🔋QE For Me, Not For Thee

Does quantitative easing even result in inflation? Why you should care about its various implications.

Press the heart button on this article, yes you! I would greatly appreciate it :)

When analyzing the energy transition, it’s easy to get lost in the nitty-gritty details of any of the many aspects and potential solutions. For example, is EROI better than LCOE, how much offshore wind is under construction, or which advanced nuclear design shows the most promise? Taking a step back and thinking about the history books, the one thing that makes the most impact is probably the economy.

For most of history, society was constrained by scarce resources like gold or silver which served as a common form of money that people trusted. Every once in a while nations would abandon these safeguards or be invaded by others and financial mayhem would eventually take hold. These days, governments have been running the largest fiat (fake) currency experiment of all time with unfathomable amounts of money being created from nothing (the US spent ~$190,000 per second in 2023). I have mentioned in previous articles the distorted incentives from easy money policies like quantitative easing and adjusting interest rates caused by the Federal Reserve. While it’s fine to lay generic blame on the Fed’s easy money policies for inflation, what I told you was true… from a certain point of view.

There is more to the story and it is not all the Federal Reserve’s fault. First, we must understand how money is manipulated, then where the money is going, before finally understanding what does each scenario mean for the real world. The first crucial distinction is to know is that there are two primary ways the money supply can increase: bank lending and fiscal deficits. The second major distinction is between fiscal and monetary policy [1,2].

Fiscal Policy: “Fiscal policy refers to the use of government spending and tax policies to influence economic conditions, especially macroeconomic conditions.” When government spending exceeds tax revenue also known as a deficit, the Department of Treasury issues new debt in the form of treasury securities to fund the government.

Monetary Policy: “Monetary policy is a set of tools used by a nation's central bank (Federal Reserve) to control the overall money supply and promote economic growth and employ strategies such as revising interest rates and changing bank reserve requirements.” Most importantly, the Fed adjusts interest rates which affects consumers, businesses, and government debt as well as does quantitative easing or tightening (QE/QT) which affects bank solvency and bank lending.

Monetary

QE sometimes results in a higher money supply, but sometimes has no effect. When the banks failed in the Great Depression, 2008, or 2022, they were promptly bailed out by the Federal Reserve. In this instance, the Fed created more bank reserves out of nowhere and gave them to the distressed banks and even some other banks if they felt like recapitalizing the banking system. These extra reserves have ZERO impact on the economy or inflation unless the bank lends more money out. While it sounds silly and it is, banks have very little practical use for bank reserves other than remaining solvent in extreme cases, so additional bank reserves will not influence the decision to lend out money. Economic conditions and the risk/reward of new loans is what is important. QE here has no impact on inflation unless the banks decide to start lending more which is not the case.

There is a case where the Fed can use QE to purchase treasuries from non-bank entities like hedge funds, insurance companies, or investment companies. While this would increase the money supply a bit, it would depend on how many assets the non-banks have and are willing to sell to the Fed which means that this factor is small.

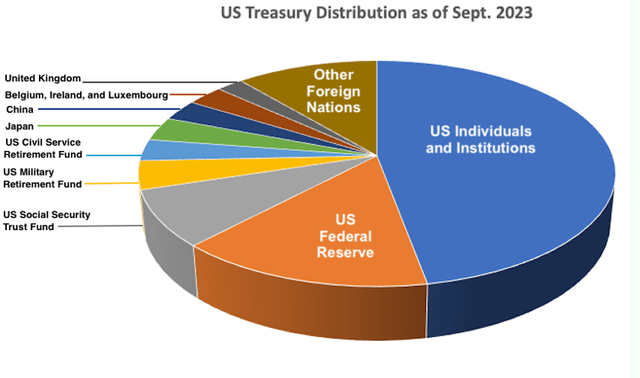

The final factor is where the Fed purchases treasuries directly from the treasury. Foreign countries, companies, and regular people can all buy newly issued bonds and bills from the treasury. If there isn’t enough demand for US debt elsewhere, the Federal Reserve can increase its share of the pie.

Fiscal

This is a growing funding mechanism for the exponentially increasing US debt. Since tax recipes and other income do not cover all of the government spending issued by Congress and the president, the Treasury and Fed can create new debt themselves to fund Congress. Again, depending on what this money is used for it may or may not be inflationary. In 2020, the treasury sent stimulus checks to households and this was very clearly inflationary to both money supply and consumer prices.

Now, the US is still running extreme deficits which include social security, health programs, welfare, and more. These “mandatory” items plus the interest on debt soak up all of the US income. That means the defense budget and any other programs are funded entirely by money creation between the Treasury and the Fed. The Inflation Reduction Act, Infrastructure Act, and Chips Act are all good examples. If the other party gains power, unfunded tax cuts would also be a form of money creation. In either case, if the private sector (already leveraged) and foreign entities cannot or are not allowed to sop up the new debt, then the Fed steps in.

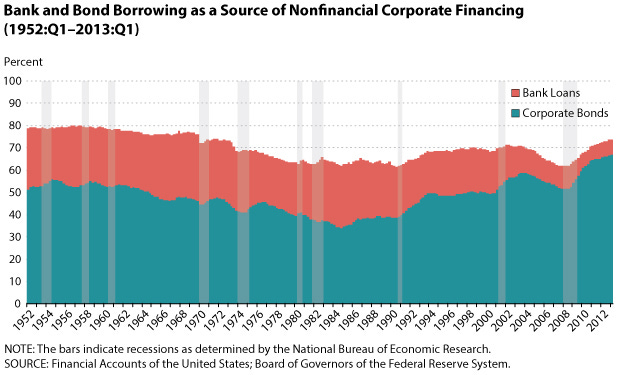

Currently, the Fed is doing QT and is holding rates high in terms of recent memory which means it is not helping Congress like it did during the pandemic. You can see below there are other times in history when either fiscal policy or bank lending were the primary drivers of credit growth. In the 70s, bank lending was high, meaning monetary policy changes would have an outsized impact on the economy. In the 30s/40s, the government funded the depression and war through fiscal policy, meaning monetary policy had less effect on bank lending and the overall economy.

Implications

The major implication which may come as a surprise is that the Fed is less important than it is given credit for. Currently bank lending is relatively low, and if (when) we enter a recession, bank lending will go down even more. In this case, monetary policy has less effect on the economy. If the Fed drops rates to zero again, but there are not good returns on capital for banks to lend, they still won't lend the money out. Alternatively, the large money flows coming from Congress will go into the economy regardless of what happens and will be a more important factor.

Where does the money go? This money goes through corporations and in theory, adds value to the economy by spurring activity in industrial investment. In practice, this spending in excess of the government revenues does add to the money supply which debases the national savings. Time will tell if these investments paid by the government will yield greater productivity than the initial cost of the debt meaning they were good investments. History does not suggest this will be the case, unfortunately as the government tends to be a poorer allocator of resources than the private sector.

On the other hand, QE has made its way into financial assets like stocks and real estate. This is seen by the dramatic overvaluation which coincided with the onset of QE policies. While this did not increase the money supply or contribute to inflation, there are societal impacts such as increasing wealth disparity and adding risk to these propped-up markets.

Finally, with bailouts for banks, investment firms, airlines, car companies, and other non-bank institutions, there persists a moral hazard of the highest degree. Those that get bailed out will operate riskier and less efficiently than if they had an existential risk of failing. In a world with failure, the strong would survive and the weak would fail, making the overall economy more resilient and stronger in the long run.

While QE itself isn’t inflationary, following where the money goes yields a greater understanding of what sectors stand to benefit and what risks are present. QE that funds fiscal deficits through the Treasury leads to inflation if sent to consumers, and opportunities in the areas where the money is flowing like chips or clean energy investments. The natural resources and technology required for these new trends are also of upmost importance.

Knowing that we are in an era of fiscal dominance and potentially lowered bank lending regardless of the Fed issuing more bank reserves means that there is a risk for assets like stocks and real estate propped up by QE. If trouble arises, banks won’t be there to support new credit and the fiscal spickits will have to be dialed to 10 again just like the pandemic. Connecting this to last week, as we know the stock market is overvalued and the Fed tools are less important, they will have less control if things start to turn negative. They will likely have to monetize debt through the Treasury/Congress to get money into the economy directly.

Conclusion

A high debt environment is deflationary as the ability to keep adding debt is smaller. Aging demographics, technology, and wealth concentration are deflationary as well. Allowed to naturally resolve would result in unpopular defaults in consumers, businesses, stocks, real estate, and banks.

The government is in a race against these deflationary trends to keep the system propped up, they just hit the accelerator too hard and are trying to quell consumer inflation (and we know why based on how the QE was implemented this time). Knowing how, where, and what is likely to happen are the keys to being successful. One last example that ties this in with the above Fed impact is that corporate financing is being done increasingly through corporate bonds, not bank lending.

The Fed needs to keep the system running one way or another, and if corporations won’t be affected by monetary policy measures that influence bank lending, they will find a way. It is illegal for the Fed to purchase corporate bonds directly, but like a good government agency, it found a way to evade these technicalities. They proceeded to buy corporate bonds of many companies, even those who weren’t struggling, showing their resolve to keep the system liquid and propped up.

As we know, bank lending is becoming less important for corporations. In that case, the “illegal” round-about ventures the Fed uses to purchase corporate bonds should be yet another concerning omen for the overvalued asset markets. Understanding QE may seem trivial, but by digging in we can understand where the inflation will manifest, what sectors are impacted, and risks to the markets. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.