🔋Proof Of Energy

The climate attacks on bitcoin's proof of work mining protocol may not be of genuine climate concern.

Help me out and press the heart button, I would greatly appreciate it!

Bashing Bitcoin

Bitcoin, the very first cryptocurrency has seen a meteoric rise in usage and price since its creation in late 2008. This new digital currency (but more specifically the proof-of-work [POW] mining protocol) seems to come under attack quite frequently for its climate/environmental impact. Bitcoin uses a lot of energy around the globe to function and thus contributes to carbon dioxide emissions, just like businesses, governments, or households do. Some politicians, probably most notably senator Elizabeth Warren who has been a staunch critic of Bitcoins environmental impact (other critics include head of the Treasury Janet Yellen, and former president Donald Trump for example). One of the attack vectors on Bitcoin is on climate grounds and said to be just another way for people to exploit burning dirty fossil fuels for profit.

Not everyone understands Bitcoin, which is okay. It can be complicated as it is completely groundbreaking to the world and is only 13 years old. Most of the criticisms like this one from the WEF in 2017 that bitcoin will use more energy than the entire world by 2020 are astonishingly false and are not based in fact. It is 2022 and bitcoin does not use anywhere near that amount of energy which I will discuss below, proving that article to be criminally wrong. Many of the negative articles about bitcoin turn out to be false factually, especially ones that discuss energy use per transaction and attempt to make bitcoin appear worse than it is. Let’s try to understand what bitcoin is and you can determine for yourself if it is worth the energy use.

Value Proposition of Bitcoin

Some people simply don’t think bitcoin is useful in any way, and from this premise any amount of energy it uses shall be considered wasted and harmful to the climate. That is fine, but millions of people around the world already find value which is reflected in the number of users and the price. The second thing I’ll address off the bat is those that believe crypto is a Ponzi scheme. Many of the cryptos are pump and dumps, Ponzi’s, and dishonest, but I am focusing exclusively on bitcoin in this piece which I believe has real value and will for a long time.

Bitcoin is a decentralized version of money that is permission-less, censorship resistant, supply constrained, and incorruptible. People can transact any amount they wish anywhere in the world for an extremely low fee and reaches final settlement within minutes. It does not need an intermediary like a bank and no trust is required on the part of the sender, receiver, or in any third-party like Visa/Mastercard for the transaction to go through. Furthermore, no one can alter the rules of bitcoin and thus the supply of coins and the issuance rate. There will only ever be 21 million bitcoin, meaning the government or any large institution has zero control over its supply. Yes, they could regulate it (see New York State’s recent bill), ban it, or blow up your operations with bombs, but game theory would suggest these to all be harmful and counterproductive strategy in the long run.

In addition to the holders/users of bitcoin, there are nodes that keep a record of the blockchain and verify that the new block of transactions follows the rules/protocol set and agreed upon by the network. The third and most important group in relation to the environmental impact is the miners.

The fundamental purpose of bitcoin mining is to confirm new transactions. A reward is received for finding a solution to the proof-of-work protocol (essentially a complex problem for a computer to solve). If your miner wins the “lottery” and solves the problem you receive a block reward(new bitcoin+share of transaction fees), which is the monetary incentive for miners to do these operations. This means that nodes and miners are securing the bitcoin network in a decentralized fashion while simultaneously yielding final settlement on each transaction in real time. It is a groundbreaking discovery being able to send peer-to-peer transactions that are near instantly settled, cannot be duplicated, and backed by the security of tens of thousands of people in a decentralized network.

Proof-of-work requires energy consumption via utilization of powerful processing equipment (ASICs) to run the computations. This process is energy intensive and the primary concern of those worried about emissions. Many other cryptos use proof-of-stake (POS) which validates new transactions through holders staking their coins and randomly getting selected to validate the next block based in proportion to the number of coins staked. This uses less energy, but completely negates the benefits that bitcoin posits. POS is fundamentally not as secure or as decentralized, and more prone to security risks. It allows the person with the most coins staked to have an outsized control over the network. In POW, there is competition among miners which keeps security and also incentivizes miners to follow the rules set by the nodes.

The energy consumption and equipment required to mine bitcoin is additional security for the network as a rich/powerful nation/institution cannot buy up control over the network. There are real world supply chains of processors and significant energy requirements that are needed to obtain an outsized control over the POW style network. Therefore, the energy consumption and infrastructure are necessary for the truly decentralized nature of bitcoin such that no hostile government/institution can control it. Thus, if the value proposition of bitcoin is worth it to you, then the energy consumption is not only necessary, but an extremely productive use of energy and resources.

Currently in wealthy western nations it may seem like this technology is not needed to many. This financial privilege does not extent very far around the globe however. Being the most scarce financial asset in history, bitcoin will likely serve as a useful store of value over the long term for people experiencing hyperinflation or confiscation of financial assets including money. The cracks in the system are already showing even in the United States as increasing wealth inequality, inflation, and negative real interest rates serve as a wonderful advertisement for the ultimate solution: bitcoin.

Environmental impact

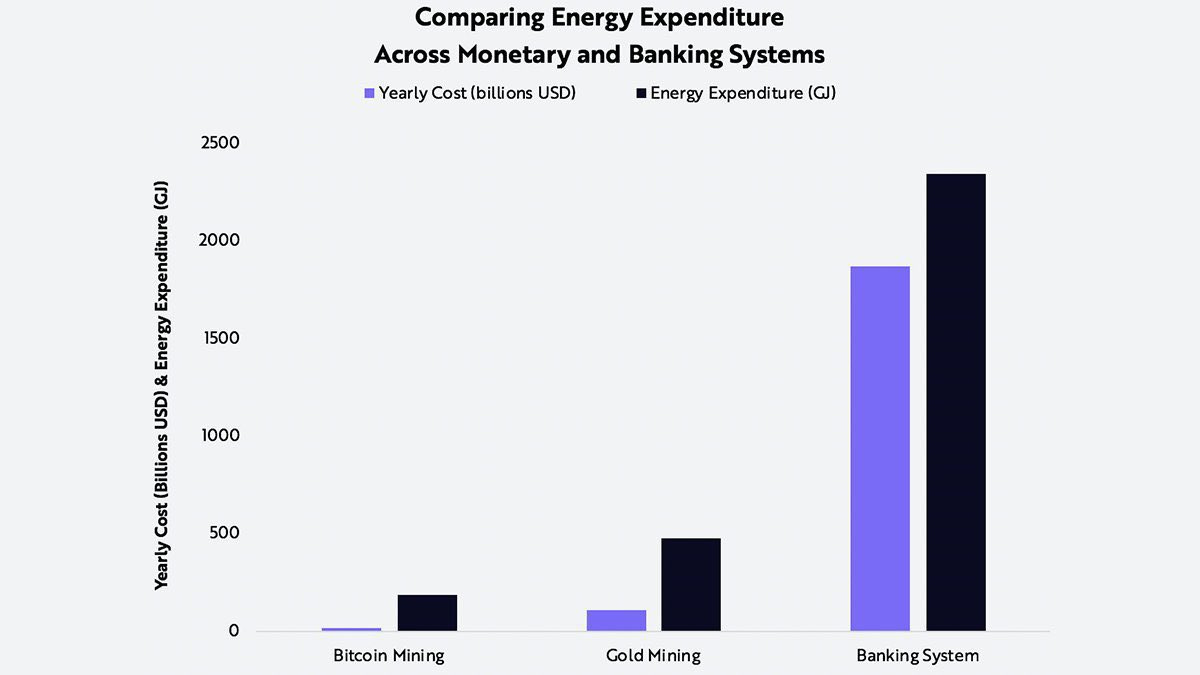

The fact that bitcoin uses more energy than many countries is used by many to show the magnitude of its consumption. Instead of sensationalizing the total amount of energy bitcoin uses, let’s compare to other more reasonable things. Don’t forget that even Google, Apple, Facebook, household drying, and even Christmas lights use more energy than many countries, yet they are not attacked in the same way. Compared to the current banking system that is expensive, slow, and centralized, bitcoin uses a fraction of the energy while solving many of the problems of the banking system. Gold used to be money for hundreds of years and also uses more energy than bitcoin mining.

Furthermore, when compared to total world energy consumption, Bitcoin uses less than 0.1% of all the worlds energy. Even with global adoption to billions of people, bitcoin will not likely exceed 1% of total energy consumption. In this scenario, the financial system would be more efficient and still have less of a climate impact than the current banking system.

In general, energy usage directly corresponds to emissions that could be harmful for the climate. The extent depends heavily on the type of energy used in the mix. Coal, oil, gas, nuclear, wind, and solar all have different emissions profiles. Renewable energy (classified by eia as wind, solar, hydro, geothermal, and biomass) have much lower emissions that fossil fuels and in the United States, 12% of all energy came from renewables in 2020.

In comparison to the 12% cumulative usage, 39% of bitcoin mining comes from renewable energy sources. Furthermore, only 9% of energy used by federal agencies in the US comes from renewable energy for example. It turns out that bitcoin mining is of the sectors of the economy with the most renewable energy generation. It is also location independent, so it can use renewable energy like hydroelectric power (most used energy source for miners) or other renewables in unimportant/wasted space that won’t get in the way of people’s day to day lives. Another example is a country in a sparse geographical location with an energy source can now monetize their energy production instead of letting it go to waste because they were disconnected from the rest of the world (see Ethiopia and El Salvador).

In addition to renewable energy and monetization of location independent energy, when oil and gas companies close down, any extra methane is flared so that carbon dioxide is emitted instead of methane which is worse for emissions. This process is essentially a waste of useful energy that causes emissions. Many oil and gas companies and specifically bitcoin mining companies have been using flared gas to mine. While this process still emits greenhouse gasses into the atmosphere, it utilizes otherwise completely wasted energy. These emissions were going to occur either way, and now the miners contributed to the security of the bitcoin network as well as creating wealth in the process. Furthermore, this counts as part of the 61% of bitcoin mining energy that was not renewable, and this process does not take away from energy that would need to be used to power homes, businesses, and transportation.

Bitcoin helps stabilize the grid, especially renewable grids. Nic Carter discusses this in great detail, but essentially miners can shut off during times of distress to allow energy for homes and vital industries. Renewables are known for producing excess energy(very cheap) and then have a lull due to intermittency. Since bitcoin miners want the cheapest energy possible, they can take advantage of the cheap excess energy, but be willing to shut off and forgo mining during times of crisis, especially since energy costs would likely be higher then anyway.

Conclusion

Why would politicians go after an emerging sector with one of the best renewable energy profiles, uses plenty otherwise wasted energy and locations for mining, and can massively help stabilize the beloved renewable energy grids? First, many do not fully understand the mining process and fundamentals of how the network works. More importantly in my opinion, is that it undermines their political power by decentralizing the monetary system.

In The Real Climate Catastrophe Pt. 1, I laid the framework for the economic structure of the United States today and some of the incentives it gives rise to (short term thinking, crisis generation, inflation, executive power, wealth inequality, etc.). The government can put together spending packages that exceed the tax receipts and pay for it via inflating the money supply. This is a pernicious control mechanism and hidden tax on the wealth of anyone using/holding the currency. Our government has been abusing this exorbitant privilege since 1944, but more significantly since 1971 and it gives them tremendous power over the people and other nations. The central bank currently gives the government the ability to access unlimited money to fund what they want. Taking the “money printer” away would significantly reduce the spending allowance and influence on monetary policy of the government.

In this sense, bitcoin is a direct threat to their power and even though bitcoin is still small, the attacks are already starting. Politicians and government agents at the Federal Reserve and Treasury are incentivized not to support bitcoin because it threatens those institutions’ very existence. We are seeing governments around the world, even some talk in the USA about central bank digital currencies or CBDCs which would give the government even more control and surveillance over the money and thus the people. This is in the exact opposite direction from bitcoin which is why I believe there are and will be more attacks on bitcoin. Using the environmental impact of mining is simply a feeble attack vector used as an attempt to discount the morality/usefulness of bitcoin.

As the saying goes,

It is difficult to get a man to understand something when his salary depends upon his not understanding it.

-Upton Sinclair

-Grayson

Further Reading

Why Bitcoin Is Good For The Planet & Climate, & Free Of Energy Limits To Its Growth

Is Bitcoin Really That Bad For The Environment?

Bitcoin’s Energy Usage Isn’t a Problem. Here’s Why.

Debunking Common Bitcoin Myths

BITCOIN EMITS LESS THAN 5% OF THE LEGACY FINANCIAL SECTOR’S CARBON EMISSIONS

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Very cool piece 👍

The comparison to gold as far as environmental damage are apt but at least you have something tangible at the end of the day with gold (jewelry, computer chips, and such). Can't remember which Substack writer but they proposed changing archaic bank 'settled funds' rules which aren't really necessary anymore. That fix would compete with Bitcoins main advantage of speedy transactions without the volatility.