🔋The Everything Shortage

We may not have enough battery materials, but that doesn't mean to resort to Malthusian ideology.

Press the heart button on this article, yes you! I would greatly appreciate it :)

“Peak Oil”

We don’t run out of things, we run out of things at low enough prices for them to be economically viable. You may have heard of “peak oil,” and this is commonly used to dispel the thought that commodities, particularly fossil fuels will run out causing a global crisis. Throughout history, people have tried to predict when the amount of oil in the ground was at its peak. History was not kind to these people as we keep finding more oil and innovating better ways to get it out of the ground. When the price of oil went up, people spent more resources on new technology, exploration, and extraction such that they could still make a profit on the remaining oil available.

Think about it this way, if you sell lumber for people to make homes and you chop down what’s on your property, you could conceive that you will be at peak lumber when about half of your trees remain. From then on out you are barreling toward the bottom of the abyss where there are no more trees and no more new homes. What ends up happening is that when you start running out of trees to cut, if you’re smart, you ask your neighbor if you can cut down his trees surrounded by brush for an extra fee. If there’s sufficient demand for new homes at higher prices, then you still make your profit regardless of the cost of producing the lumber from the extra effort it takes plus the fee you pay your neighbor. Companies are constantly deciding whether their hypothetical neighbors’ trees are worth cutting down.

This is the idea of resources vs reserves. There may be plenty of lithium resources in the ocean, but how much of that lithium is viable reserves that could economically be extracted and sold to battery manufacturers. What are the operating costs of this adventure and how do they compare to other brine or ore extraction techniques? What would this do downstream to the price of batteries? This applies to all sorts of commodities, and people smarter and with more experience than me try to estimate reserves, prices, and market implications of these phenomena. The current rendition of the energy transition as we know will require large amounts of steel, copper, aluminum, key battery materials, and key rare earth metals. Every single commodity falls prey to the vicious market dynamics that underpin the supply and viability of their extraction.

There’s Not Enough…

I recently came across an article that estimated the reserves of wind/solar/batteries vs the current demand outlook for replacing fossil fuels and it was a bummer for the renewables crowd.

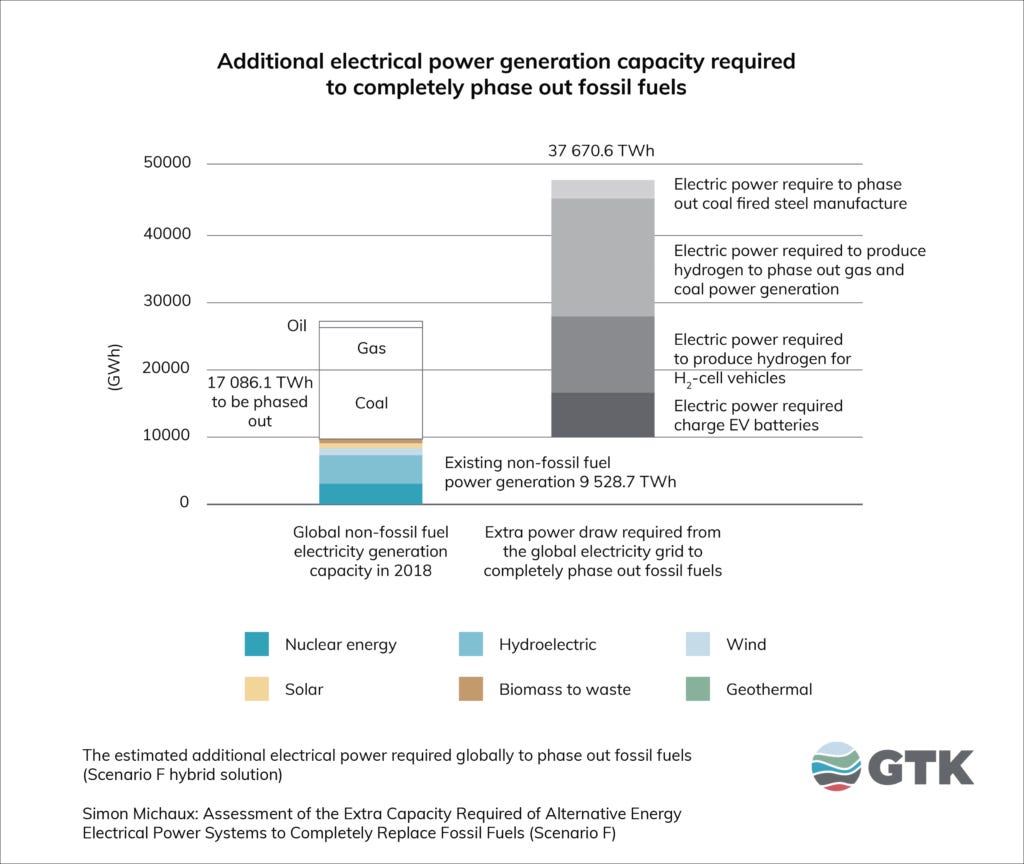

The full report, It’s Time to Wake Up | GTK, is from the Geological Survey of Finland and estimates that decarbonization efforts face a serious challenge moving forward. Its purpose appears to revise/build upon other studies attempting to estimate materials required and also have implications to guide Finland forward with. Under the study, to completely phase out fossil fuels, an incredible amount of additional electrical power generation would be required.

Furthermore, the author expresses how previous studies by the World Economic Forum and others underestimate the amount of battery materials needed to transition to away from fossil fuels via the guidance set forth by the major G7 nations. It appeared to him that their work possibly represented one country, only included passenger cars, or incorrectly estimated the number of vehicles. His estimation was that there were not enough battery reserves to get past one generation of vehicles for the world.

The article discusses five major themes. First being that nuclear is the only way to practically deliver large quantities of reliable electrical power, but even uranium reserves are not abundant past 70 years according to his calculations. Second, there are not enough lithium-ion battery (LIB) reserves to meet the demand and not enough time to explore and develop more to reach the goals set forth. Other battery technologies and hydrogen fuel cell technologies should be explored instead of the insistence on LIBs. Third, the amount land and water required for biofuels and biomass to replace petroleum products exceeds environmental capability. Fourth, industrial fertilizers are made primarily with natural gas. No viable solution currently exists to solve this. Fifth, it may be simpler to restructure society to consume less and lower demand for energy and materials.

What do I think this article gets right or wrong?

Right

Nuclear is the move - Nuclear has been demonized by the green movement which is a shame because it produces cheap and reliable emission free electricity. Waste and safety challenges are largely nothingburgers and the expensive up-front costs are largely due to government regulation and red tape. Nuclear could be the savior for reducing carbon dioxide emissions if it is given its time to shine.

Material shortage - The arbitrary demand for key battery materials set forth by major governments is outpacing reserves/projected supply across multiple sources. It is for this reason I think plug in hybrid electric vehicles (PHEVs) are the move. How to use 1/5th the batteries and still reduce emissions.

Other technologies - Sodium-ion batteries could see their time to shine, even in just passenger vehicles while LIBs are reserved for more energy dense applications. Hydrogen could be used in fuel cells for larger vehicles, and I have talked previously about other battery technologies for stationary storage like metal-air, flow batteries, and even solid-state.

Wrong

Technology innovation - while they did mention other battery technologies, hydrogen fuel cell, and even included an efficiency improvement in batteries in some of their analysis, studies such as this often underestimate the innovation that could help mitigate these challenges. It is hard to blame them as we cannot simply count on some magical solution in the future, so the optimism in me says people will innovate better products and we could stumble to better policies in the future.

More materials - Like the intro suggests, at the right price, other resources turn into viable reserves. If the price of batteries is sufficiently high to allow exploration and extraction of battery resources, while low enough to ensure demand for electric vehicles and other renewable technology remains. This is a fine line.

Recycling - Not mentioned was the recycling of LIBs for reuse in other applications. If it’s true that we could only actually replace one fleet of vehicles globally, then if successful recycling operations came along, that could extend the time frame for resources through re-use, or even delegation to less energy intensive applications (phones, stationary storage, small devices, etc).

Running out of nuclear supply - The article estimated we would run out of Uranium reserves in 70 years. Again, prices will dictate what is viable to pull out of the ground. Given time, further uranium (and thorium) can be used for nuclear fuel.

Thoughts

Given time, further reserves of lithium and other battery materials may become viable as well. I have talked about the supply issues and how unrealistic and arbitrary the goals are in the past. The ability and market dynamics that allow for more supply to be brought online despite the predictions and estimations by experts don’t discount that the supply of these materials will stay severely constrained as long as governments maintain these goals. In the short term (through ~2030), I think this article is correct, in that there are not enough reserves to meet the energy transition goals as they are presented currently, especially at low prices.

People don’t like going back to a lower standard of living. While many in wealthy nations have pretty wasteful lifestyles that most would admit are not quite necessary, taking away the ability to do the things we have today does not feel good. In aggregate people get angry if you get in the way of what they want, so trying to regulate lower energy consumption and lower demand for goods will not be a popular tactic. The bigger problem here is whether a government or organization should be the arbiter of these decisions and how that weighs on the public.

For this reason, I think it is extremely unlikely that we will ever get rid of fossil fuels. Regardless of government interference, market dynamics win out in the long run. The bulk of our lives revolve around fossil fuels, and not just the large things like heating and transportation, but plastics and rubber for example. Until a cheaper or comparable biofuel/bioplastic alternative to petroleum-based products exists, I would put money on people still demanding them at the expense of any climate goals.

The fifth theme of the article struck me, where they said perhaps the most realistic way to solve the issues is a restructuring of society with lower demand. Like I said, yes, we are wasteful, but lower demand means lower standards of living. By how much? Who decides? These are not trivial issues. A significant portion of anti-nuclear energy movement is rooted in Malthusian ideology as noted here. Taken to the endpoint/extreme, Malthusian ideology would likely devolve into various forms of population control for the “greater good.” I yet again beg the question; who the arbiter of those troubling decisions?

If we truly bought into the thinking that the finite resources are only solved through population control and lower standards of living, we would try our best to make sure we are not at the short end of that stick. This selfish short-term thinking comes at the cost of betting on each other to increase production and innovate solutions into the future. What then is more important, finding the best technologies for humans to prosper into the future? Or making sure that your status and position is maintained into your bleak perceived future?

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.