🔋What A Rift

Biden’s pause on Chinese solar panel tariffs is set to expire in June and the industry is divided.

Press the heart button on this article, yes you! I would greatly appreciate it :)

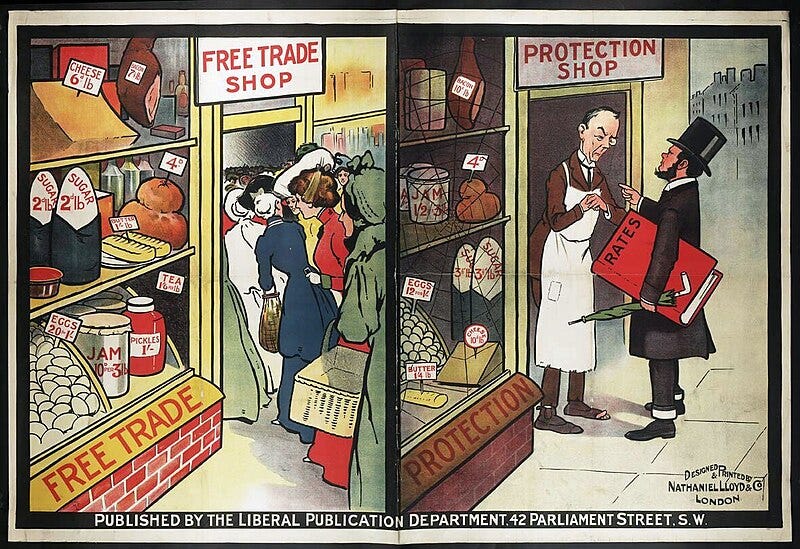

"All that a tariff can achieve is to divert production from those locations in which the output per unit of input is higher to locations in which it is lower. It does not increase production; it curtails it. - Mises, Human Action

Predatory pricing: the terminology competitors used in the early 1900s which helped convince the US government to invoke anti-trust laws against Standard Oil, splitting the company up. Standard Oil just revolutionized the world, mainstreamed business strategies widely implemented today, and continuously cut costs for consumers only to be broken up to “protect consumers.” As I discussed in A Tale Of Two Robbers, the argument stems from stakeholder theory - that the market cannot regulate itself and there must be certain moral safeguards other than the profit-motive controlling corporations.

One of the perpetual human desires is to use power to drag those above them down. Heroic corporations like Standard Oil have often been targeted by rival corporations through government regulation. If you cannot make a better product, just lobby politicians to use economic controls like anti-trust laws or taxes to regain your advantage. History doesn’t repeat, but it often rhymes.

Solar

The trade war with China is nothing new, whether it be semiconductors or mining assets. In 2018, Trump increased tariffs on solar panels coming from China. Additionally, in the last few years, the US has grown weary of the transparency of solar panels circumventing tariffs through neighboring Southeast Asia countries. In 2022, Biden imposed a two-year waiver on solar panel tariffs to encourage the sale and adoption of solar in the US.

That brings us to today, where the two-year waiver on those tariffs will expire in June. Solar developers have been enjoying the waiver, as they get Chinese solar panels at a lower cost. However, solar manufacturers here in the US are asking the Biden administration to reinstate the tariffs to discourage imports of Chinese panels and make their US-made panels more competitive. Their claims also refer to dumping schemes from China, a predatory business practice where companies sell products below market price to drive out competitors. They claim Chinese manufacturers are undercutting their prices to keep the US out and believe tariffs are the answer to their problems.

This is a lose-lose in theory. The current administration wants to increase renewables while simultaneously diversify domestic manufacturing away from China. With tariffs, they can only make either the developers or manufacturers happy. For developers, their motive is simple, they want the cheapest panels to build to make the most profit, and tariffs raise their costs (and costs to consumers). The manufacturers in the US are unable to reduce their cost of production to the level of China so Tariffs help raise the costs of Chinese panels making theirs more competitive within the US.

Some factors that make Chinese manufacturing cheaper are low-cost labor, cheap energy, and nearby sourcing of materials. China has a dominant position in the production of all components that are used in the end panel. There are some companies using forced labor which is very bad, but these abovementioned factors do not inherently attack US companies.

From the point of view of a Chinese panel manufacturer (or any company anywhere), securing low-cost labor, energy, and raw material inputs is priority number one to making a profit on your product. Chinese companies are very competent at optimizing these production factors. Thinking about it from their point of view, they see a prime market in the US to take advantage of. There is nothing wrong with this as we live in a globalized world with trade between most nations.

Tariffs

Tariffs are another form of protectionism in which a government values domestic production more than imports. In principle, a tax on imports makes those imports more expensive, therefore incentivizing domestic production. There are two types of tariffs, protectionism and revenue. Since the 16th amendment and income tax in 1913, tariffs have become a negligible part of government revenue. That leaves protectionism which is clearly the motive here.

US solar manufacturers and even US politicians blame China for their lack of success with claims of dumping products on the market below the cost of production (that of US producers anyway). This is a gift from the gods in theory. Consumers can rejoice and take advantage of the opportunity to get the goods they want at low prices. This benefits consumers, but the producer will either have to get production costs under control or go out of business. Dumping is not a sustainable business strategy, regardless of those who believe it to be consciously predatory by China. If the dumping scheme is true, then solar manufacturers should sop up the supply of undercost solar panels and re-sell them for profit or when the Chinese manufacturers inevitably go out of business from losing money (if they were really selling below market price).

That’s not true though, as Chinese manufacturers are making money which is why they keep selling. It is US manufacturers that cannot compete and want to use government intervention to their aid. Under normal circumstances, trade is a good strategy for prosperity. The US wants cheap solar to advance the energy transition and a company creates a product to satisfy demand and make profits to the benefit of many. Companies gain competitive advantages, and if China is good at manufacturing, then it is beneficial for both parties to trade. Tariffs hurt the producers by decreasing their profits and spurring ill-will while hurting the domestic economy by raising costs to consumers.

If the crutch of 50 tariffs is removed, these marginal producers must either improve their efficiency or go out of business. If they can do the former, why didn't they do it before the crutch was removed? - Mises Institute

Conclusion

It is only in recent years that growing pessimism and protectionism has grown the rift between the US and China. If Canada supplied solar panels via the same means would there be any contention? We already audit and block panels from forced labor regions, so what is the issue?

Forget tariffs for a second and ponder why a company in China would create a solar panel. I already implied it, but it is the demand in the US waiting to be filled. This demand is spurred by notions to accelerate the energy transition and real policies like the Inflation Reduction Act which give incentives for it. A company anywhere is looking to take advantage of the free money being handed out, it just happens to be China where a lot of manufacturing takes place. Would Chinese manufacturers make as many solar panels uncertain whether the US wouldn’t buy them? Absolutely not. They are here to fill market demand, just not a free one, but who would blame them. Here lies the root cause of the issue. Tariff or no tariff, the root cause is a well-intended government policy having second and third-order consequences not thoroughly considered.

Without the incentive, the market would decide which energy sources would best achieve the energy transition. Perhaps companies in China would produce fewer solar panels (potentially making it more lucrative for US companies). Perhaps the market would find other more economically efficient solutions for the energy transition and resolve the bottleneck for solar panels through an undistorted pricing mechanism.

Tariffs hurt producers and consumers alike. In the case of Chinese solar panels, they are a consequence of a demand being quenched by expert manufacturing companies in China. The US wants solar panels but has a dilemma because it also wants to increase domestic manufacturing capabilities in a protectionist scheme against China. It remains to be seen whether Biden continues to wave tariffs or allows the tariff to go back into effect. Either way, players in the solar industry will not be happy.

There is no good argument for tariffs for economic prosperity or the energy transition. Until next week,

-Grayson

If you made it this far there’s an easter egg. Read the title one more time, but slower.

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.