🔋Go Fund Me

Battery factories are being paid for by the IRA with deficit spending at the core, leaving the assumption of lower EV costs a bigger question than initially meets the eye.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Last week in At A Loss, I discussed the losses many of the top US automakers on EV sales and the factors effecting this phenomena. If EV companies (minus Tesla) in the US are losing money especially with the increase in raw material costs, what motive do they have to continue? In short, they are paid to.

Crystal Ball Of Investing

The Inflation Reduction Act (IRA) is a large piece of legislation which aims at providing industry incentives to make clean energy and batteries. Further, there are incentives for consumers in terms of tax credits as well. A non-profit called Good Jobs First did an analysis on the cost and IRA credit of the battery factories built by the major automakers. It is worth noting the bias of this organization is to worry about labor with respect to the corporation, whether they are getting good wages, and any inequity with respect to the corporation. With this in mind, they find the amount in government credits to build these factories is astonishing. Not only do the credits completely cover the cost of the factory, but also wages for a few years of production. They conclude that the subsidy per job is in the millions of dollars and they view the wages for the new jobs as inadequate.

Whether or not the wages are fair is not my expertise, but I will comment on the quantity of spending going into these projects. My biggest takeaway is that these automakers are not having to put their own money towards these investments. These companies have no skin in the game so to speak. If they viewed these endeavors as worth while, they would have put their own investment into it already.

The argument on the other side is that government credits are just accelerating what would be coming in the future anyway by helping start the process that would happen naturally anyway. That very well could be, but a lot of things can happen and no one can predict the future well. For example, weather forecasters can only reliably predict fewer than 10 days out, and Wall St analysts can only predict the market direction correctly less than 50% of the time. These experts in their fields are wildly inaccurate at foreseeing the future past 10 days, so to think that a singular future through EVs over the next 10-30 years is so clear in such a complicated market is naïve in my opinion.

In the future there could be alternative strategies or technologies to tackle the problems effectively in different ways. I put more faith in the market deciding what works than a small group of people in the government choosing. Emphasizing EV investment takes investment away from other things like hybrids, improving ICE efficiency, other novel technologies, focusing on a cleaner and more resilient grid, etc. There may have been some really great ideas that come out in the next decade that now face headwinds because people and companies are chasing the money attached with EV only production.

Debt

Further by debt financing these factories, future productivity is brought into today. We are currently living in the first “crisis” deficit spending with respect to GDP in US history NOT in a crisis. These programs are paid for via money printing and not tax revenue, and the rate of government spending compared to revenue and growth in the economy is currently at levels only seen during financial crisis or wartime [1,2]. This current record deficit in large part due to the IRA and is concurrent with a federal reserve reducing its balance sheet through quantitative tightening and raising interest rates in attempt to decrease the monetary stimulus. These are contradictory monetary and fiscal policies.

Since the money supply must be increased to pay for this debt since it is not commensurate with increase in GDP, this is the mechanism for inflation and will only drive prices of goods/services higher. This adds to burdens to the consumer in the long run, not improve it. Economists of varying backgrounds including Austrian School, Monetarist, and even Keynes’s original work posit that inflation is a monetary phenomena.

To challenge the name of the IRA as an oxymoron is self evident to any economically minded people minus those in the modern monetary theory camp. Further, analysis by the Brookings institute suggests that the spending for the IRA could be significantly higher than the congressional budget office (CBO) estimates is concerning and perhaps unsurprising with government estimates [3,4]. This number could be $780 billion by 2031 ($1 trillion by 2035) which is over three times higher than the CBO estimate for the IRA.

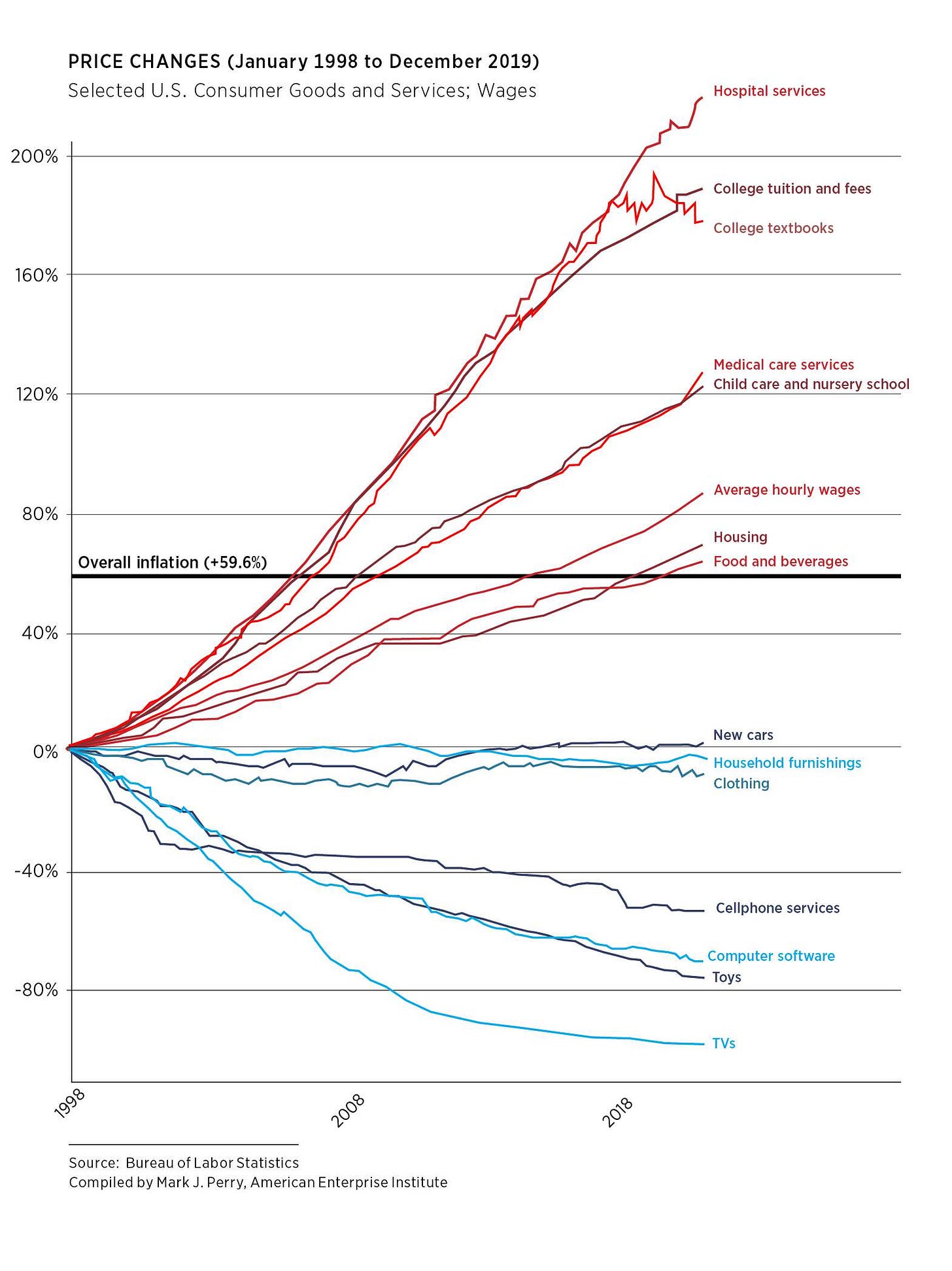

EVs as I referenced last week are more expensive to make, and by adding subsidies to the auto industry only works to drive up car costs further to get this money instead of market competition working to drive costs down. While this may sound counterintuitive from the mainstream narratives that the targeted spending will benefit these areas, the proof can be seen throughout history. When the government steps in with funding, it raises costs, not lowers them. Healthcare, college tuition, childcare, and housing grew at higher than the 2.8% year over year consumer price index, while technology, toys, and clothing became less expensive. These categories show how the government’s efforts to make areas more affordable actually had the opposite impact. There is a perverse incentive attached to government subsidies due to the market flooding in to take advantage of the capital that is to be allocated. Consider another industry not seen below which is national defense. Everything paid for down to screws and coffee pots sent to military use is unfathomably expensive.

Looking for exceptions we can consider natural gas in the united states. Shale revolution was helped by tax incentives, making unconventional drilling more profitable. The problem is that this boom was in the backdrop of record low interest rates over the last 20 years. Oil and gas companies often take on debt to fund new projects. In my opinion, the artificially cheap debt was the dominant factor in what boosted probability of shale oil/gas companies along like the rest of the stock market. This wasn’t a targeted stimulus, but an economy wide one which boosted stocks, real estate, bonds, and consumer confidence. It acts in a similar manner, but has a broader impact.

Critical Materials

Won’t the IRA spur investment into critical materials and shore up supply chains lowering costs?

Through government insistence on EVs, it places an artificial supply burden on commodities which we have already seen in last weeks article makes a big impact on automakers profitability today. The government has a solution to this as well though by funding mines and providing credits for materials from certain jurisdictions.

By regulating which regions that materials can come from, you are effectively constraining the available supply artificially. This acts as upward pressure on prices, contrary to the aim of the legislation. We have already seen this with Indonesia which I have wrote on in the past. This is a country rich with vast nickel/cobalt resources who has not only applied to join BRICS, a rival to the US trade system, but is left out of the free trade agreements necessary for companies to take full advantage of the IRA. Expect companies making sales in the US to look elsewhere first, driving up costs in Canada for example, only to leave the Indonesian metals cheaper for China to scoop up.

This also contributes to rising geopolitical conflict in the world. By discouraging trade in many regions around the world, cooperation and efficiencies with globalization will be lost, acting as another inflationary pressure.

Adam Smith wrote in The Wealth of Nations that,

The most advantageous method in which a landed nation can raise up artificers, manufacturers, and merchants of its own is to grant the most perfect freedom of trade to the artificers, manufacturers, and merchants of all other nations.

Today we do not have perfect trade, in fact there are many restrictions including tariffs, subsidies, trade agreements, trade embargoes, and so on. We have a trade war with China and sanctions on Russia among others. These frictions effect the normal decisions market actors would make and distort the most advantageous long term price discovery in favor of selective ambitions in the short term.

If the US truly wanted to reduce inflation on EVs and other technologies, it would lean into the comparative advantages that each country offers and take advantage of trade. At the same time, lowering burdens in place that effect the US from taking advantage of any comparative advantages we have.

Conclusion

If the IRA is supposed to make EVs less expensive, to that I’ll say lets see. Sure there could be some targeted impacts in the short term, but over the long term the holistic cost burden will outweigh any benefits in my opinion.

Government intervention tends to make the intervened products more expensive, and EVs may not be different. Due to the provisions discussed above and EV makers not having their own money at stake screams malinvesment to me. Even the tax incentives by raising the buying power of the consumer, allows automakers the ability to charge more for the same vehicle, yielding net zero gain for the consumer and and overall more expensive vehicle.

Why does any of this make sense? It doesn’t really, but companies are being paid and incentivized to do to build factories and sell EVs, so that is what they will do. I am not against EVs, pushing any agenda, or against the legislation from a political perspective, in fact I think batteries have an important role in vehicles now and into the future. If any, my political leaning is just that the government shouldn’t involve itself in economic matters for the long term health of the economy and fellow people.

I think people are smart enough to make their own judgement as to how much money they can save with an EV or hybrid and whether the car is worth it to them considering all of the factors that go into the decision. In general, I am concerned with how much emphasis the IRA legislation places on EV production, the magnitude of deficient spending, the unnatural signals it gives markets/automakers, and the ultimate long term impact this has on the consumer and future success of the program aims. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts on notes.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.