🔋Saving Grace

We may be in recession already, in that case, who will save the day?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

When you want to buy something, you must first save money to afford it. While sometimes you can take on debt to purchase a house, the bank requires certain collateral to go through with the deal. This extends higher and higher to corporations as well as governments. Even though there may be more advantages and loopholes when larger sums are being slung around, the underlying principle remains the same. Investment into the economy is paid for with savings, and without it, people rely too heavily on debt which can result in less safety.

Net national savings (NNS) is the savings of households, businesses, and governments minus consumption. “It essentially looks at the difference between the nation's income and consumption and is a gauge of a nation's financial health, as investments are generated through savings. [1]” In the mainstream economic view, savings rise and consumption falls preceding a recession. When people are worried about economic prospects, they typically hold onto their money instead of going out and spending. Less consumption precipitates the recession and the correct policy response would be for the government to stimulate to encourage more consumption to keep the economy active.

I’ve previously discussed how many indicators like the yield curve, employment metrics, and other leading economic indicators point to a recession. NNS itself can be used as a recession indicator as well. As I mentioned, typically in the years preceding the recession NNS increases or is stable only to fall sharply once the recession hits. Since the COVID recession, NNS has been slowly declining which is neither indicative of the pre-recession nor in recession. This slow and continuous drawdown in savings could help explain why the economy and stock market have been resilient in the last few years.

One could conclude that this time is different and thus the mainstream could be correct in assuming that the recession will be mild (assuming we get one at all). This is a bit misleading though, as savings are required to spur real economic investment both on the corporate and consumer side. However, the NNS is clearly in negative territory now. Historically, the NNS has only been negative two other times. The other two were during the Great Depression in 1929 and the Great Recession in 2008, which is not the most encouraging company.

The traditional economic model could be broken. If we enter a recession as other historical indicators suggest, then the idea that consumers putting their money in savings instead of consumption spurs recession is flawed.

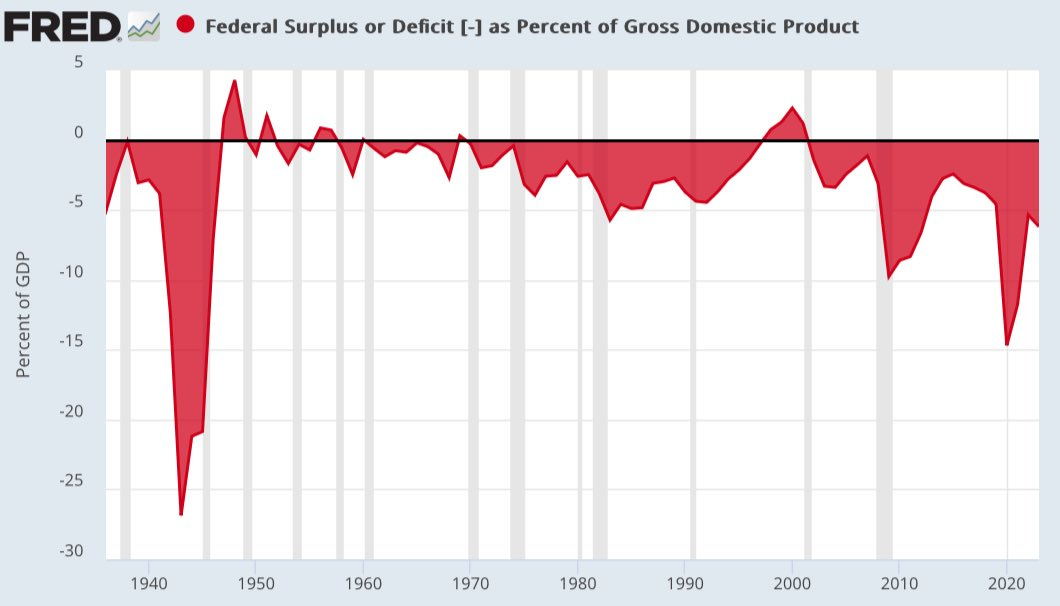

Since 2015 NNS has been trending lower rather than higher. On a larger scale, it has been on a steady decline since 1965. Since NNS encompasses consumers, corporations, and governments, the federal deficit plays a role here. The US has been running unprecedented peacetime deficits unseen outside world wars or financial crisis-type events. In addition, the same trend of increasing deficits since 1965 is apparent in this chart.

The extreme deficit spending is having an impact on the NNS numbers. This may help explain why the recession hasn’t hit yet, as the figure has been skewed by the giant government debt. Further, this debt goes into the economy and helps deliver economic activity. Government spending doesn’t have the same bankruptcy consequences as consumers or corporations, and with it, we’ve seen an exponential rise in government debt. Consumers on the other hand have been taking on record credit card debts as their personal savings rate has been dwindling too, so it does not mean it is good news for the economy.

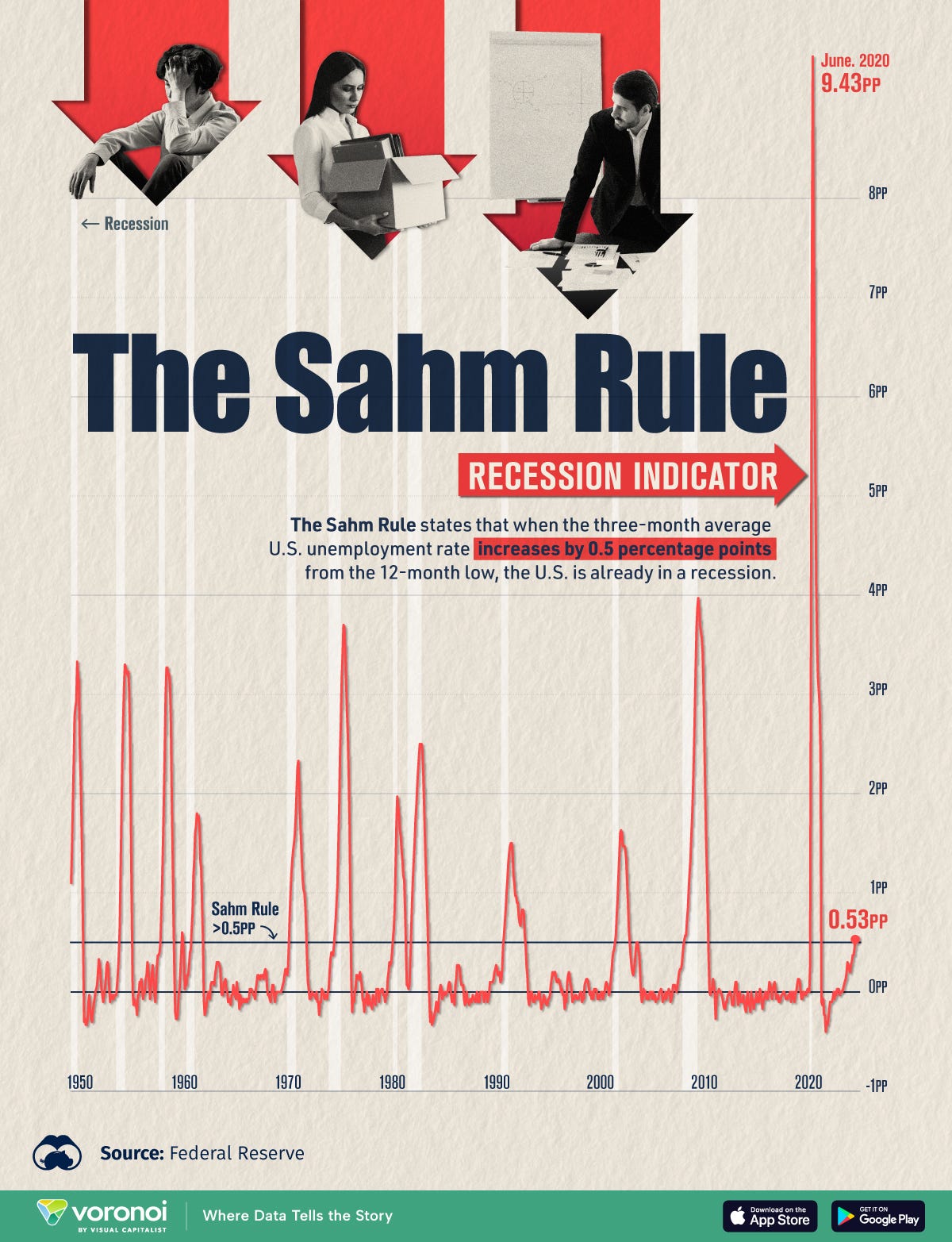

The Sahm rule suggests that the US is already in recession. When the 3-month average of the unemployment rate goes above 0.5% of the 12-month low, this has historically pointed to the onset of recession. We have just hit this level, but it takes many months (4-21) for the NBER to officially declare the recession has started (in hindsight). You have to listen to proactive and critically minded financial media to be ahead of the curve.

I have been early in warning of a business cycle slowdown in the economy for a while now, but the un-inversion of the yield curve and the Sahm rule point that recession is starting any time now. In addition, the negative net national savings point to an economy with little buffer if and when times get rough. History suggests more job cuts and a stock market correction during recessions which is something to be mindful of. I expect even more deficits to stimulate the economy in the months/years to come, increasing the deficit to GDP and further decreasing the NNS sharply. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.