In A Jam

If demographics are destiny, where are we headed?

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

If I had to bet, most people have hit a bad bout of traffic and thought to themselves, “dang, how are there so many people on this Earth?” The next logical step is to realize the systems we have in place aren’t updated to the growing number of people in cities, not that we don’t physically have the resources. While some groups think we don’t have, or shouldn’t take, the earth’s resources to provide better lives and technology, this is not about that.

China is a good example of a nation that has an even larger population than the US, but has placed significant emphasis on infrastructure during its development. Not too dissimilar to the US post WWII, bridges, roads, dams, power plants, and buildings have been constructed at record scale as the countries developed. It is possible to have the resources and energy to fit the demands of a higher population in the US, but the investment in infrastructure is not there. It may feel like there are too many people, but city design and public transit are just two examples in which US cities may not be quite as efficient as other cities around the world.

Astute readers will realize that while China has a high population now, its demographics are aging and have already begun decreasing. This was exacerbated by policies in previous administrations that limited births. There are many cultural and governance differences between the US and China, yet the US will soon face similar demographic challenges itself.

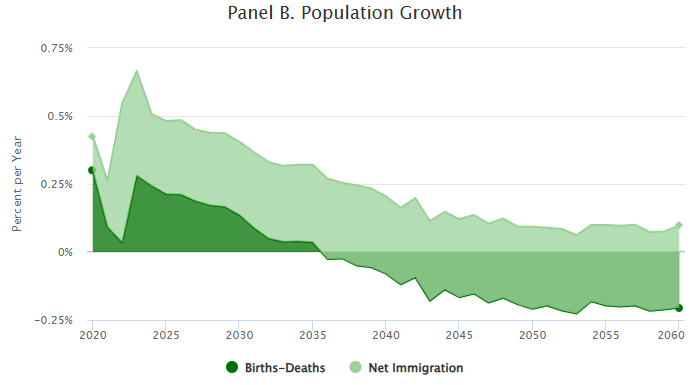

While China's population has been declining for a few years, the natural US population will only begin decreasing around 2035 (chart: dark green). There are two major inputs to this happening, which include the relatively large share of baby boomers passing away at that time, combined with lower fertility rates over time.

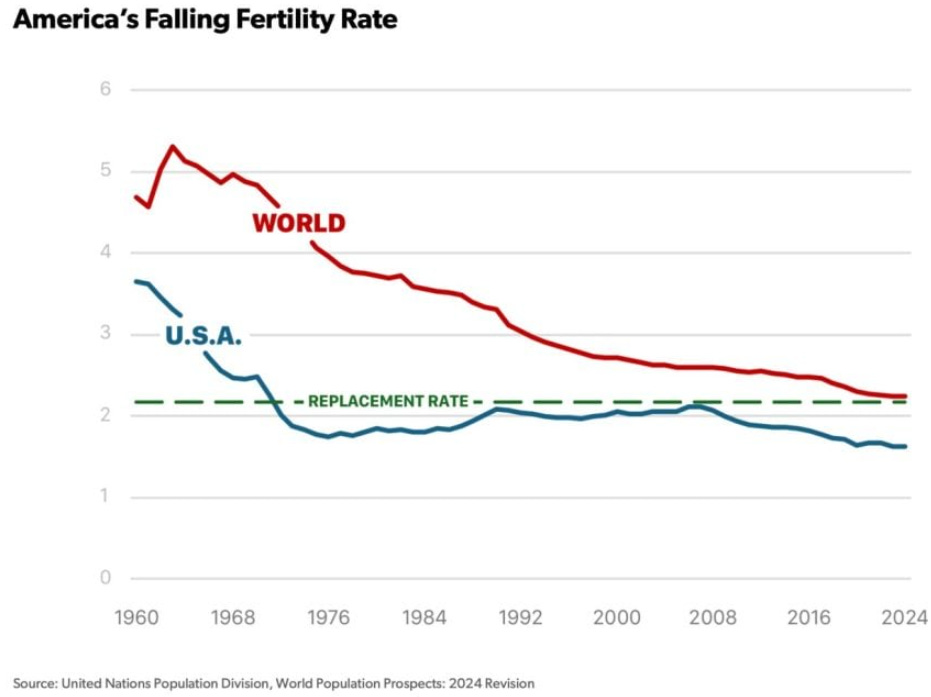

Since the early 1970s, the USA has had a fertility rate below 2. This is below the replacement level required to keep the population the same over time. The easiest thing to point to is the rising cost of living as to why fertility rates have gone down. There are a host of potential reasons that would have to be considered, ranked, and weighed in importance. Some controversial, but here are some of the topics of discussion I have seen: inflation, housing prices, culture shifts, diet, chemicals/toxins, testosterone levels, birth control, women in the workplace, phones, social media, wage/labor laws, drugs, etc.

In addition to births and deaths, the US has another factor to contend with: immigration. Again, controversial, but countries have differing views on the benefits of immigration. Some countries, like Japan or Denmark, have strict immigration/citizenship criteria, which helps keep cultural hegemony. Other countries, like the USA or the UK, are known as melting pots. These countries, known for being welcoming to all immigrants, view it as economically beneficial and culturally enriching.

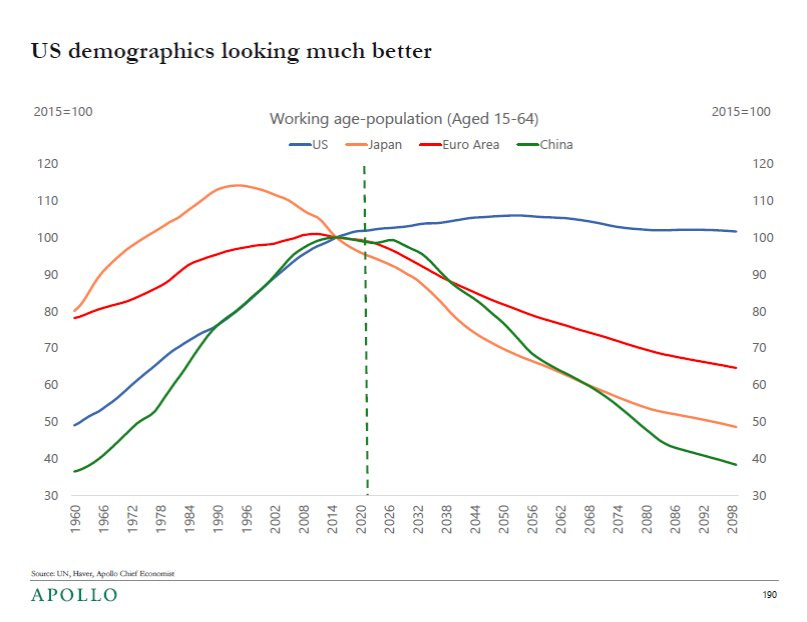

Immigration is a politically charged topic, so I am intentionally withholding judgment, but Americans generally view immigration as a positive. Immigration is important because it is what keeps the US population increasing, considering the natural fertility rate is below replacement levels. This is seen in the first chart in this piece, with the lighter green curve. Including immigration at relatively steady levels (not guaranteed given polarized politics), the US population will continue to grow smoothly with this boost, which puts it at a stark contrast to other economic blocs, especially when considering only the working-age population (15-64).

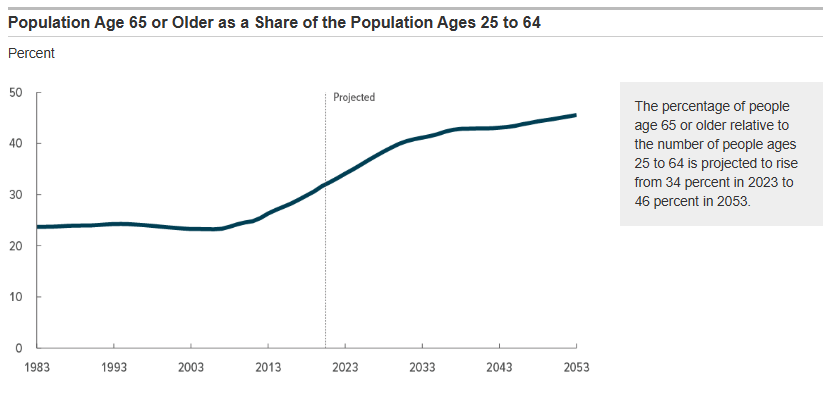

To fully appreciate the economic impact of changing demographics, we do have to separate the working age from the total population. As I alluded to, the US, as well as China, has aging demographics, with Boomers in the US constituting a larger relative share of the population compared to other generations. Since the Great Financial Crisis, we have seen a sharp increase in the elderly/working-age population. This is expected to abate in the mid-2030s, but will result in a different world.

For most of the post-WWII era, the elderly who do not contribute much as workers were only 23% relatively. Now it is ~36% and will be ~46% in the new world in 2035. This has heavy implications, like heavier welfare burdens on the elderly in the form of Social Security and Medicare. These wealth distribution policies are funded through taxes, and there will be a smaller working base to pay these taxes. Since these policies have not been properly funded and will increase in size, taxes will increase in order for them to continue. Taxes can include regular taxes as well as monetizing fiscal deficits, as far as I’m concerned. This process reduces economic growth over time, which reduces the purchasing power of the currency(not to mention the fewer working-age people contributing to economic growth).

Not only are these concerning long-term trends for economic growth, but they are also for financial markets. The retiring and passing elderly population draws money out of retirement funds, which have been the largest and growing driver of stock market returns. Passive investing inflows cause excess returns in an inelastic market, but outflows can reverse this trend.

We must be careful not to underestimate technological innovation when predicting the future. With recency bias, lack of clairvoyance, and ignorance in some domains, progress can be discounted or overlooked. “Demographics are destiny” is a common saying, but it could be wrong if AI means we do not need as high a working-age population as history suggests. Energy or transportation breakthroughs could lead to increased productivity in addition to AI/automation. We should remain optimistic about the future, but know that demographics are an increasing headwind for the long run growth and market returns, even with immigration. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView