🔋This Is Fine.

While Germany has escaped their short term energy price runaway, the problems continue to mount around them.

Press the heart button on this article, yes you! I would greatly appreciate it :)

Let’s check up on Europe, shall we? I have previously discussed Europe’s issues in terms of natural gas, monetary policy, and energy policy which could provide some optional context to my discussion here. As inflation is a top priority around the world, the ECB has raised interest rates from below zero up to 2% in an effort to slow demand, reduce inflation, and hopefully not send the continent into a recession. How are they doing?

Focusing on Germany for this piece as they are the top economy in the Eurozone, inflation (producer/consumer) stands at a staggering 45.8%/10.4% for October. Even with all the negativity around inflation, the economy continued to grow for the first three quarters of 2022, however reports suggest it may begin slowing in quarter four. Furthermore, the big craze about German electricity prices have come down off the large blow off top seen in August as natural gas storage levels for Europe are nearly full. The fall in energy prices has kicked off a resurgence in industry and manufacturing.

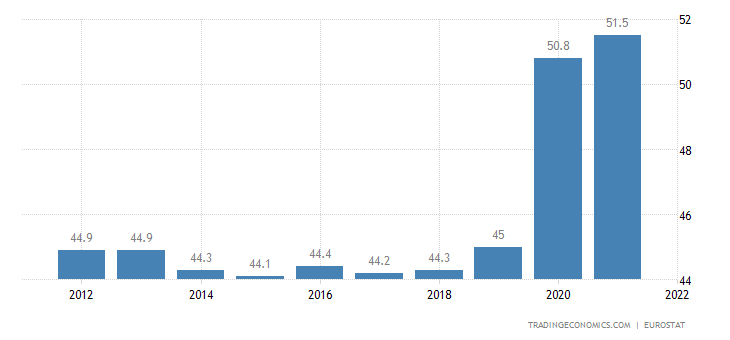

While Germany and the rest of Europe may be able to get through this winter, their troubles don’t end there. While energy prices have backed off, prices remain at levels roughly twice what was commonplace before the crisis kicked off in 2021. German company insolvencies have increased in recent months with many more feeling the pain since I last wrote about Europe. This is a big deal from an economic perspective. Unemployment and a contracting economy is a problem that governments hate just as much if not more than inflation, thus drawing attention from the political leaders. Germany has even loosened insolvency rules, in a similar manner to during the COVID pandemic in order to keep businesses afloat.

I don’t know about much about these companies and if they were poorly managed, had unrelated issues, etc… but a crazy stat is that these companies went through events like both world wars, the collapse of the Weimar Republic and corresponding hyperinflation, and the great depression. Pandemic shutdowns and/or the energy crisis finally put them under.

The economic minister suggests here that companies can halt production for the time being. While loosening up insolvency rules is one tool, the other tool is direct subsidies if companies simply cannot keep running. The country has already embarked on energy subsidies for households due to rising costs. The costs will be quite substantial.

The German government plans to spend as much as $82.8 billion (83.3 billion euros) on funding a planned cap on electricity and gas prices next year as it looks to help businesses and consumers with coping with high energy costs.

The figures provide a more granular breakdown of the 200 billion euro shield the German government has drawn up via its economic stabilisation fund to ease the burden on households and industry in the wake of rising energy costs - Reuters

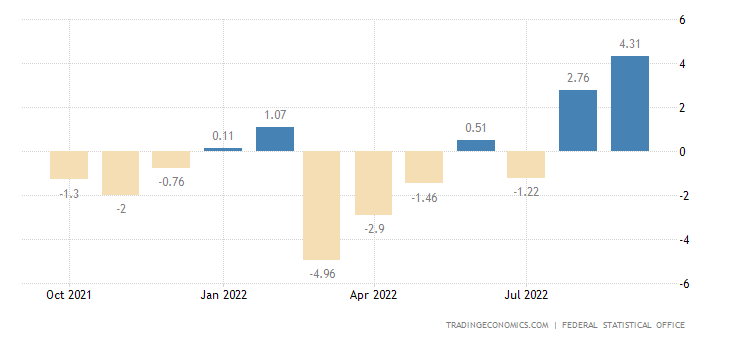

200 billion Euros is an enormous government stimulus that equates to 4.74% of GDP and 24% of the tax revenue in 2021 terms. This amount of government spending dips well past the tax receipts that the country earns and into the territory of deficit spending. COVID and the energy crisis have caused the government balance of payments to go crazy as seen below.

The negative balance of payments and increase in government spending is bad for the fight against inflation when it means new money in the system. This strikes at odds to the ECB policy of raising interest rates to fight inflation. It is a double edge sword in fact as the higher debt and interest rates mean higher national debt service payments. Debt service alone could spike from 4-30 billion Euros which adds even more expense that the country can’t afford. While the US can afford a budget deficit due to its exorbitant privilege, other countries cannot without consequences in the form of defaults and severe inflation.

On top of the double edge sword that the deficit spending into higher interest rates causes, the energy subsidies themselves distort price signals by merely applying a discount for consumers that would normally refuse to pay for the energy they cannot afford. This artificially increases demand for energy adding a further push on prices and doing nothing to solve the supply side which is the real issue. While it would suck for the people and businesses of Germany to go through such a thing, the consequence is a government that foots the bill and kicks the can down the road to inevitable future problems. German policy to subsidize energy is the expedient and predictable political choice in today’s world and provides some short term comfort and safety. I suspect any confidence about the state of affairs in Europe from national perspective will be short lived unless some of the issues are truly solved. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

If Germany doesn’t get its energy supply sorted out, it will have demand destruction until it does.

Unfortunately, ‘demand destruction’ is the (probably permanent) loss of industrial capacity. And bluntly, Germany is not sunny and windy enough to be a wind and solar powered industrial center.