What's Up With: Oil

The future of oil in the US.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

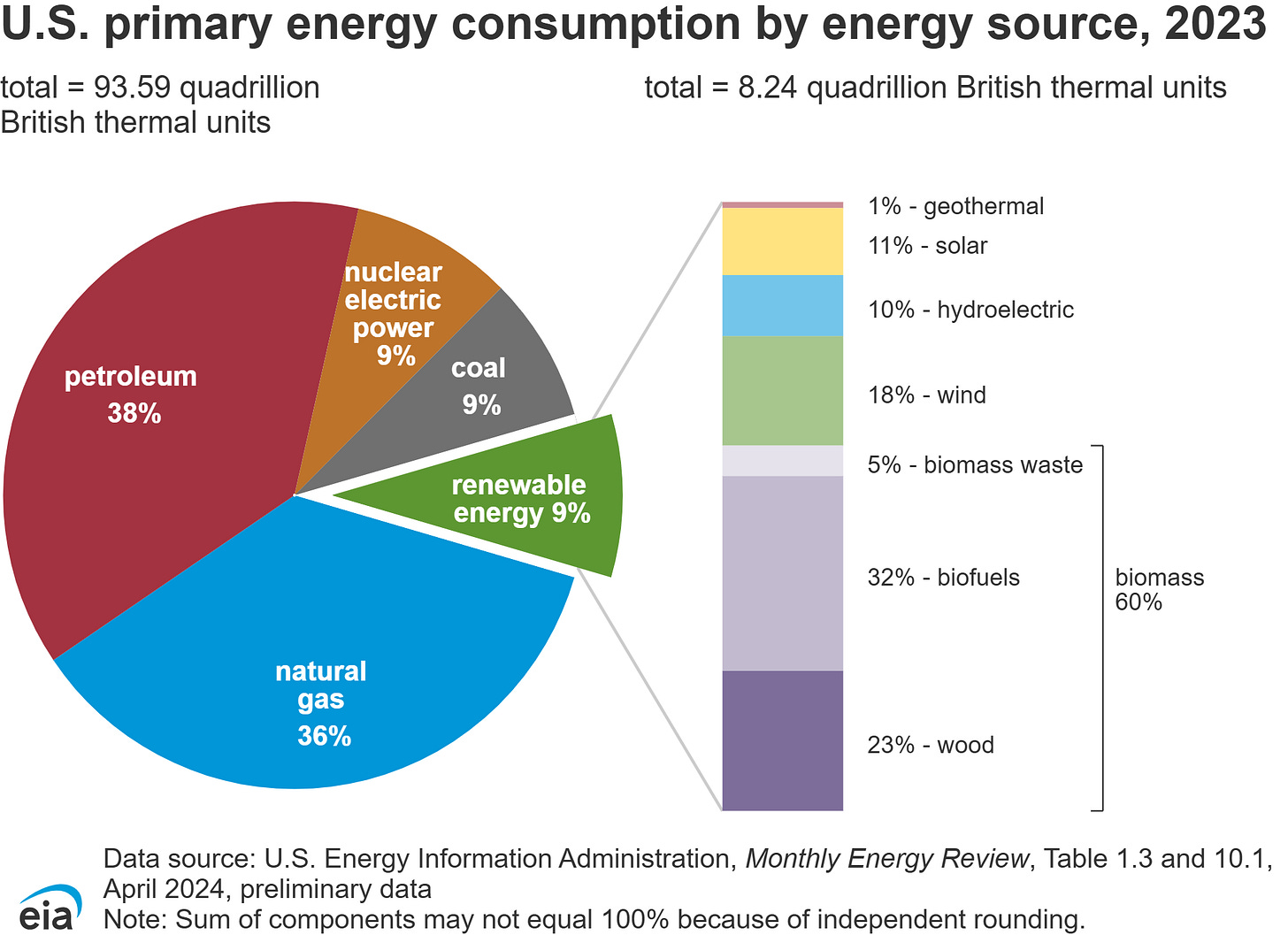

Energy consumption encompasses more than just electricity. While renewables accounted for 21% of electricity in 2023, they only account for 9% of total energy consumption. This also includes transportation, heating, and industrial use. While it would be nice to have a perfectly sustainable grid, the reality is different. In this series, I will highlight the roles of various energy sources and their outlook. For the year 2023, fossil fuels accounted for 82%, nuclear 9%, biomass 5.4%, and renewables 3.6%.

This is a series I’m going to do where I will research and update my outlook on each energy industry: renewables, batteries, nuclear, and fossil fuels. This week is about oil.

Oil

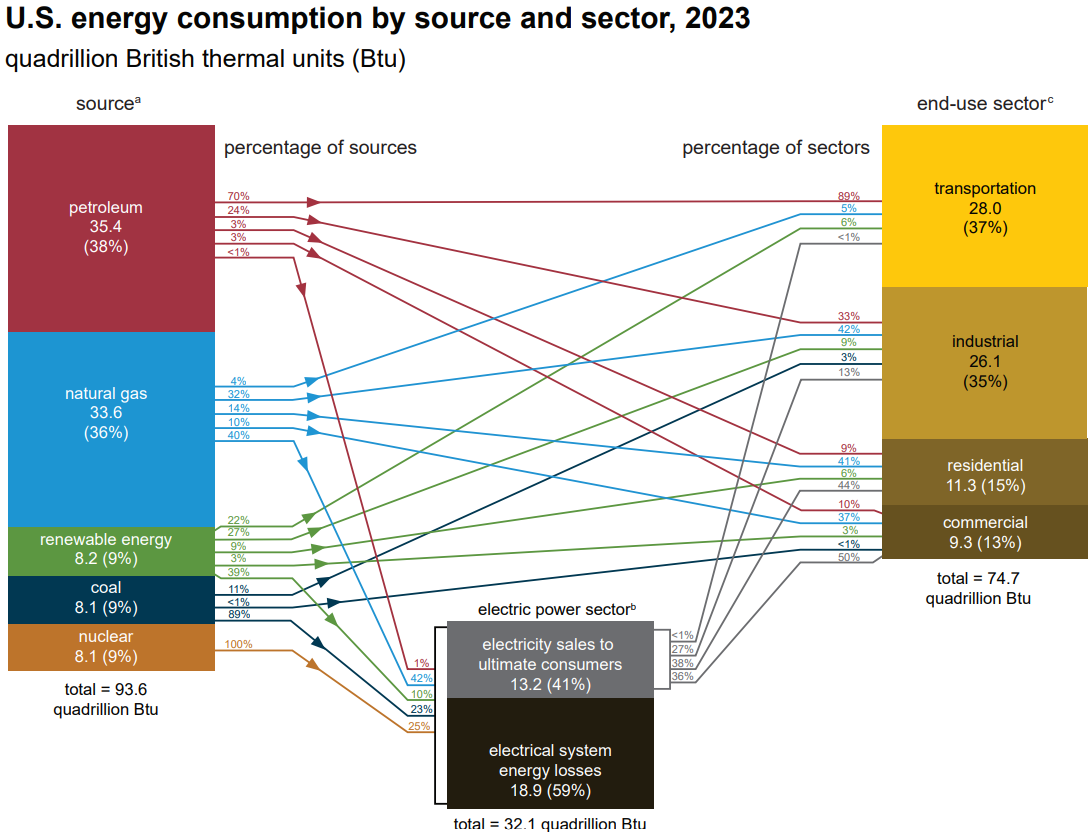

Even though it is the largest source of energy consumption, it can get overlooked because it doesn’t contribute to electricity consumption. The vast majority goes towards the transportation sector, followed by the industrial sector in a distant second. Natural gas and coal don’t contribute to the transportation sector, but they heavily contribute to the industrial, residential, and commercial sectors. This is both directly and through electric power generation, as you can see in the figure below.

Oil’s use case might seem obvious, considering most people fill their cars with gasoline every day. Airplanes, trains, buses, and ships all use oil as well. Vital but less thought-about applications that are dependent on oil include steel, fertilizers, plastics, rubber, petrochemicals, carbon materials, and construction materials. It is easy to want to eliminate fossil fuels, but easy and cost-effective alternatives to these essential sources of energy for modern society are rare or nonexistent. The norm of modern shipping, roads, and consumer products would cease to exist without fossil fuels.

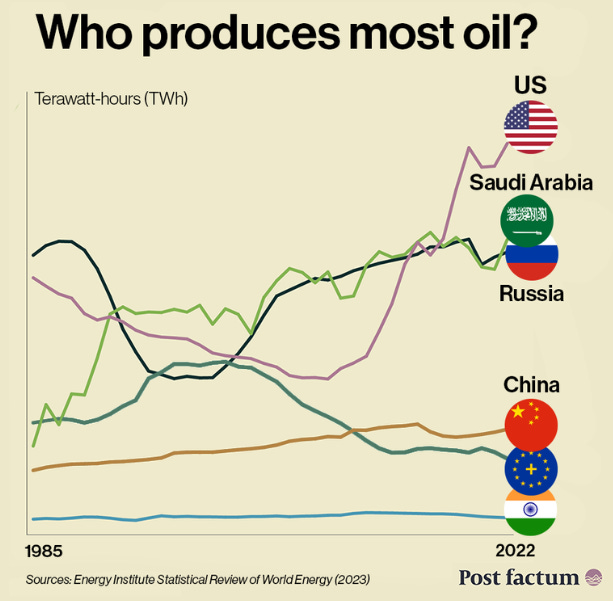

With all the talk of clean energy, some are actually surprised that the US is the top oil producer in the world, followed by Saudi Arabia and Russia. Surprisingly, the US still imports significant quantities of oil. This is because there are different grades of oil: heavy, light, sweet, and sour. US oil tends to be light and sweet, while OPEC oil tends to be heavy and sour. A mix of both is important because heavy grades are converted into petrochemical feeds, asphalt, and industrial fuels better than light grades. Conversely, light crude is easier to convert into gasoline. This is one reason why oil in South America/the Middle East is so important, and cutting ties isn’t as simple as it appears.

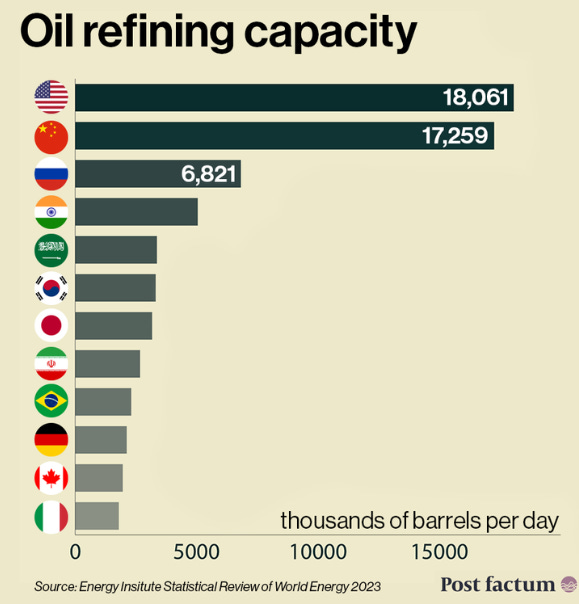

Most people stop at who drills oil, but the next step is refinement. Interestingly, China jumps up to the second spot right behind the US. Russia, India, and Saudi Arabia are the next highest. Refinement is crucial because refinement can be a crucial bottleneck for specific inputs, whether it be coke, distillates, gasoline, petrochemicals, or others.

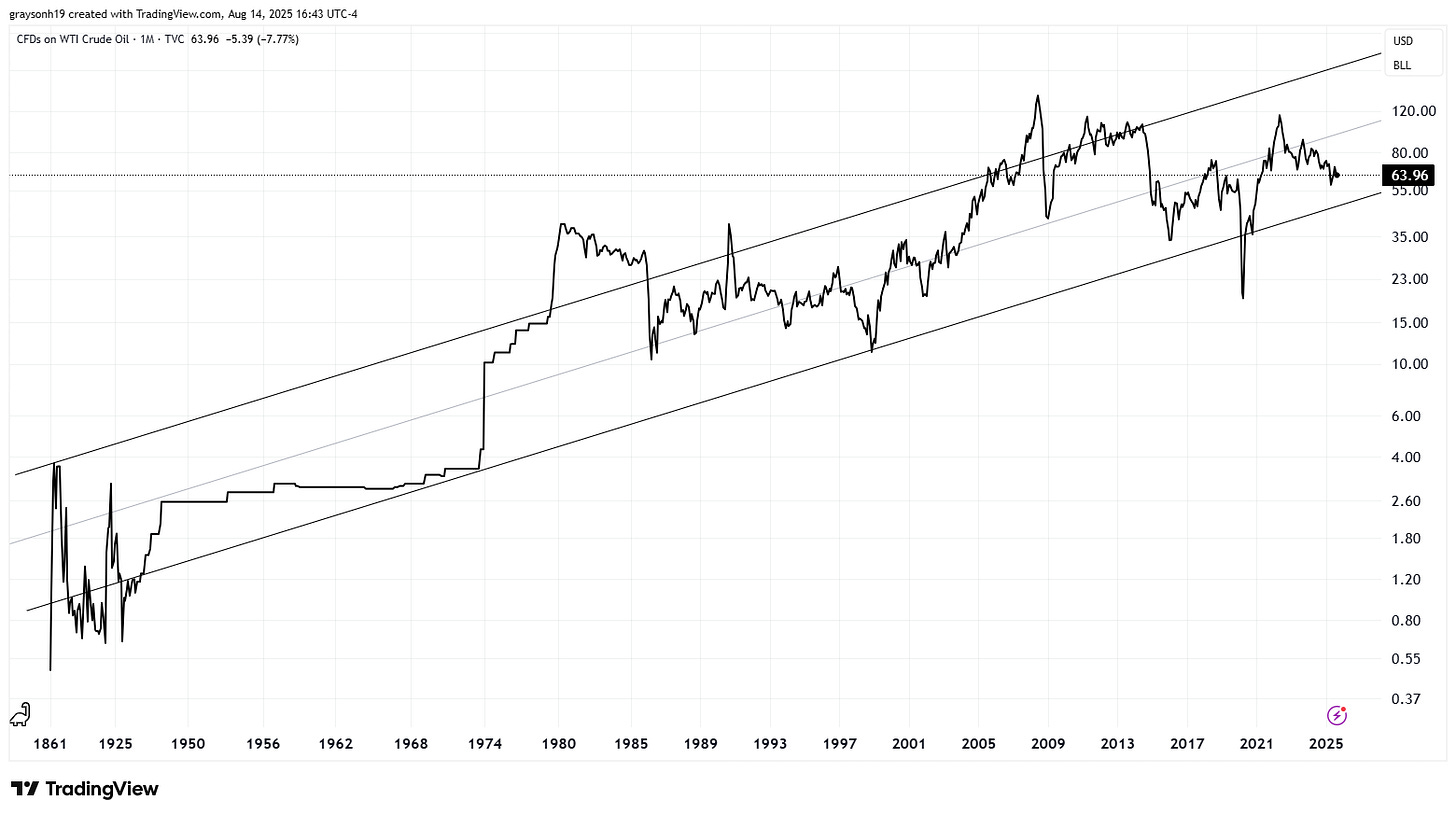

Oil prices are crucial for understanding inflation and general economic demand. Being such a large input into the economy, saying gas prices affect the economy is not hyperbole. Oil prices are currently $63/barrel, which is on the lower end of the upward-trending channel going back to civil war times. As a general rule of thumb, oil can be a proxy for economic demand. Several periods of recession can be coincident with sharp declines in the oil price, with inflationary periods like the 1970s as an exception.

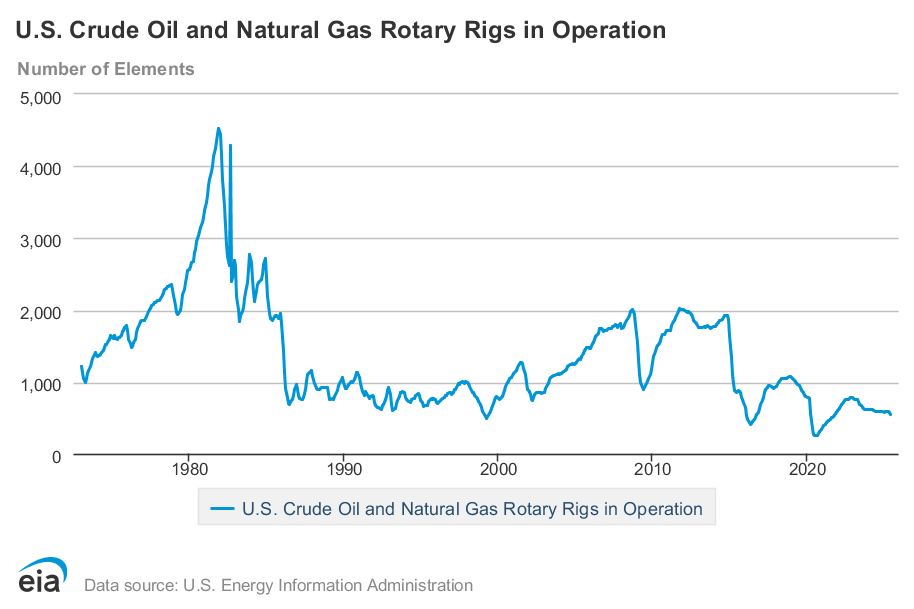

If oil prices have been declining since 2022 and economic data have been slowing, should we expect oil prices to keep coming down? Generally speaking, yes, but fundamental factors are singing a different tune. First, the oil rig count in the US has been declining since 2012. While the US is still increasing production, it is not growing rig numbers commensurately. Rig count tends to follow oil prices, which makes sense.

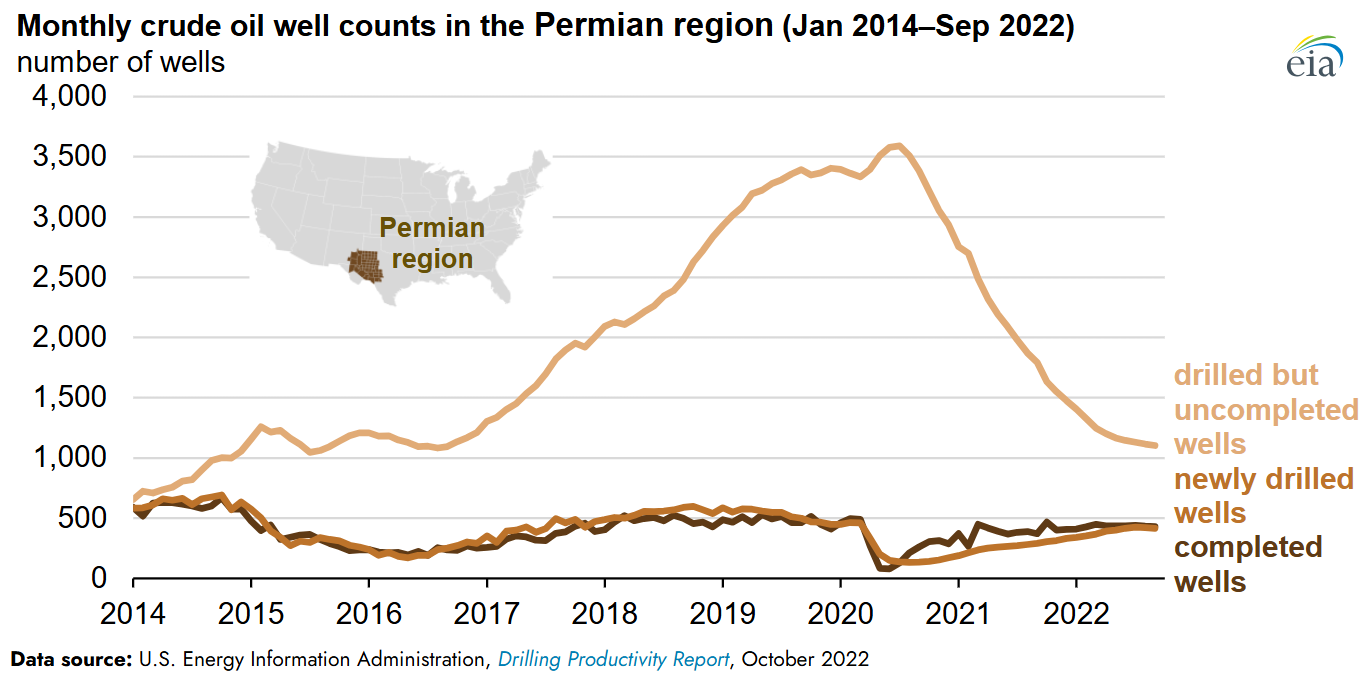

From 2015 to 2020, drilled but uncompleted wells (DUCs) in the largest oil region were increasing. A DUC means that the company drilled the well, but it is not producing oil yet (completion). After 2020, instead of drilling new wells, companies just tapped their existing wells instead of drilling new ones. Now we are at a point where DUC levels are low, as well as the total number of rigs in operation. This leaves US oil production less flexible than it was during the last 5 years if companies want to increase production.

Future oil production growth is constrained unless oil prices rise enough to justify restarting more drilling. This leaves a precarious scenario as companies may have been burned by the 2020 oil price collapse and are hesitant to drill new wells with low prices. Perhaps they are also sensing slowing economic demand and don’t see the incentive to drill many more wells. In this case, they may be making the right call. It leaves the industry in a supply crunch if demand soars back, potentially causing an oil price spike.

Conclusion

Oil really is the lifeblood of the economy. From getting us where we need to go, powering industry, and the plethora of miscellaneous applications keep modern life possible. There is a lot of talk of using less fossil fuels. So far, the transportation sector has not been overhauled by electrification. With all the efforts and growth in electric vehicles so far, less than 1% of the transportation sector has been disrupted.

Petrochemicals, rubber, plastics, fertilizers, and cokes are also hard to replace. Oil is here to stay and will never be fully eliminated. That being said, growth in oil production has come from DUCs, not fresh drilling, showing hesitancy among oil companies. Even though a slowing economic environment should keep bringing oil prices down, the declining rig and DUC count leave the industry less responsive to new drilling opportunities.

Oil has the biggest impact on the economy of any energy source, as it is the largest and most integral to everything operating. Fossil fuels, including the others (natural gas and coal), are a heated political topic, with one side believing it is morally imperative to eliminate them, while the other does not care at all. Regardless, they are here to stay for a long time, as the growth rates of renewables have not been fast enough to eliminate them any time soon. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView