Not So Bright

The sun has a greater effect on markets than most people realize.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

When you think of the sun, what things come to mind? Maybe it means going to the beach, just a beautiful day, or perhaps you think about space and the stars. Whatever you thought of, I’d be willing to bet it wasn’t your stock market portfolio. What if I told you the sun, or specifically incoming solar radiation, affects your precious market returns?

Before you brush it off as pseudo-science mumbo jumbo, you must remember that the stock market is an accumulation of human emotion. Anything that affects human emotion, whether it be the weather, hormones, stress, relationships, your job, or maybe even the moon, can make a difference.

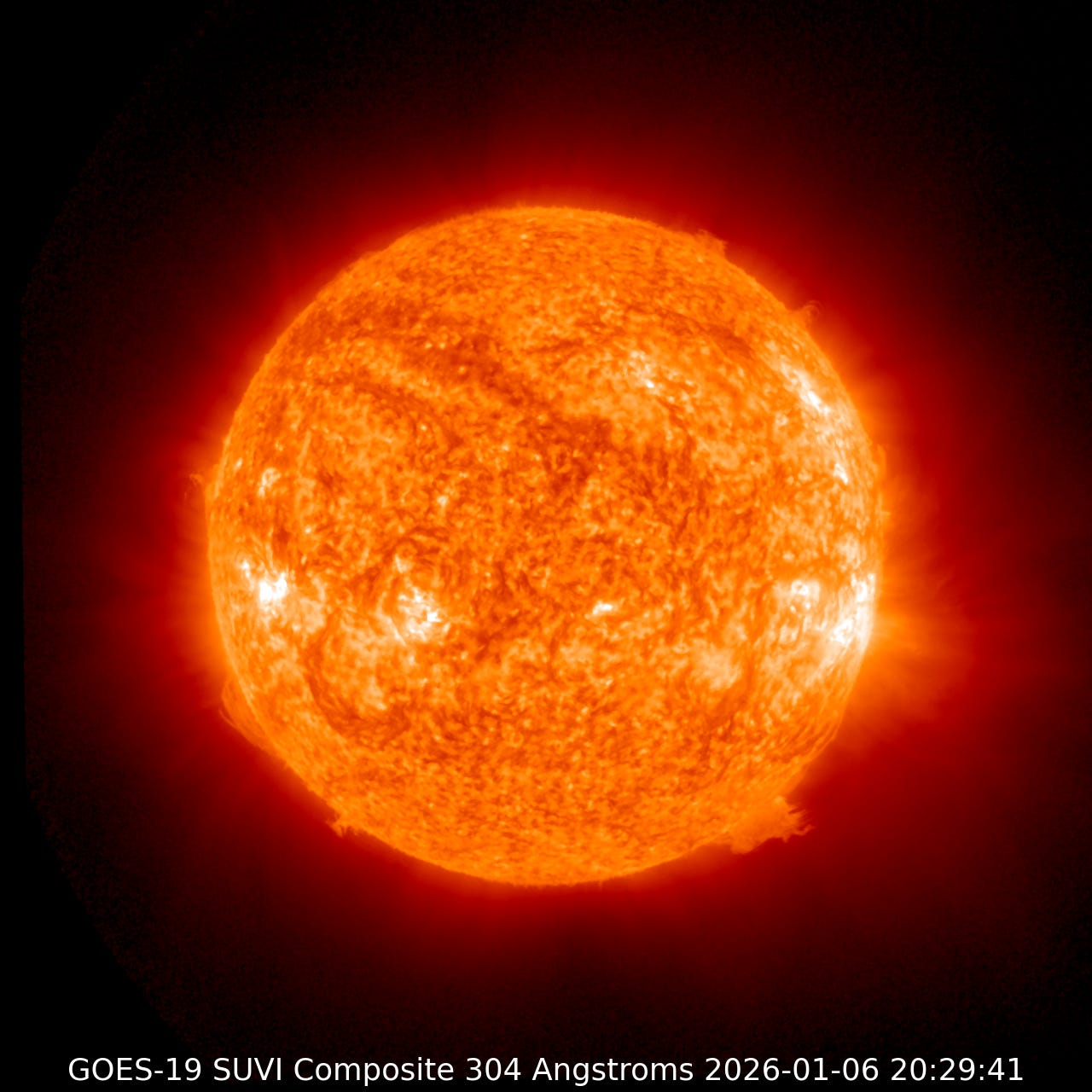

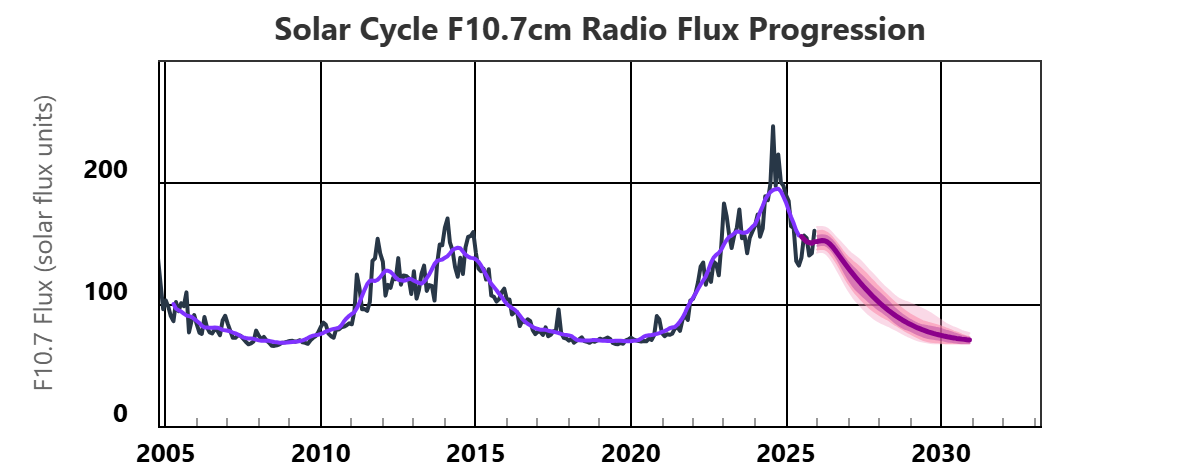

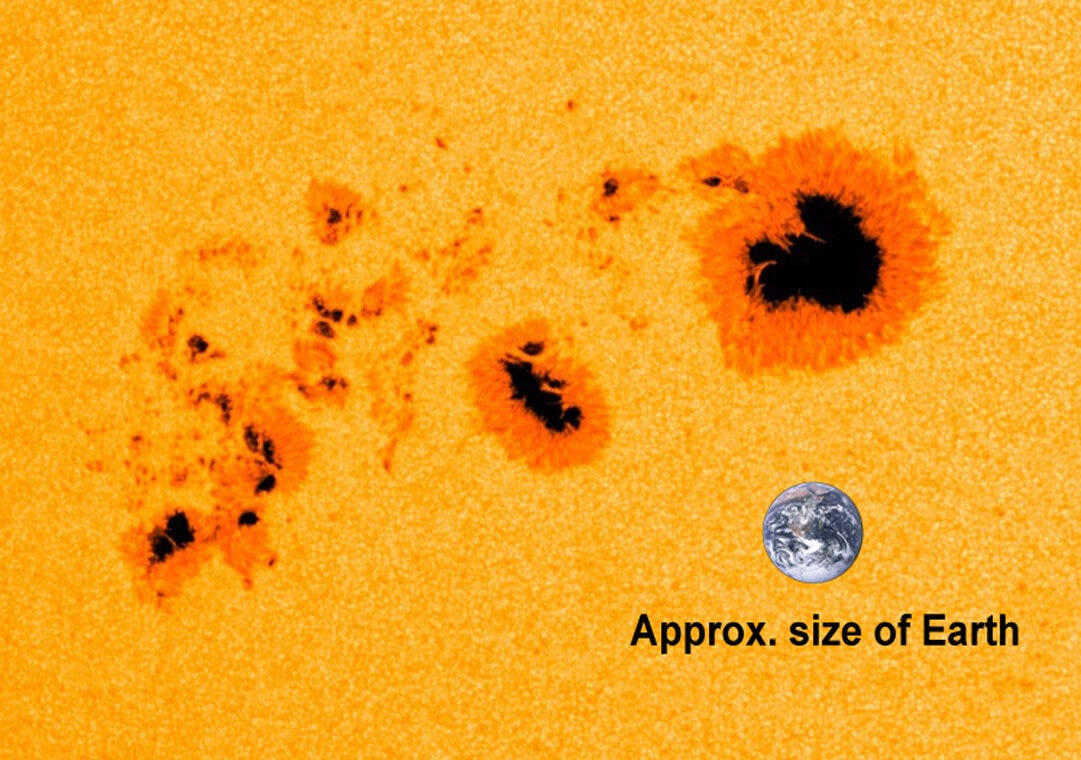

The sunspot cycle is a scientifically established phenomenon in which the number of sunspots and the sun’s magnetic activity rise in 11-year cycles. During this time, higher amounts of light radiation (UV, radio, X-ray, even Gamma) are hurled towards Earth. In addition to light, coronal holes cause increases in solar wind, sending charged particles and plasma towards Earth. NOAA believes the latest solar maximum has peaked, and we are waning into solar minimum. The next solar maximum will be ~2036.

With sufficient size and complexity, sunspots are what cause solar flares and coronal mass ejections, which may send large amounts of plasma and charged particles towards Earth, causing geomagnetic storms. These storms are what cause auroras to be visible in lower latitudes and can cause damage to electrical infrastructure. The initial energy from CMEs can cause damage to satellites, be of concern to astronauts, and even disrupt some radio communication. The sun must release really strong CMEs to affect us down at the surface because the Earth’s magnetic field deflects these charged particles and flings them away towards the poles (why Northern lights are near the poles).

Currently, the Earth’s magnetic field is weakening and has shown significant deterioration since 2014. The Earth’s magnetic field not only shows slight changes in strength, but it has also had extreme changes in the past. With the weakening magnetic field in addition to the sunspot maximum, more solar radiation and charged particles make it past the magnetic field and reach Earth’s surface.

Taken to the extreme, the concern is a Carrington-level event, which at the time destroyed much of the telegraph infrastructure. Today, blackouts and damage to the grid have been seen with strong enough flares, like the Quebec 1989 blackout.

One consequence is more intense/frequent low latitude auroras, like the ones visible in the US in November 2025. Another is more grid issues or anomalous events like the one in Spain last Spring. Another is changes and effects on human biology.

There are numerous scientific articles linking geomagnetic storms to things like the central nervous system of mentally ill patients, happiness levels, mood, depressive episodes, heart issues, lung issues, decision-making ability, white blood cell count, circadian rhythm, and more.

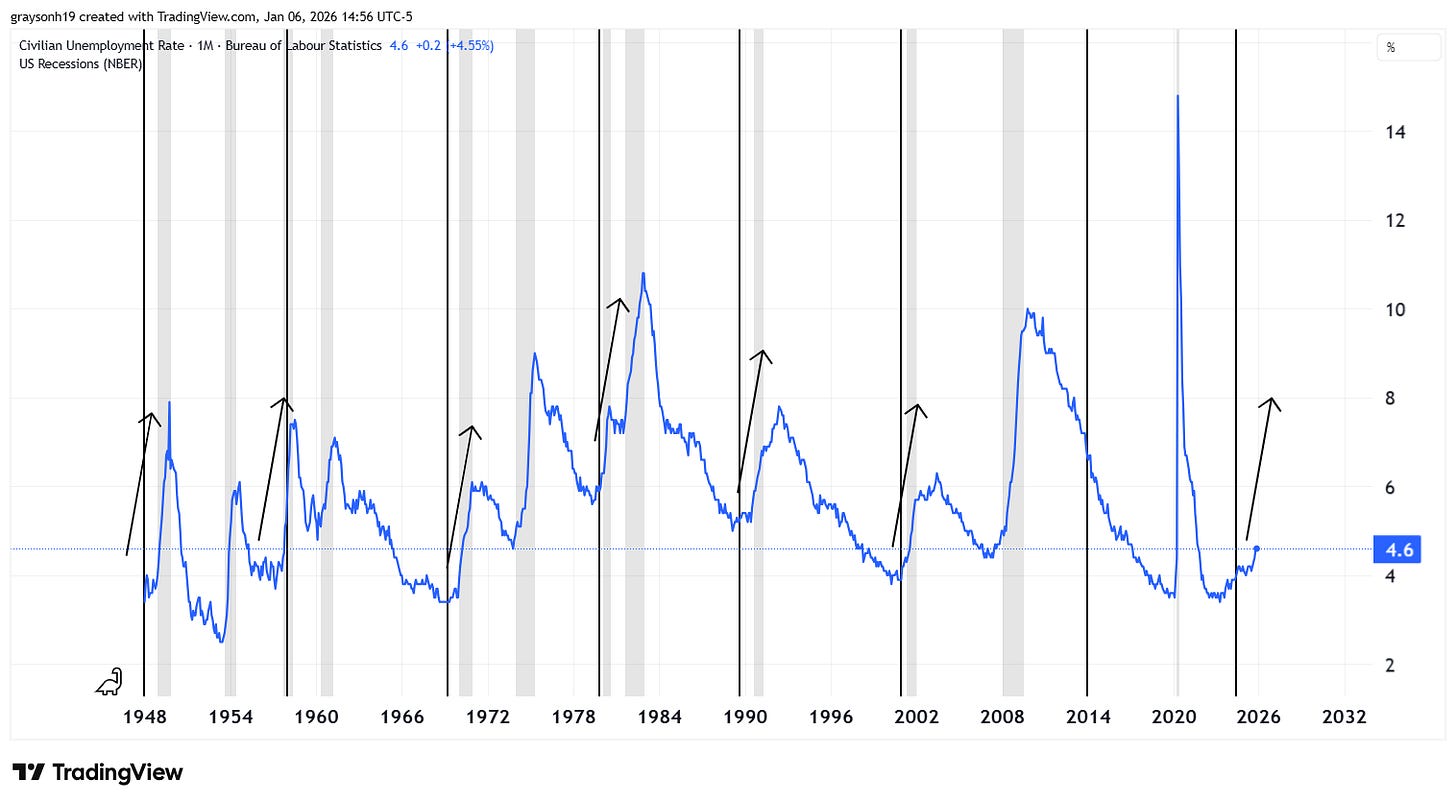

Historical correlations are pretty uncanny as well. Going back 80 years, 6 out of 7 sunspot maximums marked a turning point in the unemployment rate. Recessions typically cluster following a sunspot maximum. Only the last 2014 solar cycle failed to follow the trend. In recent history, the 2008 recession and the brief COVID unemployment spike occurred at solar minimum. While atypical, there was also a solar minimum recession in the 1970s. This data suggests that it’s more likely than not that we are near a recession and a pickup in unemployment.

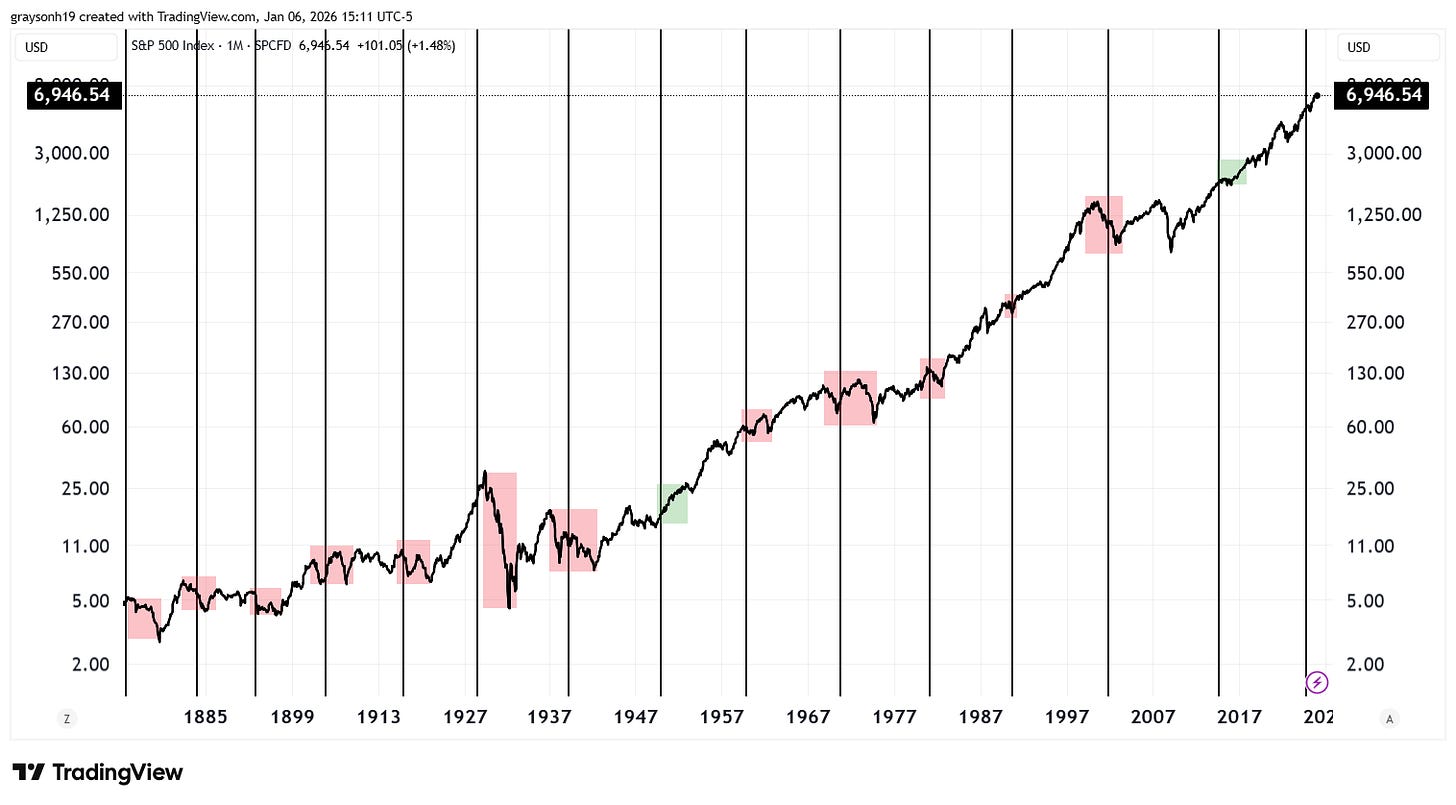

In addition to economic health, stock market performance is also of keen interest. Following the sunspot maximum, there is typically market volatility. Out of the last 14 solar cycles going back to 1870, only two (1948, 2014) avoided significant negative market volatility. Solar maximum was coincident with some of the most brutal economic periods in history, including the dot-com bubble, the 1970s, great depression, and the Panic of 1873.

Wars can also be linked to these sunspot maximums. With some of the scientific literature, we can postulate as to why. I am not arguing causation where there may only be correlation, but there may be some scientific factors to support. If mood, decision-making, and happiness levels are impaired by the increased solar forces, this may push leaders to make more rash decisions. Further, if exuberance and confidence wane, this could explain some market volatility. Investors and businesses may make poorer and more volatile decisions during these time periods, contributing to recessionary forces.

This is unlikely to be proven with any scientific rigor, but the trends are there for us to heed the warning. We are currently in a period where we would expect a rise in the unemployment rate and increased stock market volatility. I’ve mentioned fundamental and technical reasons to expect a recession in the past; we add behavioral forces exacerbated by the sun to the mix. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

This correlation between solar cycles and market volatility is genuinely surprising. The historical data on unemployment rate turning points lining up with sunspot maximums (6 out of 7 times) is way more consistent than I'd expect from coincidence. What caught my attention is the biological mechanism you laid out, if geomagnetic activity actually affects decision-making and mood as those studies suggest, that's a pretty direct transmission channel rather than some vague cosmic influence. The weakening magnetic field angle adds another layer, makes me wander if the next few cycles might show stronger effects than historical norms.

Interesting, yet another cycle peaking currently (in addition to three other economic cycles talked about by Ray Dalio). It isn't surprising that the Sun dominates everything, it's an incredible amount of energy and gravity stabilizing our planetary system. A Carrington Event would be disastrous---we've insulated ourselves pretty well against many calamities: insects, drought, disease, and such but we are incredibly vulnerable to a disruption from a solar flare. I'm sure military hardware, government and AI data centers, high security things like that are 'foil-hatted' but our electric utilities, autos, trucking, computers, phones, etc. can all be damaged, disrupting food supply, heating/AC and medical needs first and foremost. One can only hope we're on the dark side of the planet when it blows through.

I've been following an amateur meteorologist who swears up and down we're entering a new 40 year solar cycle where the US at least will be much colder and wetter---and the SW US' long drought can be explained by the previous solar cycle, not CO2. Well, I take it with a large grain of salt, it doesn't help that he appears to be a right-winger but I'm ordering a few barrels of popcorn to watch the next few years environmentally and economically, lol.