Twin Chains

The creature and the shackles: America’s worst year in history.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

February 2nd, 1913, a cool breeze cuts through a man’s suit on the lively New York City street. There is a sense of optimism in the air. Is it the warmer winter air, or could it be the excitement of the reopening of the world’s largest railroad station, Grand Central Terminal?

America was once by far the fastest-growing economy in the world. The factories were churning, jobs were plentiful, buildings were constructed, and technology was flourishing. Fenway Park had been completed the prior year, giving the national pastime some of its most inspiring players and heated rivalries in years to come.

The industrial might and technological prowess of the US were indeed impressive, but seeds of doubt crept into his mind after the sinking of the mighty Titanic less than one year ago. Even still, opening the door to the mighty Grand Central Station, he had no idea he was entering the worst year in American history.

Income Tax

At that time, the federal government was lean, funded through tariffs and excise taxes. Washington’s reach was narrow, with states holding real autonomy and courts with power. You kept all of your pay, no taxes, insurance deductions, social security, or 401 (k). Interest rates were set by regional banks and lenders, money was constrained by gold reserves, and national debt was low. Banks failed, and panics ensued; it was the wild west as no one bailed them out.

Later that month, in February, Congress passed the 16th Amendment, which allowed the federal government to levy an income tax. This was not the first time the US has issued income tax. During the Civil War in 1861, a modest income tax was levied to pay for war efforts and actually expired in 1872. I guess government programs used to be temporary. The 16th Amendment was a permanent solution to a funding issue in the Federal Government. It was sold as a way to pay for wars and a fairer taxation system than the tariff and excise tax regime.

In reality, income tax granted the federal government more power over individuals and states. This collectivization of power changed the balance between citizens and the state forever, creating moral hazard, loss of privacy, and centralization. Initially, income taxes were very small. Only months later, the US entered WWI, and top-end tax rates increased from 7% to 77%.

It can be argued that income tax is a more uniform and fair policy than its predecessor, but the consequences are undesirable. WW1 and WWII were expensive, huge, and lasted quite long. Before this, the War of 1812, Mexican-American War, and initially the Civil War were fiscally constrained and local. Income tax allowed the US to fund massive international wars that lasted much longer. Doing this in prior wars would destroy bond demand or cause revolts in the tariff/excise tax-affected industries.

After WWII, the US was able to fund military excursions in Korea, Vietnam, the Middle East, and the Cold War. Tax rates never went down after WWII either, with broadly higher income tax rates a permanent feature of American life. Higher revenue during peacetime meant more income for the government to find uses for. Social welfare policies, economic subsidies, and government agencies were able to grow with this new funding mechanism. This has driven a perpetual increase in the size of government and government spending since.

Fundamentally, income tax was and is a striking invasion of federal control on the individual. Before, the individual citizen may have had little day-to-day dealings with the federal government. After 1913, every action that creates income is met with the threat of jail for failing to let the government siphon some of the value you created. This degraded property rights and individual autonomy to a revolutionary extent. Today, tax day is one of the most important times of year, with hefty consequences for non-compliance, meaning the federal government owns your income.

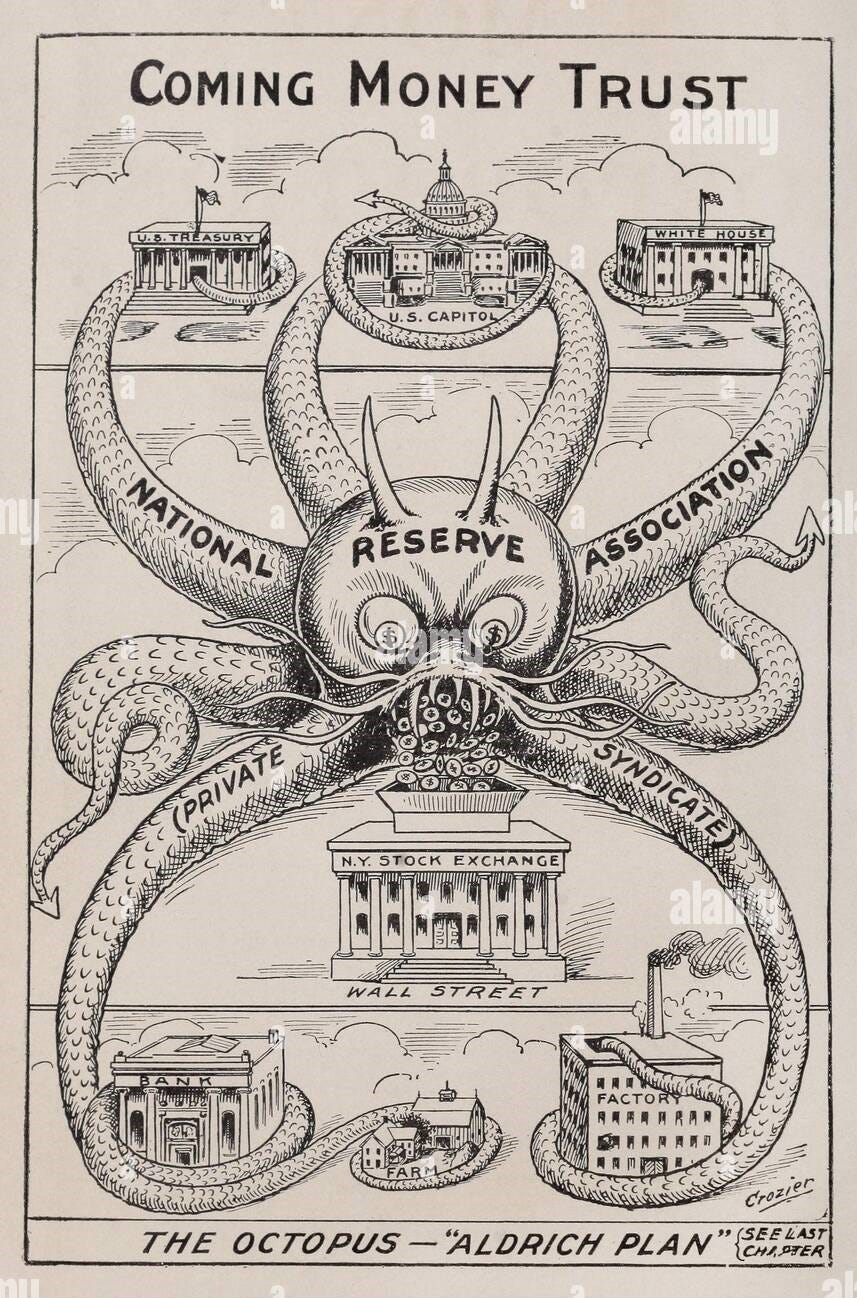

Federal Reserve

If income tax wasn’t enough, its big brother arrived later that year. The central bank arrived two days before Christmas as a big lump of coal disguised as a present.

Long before the creation of the Federal Reserve (Fed), there was a history of events that led up to it. Entire books have been written about it, so I will only be able to provide a short and sweet description of how it contributes to my view.

Large banks were powerful in the post-Civil War period, following the National Bank Acts, but started facing threats in political debates. These state-chartered banks actually thrived in the gold standard, and presidential candidate William Jennings Bryan was a vocal critic. If Bryan’s policies won, bankers would have less political power, and inflation could reduce their profits. Political interests (Morgan, Rockefeller, etc.) worked hard to get McKinley nominated as president in 1896. Once elected, the Gold Standard Act of 1900 was quickly passed, solidifying the gold standard, but not fully establishing their banking monopoly.

The Panic of 1907 was used as political grounds for banking reform in the US. If banks were allowed greater monetary elasticity, harmful panics like this could be avoided. For years, it was a political topic, sometimes in the shadows like the infamous meeting at Jekyll Island in 1910. Some even more colorful conspiracy theories even suggest that the Titanic sinking in 1912 removed some political opponents, allowing for the creation of the Federal Reserve.

While it is impossible to prove that, the consequences of the new central bank have been lasting and harmful. The large banks supported the Fed because it provided a backstop during financial instability and allowed them to expand credit more than before. Ironically, the banks did not support inflationary policies before, but do now. The difference is that this time, they have control of it.

The hard political work paid off this socialized risk, while privatizing profit. The ultimate and perfect monopoly was achieved. From 1900 to 1913, the gold standard was fair for banks and actually helped small banks thrive. 1913 saw the large banks consolidate power. Many small banks failed or were acquired by large ones in the future turmoil, while large banks were bailed out.

The Fed solidified a regime of ever-expanding bank credit, which is what we have seen with the forever-increasing public debt. Just like income tax, the Fed helped the federal government expand fiscal spending through excessive debt issuance. Like income tax, it was not immediate, but was expanded over time. The enormous social welfare policies of the Great Depression, the 1960s, and the 2000s would not be possible without the monetization of debt by the central bank. Similarly, the growth of unelected government agencies would not have been possible without this funding mechanism.

This credit expansion could also be taken advantage of by the government to fund wars, just like income tax. Over time, this method has been shown not to show the same constraints as income tax. It may be politically unpalatable to raise income taxes too high before the loss of voters, but a stealth tax through credit expansion is not obvious to the voter and thus has rapidly grown over time, unlike income tax.

This dangerous new tool has also caused more financial instability, not less as was advertised. Rapid credit expansion, even during the gold standard, created asset bubbles. The Great Depression was not caused by a lack of credit, like conventional economics teaches, but by excessive monetary expansion and bubble during the 1920s. Further bubbles like the 1970s, 2000, and 2008 can all be put in the context of easy monetary policy at the hand of an unbridled Federal Reserve.

COVID was met with yet another unprecedented monetary and Fed-supported fiscal policy. Another crisis looms as the Fed-induced moral hazard only creates financial instability and asset bubbles. We are in an asset market bubble currently and have already seen regional bank failures in 2023, with the contagion risk once again backstopped by the Fed.

Conclusion

These may not have made 1913 bad immediately or been the most negative externalities, but the consequences have driven some of the worst future years and events. Virtually all events can be traced back to being facilitated by these policies. I think a large share of blame for the death toll in all wars since WW1, and undoubtedly the severity of every economic crisis since, can be placed at the hands of these 1913 policies.

What was the worst year in American history? 2001 with 9/11, 1941 with Pearl Harbor/WWII, 1933 in the depths of the Great Depression, 1861 and the outbreak of the Civil War? These events are top candidates and terrible times, but cannot compare to the long-lasting effects of the creation of the “creature and the shackles,” aka the Federal Reserve and the 16th Amendment.

The consequences were countless wars, economic crises, centralization of power, moral hazard, and the destruction of individual freedom. 1913 in itself was not as bad as many horrific years, but for its long-lasting consequences, it is the worst year in American history. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView