🔋Money Chase

Without the incentives of lucrative subsidies like IRA and CHIPS Act, the US wouldn't need infringing policies like the Corporate Transparency Act.

Help me out and press the heart button, I would greatly appreciate it!

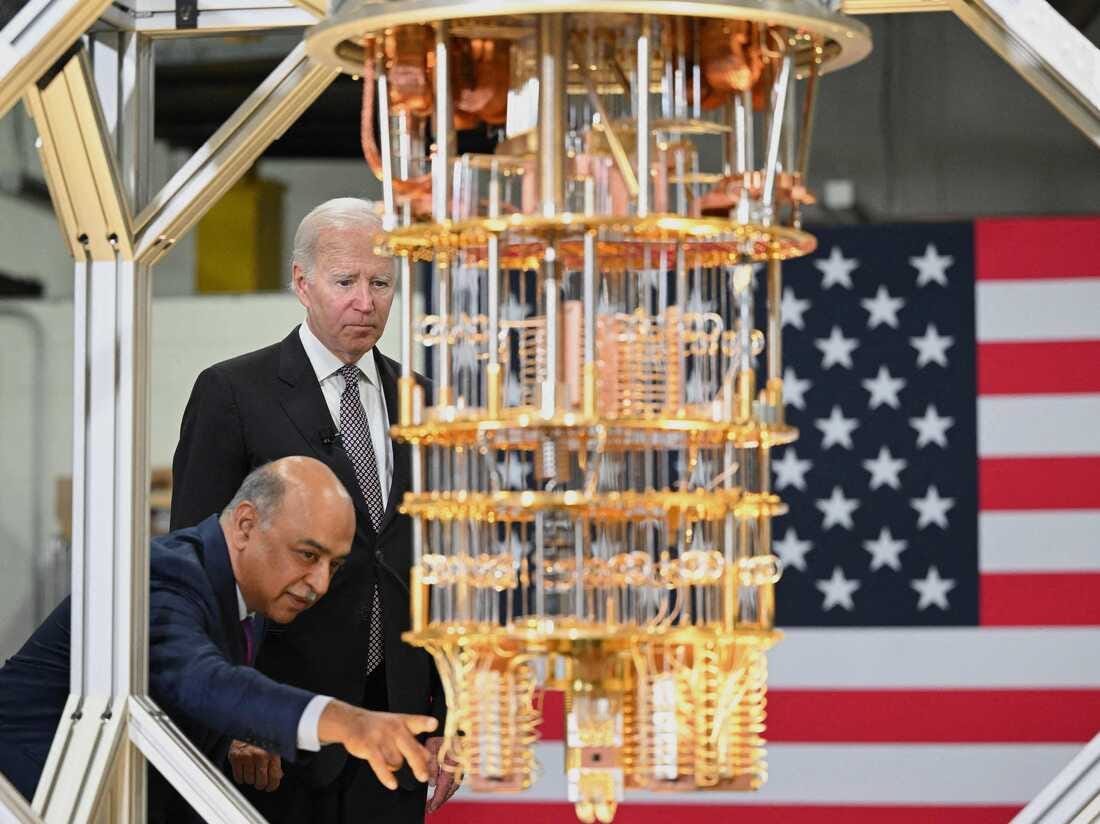

During the Biden administration, some top bills included the Inflation Reduction Act (IRA) and the CHIPS Act. These politicians were able to successfully pass legislation with what will likely be some of the most important topics this decade: semiconductor technology and energy. While the merits of these bills, their motives, and their impact can be debated, there is no doubt there will be massive implications for the global economy. In short, these bills grant subsidies and tax breaks to certain industries intending to enhance domestic competitiveness in the fields of semiconductors and clean energy.

To support the domestic economy, these policies include restrictions on certain countries/geographies to avoid geopolitical uncertainty while still supporting the industries of choice. For example, the IRA posits that throughout the bill companies need to get increasing amounts of raw materials and manufacturing in the US or countries the US has free trade agreements with. The CHIPS Act restricts the use of advanced designs based on which country the company is from. With such an interconnected globalized market, global shipping lanes, foreign investments, and complex global dependencies, how can the US hope to monitor and regulate which products of the many qualify for the sweet freshly printed subsidies?

Incentives

A year and a half in, funding projects through the IRA is just getting started. Government estimates were ~$400 billion whereas private estimates suggested up to $1.2 trillion of total spending for the bill. At the one-year mark last August, it appears that the government already passed out most of that $400 billion, which means we likely have surpassed the total estimated cost for the lifetime of the bill already. A couple hundred billion more for the Chips Act and you have a significant monetary influx in these sectors. While championed by energy transition advocates, there is more than meets the eye in the second and third-order consequences.

As I discussed last week with the example of the transcontinental railroad in the late 19th century, government subsidies created a deleterious incentive for railroad companies. Durant laid track as quickly and windy as possible to soak up as much money as the government would hand out. This resulted in poor quality, delays, and conflicts. On the other hand, Hill rejected government subsidies, looked for the shortest paths, and used high-quality materials.

This is an example of the perverse incentive of government incentives. They divert effort away from the targeted objective. If the goal was a quality and functioning railroad, no subsidies would have been a better option in the 1800s. In 2022, the IRA introduced a pathway for many political entrepreneurs to look towards government handouts. This incentive drives people to chase government money instead of profits, generating value, or improving the product/service. You may be saying look, this isn’t the 1800s and people would find out if a railroad company was laying miles of extra track if they had today’s communication. That may be so, but that leads us to the second perverse incentive it creates.

With the subsidy in place, it must be maintained that those who should be getting it are, and those who shouldn’t, aren’t. This is the problem of enforcement. There must be people to create the guidelines and enforce them. In January, I discussed how during WWII the Office of Price Administration needed to be created to monitor the complex and ever-changing price control policies at the time. The challenges of this operation in practice quickly resulted in this organization growing larger than the Department of the Treasury.

IRA funds will be distributed through over 10 different federal agencies with the Treasury Department expected to handle the bulk of it. The treasury along with the IRS have been releasing guidance on funding requirements for the IRA and Chips Act over time. With over 100,000 employees at the treasury and 79,000 at the IRS (87,000 more on the way), it is both surprising and unsurprising that they have the bandwidth to handle matters such as energy policy as it relates to geopolitics and semiconductor technology with the same considerations. While guidance is one thing, we still have the matter of enforcement today.

Enforcement

With the incentives laid out above, it is natural for foreign companies to invest in US operations to try to get some of the government's money. Since the US arbitrarily discriminates against those who can receive subsidies (think China and Russia), it must be illegal to bypass the rules of the game. US corporate laws are complicated, but often there can be foreign entities that own US assets through holding companies. If a US company operating domestically and sourcing materials domestically is owned by a bunch of Chinese and Russian holding companies, what does this mean for the subsidy? This is just an example, but it is already happening. Chinese battery companies are investing in nations like Morrocoo which has a free trade agreement with the US to bypass US restrictions and still taking advantage of the IRA.

The Treasury knows this is an inherent flaw, which is why they have guidance to limit these “Foreign Entities of Concern” from getting any IRA or CHIPS money.

Direct Control—when a foreign country that is a covered nation controls at least 25% of the board seats, voting rights, or equity interests of an entity.

Indirect Control—when a parent entity (including the government of a foreign country) directly holds 50% or more of a subsidiary entity’s board seats, voting rights, or equity interest, then the parent and subsidiary are treated as if the subsidiary were an extension of the parent. If a parent entity directly holds less than 50% of a subsidiary entity’s board seats, voting rights, or equity interest, then indirect control is attributed proportionately.

Effective Control—when a contractor in a contractual relationship has the right to control production, consumers, and site access, or the exclusive right to maintenance and operation of critical equipment.

This is fine and dandy, except when it comes down to monitoring and enforcing which companies have control, and how much control they have. That brings us to the Corporate Transparency Act (CTA) which went into effect in January 2024.

The CTA was established to prevent individuals with malicious intent from hiding or benefitting from the ownership of their U.S. entities to facilitate illegal operations which, according to Congress, is a widely-used tactic that affects national security and economic integrity. - Chamber of Commerce

The CTA allows the US to collect much more detailed information about private corporations and is advertised to crack down on illegal activities and money laundering. Companies must explicitly report information about all owners. If a US battery company has ownership from another holding company, they must get and report detailed information about the ownership of that company. The US FinCen can collect more information than ever on businesses. They can use this to crack down on money laundering and illegal activities, but if investment from one country counts as illegal and another doesn’t, you can see where this is going.

There is a chance this winds up being unconstitutional and many believe it runs askew the private protections that forming a corporation were supposed to provide. On top of this, for many small businesses, reporting and accounting costs become increasingly burdensome which only adds to the growing advantage of large corporations relative to small in the US. With the increase in frictions on reporting ownership, it is predicted that this will decrease investment as well.

While it isn’t stated to be for this purpose, the CTA is a natural consequence of the IRA, CHIPS Act, and all other federal subsidies. With such sweet incentives in place, there must be a mechanism to enforce that the policies are doing what they are intended to do. This increases the administrative frictions of businesses. It also adds more burden on the government which will cause them to increase in size to handle the new responsibility. This is exactly what we are seeing, and they won’t be able to track down companies that invest in Morocco, Mexico, and elsewhere. The US doesn’t have jurisdiction over the corporate transparency of other countries. Political entrepreneurs around the world will continue to find the IRA and CHIPs money regardless of the CTA and treasury guidance, albeit in a more roundabout way.

The worst part is that these actions are funded by a widening peacetime fiscal deficit in the US. The US taxpayer, small businesses, and the domestic economy suffer over the long run from the exponentially increasing debt burden and decrease in purchasing power stemming from it. If the US didn’t sign the spending laws in the first place, there wouldn’t be a need for draconian invasions of privacy and deterioration of the protections granted by the most successful corporate institution in the world. While the goal is to get rid of illegal activity, that same illegal activity would cease to exist without the incentives created by the same government in the first place.

I certainly support the semiconductor and energy sectors on an individual and theoretical basis going forward. But, even if you support the goals and aims of the IRA and CHIPS Act, the incentives they provide only serve to distort the market pricing mechanism, incentivize chasing subsidy at the expense of creating value, lead to malinvestment of capital, promote illegal activity (some arbitrarily/discriminatorily deemed illegal), cause bureaucratic bloat, lead to harsher and harsher methods of enforcement, and hurt taxpayers and small businesses. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!