🔋White Gold

While the list of comparisons between gold and lithium are short, mining of the scarce metal is garnishing much attention globally in an effort to achieve climate goals.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

With the extraordinary push for electric vehicles and renewables, there inherently lies higher resource requirements across the board. Instead of a focus on things like oil, coal, or uranium, a variety of nuanced metals in addition to some industrial staples are required. This includes copper, aluminum, steel, nickel, manganese, graphite, cobalt, and more. A lot excitement has followed one metal in particular though, and that’s lithium.

The reasons behind the excitement and its nickname “white gold” are clear, the supply of new lithium will have a hard time matching expected demand in the coming years. I discuss this and more in a previous piece called The New Gold. This scarcity relative to demand is the foundation of this comparison, however the comparisons end there. First of all, gold is a precious metal where its main purpose is a store of value with only a few industrial or consumer applications. This is due to its durability and is reason it has been used as money for thousands of years. Pure lithium on the other hand is unstable in ambient conditions. Lithium is an industrial metal where almost all of the mined material is immediately used for something. To really put it in perspective is the total scarcity. Global lithium reserves total 89 million metric tons while global gold reserves in ground total a meager 57,000 metric tons by comparison (another ~30,000 above ground).

Of these reserves, they occur in salt flats, brine, or hard rock deposits depending on location. South America has by far the most proven lithium reserves, followed by Australia, the US, and Canada. Proven reserves mean that it has been explored, is likely owned by a company, and has a quantified recoverable amount. For example, Bolivia has an estimated 39 million tonnes of lithium (S&P Global estimate), but has not yet overcome political challenges to open up mining.

Of the proven reserves, not all countries are mining at the same rates, so actual production varies significantly. You’ll notice that active mining volume is dominated heavily by Australia, Chile, and China.

China then also dominates lithium processing for lithium ion batteries, where the country holds 60% of the share of lithium processing in the world. Where is the US and Canada on this list and aren’t we supposed to friend-shore materials as part of the Inflation Reduction Act? These are valid observations and questions after seeing this data. While the US maintains a free trade agreement with Australia and Chile, the bill still requires 40% of critical materials sourced from countries with a free trade agreement, increasing by 10% each year. Simplistically, either the mining or processing will have to be done in a FTA country. For the detailed guidance from the US treasury about the guidelines, see here. With the initial concern that no one would qualify under the inflation reduction act rules, it seems like at least the lithium component would be okay if it comes from Australia/Chile even if it’s processed in China.

As far as Canada is concerned, their first lithium mine opened last month, with many more explored and or advanced.

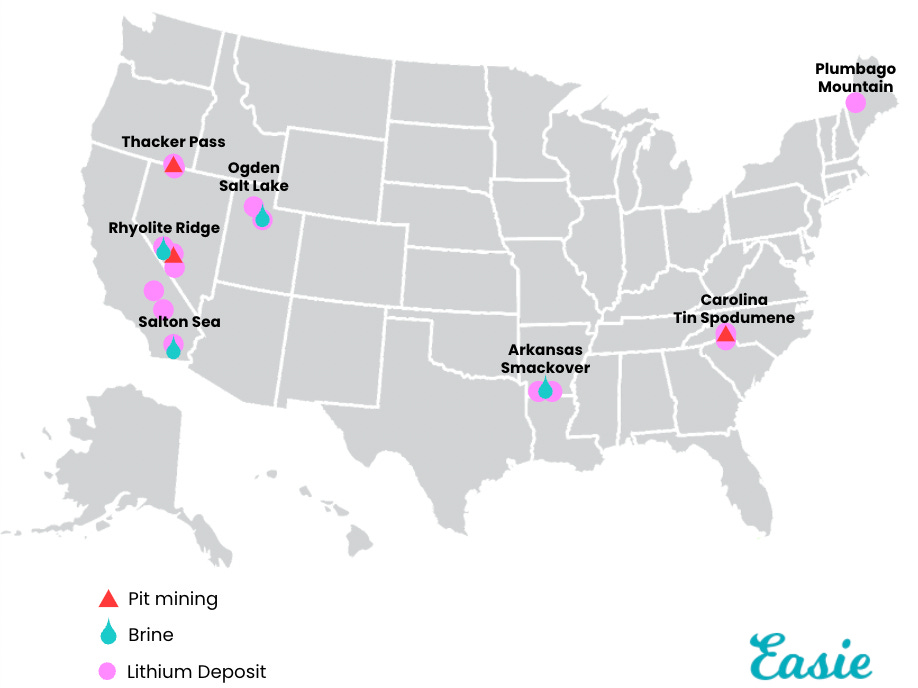

In the US, similarly there is only one active lithium mine, which is in Nevada owned by Albermarle. Others are in similar exploration or advanced stages, with some projected to start in the coming years (Thacker pass, North Carolina).

Overall, North America is still just drops in the bucket in terms of lithium mining. While Canada is a leading producer of many important commodities, it has only just begun to tap its lithium reserves. The US on the other hand is battling with the regulation and environmental pushback in getting new sites operational [1,2,3]. Since the new guidance by the US treasury on Inflation Reduction Act requirements, my fears about the ability of the bill to reach anyone have been eased, at least on the lithium front for the time being (I have not looked into sourcing of the other battery materials yet). At the end of the day, the bill was signed and the government does want this money to be spent. While Canada has historically been much friendlier to mining, the US has counteracting pressures that have it seemingly at a roadblock. It has been throwing money around to large companies and startups trying to get it going but progress is slow. It will be interesting to see how fast companies in both jurisdictions can ramp up production in effort to reach these goals. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts here.

Also, since Substack and Twitter are at odds these days, check out Substack Notes

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.