What's Up With: Batteries

The future of batteries in the US.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

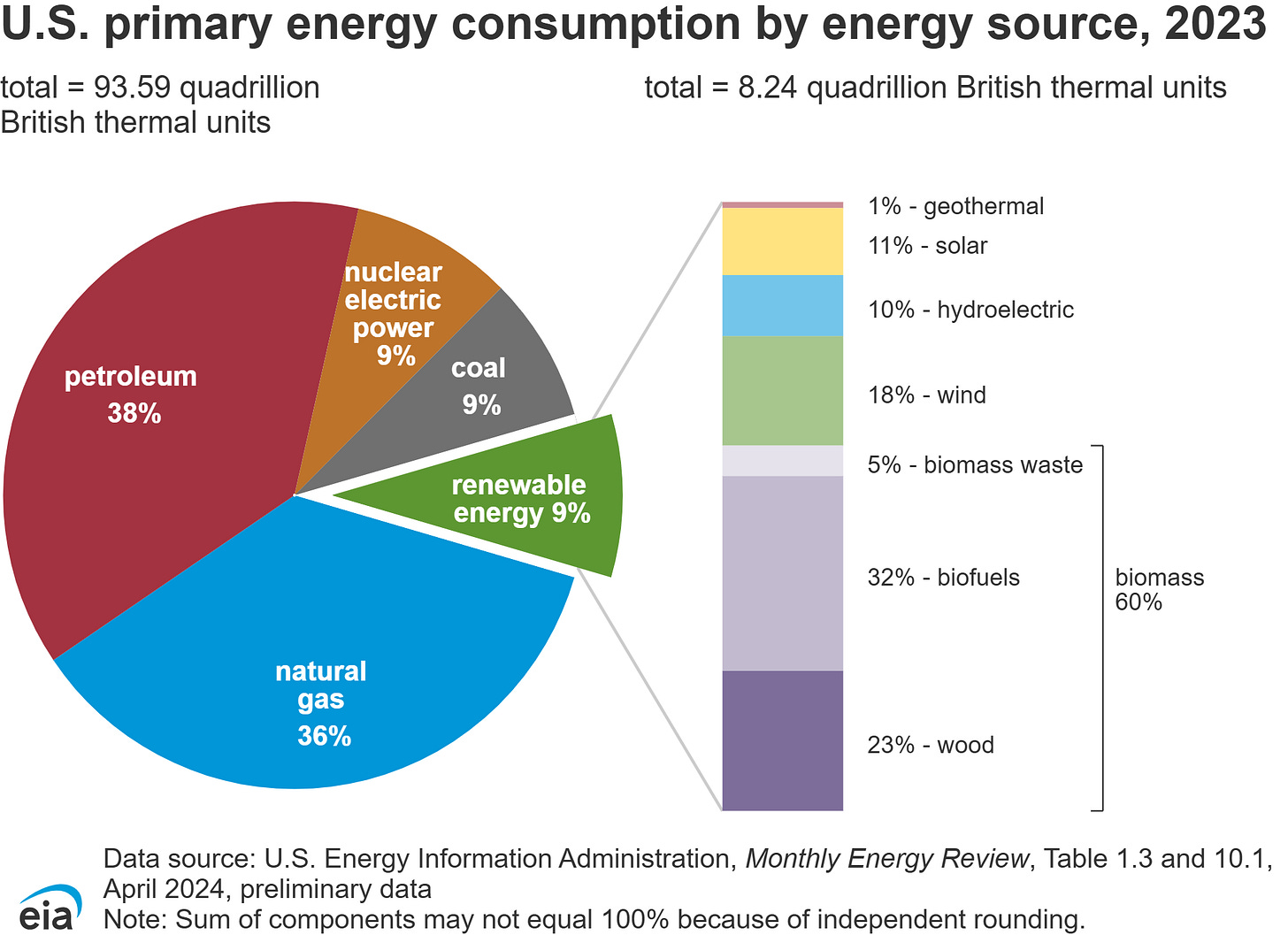

Energy consumption encompasses more than just electricity. While renewables accounted for 21% of electricity in 2023, they only account for 9% of total energy consumption. This also includes transportation, heating, and industrial use. While it would be nice to have a perfectly sustainable grid, the reality is different. In this series, I will highlight the roles of various energy sources and their outlook. For the year 2023, fossil fuels accounted for 82%, nuclear 9%, biomass 5.4%, and renewables 3.6%.

This is a series I’m going to do where I will research and update my outlook on each energy industry: renewables, batteries, nuclear, and fossil fuels. This week is about batteries.

Grid

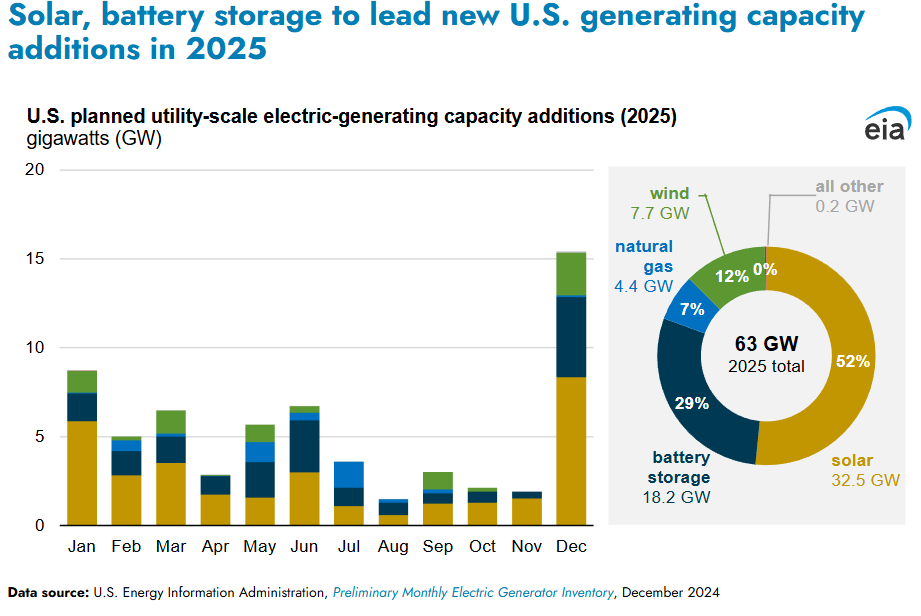

Batteries are a medium of energy storage, not generation. While coal, oil, nuclear, and renewables generate electricity, batteries store it for specific applications, including the grid, cars, and devices. With the increased popularity of intermittent renewable energy generation, batteries arise out of necessity and utility. As energy is overproduced when it is sunny/windy, this energy is stored when prices are low and discharged at night/low wind when prices rise. Some argue that renewables/batteries are the future of the grid, and critics argue the exact opposite.

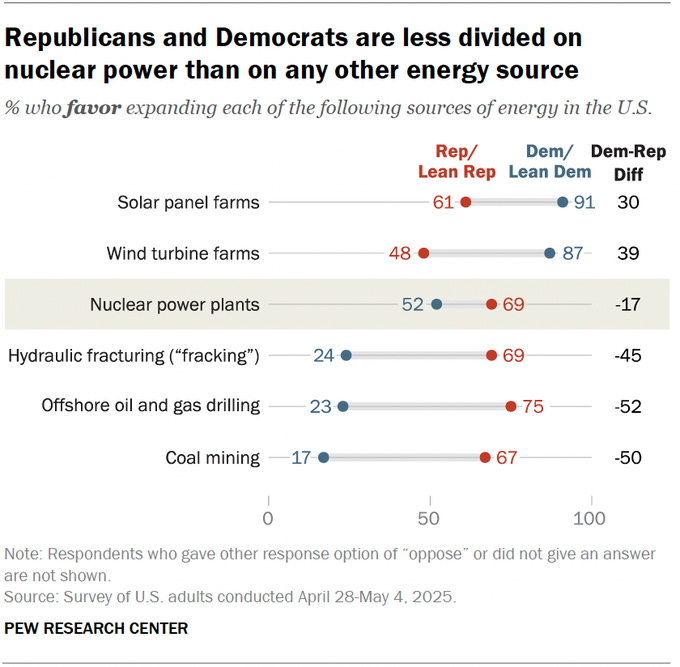

Energy is a politically divided topic, making discourse extra challenging. Nuclear is the least divided, with both sides supporting it. Renewables are also supported bipartisan, but much more by democrats. Fossil fuels are politically opposed. I would assume we can lump batteries in with renewables, as on average, republicans are vaguely in support of or indifferent to the expansion of wind/solar/batteries for the grid.

There are other forms of electrical energy storage, including thermal, compressed air, and flywheel. Batteries are by far the largest, most mature, and commercialized energy storage market. Within batteries, Li-ion batteries (LIBs) are used in the utility side as well as EVs. Many don’t realize that traditional LIBs are near their theoretical limit for energy density and performance. Anyone marketing exponential improvements in batteries is misinformed or lying. Further, even taking higher engine efficiency into account, oil is an order of magnitude more energy-dense as a fuel than the best LIB. Other batteries include sodium-ion, solid-state, flow, or metal air. While addressing certain limitations to LIBs like energy density, safety, duration, or cost, they are still in the development stage.

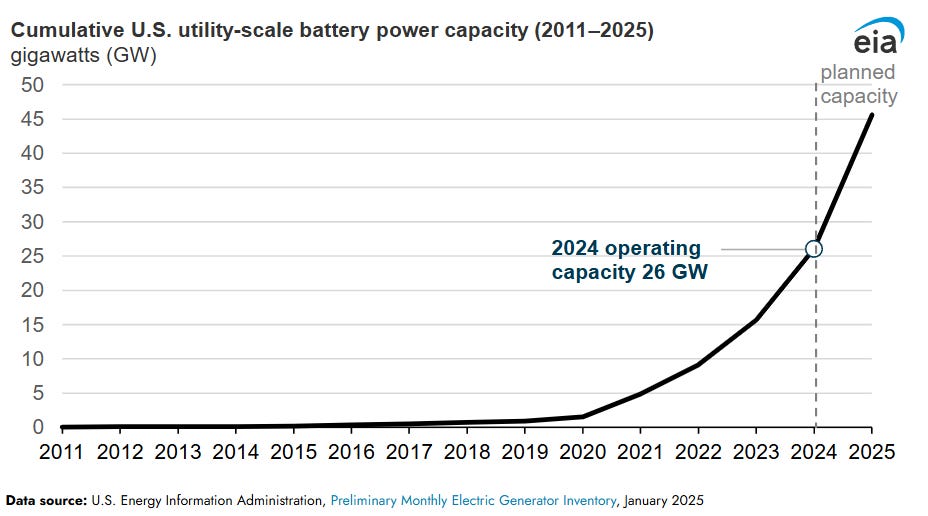

LIBs for utility-scale storage and power are a small but growing market. As of 2024, there was 26GW of installed utility battery storage capacity. This represents 2% of all energy capacity in the United States.

While folks like to include hydroelectric in renewables and pumped hydro storage (PHS) in the electric storage, I don’t think it belongs. While technically renewable, they are highly geographically dependent and not infinitely scalable like wind/solar, so they should not be in the same category, in my opinion. Further, most PHS were built in the 60s/70s, with the last one in 2012, so it is misleading to present it as a developing technology.

California and Texas have by far the most installed battery storage. These are the same states adding wind/solar at the highest rates, meaning that batteries are being built alongside. The battery capacity is smaller than the renewable capacity, meaning the energy is not backed 1:1, so only limited backup generation is available (hours). In some cases, batteries are used for frequency regulation. This is jargon for making sure the grid stays running without disruptions. For more information, you can read my piece, Just Keep Spinning.

EVs

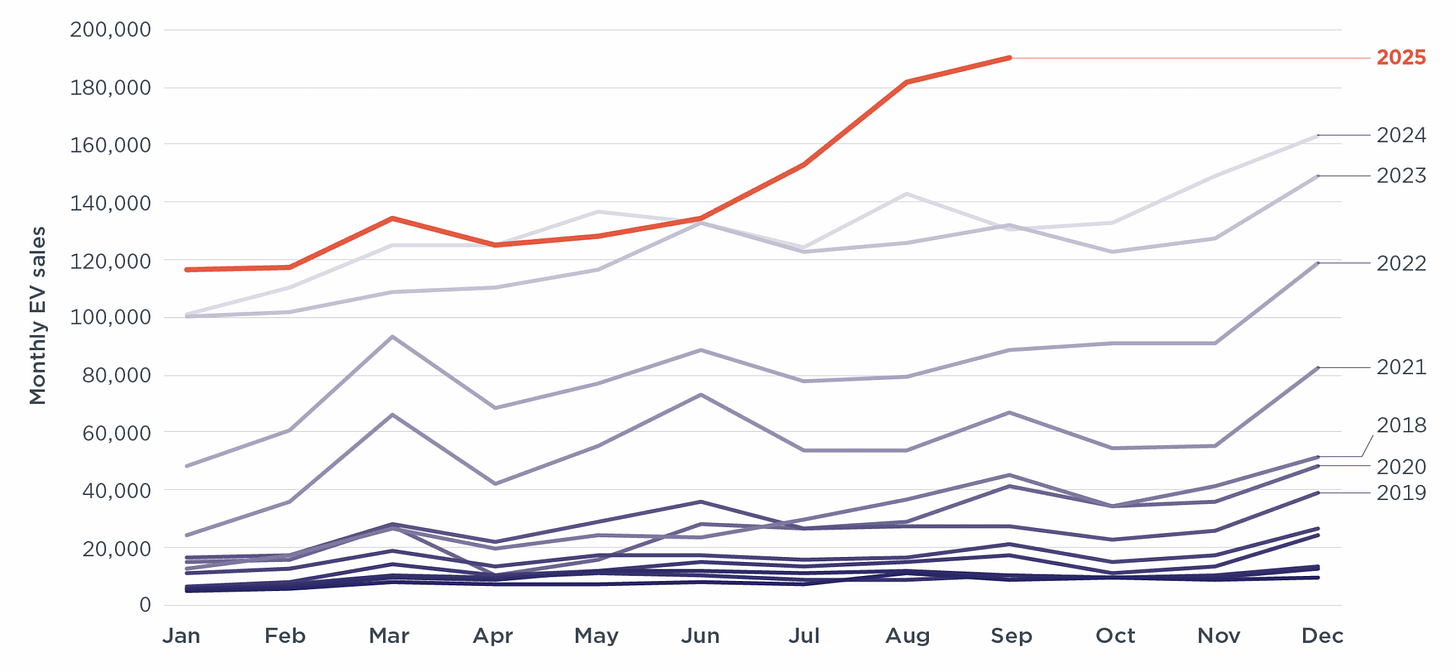

The other major source of batteries is electric vehicles (EVs). Many predicted a meteoric rise in EVs, while others say that no one buys EVs. The reality is somewhere in the middle, as the EV industry has seen steady growth, but not as much as anticipated. This is seen clearly as Ford recently announced it is canceling much of their EV division. Political, economic, and business factors all contribute to this decision. Despite this, more EVs are being sold each year, with 2025 setting records.

Regardless of what you think about Elon, Tesla sells the best EVs in the US. It is evident in the sales figures as well, as Tesla represents 61% of all EV sales in 2023. The primary hurdles for purchasing EVs are cost, performance, and charging. It is true in the US that cost is the top factor, followed by the inferior charging network and speed.

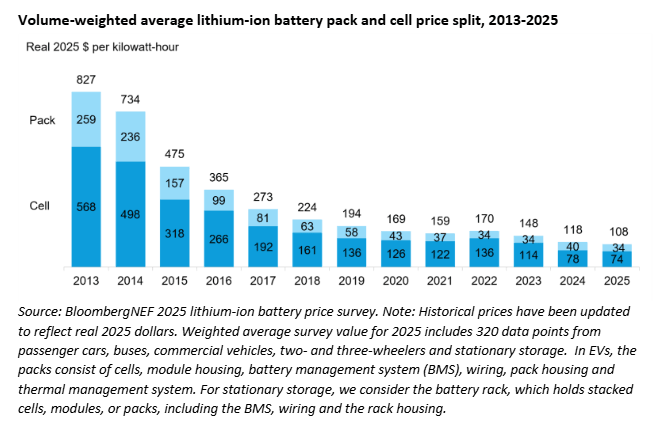

The top cost of an EV is the battery pack, which has been coming down year over year, other than a brief hiccup in 2022. This is driven by raw material costs coming down, an industry shift from NMC to LFP (cheaper), manufacturing improvements, and excess cell manufacturing. In my opinion, it is not covered enough that the economic slowdown and the pre-recession phase we are in are also reasons for prices to come down in things like oil and batteries.

Critical Materials

We can’t have a battery article without talking about the key materials: nickel, cobalt, lithium, and graphite. China dominates every step of the way, from raw material production, active material synthesis, cell manufacturing, pack assembly, and recycling. While the Trump administration doesn’t care much about batteries in the public political sphere, his themes of re-industrialization overlap to some extent. While he has shown great disgust over things like the Inflation Reduction Act, which had many supports for battery production, the government has taken a stake in a lithium mining company. There has been a strategic focus on the critical materials, which include battery materials, through executive actions, discussions around Canada/Greenland, trade/tariff deals with other countries, and mineral deals with other countries.

Battery metals were in a bubble in 2022, which has since collapsed. Mineral scarcity fears and EV exuberance led it on. While the scarcity fears given the 2022 projections were true, the projections were not. EVs and renewables did not grow as fast as projected. Alongside demand, prices came down. In addition, economic weakness does not help prices for goods, especially higher-end products like EVs, which may be out of budget for many households.

Outlook

The battery industry is not dead, and will keep on going alongside renewable buildout and EV sales. Before the AI craze, these were the last bubble themes of 2021/2022. The hype has not been realized, leading to a massive price correction in battery metals prices and slower demand. Steady growth remains in the sector, but no one cares anymore.

The US will never be a manufacturing hub again, but that doesn’t stop each administration from pretending to care about certain sectors. Batteries are tied to the growth of renewables and EVs in the economy. Ironically, Trump has the potential to do more for EVs than his predecessor if he really clears the path for small/tiny car production in the US since cost is the key concern for households. Unfortunately, renewables/EVs are not technologically superior, so as goes those, as go batteries. Next week is off for the holidays. Merry Christmas!

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

As I understand it the car makers have stopped production of smaller cars because of low demand and lower/no profit compared to larger vehicles with a multitude of expensive add-ons. Don't know that regulations ever stopped them, but maybe the micro-cars (questionably street legal) is what Trump is talking about.

Another battery type is hydrogen fuel cells which have consistently underperformed economically but may be practical for shipping (small nukes have been suggested too).