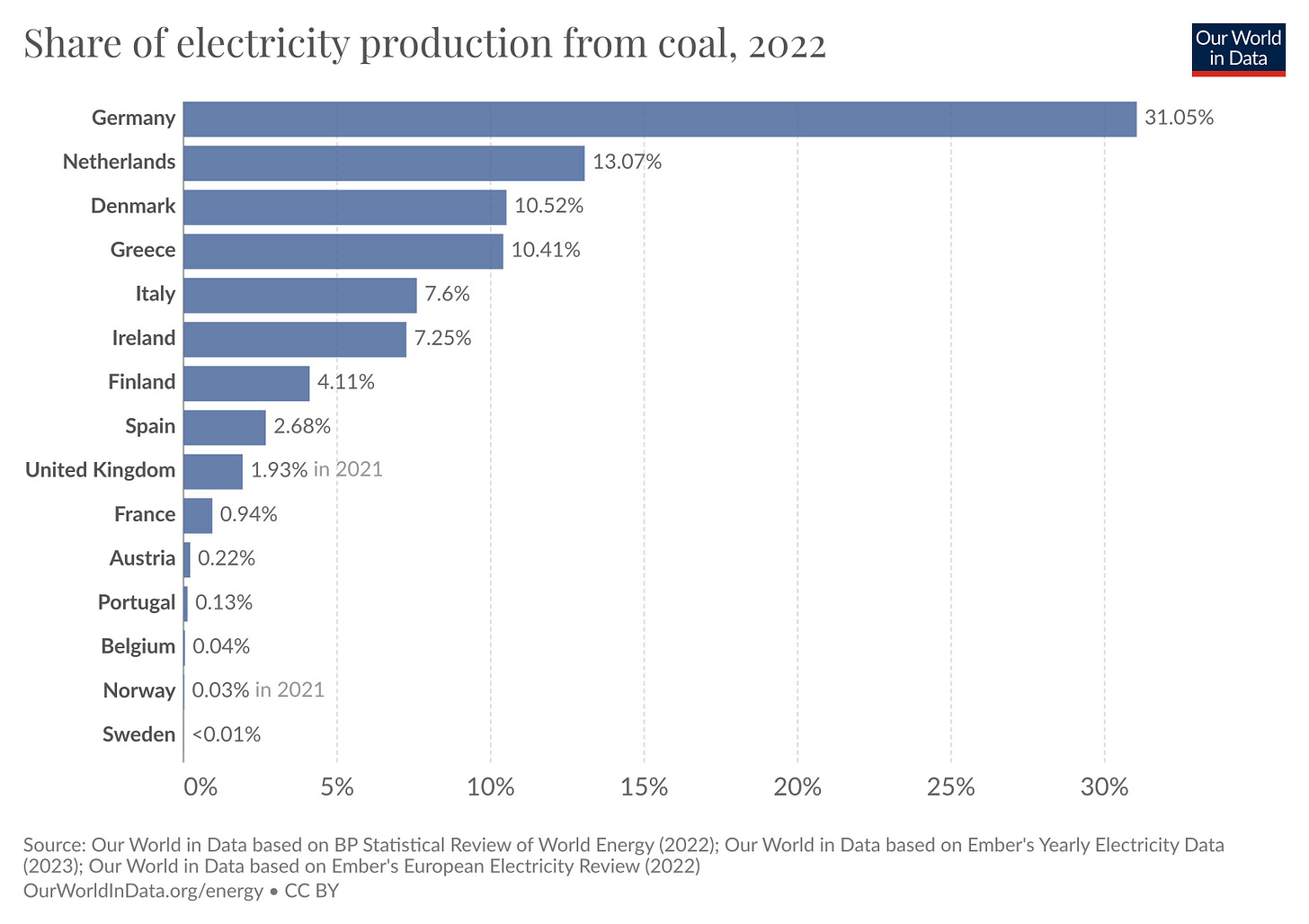

Below is the share of coal used for electricity in 2022 among major European nations. 2022 was a tumultuous year for the country due to the Russia/Ukraine war disruption and the sabotage of the Nord-stream pipeline supplying natural gas to the country. This made an energy crisis worse and a scramble for natural gas around the world including major deals the US and Qatar. Germany is able to bid up the price of natural gas at the expense of Pakistan and other countries with less resources. While many analysts were worried about the country heading into the winter, extending the nuclear powerplant operation, exorbitant effort/cost to fill natural gas stockpiles and secure inflows, and an unseasonably warm winter helped Germany get through the winter relatively unscathed. That being said, the graph shows just how much Germany still had to rely on coal, despite its best in the world renewables fleet. Ask yourself whether this number is more likely to remain high or come down after shutting down all remaining nuclear plants (6.3% and 11% of electricity production in 2022/2021).

As Arpit Gupta points out, had Germany just maintained their nuclear fleet that was world class in the 90s, the G7 nation would have zero reliance on coal right now. Coal is the most polluting of the fossil fuels which is why it is the most meaningful fuel to reduce in order to lower emissions.

Electricity maps has the carbon intensity of each country in a very intuitive site. If we look at Germany’s lowest intensity month in the last year vs. France’s highest intensity month over the same timeframe, the picture is quite clear. Germany could have values 122g and below had they not gone anti-nuclear. France has some of the lowest carbon intensity of electricity production of anywhere in the world, especially of a major nation. They even export clean energy across Europe. France drew some criticism last year because of its nuclear fleets inability to live up to the task during heat/draught (water needed for cooling), however these reports were not entirely correct as only 0.2% of losses could be contributed to heat/draught per the EDF.

While carbon emissions are important, arguably more important is the cost considering the extreme volatility in electricity prices seen last year leaving consumers shaken. Consumers hoarded firewood, were asked to ration electricity, and were hit harder in the wallet last year. Hours before closing the nuclear reactors, one German utility (Eon) announced a 45% increase in consumer electricity price with some others having already done the same. While it most certainly contributes, it is easy to blame this price hike on this event since they were so close in time. Utilities could be increasing prices regardless of this nuclear plant closure date based on the previous year and their outlook going forward having known for a while this was coming. Also the government energy bailouts create an incentive for utilities to raise prices given the new money flowing into the area where the utilities may try to capitalize. This could be a contributing factor and have the utilities under investigation.

These are not healthy market behaviors, brought on by the German government’s intervention in the form of energy stimulus and deleterious energy policy. Further, some fail to realize that increasing the money supply inflates prices whether it be asset valuations, CPI, healthcare/college costs, and perhaps now energy prices. Germany’s energy policy is expensive too, costing 30+ billion Euros each year over last number of years with a total cost to achieve their ambitions with estimations in the trillions total. Add to that the 200 billion in energy bailouts due to the instability and energy insecurity they faced and the bill keeps getting costlier. With governments holding the printing press and seemingly incapable of thinking past first order consequences, it is prudent for individuals to remain steadfast in searching for the truth and understanding the root cause of these problems.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest post on notes.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Until we get to utility scale storage, intermittent renewable can never become economically sound. The distribution networks demand power now else fail. Musk is trying but Li-ion current chemistry can't scale.