Off Track

Data center buildout is no different than railroads and routers.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

Over the long run, you can buy and hold the S&P500 to make steady 8-10% returns per year. Why would you do that when 340 billion dollar companies increase by 35% in overnight hours? That’s what Advanced Micro Devices (AMD) was up by Monday morning when the market opened. The company recently announced a deal with OpenAI to provide processing power for its AI infrastructure.

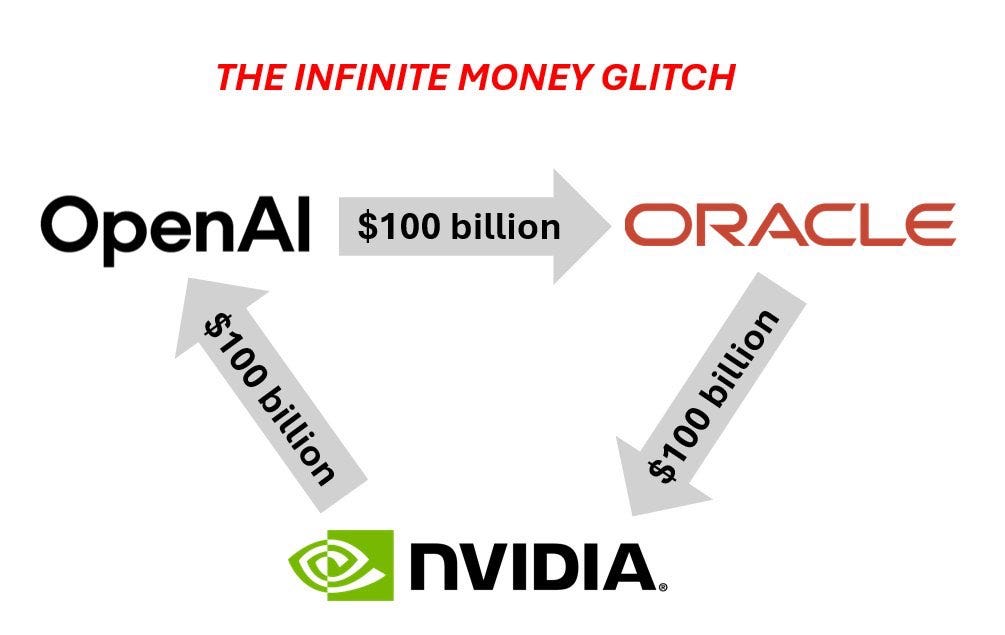

If you’re thinking, wait a minute, I thought they just did a deal with NVIDIA, you would also be correct. On September 22, NVIDIA invested $100 billion in OpenAI, money which, in part, will be used to buy NVIDIA chips. Everything is fine until it isn’t, and this operation could put NVIDIA in trouble if somehow there isn’t the expected return on investment.

It gets worse, as this vendor financing model isn’t just limited to the largest cash generator, NVIDIA. OpenAI and Oracle agreed to a $500 billion deal for cloud capacity (Oracle up 40% on the news). In this case, Oracle doesn’t have the cash for this, which means it’s vendor financing with debt, even riskier. Oracle must purchase hardware from NVIDIA to build out the data center capacity to host cloud services, creating a loop of capital facetiously called the infinite money glitch.

For NVIDIA, doing seller financing is only dangerous if the buyers struggle to pay, as they are left without the capital or the inventory of chips if it falls through. In this case, we see the valuations of companies at lofty levels and mega-cap stocks pumping like memecoins, further fueling the debt financing ability, which allows them to take on greater risk.

Internet

Seller financing is a normal phenomenon, but there are times in history when the deals ended horribly. Once such a time was 1999, with the internet buildout boom, which led the the collapse of the dot-com bubble. Cisco was the NVIDIA of 1999, selling internet infrastructure.

During the dot-com bubble at the turn of the 21st Century, telecom equipment makers such as Nortel, Lucent, and Cisco lent money to startups and telecom companies to purchase their equipment. - Fortune

The internet was correctly viewed as revolutionary, paving the way for the digital world we have today, and many of the top companies in the world. However, that did not stop Cisco from declining 80% in one year, and the broader market went down 47%. Companies went big on internet buildout, but with the recession and declining stock prices, the internet boom didn’t materialize in the way these companies expected. Buyers were not able to turn revenue and return capital to Cisco and others, leaving some bankrupt and others with impaired stock prices.

Railroads

Another bubble was the railroads in the late 1800s. These companies were among the first publicly traded companies. Investors from the US and UK lined up to invest capital in the booming industry. Railroad companies issued corporate bonds similar to today. This was fine until a similar vendor financing scheme began.

Iron, timber, and locomotive suppliers sold equipment on credit or accepted railroad bonds as payment. These bonds could be used as collateral for additional bank loans to finance more production. As asset prices of the railroad companies went up, things were fine. When the Panic of 1873 struck, railroad companies had a hard time selling bonds. The circular economy seized up, causing banks to fail, railroads to go out of business, and miles of track to be abandoned.

Final Thoughts

In these cases, liquidity is merely a credit illusion. Everything is fine until it isn’t, or until there isn’t the same demand as was promised. Railroad companies laid tracks in areas where there was no freight volume, while internet companies built infrastructure based on clicks and not cash flows. Investor speculation also played a big part in contributing to the ability of these circular economies to continue.

The bubble can keep going, and I’m not saying the AI craze is going to collapse tomorrow, but history does tend to rhyme. OpenAI, Oracle, NVIDIA, AMD, and others are all intertwined in seller/debt financing schemes, which are not bad on paper, but pose big risks at this scale. OpenAI just became the largest valued private company, a similar title NVIDIA garnered in the public market. If OpenAI or any part of the chain doesn’t have the future cash flow to return value, then things could go south for the whole market, as NVIDIA is the biggest driver.

Vendor financing doesn’t matter much when it’s a car company lending to a consumer, which represents less than 1% of its revenue. In this case, NVIDIA is literally moving the market with its price action, and news events are shifting hundreds of billions of dollars in less than a day. Toyota won’t go out of business if you don’t pay your car loan, but NVIDIA and the stock market will have a hard time if Oracle and OpenAI can’t deliver on the lofty projections.

People are trying to put AI everywhere, but for what purpose? At some point, it will become obvious, but perhaps we are laying railroad track in places that won’t have shipping volumes. Perhaps AI is as big, or bigger than the internet, but that doesn’t mean NVIDIA can’t go down by well over 50%, dragging the S&P down with it.

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

Makes me want to start dollar cost averaging into a short ETF.