🔋All In - Pt. 1

Investors are all in on the stock market, which could leave them ill-prepared for what’s next.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

The average shopper looks for the cheapest good that fits their requirements and will hunt for deals, use coupons, etc. The average investor does the exact opposite. They tend to become greedy when stocks perform well and are more likely to buy. Conversely, when the stock market is struggling they tend to become fearful and sell their holdings to protect against further losses. Everyone knows this is a good way to lose money, but most people still cannot do it.

The buy-and-hold investing strategy was marketed to help investors avoid these common pitfalls. With average returns of 6-10% per year in the S&P 500 and stocks up 33 of the last 44 years, they make a good case. This strategy has been especially successful since 2009 with only two large drawdowns of 35% and 27% in 2020 and 2022. The highs were also reclaimed within a year after Feb 2020 and about 2 years after Dec 2022. In contrast, it took 5.5 years for the S&P 500 to reclaim its high after the 2007 top after dropping 56%.

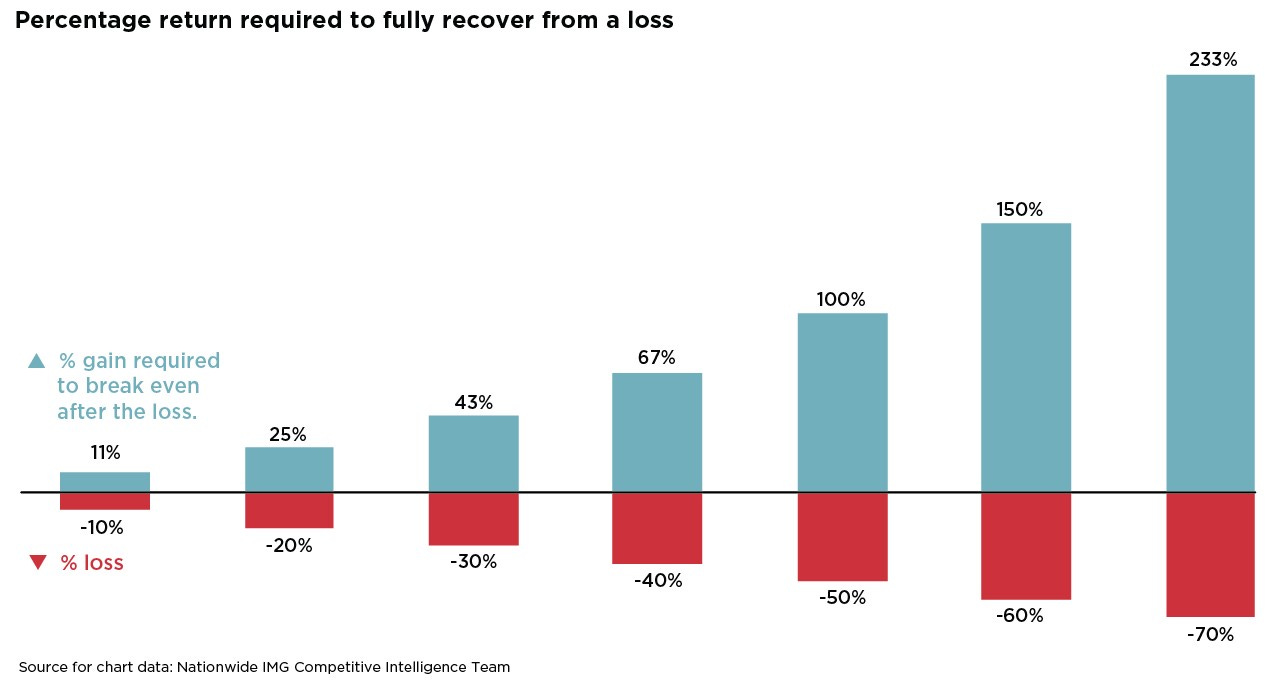

For those near retirement or who wish to elevate their returns, a large drawdown like this is not acceptable. It could be the difference between being able to retire or not for some people. These are the types of risks I bring attention to, especially knowing how overvalued the market is on various metrics. Many financial media and experts are so far removed from a true bear market like 2008 that recency bias has misled them into a more passive approach to investing. The danger is that it is much more difficult to recover from a loss the bigger it is.

Unfortunately, just like most people aren’t aware of the overvaluation risks, the incentives do not line themselves up to benefit the average retail investor either. In reality, the endless financial products and advisors out there are not meant to help you, but merely sell you a product and collect fees on your money. Many advisors put money into passive funds or their own marketed funds themselves and do not provide much of a service that could not have been done yourself. At the end of this, less than 10% of money managers even beat the market.

Not only does your advisor collect a fee, but the index fund or ETF also charges a fee on your invested capital. In this way, each investment ETF or product is marketed just to make a fee. Regardless of whether the market goes up or down, they collect your money. The incentive for them is to get as much of your money invested into these products as possible, as it is easier to make money this way than to do the research, pick good companies, and worry about market risks and returns. The market just can’t do poorly enough for you to take your money elsewhere.

Asset price manipulation aside, these advisors and funds have had it easy over the last 16 years. It will take another true bear market to shake people out of this delusion that stocks always go up. A measure of the market’s extreme greed and optimism is the speculative/conservative stocks. Taking the NASDAQ which is the forward-looking tech stocks compared to the boring DOW Jones Utility average shows that we are at high levels of optimism.

Retail investors have record amounts of money held in the stock market. Not only does this mindset leave Wall Street and the average investor ill-prepared for market drawdowns, it could potentially de-rail retirement plans for millions of people if we do have another large correction associated with a recession. With the market at extreme overvaluation and investors at extreme levels of stock market exposure, there could be a messy end at some point which I want to caution my readers. You can see that high household equity ownership as a percentage of financial assets usually indicates the top in the market, and can precede some pretty nasty drawdowns.

Unfortunately, that is only half of the story. The psychology behind this behavior is only a surface-level consequence that manifests after the root causes under the surface. Next week I will delve into the passive index machine and how it mathematically boosts the stock market to higher levels artificially and isolates wealth in fewer and fewer companies creating the illusion of market strength.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

Since the 2008 bust the Fed and politicians have been doing everything they can to keep the stock market going up and the result is an astounding federal deficit. I can only think that this will compound a financial reset, we can only print so much money (can't remember the name of the GDP/deficit chart but 130 percent is the point at which governments get into trouble and we're at 122 percent ).