🔋The Ultimate Value

Is money the root of all evil, or something much more?

Press the heart button on this article, yes you! I would greatly appreciate it :)

Show me the incentives, I’ll show you the outcome - Charlie Munger

Some of the most important values among people are honesty, responsibility, empathy, generosity, tolerance, gratitude, and more. These can be shown through how you spend your time, how you carry yourself, how you treat others, and perhaps things you get for other people. It is also said that your actions define what you value and often these core values and actions can overlap. There is a hierarchy of values where people may choose food and water over comfort and relationships for example. Then below that may be things such as entertainment, goods, and vacations.

Another famous adage is that money is the root of all evil. This is often used to characterize greed and how people can become obsessed with lower levels of value at the expense of higher ones like relationships with family and friends. This adage, while encapsulating the dangers of greed can be construed to mean that money in itself is bad. This could not be further from the truth though. Money is the ultimate form or expression of value. Each monetary exchange made or sacrifice made to earn a wage encompasses value.

Money is value

Over time people strive to earn wages doing something they enjoy or find meaning in. This is the first form of value being the exchange of time for money. A laborer could sacrifice his labor or barter for each good or service he wants, but over time societies have realized that money and wages are easier and more efficient than the barter system. In free societies, people go to work doing different jobs, and whichever one they pick is a sign of something they value.

What people purchase to eat can be an important sign of value because it shows whether they value themselves in the form of health or the practices it takes to procure that food (ex: factory farming). Where you live is another easy example of what people value most whether it be proximity to family/friends, location, cost of living, scenery, etc.

Once we have wages and pay the high-order forms of value like food, water, and shelter, there’s disposable income left over. This is where I think the adage should be greed is the root of all evil, not money. Money is merely the medium of exchange to get things. Someone could love money and spend it on cars, vacations, and other things and neglect their family. Someone could even be obsessed with making money, but is money the problem or do they feel insecure about their finances or not feeling good enough? The money itself isn’t bad, just the underlying values and motivations that are expressed with it.

Freedom

Without the freedom to transact and the freedom of money, there is no freedom in the modern world. Unless you aren’t participating in the modern world, money is the means to transportation, food, goods/services, shelter, etc. One must trust the money is safe and won’t be tampered with. If people can’t do what they want with their money, there is no way for them to properly express their values to the world.

Today the dominant form of money is the US dollar or other fiat currencies depending on the country. Since the break from the gold standard, our money has been manipulated and tampered with in the form of dilution and interest rates, not to mention many nations around the world with heavy restrictions on citizens and their ability to earn and spend money. Even in the US, central bank money printing decreases the value of all savings in that currency pushing people into bonds, stocks, or other riskier assets. Further, manipulation of interest rates distorts the time value of money by bringing investment from the future into the present.

While the US is still one of the more financially free nations, the money is still being heavily manipulated which is a big reason why assets like gold and Bitcoin are compelling. The money supply was increased by 40% post-COVID and interest rates dropped to the zero bound before being raised again in 2022. While life goes on and the US still thrives and grows, the dangerous incentives from money manipulation perpetuate through society in many ways.

Savings

Typically when purchasing an expensive good, you work hard and save up money to purchase it. With lots of savings, people can buy goods they’ve been wanting, invest in business opportunities, or invest in other assets. The easy money policies I described incentivize this hypothetical person to purchase goods today because your savings will be worth less in the future and the interest rate is very low which also may go up in the future. Over time savings rates would go down in this regime which is exactly what has happened in the US. Once savings get to a sufficiently low level there is a risk that it cannot sustain or there will be no protection during any hard times that may arise.

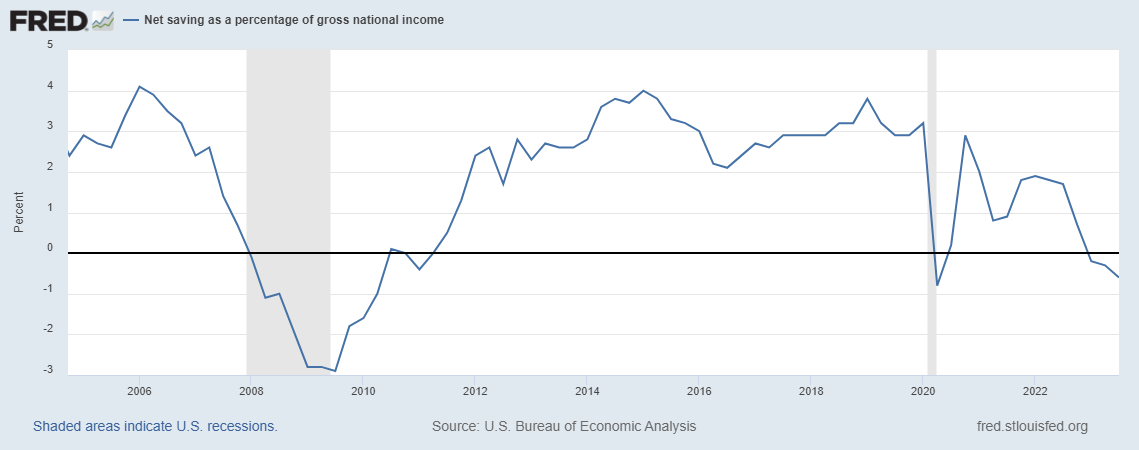

Respected economist Lacy Hunt speaks on how not only the personal savings rate for consumers is near record lows, but the net national savings is now negative. This metric takes into account corporate and government savings in addition to personal. Negative net savings today imply that negative government savings (debt) are crowding out the private sector. In Hunt’s words, this means “The economy is financing consumption by not replacing the value of that capital stock that was depreciated by its various uses.”

We can see that this has only happened a few times in history, during the great depression, the 2008 financial crisis, briefly during COVID, and now. This isn’t great company to be with for the economy to keep growing and implies something is different this time. During the great depression, the negative rate was driven primarily by lower corporate savings followed by negative personal and government savings. In recent memory, corporate and personal savings rates remain positive so the total was led primarily with very negative government savings aka unproductive debt. This means that at the moment, the economic activity is dependent on foreign inflows of capital to continue its current growth. There are two ways to get out of this unsustainable negative environment, the first being an increase in the savings rate of the components which would cause the economy to slow. Second, if the private sector grows allowing the savings to increase without increasing their savings rate, or simply put the private sector is more productive. Unfortunately, the government is taking an increasing share of GDP over time serving to crowd out the private sector and decrease economic growth over time.

Moral hazard

Lacy Hunt also provides some context as to why government spending can lower productivity in the long run. One of the ill incentives put in place by government incentives is the introduction of moral hazard. When banks were bailed out in 2008 or airlines in 2020 it is naive to think these companies have learned their lesson. Knowing there will be bailouts, banks and large companies don’t have to run as tight of a ship and can afford to be more speculative with their money. Everyone knows that spending someone else’s money is easier than your own earned money. The large bailout packages as well as any subsidy packages are funded through the taxpayer in one way or another with taxes or monetary devaluation.

With the government taking a larger share of the economy and continuously stimulating with easy money policies, the moral hazard perpetuates society. I’ve discussed how this can inflict a meaning crisis as well as plague a pillar of what made the US powerful which is science.

Ill incentives of money will always perpetuate throughout society and will not only diminish people’s ability to assign value, but will corrupt how people express their values, and can even promote bad behaviors from corporations. Regular people are not able to properly express their value today even in a free country and the consequences of faulty government policy and bailouts always fall on them as well. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!