🔋Q-Infinit-E and Beyond

Instead of juicing consumer prices, the Federal Reserve has been juicing asset markets since the big bank bailouts in the Great Recession.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

“Nothing is so permanent as a temporary government program.” - Milton Friedman, “Tyranny of the Status Quo, 1984

Historically speaking, it’s only a matter of time before we enter a recession as I touched on in The R Word. The stock market decreased between 14-89% during recessions depending on the severity. After the 2008 financial crisis and the great recession that ensued, the government stepped in to bail out banks, corporations, and some individuals. Specifically, the Federal Reserve (Fed) started its quantitative easing (QE) program which involves the Fed purchasing bonds like US treasuries or mortgage-backed securities on the open market to push more reserves into the hands of banks or non-bank institutions. The aim is to keep stability in the financial system and prevent major existentially important companies from going bankrupt since at the time, many institutions were over-leveraged in the housing market.

Although this was heralded as a temporary solution with the Fed eventually rolling off all of the assets off its balance sheet that it had bought, hindsight informs us of the opposite. There have been three and soon-to-be more instances of QE following the temporary program and at its peak in 2022 the Fed balance sheet was 4x its size ($8.9 trillion) from the QE1 era.

While QE contributes to inflation, it’s not the main driver for the consumer price inflation we have seen. While this injection of money doesn’t go into the consumer's pocket for them to spend, it can be kind of abstract what happens to the money. In some instances, the higher bank reserves can keep firms solvent so they are more comfortable lending money out, but structurally, this doesn’t change anything. In reality, the money goes into and contributes to the inflation of assets by encouraging more lending and distorting interest rates.

The new money has flowed into assets like stocks and real estate most notably. There is evidence of this too, first seen last week in the home prices relative to incomes. By purchasing mortgage-backed securities and other longer-dated bonds, QE works to distort the free market’s signals as to whether current mortgage rates and lending environment are attractive. The consequence has been the ability of banks, government offices, investment offices, and homebuilders to offer very low interest-rate mortgages. In turn, more people and companies bought real estate than otherwise would have, leading to another bubble in real estate less than 20 years after the first. Home prices are more expensive relative to incomes than they were at the peak of the 2008 housing bubble.

More importantly, it pushes large investors out of expensive bonds not providing any yield into other riskier assets in search of yield. If bonds are yielding next to nothing because the Fed has bought down the interest rate artificially, then firms must buy something to secure returns and not lose money to inflation.

The second asset class which received the QE inflation was the stock market. Luckily for us, there are a few ways to predict how expensive the stock market is. The cyclically adjusted price-to-earnings ratio (CAPE) ratio is a valuation measure that uses real earnings per share (EPS) over a 10-year period. The values have a strong historic correlation with future returns over a 10-20 year period. Current market valuations are also in bubble land, alongside the pre-Great Depression 1929 bubble and the dot-com bubble of 2000.

Based on CAPE valuations today, you should only expect an annual return of 2-4% over the next 10 years. Yes, you read that right. Most financial media these days suggest that the market goes up by 8-10% every year and to not worry about the price of stocks. Looking out 10 years, history suggests this couldn’t be more wrong. Critics have supposed that we are in a new regime of stocks and new accounting methods have resulted in higher CAPE ratios than in years past. Even so, other metrics paint a similar picture.

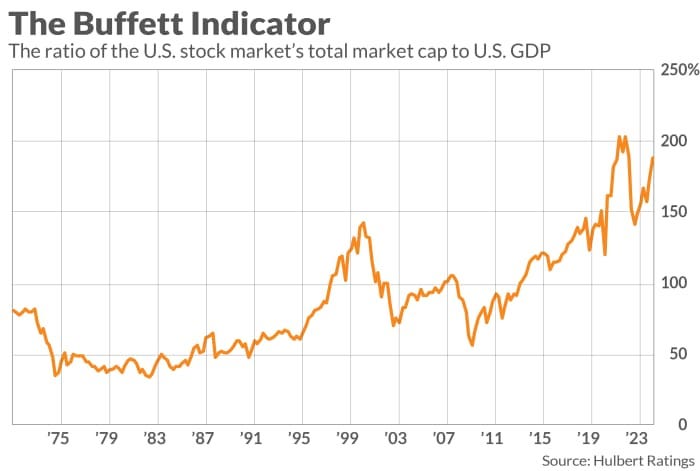

The Buffet Indicator (or the stock market value vs that of US GDP) shows that the size of the stock market has been growing much larger than the total US economic output. This relationship was coined after and used by Warren Buffet, one of the greatest investors of our lifetime. This indicator clearly shows the value of the stock market accelerated higher relative to the underlying economic output when QE began in earnest in 2009. This again shows evidence that QE has affected the value of stocks. The criticism of the Buffet Indicator is that it doesn’t account for an increasing foreign share of goods and services which US companies can take advantage of, implying that there is less reliance on solely US GDP.

Regardless, both of these indicators together can hedge the others’ weaknesses and paint a picture of a historically overvalued stock market just like in housing. Some are skeptical of the role of QE in propping up the stock market. However, even with all of these roundabout or underlying incentives, the Fed began buying corporate bonds directly. While illegal in principle (just like the Fed itself), they have managed to find a loophole in which to undergo this financial engineering. The Fed purchased billions in large-cap stocks and ETFs in 2020, which provided extra funding to those lucky companies.

The Fed moves billions of dollars every month, especially when they are undergoing quantitative easing. These money flows have important implications, even if it doesn’t directly contribute to consumer price inflation. The inflation of asset markets like stocks and housing help those who already have assets. Unfortunately, those without assets are not able to benefit from the outsized returns leading to greater wealth disparity. Further, meager 10-year returns are predicted by CAPE ratios meaning those wanting to participate in the scheme will likely be disappointed with returns from such rich valuations. At the end of the day, stocks and real estate remain in bubbles exacerbated by Fed policies. With the government becoming a larger and larger chunk of the economy, it is more important than ever to know where the money is going and how it might affect these markets in the future. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.