🔋Great Depression

A contrarian take on the Great Depression and why history is doomed to repeat - this time in the technology and energy industries.

Press the heart button on this article, yes you! I would greatly appreciate it :)

We live in a time of near constant government intervention in the economy, so much it is normalized. In 2008, large banks were bailed out at the expense of the US taxpayer. Similarly, in 2020 the US sent checks to households to uphold purchasing power amidst forced unemployment due to the pandemic. The last decade has seen historically low interest rates as well as unprecedented increases in the money supply from the central bank. These are just a few major examples of intervention in the economy that has not always been the case. While the economy has largely been booming, there are continuing signs of weakness and increasing signs of distress in the federal fiscal situation. Can we look to history as a guide to understanding these the economy?

It is often taught in schools that laissez faire economic policy in the 1920s combined with unregulated stock market speculation is what led to the infamous 1929 stock market collapse and subsequent Great Depression(GD). It is then taught that president Hoover’s inability to maintain/increase the quantity of money and intervene to help the economy was what prolonged and made the GD worse. Finally, Franklin D. Roosevelt’s (FDR) courage to intervene with New Deal economic policies and/or World War II is what brought the nation out of its economic peril.

Contrary to what I was taught in school and what most people think, these presuppositions are mostly false. Murray Rothbard’s America's Great Depression, lays the case of the Austrian School of economic theory as it applies to the GD and is the source for much of the information laid out in this piece. In brief, the Federal Reserve expansion throughout the 1920s sewed the seed for the “bust” phase of the business cycle through the propagation of malinvestment. The Hoover/FDR administrations inability to properly let the economy re-adjust through constant interventionist efforts is what exacerbated and prolonged the GD.

How can the Austrians claim Hoover was an interventionist when schools tell the opposite story? Here I will make the Austrian claim of the GD more concise and more importantly relate it to the present and what we may expect in the future.

Roaring 20s

The roaring twenties were far from laissez faire and unbridled capitalism. In fact the federal reserve purchased bonds which lowered interest rates close to the extreme zero bound and increased the money supply by 61% from 1921-1929 (7.7% annually). Volumes of urban and farm loans increased substantially past historical averages to take advantage of cheap credit. Cheap loans encouraged margin speculation, which led to asset bubbles in stocks and real estate that eventually ended in the stock market crash in 1929.

In addition to direct intervention, the fed also lowered reserve requirements for banks (banks only need to hold 3% instead of 10% of deposits), which increased the amount a bank could lend, increasing the money supply further. Initially in 1913, the fed was in charge of strengthening banks. Later it adopted the policy of price stability/expanding credit when demanded (aka permanent inflation) during and following WWI. This by consequence made banks weaker and increased the money supply.

In addition, post WWI Europe was not in the best place, even for the countries who made it out of the war on top. Gold was flowing from Europe to the US as consequence of the relatively tighter monetary policy of the US. To support the UK and other currencies, there was collusion between the fed and the UK to supply cheap credit to European banks and business in addition to the domestic operations. These were not sound loans which eventually did not bode well for either side.

Hoover

We might have done nothing. That would have been utter ruin. - Herbert Hoover 1932

According to the Austrian School, interventions that perpetuated the GD are acts that delay liquidation, inflate bank reserves, keep wage rates up, keep prices up, subsidize unemployment, and other relief measures. By this account, Hoover did everything in his power to propagate depression, but not for the reasons the mainstream explains.

It may seem like keeping wage rates up and some of the other measures are good, which is the mainstream view today, however prices are the function of supply and demand and aren’t to be toiled with in a true free market. There is no ideal price, and lower prices just reflect market behavior and any tampering with the price delays the re-adjustment process in the business cycle. The government began thinking deflation was bad and had to support prices with inflation and price controls instead of letting the market figure out what to do. Hoover administration continued the practice of monetary inflation as well as instituted price controls on some key industries I will discuss. Prices also matter for labor itself and if the market is not allowed to find the optimal price for labor, it can perpetuate unemployment and malinvestment. Hoover took it a step further and instituted unemployment insurance or welfare, which provides ill-incentives to the labor market to refrain from work.

One of Hoovers first acts was a protectionist policy of increasing tariffs to discourage exports. This hurt the agriculture industry heavily leading to artificially high supplies which lowered prices. Unemployment in this sector was increased. The agricultural sector was plundered with malinvestment from cheap credit and export controls in the prior boom phase during the 1920s. To “fix” this issue, the Hoover administration enacted price controls on agricultural products. Loans were given to farmers not to plant crops which backfired when farmers realized they could plant more and sell crops to the government. Next, the newly created federal farm board got to the point of encouraging plowing over fields and slaughtering herds of healthy livestock. These policies were the same tactics used later in FDR’s Agricultural Adjustment Act (AAA); a bill that was later deemed unconstitutional, but viewed as one of the successful New Deal policies by many mainstream historians.

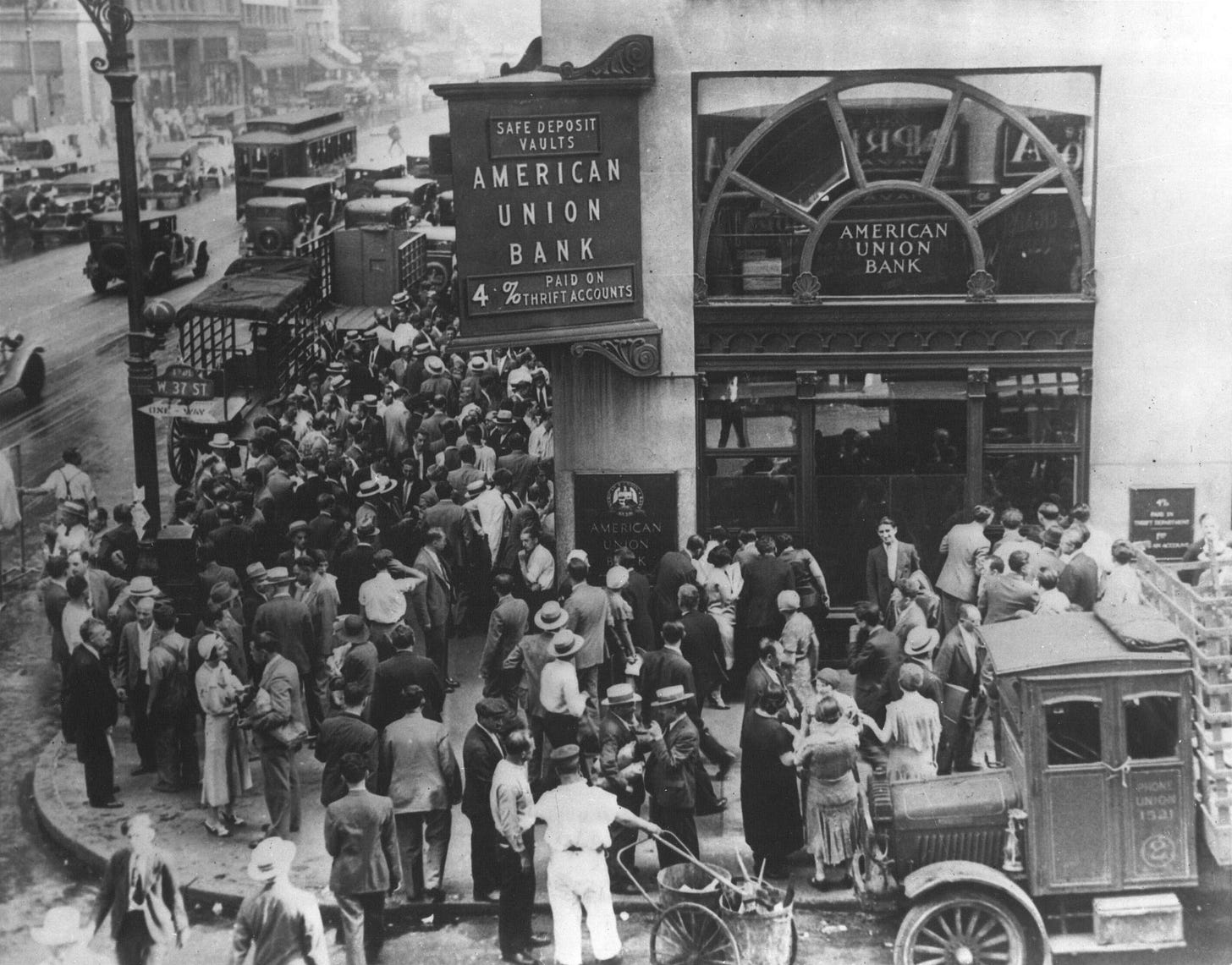

With exposure to the agriculture market, regional banks found themselves in trouble and confidence in banks waned. Monetarists point to the money supply decreasing in the 1930s as the reason why the GD was prolonged and only if they stimulated during the downturn that the problem would’ve been resolved. Rothbard points out that this is merely a distinction in the metric. In fact, there are “controlled” reserves which the federal reserve is in charge of and “uncontrolled” reserves which effect individuals and foreign markets. During this period individuals were rightfully wary of banks and withdrew reserves in favor of cash/gold. Further, banks were wary to make new loans in the uncertain economic environment. While the Fed doubled balance sheet to provide reserves and government campaigns to keep reserves in banks, above-mentioned factors decreased the money supply due to the nature of fractional reserve banking. People taking custody of currency meant banks had less money lent out and thus lowered the money supply. The misnomer here is that the federal reserve was in fact increasing all the “controlled” reserves they could, it was just offset by those “uncontrolled.”

Instead of letting poor quality banks fail, the administration provided cheap loans to large banks to acquire smaller banks and decreased the requirements for banks to tap the fed (aka get bailed out). This is not so dissimilar to behavior seen in 2008 financial crisis or as recently as March 2023 with the launch of the bank term funding program (BTFP) to provide loans to illiquid banks. During the 30s, corruption of the bailout funds was prominent, similar to speculation of the same in 2008 and 2023.

Taxes were and continue to be a pivotal economic policy tool. Hoover signed the 1932 revenue act which doubled federal income tax which encouraged many states to follow suit. The overall tax burden nearly doubled from 16% to 32% in the most aggressive tax increase in history at the time. Generally, people understand that higher tax rates discourage investment and thus the federal revenues actually declined following this legislation. FDR used the same playbook of increasing tax rates in 1935 with a progressive income tax structure similar today.

Once the GD was in full force and unemployment rose, another one of Hoover’s protectionist policies was being against immigration. The reason they cite is that it could take jobs away from Americans and lower wage rates. Although he failed to get anything passed through congress to ban immigration, visa acceptance went to zero and emphasis on deportation increased resulting in a few thousand more deportations per year. This was one of the few economically minded positions not shared by FDR.

Public works were one of FDRs popular policies. These too found root with Hoover who ran up huge budget deficits to fund public works projects to mitigate unemployment. While it may sound good to help people out with jobs, these policies slow the re-adjustment of the economy to where labor is needed most and where wage rates need to be to attract the correct jobs.

Lessons

Schools today twist history into a story in which Hoover’s lack of intervention in the economy is what turned the 30s into the GD. The only way this is remotely true is if the claim is FDR did more than Hoover, but the seeds for every FDR policy were rooted firmly in Hoover policies. Hoover himself in speeches bragged about his intervention in the economy, worked to increase the government role in business as secretary of commerce in addition to presidency, and failed to listen to advisors who recommended the economy to allow the natural liquidation process that occurred in past depressions. It is not even necessary to cover FDRs policies in discussing the GD since the root cause laid in the 1920s and each interventionist policy and consequence was used previously under Hoover. All Hoover or FDR did was prolong the economic re-adjustment process and keep America in depression.

FDR was in office for 9 years before WWII and managed to only get the unemployment rate down to 15%, still extraordinarily high. The argument that WWII ended the great depression is another half-truth. Yes unemployment decreased as much of the working age population was sent to war and the economy adjusted upward largely supported by wartime industries. I would argue that sending people to die is not a productive use of labor, and during the 40s, most of the economic activity/GDP was from federal expenditure(real GDP numbers were also boosted because of price controls at the time). Private market driven economic output declined heavily during the war years, again not ideal.

The “forgotten” depression of 1920-1921 was a swift 1 year compared to the 10 years of the GD. In this and all prior depressions, the market readjustment was quick and did not involve large scale government interventions. This was the last true market driven re-adjustment, because many of the GD era policies carried on and were compounded upon as well as the seeming insatiable desire for the US to involve itself in foreign conflicts.

Today, most if not all of the deleterious interventionist policies rooted in the GD keep occurring today. The Austrian School of economics is not the prevailing economic theory today though, set aside to primarily Keynesian schools of thought which support government intervention. As such, banks continue to consolidate and the pace has only accelerated. The federal reserve continues to bailout banks, most famously in 2008, but also in 2023 with the BTFD. As banks get larger due to consolidation and bailouts, it propagates poor behavior and instability. In addition to bank bailouts, the fed continued to manipulate interest rates, increase money supply, and encouraging speculation and asset bubbles. The government continued the policy of budget deficits which eventually became a go-to policy tool to simulate the economy during downturns. Government intervention continues with targeted credit to various industries similar to agriculture in the GD, as well as expanded welfare, healthcare, and retirement programs.

Conclusion

Is the Austrian School of thought wrong if all of these measures have continued/intensified and we have not had another GD? I would argue not exactly. The federal reserve and government has recognized that they can keep the economy propped up with “aggressive enough” measures that Hoover was not able to implement at the time. Even though there have been a few blown asset bubbles in 2000, 2008, and 2020, the federal reserve has been quick to step in each instance and provide liquidity to the market, bailout any instability, continue lowering interest rates, and keep perpetuating the bubble further. This however just delays the re-adjustment process and likely makes the coming “bust” part of the boom/bust cycle worse.

In this world, a business cycle bust is inevitable and with it comes an increase in unemployment rate and lower economic activity. Normally, prices of goods, services, and labor adjust and people respond accordingly. History since the GD tells us not to expect that natural process anymore. When the bust phase happens, the federal reserve and government will come in again to provide liquidity, bailouts, and social programs in effort to suppress unemployment and deflation.

The government induced economic activity is exponentially bogged down by its rising debt burden. This is a drag that over time lowers the government’s effectiveness of monetary intervention and necessitates more over time. History serves as a playbook to potential future outcomes so we can expect things like price controls of certain industries, expansion of social welfare programs, fighting to not let deflation of wages or prices, and other relief measures.

With the peacetime intervention in the battery and energy industry through the IRA which will inevitably impact the prices of its components, it is easy to see how these policies get ramped up in times of serious distress. Major nations already tried to institute a price cap on Russian oil; is lithium, nickel, copper, rare-earths, or semiconductors out of the question? With a raging trade war going on with China, tariffs could continue to be used and serve to distort the economy in areas such as technology and energy. With an increase in unemployment, new public works projects could be the saving grace for many workers. These programs could be in climate/energy related fields to help the energy transition, a win-win as far as the government is concerned. Cheap low interest loans or bailouts could be given preferentially to industries deemed critical. Airlines have been bailed out already, so could automakers, mining companies, or domestic manufacturers. There could be preferential treatment to certain industries based on which political party is majority.

These are features that are realistic this decade in my opinion if they haven’t begun already. Further, with the substantial national debt service, it is inevitable that the federal reserve lowers interest rates and/or restarts the “money printer” soon. This will come concurrently with whatever economic distress is the trigger. In 1929 it was a stock market bubble popping, I would be lying to you if I said I knew what it would be in the coming years(potential events could be commercial real estate collapse, sovereign bond markets failures, or environmental/geopolitical disaster, another pandemic, etc.).

I went through this entire piece without highlighting the importance labor and unions played in the GD, the economic theories, and today. This was intentional and is the focus for next week, with real life implications going on presently. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest post on notes.

Let someone know about Better Batteries and spread the word!

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.