🔋No Place Like Home

The housing market is not as resilient as it seems, with some indicators last seen before the 2008 financial crisis.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

“The Federal Reserve is not currently forecasting a recession”. - Ben Bernanke [January 2008]

“There's no evidence or no reason to think that the U.S. economy is in some kind of short-term risk of falling into recession”. - Jerome Powell [May 2024]

In 2007 Federal Reserve chair Ben Bernanke went on record in Congress and advocated that the sub-prime mortgage crisis that was beginning to plague the housing market was contained. Later he suggested the economy would not be heading into a recession. In hindsight, we know that subprime was far from contained resulting in the popping of the largest housing bubble the US had seen, and the economy went into the worst recession since the Great Depression of the 1930s. Bernanke not only avoided criticism for lying to the entire world and being horrifically wrong about the economy but he was celebrated for his efforts and even given a Nobel Prize.

Lesson number one in The Gray Area Economics 101 is that the Federal Reserve is incompetent, lying, or some mix of both. While this may sound pessimistic, their track record for doing what they say and forecasting the future is worse than Punxsutawney Phil. The sooner you realize this, the better you will understand what is really going on.

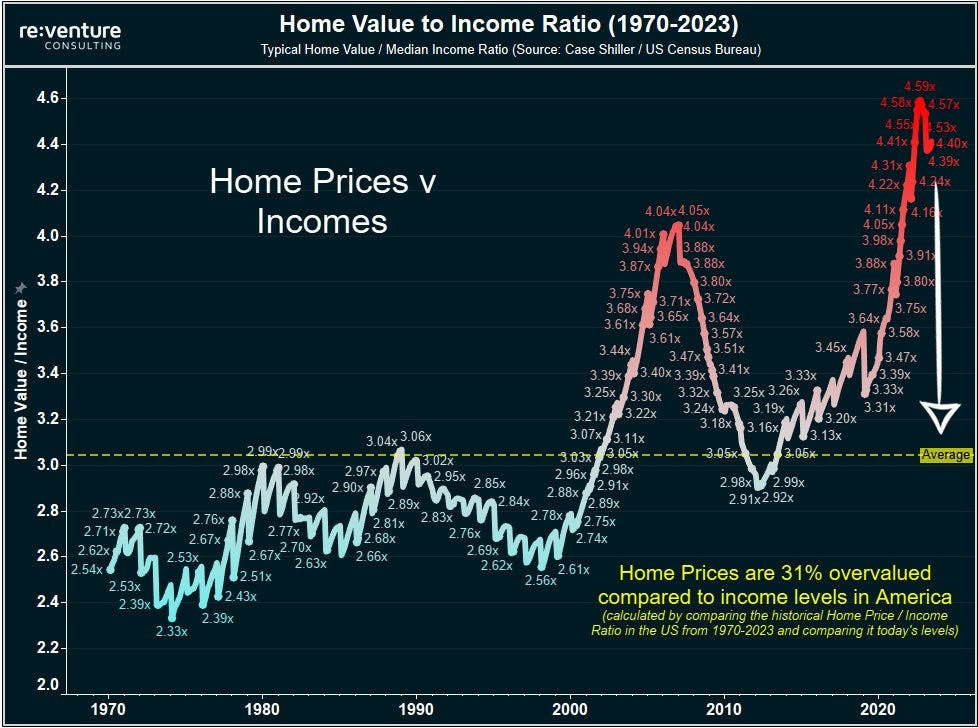

The housing market is tricky today and remains an important sector of the economy, especially for everyday people who want to support a family. It’s easy to say housing is expensive, but what does that really mean? The best way to show this is to divide prices by the median incomes. In this way, we are comparing how much the homes cost compared to how much money people make over time. Price to income suggests that homes are among the most expensive they have been in history, well above the pre-housing bubble levels in 2008. Reventure suggests home prices are 31% overvalued relative to incomes.

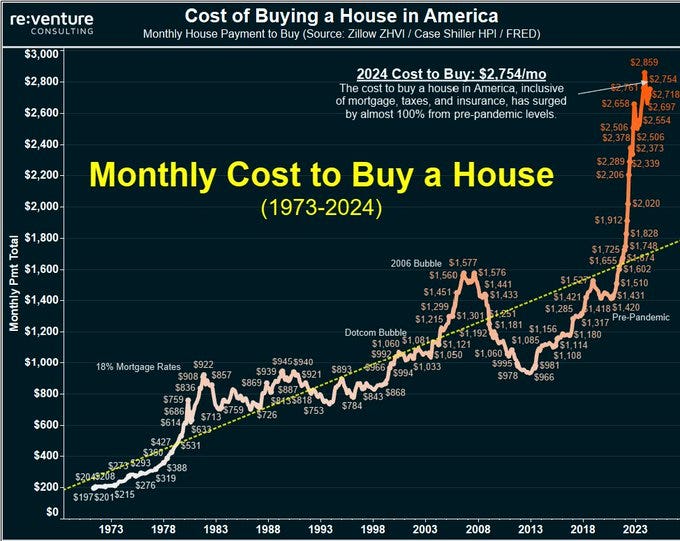

Add on higher interest rates, inflation in insurance, ownership costs, and taxes and the cost to buy a home is the highest it has ever been in history. The monthly cost to buy a house is $2,754 which makes the 2008 housing bubble $1,577 look like child’s play.

It is safe to say housing is indeed expensive, not dissimilar to the stock market. The housing market is a bit more nuanced than the stock market because housing is much less liquid than stocks, there are separate markets for different participants (i.e. single family, multi, commercial), and regional differences. While commercial real estate is an important sector of the economy and shows some problems, I am focusing on single-family homes. To get the whole picture of what is going on in housing and what may lay ahead, I will take into account both supply and demand.

Demand

There are buyers and sellers of a house. This is obvious but each player is critical and there needs to be a committed agreement by both parties for any transaction to go through (just ask anyone who has almost sold a property about that).

If there were adequate demand for housing, it would be reflected in home sales. We are seeing a sharp decline in home sales in existing and new homes. This means buyers are not showing up to pay for houses in the current environment. It is worth noting there are 6 times more sales for existing homes than new ones. This means that while new inventory on the market can help, existing homes are where most people are transacting and make up the majority of sales volume.

While sales are a good indicator of demand, we can take another step back and look at mortgage applications. People are giving up trying to buy homes right now because house prices as well as high mortgage rates are high.

Supply

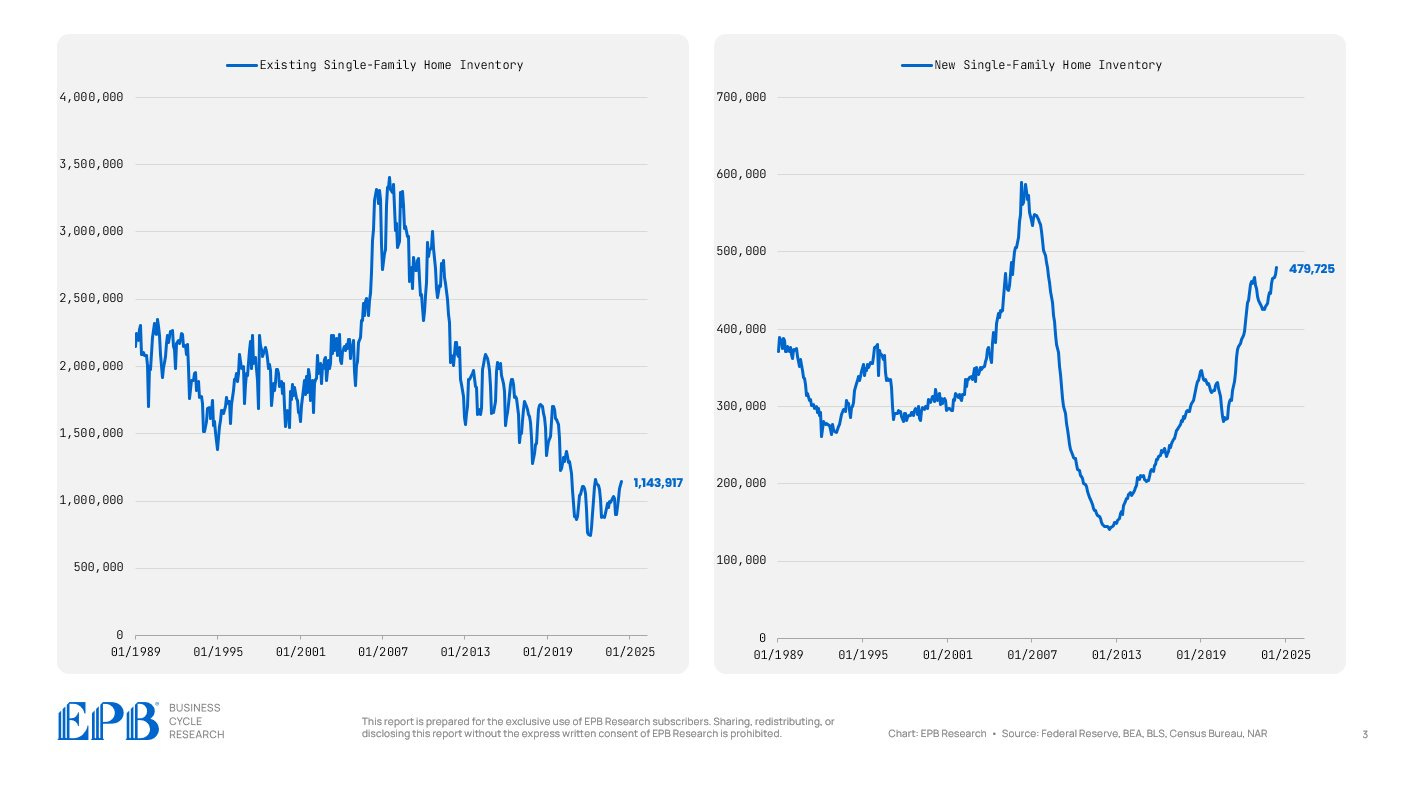

The big hoopla in the housing market has been about inventory. With interest rates high, those who have locked in low-interest mortgages before 2022 have little incentive to move and pay much more for less in another house. This causes fewer sellers and thus less existing home inventory. Homebuilders on the other hand are at above-average inventory. New housing is very regionally dependent, with the south accounting for a whopping 65% of all builder homes and the northeast having the least. New builder inventory continues to creep up, likely in response to or in conjunction with the lower demand.

Existing inventory is still low and while there is little on the surface that looks like it will change this, last week’s readers have an idea of what could. Recession precipitates job losses and unfortunately, those caught blindsided by the pink slip may not be able to afford their mortgage payments. We know from last week that full-time employment has been going down and with major layoffs from companies like Intel, it may be a sign of more to come. Mortgage delinquencies from the lowest-tier borrowers with FHA have already started ticking up. In recent weeks, delinquencies in other areas have hit the highest month-over-month increase since the 2008 crisis.

The number of short-term rental properties since 2020 has increased higher than the number of homes for sale in many areas. Decreasing profits on these units could cause a wave of selling as lenders demand payments on the loans. This is another reason that more inventory of existing homes could come onto the market.

Prices

After 2020 we saw demand for houses go up and since 2022 supply has gone down due to mortgage costs. These factors have been keeping prices high. Demand has started decreasing and supply has begun increasing which marks what I think are inflection points. This points to deflation in housing prices just like what I believe is coming for the stock market.

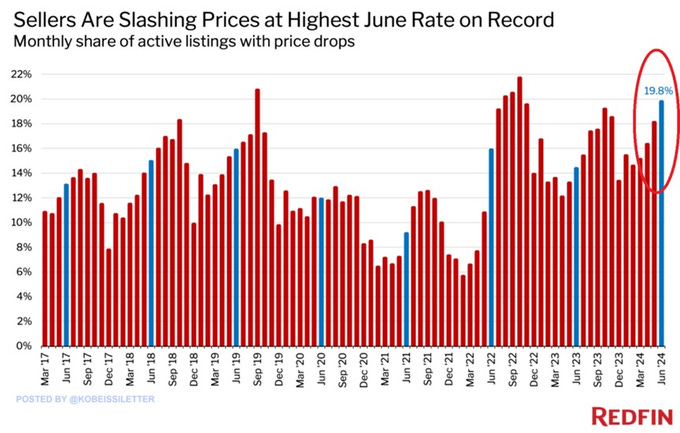

The data is starting to support this as well. 1/5th of sellers cut prices in June which is typically a strong selling month. New home builders have been slashing prices for a while existing home sellers have remained reluctant. This is now changing which is a very noteworthy development.

While we do not have the same sub-prime crisis or level of debt exposure on the consumer or bank side as in 2008, a recession can still have similar deflationary characteristics. The extent to which the government is willing to purchase distressed debt will determine the length and severity of the housing downturn, but the data suggests the market is going in that direction.

Trends that supported demand for housing and low supply look to be reversing. House prices on average have been stagnant down slightly nationally and could go down even further in conjunction with last week’s economic research. While this will affect certain regions more than others based on supply dynamics, house prices have to revert to what incomes can afford at some point, and a recession is a good catalyst. Real estate is slow and this can take time, especially if the economy stays “fine” until elections are over, but the risks for the housing market are clear so remain vigilant. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

There's another sub-market that could head downhill, especially if the stock market also crashes--people with second homes. Granted it's mostly upper end homes and not likely to get pounced on by middle class buyers but there are a lot of homes only getting used a few weeks a year. If portfolios get squeezed these folks may think twice about paying for second home.