🔋Invest In Yourself - Pt. 2

The federal monopoly and subsidy of student loans is the chief cause of the student loan crisis today.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Last week, I discussed the rising defaults in student loan debt and spillover risk into the aggregate economy. I even proposed a radical Trump policy that I bet you haven’t considered. Student loans are a problem that won’t be solved with a bailout, but how did this even happen?

One reason why capitalism works better than socialism in the long run is that entrepreneurs are experts in their field and can decide where to invest time and money to make a return. In the other instance, government agencies come up with quotas for certain industries they deem important. Are you betting on Elon Musk to guide rocket production or some random bureaucrat? As if there was any doubt, the government was bad at allocating capital and resources, I present the student loan issue.

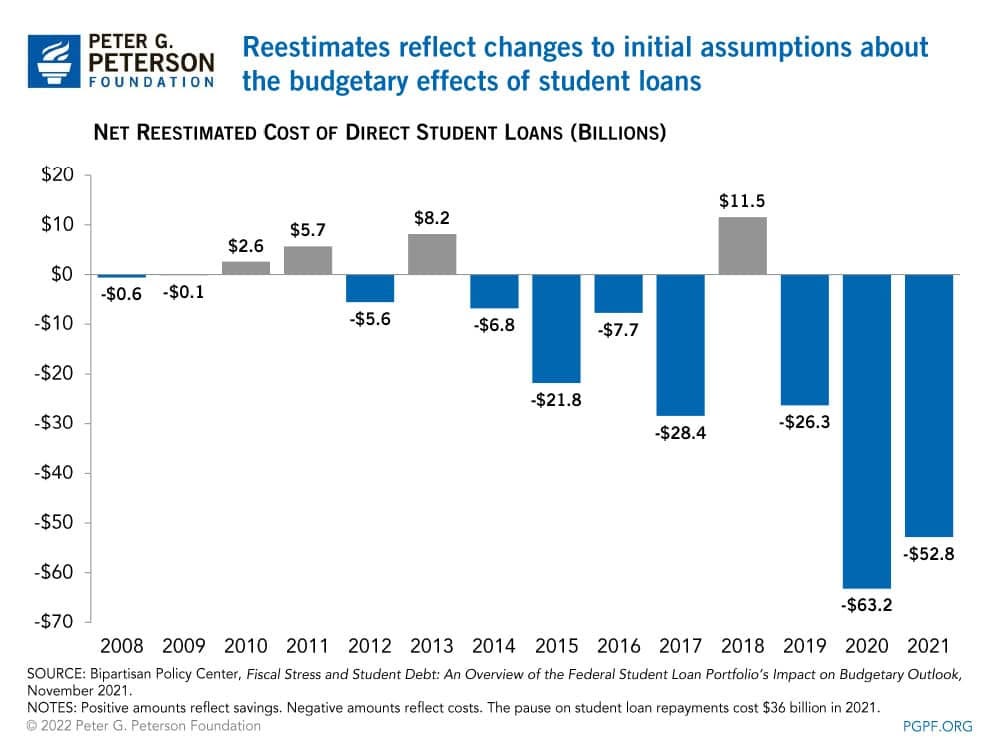

Government-funded student loans began in 1965 and increased again in 1972. In 2010, the Affordable Care Act eliminated student loan sub-organizations and established direct federal student loan lending. [1] This was done with the promise to save money in the federal budget and ensure lending wouldn’t stop during recessions. This was as successful as most government programs, as instead of saving money, the government began losing much more money.

The US government holds 92% of all US student loans. A true monopoly. Federal student loans are only given to US citizens, and private lenders have no market because the federal loans are subsidized. Going to college is deemed a good thing, so helping fund college for Americans is a good idea, at least they thought.

First, making it easier to get a college degree dilutes the value of those degrees. Supply and demand are simple; if there is a 10x increase in the number of people who have a bachelor’s degree, people have to pursue master’s and PhD just to distinguish themselves again.

Second, with more people going to college, it creates a misallocation of labor. We are already seeing shortages in electricians, builders, and tradesman. This will only get worse as more retire.

Third, subsidized loans without lending standards result in a malinvestment in credit. People are choosing to study silly majors with low prospective incomes.

Fourth, universities are incentivised to milk the government money. My favorite example is the transcontinental railroad was built from both sides using federal subsidies. Both companies were making so much profit off the subsidy that they built past each other instead of connecting the two ends, proving the poor incentives. Universities have become extra wealthy over the last 50 years by taking on these inflated student loans. They promote the value of the humanities and learning random classes to keep you in school longer. They teach silly majors because they can get away with teaching them, as the money keeps flowing into them, and people are taking the classes.

Fifth, student loans become more expensive as universities can get away with charging more for government debt. This is similar to how military tools cost double or triple what they cost to the consumer.

Comparing international students to American students paints the picture clearly. Indian and Chinese creditors are most likely to give a loan in fields such as science, engineering, and technology, for example. Why is this? If you were to give a loan to a student with hopes of getting a return on investment (rather than charity), would you rather give a loan to a student studying mechanical engineering or medieval literature? If it were $100k of your own money?

Here lies the problem with US student loans. It does not matter what you are studying. The same loans are given to chemistry, nursing, and civil engineering that are to social work, gender studies, art, and literature. There is value and an important place in the world for the humanities, but it is objectively not worth $100,000 at a 4% interest rate in today’s macro environment. No creditor worth their salt would give out that loan to someone making $40k out of college and expect to get their money back.

The federal government is the only one willing to give out these loans, and it is a shame. It is taking people down a dark path of debt with few income prospects to pursue it ($120k writing degree, $100k journalism degree). Americans today are blessed with wealth and have abundant choices, but this can lead us to make bad ones. An Indian student is not going into a gender studies major. They are likely choosing science or technology.

This is a big reason why science departments at US universities and startup companies are dominated by foreign talent. It is not because Americans are becoming dumber and lazier. Foreign creditors only allow them to choose these high-quality majors, while the US government allows students to study anything their heart desires. This dilutes the share of US citizens going into STEM while foreign students are preferentially choosing those. Diversity programs/quotas at the federal and university level only exacerbate this by bringing in more foreign students.

Like I said, the universities are not only complacent in this, they are directly benefiting from the higher price tag due to government inflation of student loans. Tuition revenues for the largest universities can be a small percentage of a university’s overall revenue. Places like Harvard are making so much off of endowment investments that the teaching students doesn’t matter much financially.

All in all, the federal government taking sole responsibility for student loans is the root cause of why student loans cost more, people are taking on irresponsible loans, why international students predominantly make up STEM fields, and why student loan defaults are now a major economic issue. Return student loans to private funding and silly majors go away, there is more competition from Americans in STEM, and people won’t have absurd student loan debt burdens. Until next week

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me on Twitter/X @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

Some interesting points you make. I had two main interests in college, Botany and Landscape Architecture. I ended up getting the landscape bachelor's degree but went back to grad school to get a Botany master's. I was around halfway through the coursework when I ran out of money, even living out of my car for a bit. It was get a loan or get on with living---I chose the latter after asking myself if I was really suited to sitting in a lab for work, I wasn't, and I had a nice 40 year run owning a design/install landscape construction business. Maybe I'm more practical than others but don't students ask themselves these kinds of questions when getting a loan?