🔋Tesla ESG Debacle

The removal of Tesla yields insight into the motives behind the ESG movement and Elon Musk has more problems than meet the eye.

Help me out and press the heart button above or below I would greatly appreciate it!

Last week Tesla was taken off the S&P 500 ESG fund. This is a separate fund of a select group of companies in the broader S&P index that meet a desired ESG score. Elon Musk was unsurprisingly not happy with Tesla’s exclusion from the list, as it could mean less money going into Tesla stock. Elon has been on one lately, first taking on the challenge of buying Twitter, now taking on the ESG movement. In a series of blunt tweets over the last week, he calls ESG a scam.

To be transparent, I have been critical of the ESG movement in the past in my The Real Climate Catastrophe series and I think in general the environmental aspect will cause more problems than solutions in the long run. I want to look into this case in particular and figure out what is going on beside than the sensational reactions to the news. I will discuss what the ESG requirements are and whether Tesla’s removal from the fund reasonable based on their guidelines, whether I think the fund itself is reasonable, and take a critical look at Tesla and analyze using a more honest framework.

ESG

ESG stands for environmental, social, and governance, so there are three components that we need to consider. From Investopedia (emphasis added),

Environmental, social, and governance (ESG) criteria are a set of standards for a company’s behavior used by socially conscious investors to screen potential investments. Environmental criteria consider how a company safeguards the environment, including corporate policies addressing climate change, for example. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Rating agencies score companies across these parameters and then funds can invest in higher ESG companies if they wish. This has been an increasingly popular investment tactic over the years and has been pushed by many influential organizations such as Blackrock and World Economic Forum (WEF). Companies have been pushed to put more care into the social good and their environmental impacts. Investment funding has been easier to come by recently for those with ESG qualifications. Certain industries have been underinvested and neglected due to funds seeking ESG friendly areas as well as corporations hesitant to expend capital where they see heavy political pushback due to the ESG narrative.

Tesla’s Removal

Here is the quoted reason for Tesla’s removal from S&P,

A few of the factors contributing to its 2021 S&P DJI ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy and codes of business conduct. In addition, a Media and Stakeholder Analysis, a process that seeks to identify a company’s current and potential future exposure to risks stemming from its involvement in a controversial incident, identified two separate events centered around claims of racial discrimination and poor working conditions at Tesla’s Fremont factory, as well as its handling of the NHTSA investigation after multiple deaths and injuries were linked to its autopilot vehicles.

Even though Tesla’s mission is to help solve climate change by building electric vehicles to reduce carbon dioxide emissions, they failed to prepare a specific decarbonization strategy which is the first reason for their exclusion and regards the environmental aspect. The other examples likely have to do with the social and governance aspect and are based on discrimination/conditions claims and how they handled an investigation. Most of the rhetoric I see is how hypocritical Tesla’s removal is based on the environmental factor. However, there are two other social/governance reasons for their removal as stated and environmental impact is only one part of the index. From this perspective it is easy to see how they make the case that from the wider ESG lens, S&P have reason to remove Tesla.

S&P ESG Fund

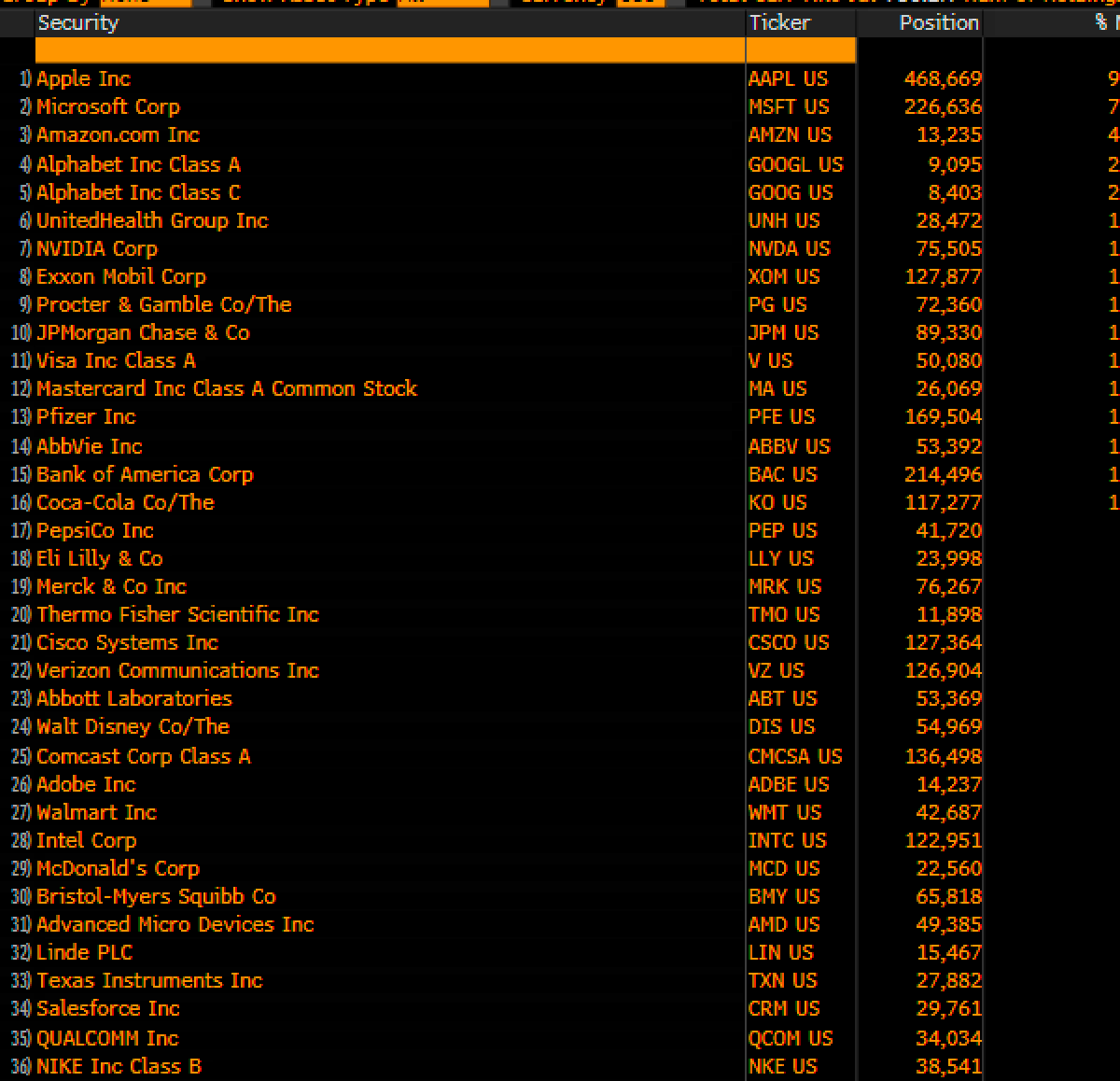

The contradiction that Elon points out is that Exxon Mobil Corp is ranked in the top 10 even though it is an oil company, which by default is pretty bad for the environment. Even though the ESG score takes a hit in the environmental category, the other factors play a key role as mentioned above. Three members of the Exxon board have been replaced by activist members. This governance piece likely goes a long way because they know they have influence in the company. They cite social issues that are still claims and disagreement over how Tesla handled an investigation which don’t seem like the strongest grounds. Furthermore, Exxon has a set plan to be net-zero emissions by 2050. Do they mean bankrupt? It is clear that they value this “plan” to decarbonize highly, whereas Tesla lacks a plan in spite of literally building electric vehicles which is one of the hallmarks of the ESG environmental narrative. I’m hard pressed to find any company on the list that has an environmental mission more in line with ESG than Tesla. Additionally, Musk has been vocal about his opposition to labor unions, a sentiment opposed by the Biden administration and is key aspect of the S in the ESG narrative. My feeling is the ESG followers and rating agencies dislike the lack of control and influence they have over Musk.

It is difficult to locate the actual methodology for their rankings, whether they hold it as confidential or leave it intentionally vague for times like this is questionable. Perhaps a bit of both. I went through various methodology documents (1, 2, 3, 4) and did not find much concrete information. A rule of thumb for what they look for can be found toward the bottom of the Investopedia page.

According to Forbes, the WEF plays a major role in determining the ESG guidelines. The big four accounting firms are responsible for the UN sustainable development goals which are a framework for societal impacts and are related very closely to the WEF framework. If you are at all concerned about personal rights/well-being/liberties and are open-minded in the slightest, the WEF is a scary thing. This piece comes out in perfect alignment as the newest WEF meeting this week. I’ll leave this alone for now because it easily warrants its own article.

One of the hallmarks of ESG is the stakeholder theory (as opposed to stockholder theory) where the stakeholder verbiage is used frequently throughout the ESG methodology. It means the stated purpose of a company is liked to societal benefit, not just returning value to the company. Now I doubt anyone wants employees taken advantage of or large scale pollution, but anything can be taken too far. The idea is that left to their own self-interests, capitalists/companies will take advantage of their employees, communities, and environment. The main issue I see with stakeholder theory is that the values pushed can be arbitrary and for the self-interest of people already in power. Does your company fit the social good? What is the social good? Who decides what the social good is? Is it whatever the WEF/rating agencies/politicians say? The self interests of folks in power creating the stakeholder values are also driven by political gain and their own self interests. There is also often a disconnect between the stakeholder value as created and the actual value of the common person. Here is an example of a policy exclusion so it doesn’t effect the policymakers.

ESG guidelines have very arbitrary and cherry-picked items deemed to be valuable. For example, the environmental aspect supports renewable energy like wind and solar but demonize nuclear and natural gas. This makes little sense realistically as nuclear is emissions free, safe, and has a large energy density and natural gas has done the most out of any energy source to reduce emissions by replacing coal. Wind/solar are lower energy dense sources, require large amounts of mining in sometimes questionable jurisdictions, and their cost reduction has trended closely alongside baseload energy prices (typically fossil fuels used to produce them). Furthermore, I am less astute when it comes to the social and governance aspects, but you can find similar types of contradictions in these aspects as well if you are willing to look.

My point is just as there is an incentive for a stockholder to exploit for personal gain, there is incentive for the person who creates the stakeholder values to exploit the values for personal gain. This results in arbitrary rules and decisions which continuously sway further than societies actual desired goals. I think that is what is going on here. By S&P criteria, Tesla has good reason to be kicked out of the ESG index, however the S&P criteria sucks, is corrupt, and is not a good representation of their slated objectives.

Tesla

Let’s take a deeper look into Tesla specifically ignoring the arbitrary ESG criteria and considering the company on more dimensions of ethics. First, Tesla is the largest and most successful electric vehicle manufacturer by far. Based on the battery supply chain, EV’s may not be the best for bringing the US toward its climate goals. The battery raw materials are in short supply and will be increasingly expensive with the supply shock. The volume of battery materials is large and comes with its own environmental and societal impacts. There are tremendous amounts of emissions, community exploitation, environmental destruction, and poor labor conditions intertwined with much of the batter material supply chain. These are very important first upstream problems that are not addressed.

ESG Hound is a fellow substack writer who is very critical of Tesla/Musk. He raises many points against Tesla’s case for being ESG besides the reasons listed as why by the S&P. He brings up the point that if full life-cycle is taken into account, it is debated whether EVs are better from a climate perspective. ESG Hound has written about the natural gas plant they want built in Texas even though they claim the gigafactory will be powered by 100% renewable energy. Tesla seemingly ignores the humanitarian Uyghur issue by expanding sales and sourcing materials from the Chinese market (they have been decreasing exposure to China for battery cells and raw materials). He brings up various legal issues, working condition issues, and more in the thread which expands past the 6 shown, in which some are more grounded than others.

Another point I would like to make is that Tesla has the second largest holder of Bitcoin as a reserve asset of any company behind MicroStrategy. Bitcoin is often misconstrued as anti-ESG because it takes energy to run the Bitcoin network and fossil fuels are burned in the process. Musk even halted further Bitcoin exposure to appease the ESG crowd over environmental concerns. The fact of the matter the environmental effects aren’t as bad as portrayed, is helpful for the environment in various ways, and at the end of the day the value the bitcoin network provides is substantive enough for millions worldwide. Bitcoin is the best tool for financial freedom and is a superior financial network for people that is free of counterparty and confiscation risk. As Alex Gladstein says, Bitcoin is the most powerful “S” in ESG holding one can have.

Conclusion

Does the S&P/Tesla decision make sense based on their statement? Yes

Does Elon in the right to complain, especially considering other companies in the index? Yes

Are the ESG standards arbitrary and ideologically based? Yes

Is Tesla/Musk in the clear ethically? No

I say no because as noble the mission of Tesla to bring self driving electric vehicles to the world is not free from its environmental problems with raw material mining and supply chain. As far as ethics go, he is getting materials from and profiting massively in China despite their human rights violations. Furthermore, he is in various lawsuits for workplace conditions/discrimination as well as the SEC. Even though they may still be claims, that’s not a good look for his company. There are also fraud, unfulfilled promises, various allegations, environmental issues, safety issues, and more issues that have plagued the company and Musk over the years.

I think Musk has a good vision and wants to improve the world, but no one is perfect. Not you, not me, not Elon Musk, not anyone at Tesla. Elon wants to point out the hypocrisy and lunacy with the ESG index and there is merit to doing so, but Tesla is not void of any meaningful ethical issues itself. There are issues that should be addressed and fixed regardless of how bad the ESG index is. All of us can and should aim to be better socially and be more environmentally cognoscente regardless of some arbitrary investing criteria. At the end of the day, ideological battles get in the way of real innovation, investment in quality companies, and can lose sight of helping real people.

ESG comes from a place of trying to help people, but the bullet point issues it addresses are certainly not black or white like it is made out to b. Overall, the central planning of values is never going to be representative of the whole world and has inherent corrupting incentives. My fundamental issue is that ESG not only can, but already has become out of touch with what will genuinely help the most people prosper while caring for the climate and each other. Ideologies will scrutinize whoever and wherever the narrative leads, unfortunately at the expense of the proclaimed ethical goals, and even worse… the people.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Taking Tesla off of the S&P top 500 has made ESG a sick joke. Just pure propaganda. And this mickey-mouse nonsense Gladstein states are less than worthless. Exxon @ #8, Jesus. Do these scam artists have any self-awareness whatsoever? Any knowledge of Energy & the Environment whatsoever? Apparently not.

Putting Amazon, Microsoft and Apple at the top 3 just because they pump themselves up with the wind & solar credits scam. Just ridiculous. Pretending if you buy a GWh of solar credits dumped anywhere on any grid somehow that offsets the mostly Coal & Gas power they consume.

The problem with wind & solar is because they are intermittent & seasonal they require a mirroring fossil/biomass/nuclear/hydro energy source that supplies almost 100% of grid demand during the wind/solar lulls, which often occur when grid demand is highest, i.e. large stable high pressure cell in the winter. So the best wind & solar can do is theoretically replace some fuel when they are operating. But fuel cost is only about 1/10th the electricity price you pay. Most of the rest is grid costs. So to have that meager fuel savings you essentially have to have two parallel grids operational at all times. To add misery to madness induced cycling and economic inefficiencies in the buffering fossil/nuclear generators mean in reality negligible fuel is actually saved by the wind & solar. Even if the Wind Turbines or Solar Panels were free they would still be far too expensive to be practical except in areas on diesel generation (very expensive fuel) and with a large reservoir Hydro resource or for off-grid homes.

There is a linear price relationship between wind/solar grid penetration and price of electricity. See Ken Gregory, P.Eng, graph Euro/kwh by country 2019: Conclusion: European Wind Plus Solar Cost 6 Times Other Electrical Sources:

friendsofscience.org/index.php?id=2550

End result is after spending over $4 trillion worldwide on wind & solar total, World Primary energy supply is unchanged at 90% combustion fuel as it was 10yrs ago. In spite of improved efficiency of replacing conventional coal with supercritical coal, OCGT with extreme efficiency CCGT, coal/gas with hydro, LED lighting, substantial improvements in transportation efficiency, improved building insulation, heat pumps. Wind/solar hasn't even nearly been able to cover the growth in fossil consumption never mind actually replace fossil. Wind/solar has already been a dismal failure in Europe, leading to high energy prices, electricity & heat supply shortages and steep price increases, dependence on Russian energy & energy blackmail.

As further evidence, a survey of 68 nations over the past 52 years done by Environmental Progress and duplicated by the New York Times shows conventional hydro was quite successful at decarbonization, nuclear energy was also very successful and both wind and solar show no correlation between grid penetration and decarbonization. In other words wind & solar are not replacing fossil, they are a complete waste of money. They only succeed in increasing energy prices which does reduce emissions only by creating energy poverty.

So IN FACT any company financing wind & solar is a carbon emitting glutton. Tesla does badly in that department but far more than offsets that by having been by far the #1 supplier and developer of BEVs which unlike Wind & Solar can seriously reduce emissions, both GHG & pollutants. And SpaceX by reducing cost of material to orbit by 1000X has vast implications for ESG methods of the highest order. Including putting a SunShade at the Solar L1 point which would be the final solution for global warming - if necessary.

Other than that the ONLY companies that should be at the #1, #2 and #3 spots on the ESG list should be those installing and developing Nuclear power. That's just the facts. Where are they on the S&P 500 - oh, nowhere. ESG is a joke and a scam.

Great points. Thanks for your input. Yeah, I just ditto that I agree nuclear and hydro where possible are definitely no-brainer ways forward. Result: the esg movement totally gets in the way of best decarbonization strategy. 🤙