What's Up With: Nuclear

The future of nuclear in the US.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

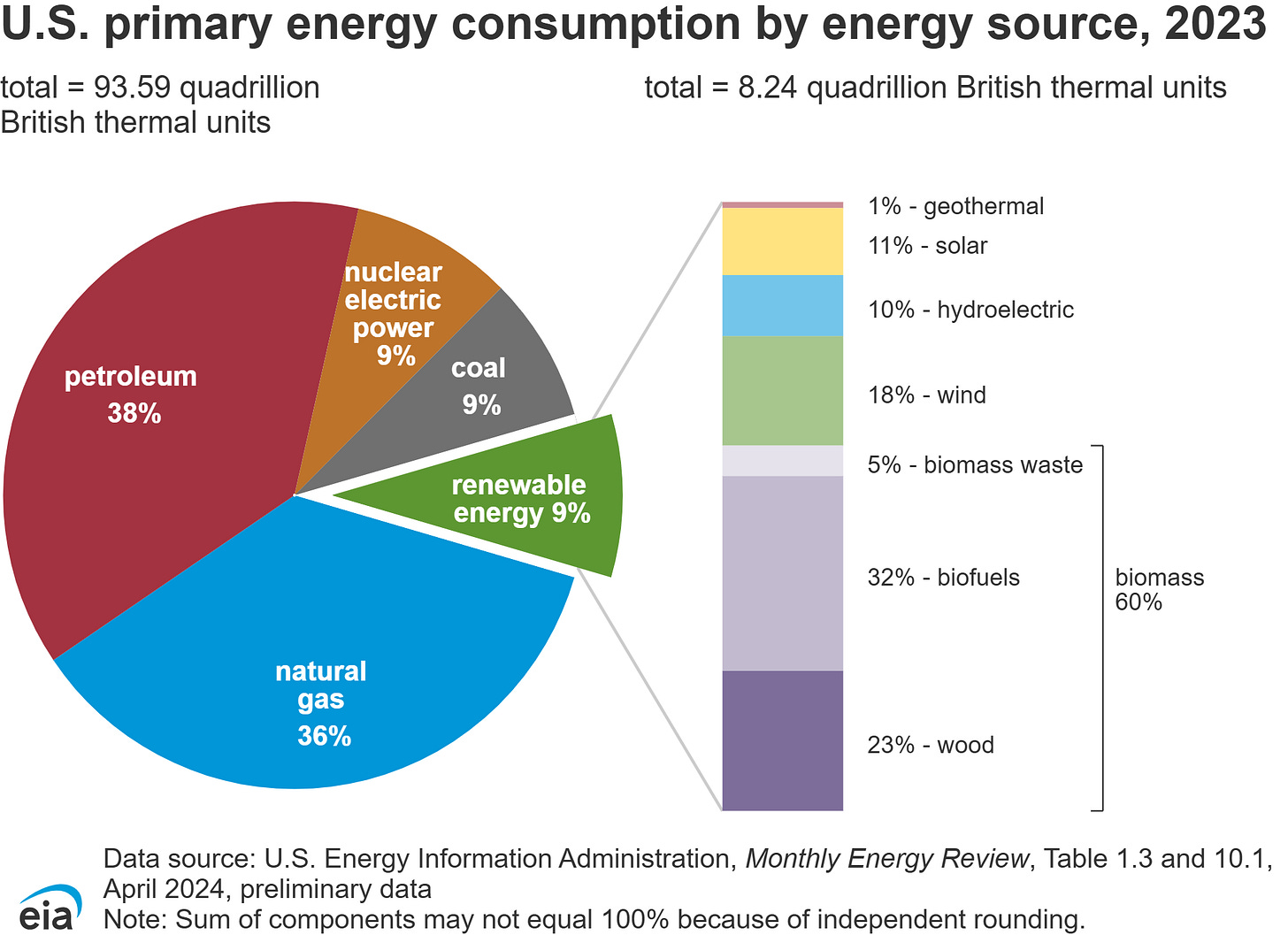

Energy consumption encompasses more than just electricity. While renewables accounted for 21% of electricity in 2023, they only account for 9% of total energy consumption. This also includes transportation, heating, and industrial use. While it would be nice to have a perfectly sustainable grid, the reality is different. In this series, I will highlight the roles of various energy sources and their outlook. For the year 2023, fossil fuels accounted for 82%, nuclear 9%, biomass 5.4%, and renewables 3.6%.

This is a series I will research and update my outlook on each energy industry: renewables, batteries, nuclear, and fossil fuels. This week is about nuclear.

A nuclear power plant is truly unlike anything else on the planet. Left unchecked or mismanaged, it can be the most devastating, as seen in the Chernobyl disaster. The Fukushima and Three Mile Island events also shook the news and perception of the nuclear industry. Furthermore, the association with nuclear weapons may not be directly comparable, but it is also a perception not easily shaken.

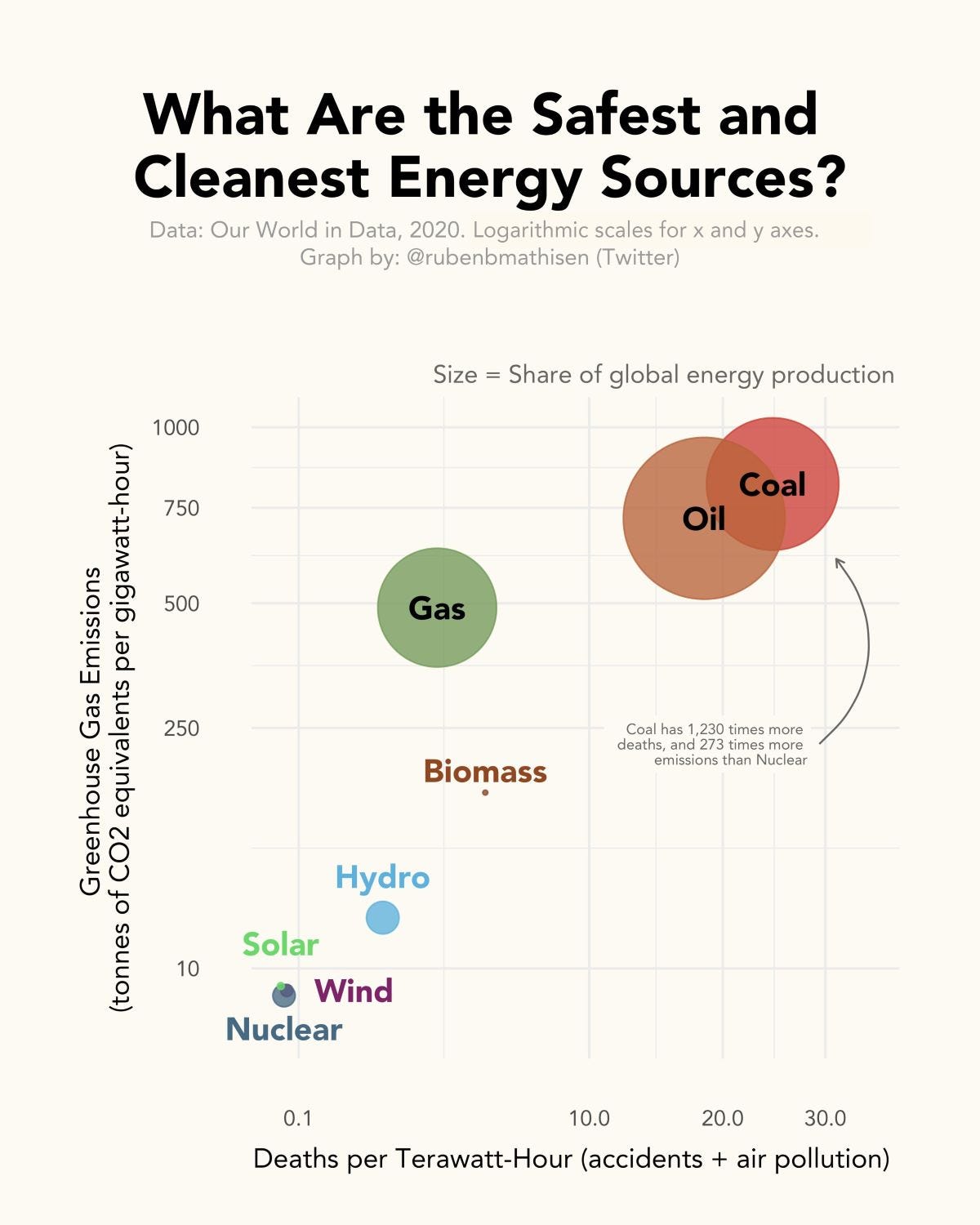

While theoretically dangerous, nuclear energy may also be the most misunderstood energy source. Nuclear safety has improved immensely since Chernobyl, and there is little practical worry about the safety of commercial reactors today. Further, waste is less of a problem than it is made out to be. Processes for safe storage and containment of waste are strongly regulated, and small in quantity. For example, the entirety of US nuclear waste could fit in a football field, only a few meters high. Finally, compared to other energy sources, it is one of the safest alongside renewables.

Now that the dangers are out of the way, let’s talk about the positives. Nuclear is extremely energy dense and has zero greenhouse gas emissions. For example, less than a soda can of uranium fuel represents the electricity use of the average American over their entire life. Compare that to other forms of energy, and it is not even close. In terms of excess energy generated, energy return on energy invested over 10 is desirable, meaning renewables and biomass struggle to make more energy than it takes to produce it, while nuclear fission is the top technology discovered so far.

There are 94 operating nuclear reactors in the US, which is equivalent to about 30% of global capacity. Even with hardly building any in the past few decades, the US is still a leader in nuclear production. Certain regional grid operators favor nuclear more than others. This has to do with geography, electricity needs, and regulations. MISO, PJM, and the Southeast grid operators have the most operating power plants.

All of these are large conventional light water reactors which work by triggering the fission of uranium, which creates heat used to spin a turbine and power an electric generator. On the other hand, advanced nuclear reactors are not commercialized yet, but several companies are working on them. These reactors are smaller and may use alternative fuels and coolants. Some can even allow for industrial heat production like fossil fuel power plants, which is an advantage over renewables.

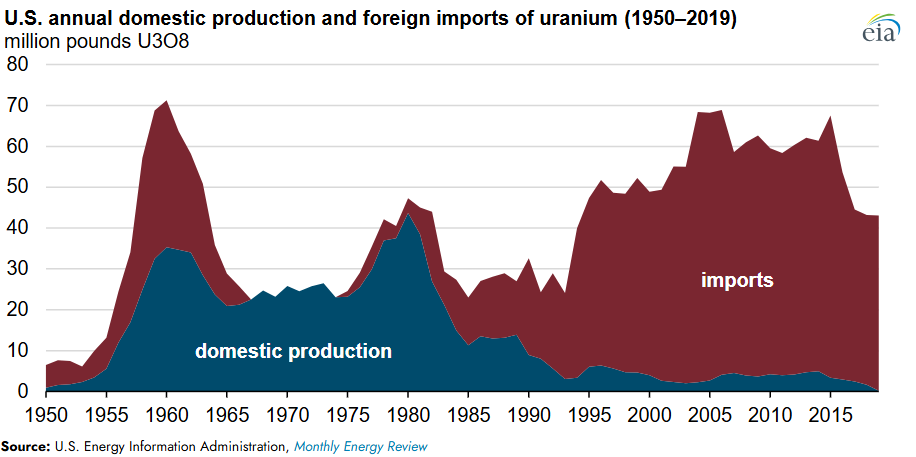

Just like other industries, they rely on the underlying commodities. In this case, uranium is mined out of ore around the world by a surprising set of nations. The countries that mine the most uranium oxide are Kazakhstan, Canada, Namibia, Australia, Uzbekistan, and Russia in that order. Like many things, the US used to be the leader in uranium oxide mining, but has since turned to imports as domestic capabilities cratered in the 1980s.

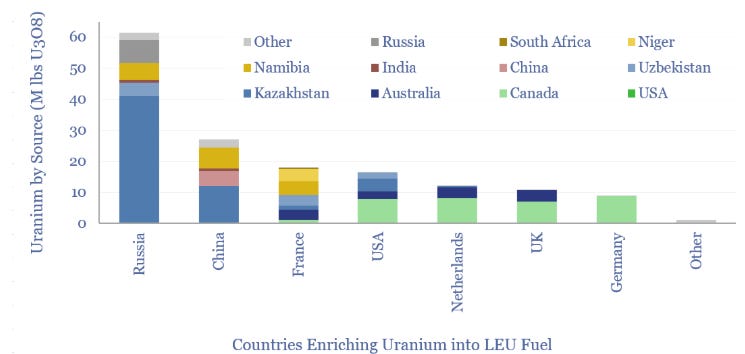

Mining does not paint the entire picture, just as oil production vs. refining can present multiple countries to differentiate strengths. Russia, China, France, and the United States rank at the top of the list for uranium enrichment. The suppliers of that ore differ by region. Russia and China work closely with the largest producer, Kazakhstan, while the US and Europe work closely with Australia and Canada.

The US imports significant enriched fuel (LEU) from Russia, posing potential geopolitical risks. Unlike oil and natural gas, which the US has abundant production and refinement, uranium is not as bountiful. It is less of a geopolitical concern than China with battery, renewable, and rare earth production, though. Uranium is listed as a near-critical mineral according to the Department of Energy.

Many advanced reactor designs require higher concentrations of fissile uranium isotopes. LEU (3-5%) doesn’t cut it, so HALEU (5-20%) must be used. This presents further supply chain constraints, as the only reliable sources are from Russia and the downblending of military stockpiles of HEU (20+%).

There are several hurdles the nuclear industry has to overcome to be revived in the US. First, the Vogtle power plants show just how expensive it can be to build a new nuclear power plant. High capital costs and long build times have deteriorated the investment promise. The competition from natural gas power plants and renewables is compelling, as they can be built cheaply and brought online sooner. Alongside this, the changing grid landscape has brought more variability. While it may sound like a good thing to have some stable power from nuclear/coal to balance, it is actually more complicated to build a mixed grid than to plan one that is one or the other.

Other challenges include sentiment and regulation. Studies are showing an improvement in nuclear sentiment over time. The majority of Americans now support nuclear energy. Finally, regulations are important for safety; however, they can sometimes become burdensome and costly. The Nuclear Regulatory Agency (NRC) has made permitting reactors extremely difficult and has imposed regulations likely above and beyond what is necessary.

On the bright side, there seems to be bipartisan support for nuclear. On the one hand, it is a carbon-free power source. On the other hand, it may improve national security or power any potential re-shoring objectives. DOE and federal funding are active for the restarting of some plants, the production of new fuels, and the advancement of new reactor designs. Further, Trump has signed executive orders attempting to expedite the permitting process for new commercial reactors.

Is government support enough amidst the cons I outlined above? There are other positive movements, such as the demand for data centers. Many companies like Amazon and Microsoft are making deals directly with power providers to power data centers, even restarting Three Mile Island. Finally, if some of these young companies provide advanced reactors with benefits at reasonable costs, it could provide the boost needed for a wavering and vital industry in the US.

Nuclear is foundational to American life, providing 19% of electricity production and 9% of total energy production. To provide a clear future outlook, I think it is important to value trends. Companies are looking to nuclear power for their vital new AI investments, amidst bipartisan political support working to deregulate and add stimulus to the industry. While Vogtle may be the last new conventional reactors in the United States, nuclear demand will likely see a resurgence. Advanced nuclear reactors may be that path, although it won’t be until the early 2030s that we see commercial powerhouses emerge.

Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView