🔋FH Pay

FHA homeowners are showing signs of trouble and the government scam of hiding foreclosures is front and center.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

At this juncture, however, the impact on the broader economy and financial markets of the problems in the sub-prime market seems likely to be contained. – Ben Bernanke, March 2008

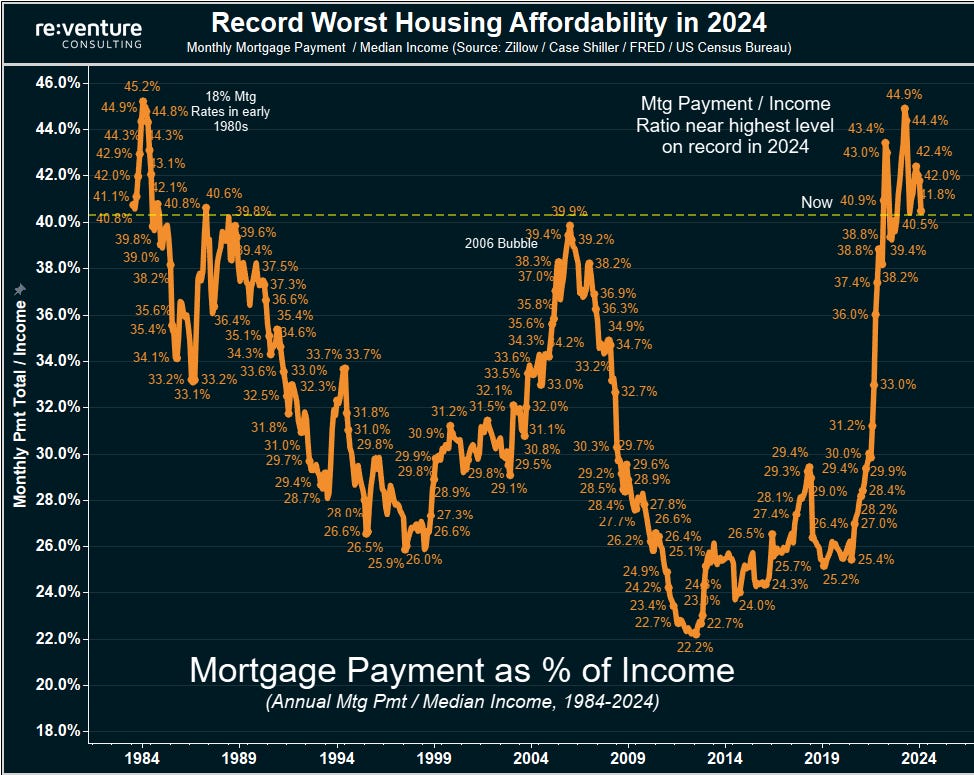

As most of you know, this quote did not age well. Later that same year, the housing bubble of subprime mortgages popped when defaults picked up amidst a slowdown in the economy. Before the 2008 recession, the housing bubble peaked with housing payments 40% of the median income. This leverage and unaffordability left many sub-prime and unemployed Americans to default on their loans, exacerbating/causing the greatest economic downturn since the Great Depression. This spurred reforms in the housing lending market for lending standards and rules. If we learned from our mistakes in 2008, how could housing affordability be in an even greater bubble today?

Housing History

You may be sick of me talking about the Great Depression policies, but most of the interventionist policies we have become accustomed to began during the 1930s. So many Americans at the time became unemployed and defaulted on their loans that mortgage lenders like banks also went bankrupt. Because of the negative sentiment and deflation of asset values, other banks halted lending to new borrowers. Like many other of Hoover and FDR’s bright interventionist policies, the government stepped in to stabilize the housing market.

The Housing Acts of 1934 and 1937 created numerous organizations around today like the Federal Housing Administration (FHA) and Fannie Mae. These were meant to provide government support to housing lenders from going bankrupt and also help people afford houses.

The FHA does not provide loans like Fannie Mae does, but they provide mortgage insurance. FHA loan protects lenders like Fannie Mae or banks from losses imposed by a delinquent borrower. Instead of facing the risks from bad loans, they are not insulated with a government safety net. It also allows lower-qualified borrowers to get mortgages they otherwise would not get from a bank.

Lenders during the housing bubble moved away from FHA insurance toward conventional mortgages which meant that lenders weren’t insulated from the housing crash resulting in large Wall St financial institutions being collateral damage to Main St’s housing defaults. A greater share of mortgages have been insured by FHA since then, equating to an estimated 17% of mortgages today. It has become a go-to for low-quality borrowers or first-time home buyers, considering the 3.5% down payment requirement. Today, looking into FHA loans has the potential to give us insight into future housing trouble.

Housing Today

Readers know that I do not think the Federal Reserve has completed a soft landing and that the yield curve recession warning is not wrong. Asset markets are extremely overvalued and the economy is likely to slow down due to natural cyclical forces. Housing is in another bubble today evidenced by the extreme unaffordability. One of the main talking points about the housing market is the tight supply. Low supply leads prices to be higher with demand equal. Things that could change the supply are unemployment and delinquencies causing people to sell homes as well as asset value repricing causing investors to liquidate.

FHA loans give us insight into the houses of low-quality borrowers. If you ask me, there is a massive scandal going on with FHA loans by the government backstopping millions of loans from going delinquent. This WSJ article exposes the government’s tactics since the pandemic to pay for people’s mortgages and not let them go to foreclosure. This has allowed delinquent borrowers to stay in their homes without paying and keep the housing supply off the market.

“…provided home-retention options to approximately 8.5 million homeowners since 2020. Imagine the economic and housing-market fallout if these homeowners went into foreclosure.” - WSJ

This doesn’t mean that there are 8.5 million homes currently in default, just that had payment assistance since 2020. Some percent of them likely are still delinquent and none of them should’ve been given a bailout. Officially, the FHA first-time buyer program currently has a whopping 14% default rate which equates to 1 million homes in default but not being foreclosed (using your taxpayer dollars of course).

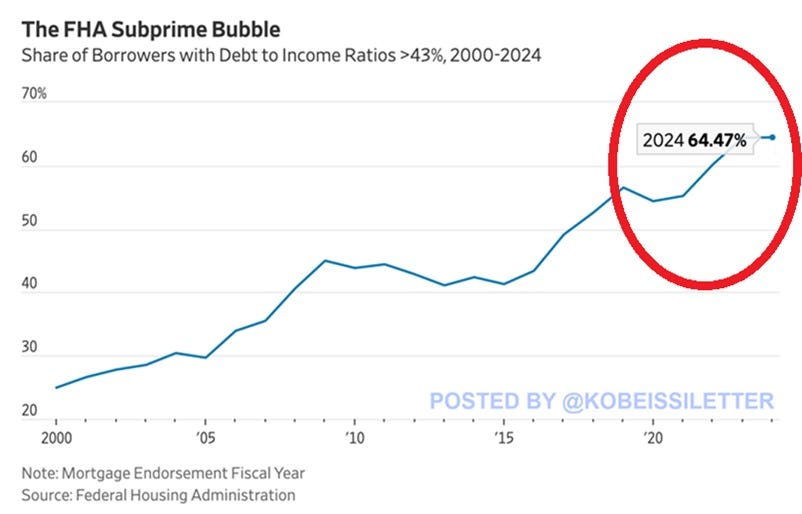

All FHA-backed loans certainly have a default rate of 11.3% which is also alarming since it is not just first-time home buyers. Some multiple millions of homes are delinquent with artificially halted forclosure. On top of this, 2/3rds of FHA borrowers are spending over 43% of their income on these houses which is an exorbitant amount and could lead to even more trouble given recession and unemployment increasing.

There is no way to sugarcoat it, the government backstopped defaulted mortgages which helped keep inventory off the market and prop housing prices up using taxpayer dollars which is a scam. These are akin to the subprime mortgages of 2008 but instead of defaulting on lenders, they are bailed out by the government.

If the Trump administration decides to do something about this it could flush a bunch of housing inventory onto the market which would certainly lower housing prices. If too fast, it could initiate a quick drop in prices in many areas. While this could be good for prospective homeowners and the long-term health of the housing market, it will not be comfortable for folks looking to sell or reliant on the asset value of their home nearing retirement. In this scenario, I foresee investors also dumping inventory they no longer think they can make quick profits on, further exacerbating the problem.

Of course, the Trump administration could want to avoid a housing crash and keep the scam going. However, this is an important sign of trouble in the bubble areas of the economy. Housing and stocks are massively overvalued and being propped up by various mechanisms I’ve discussed. If something changes these dynamics, deflation can be a scary thing for assets we are repeatedly told are safe and always go up. Until next time,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.