🔋Bridge Fuel

Amidst a supply glut in the US, natural gas faces an interesting future.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Other than shifting manufacturing out of the US, the biggest driver of decreased emissions in the US over the last 20 years was not renewables, but natural gas. Primarily methane, natural gas burns much cleaner than coal or fuel oil and can be used for industrial heating applications or converted into electricity. As seen below, a significant portion of the US coal consumption was replaced with natural gas starting in 2008. Wind and solar have grown but remain relatively small in the energy mix and only serve as electricity production.

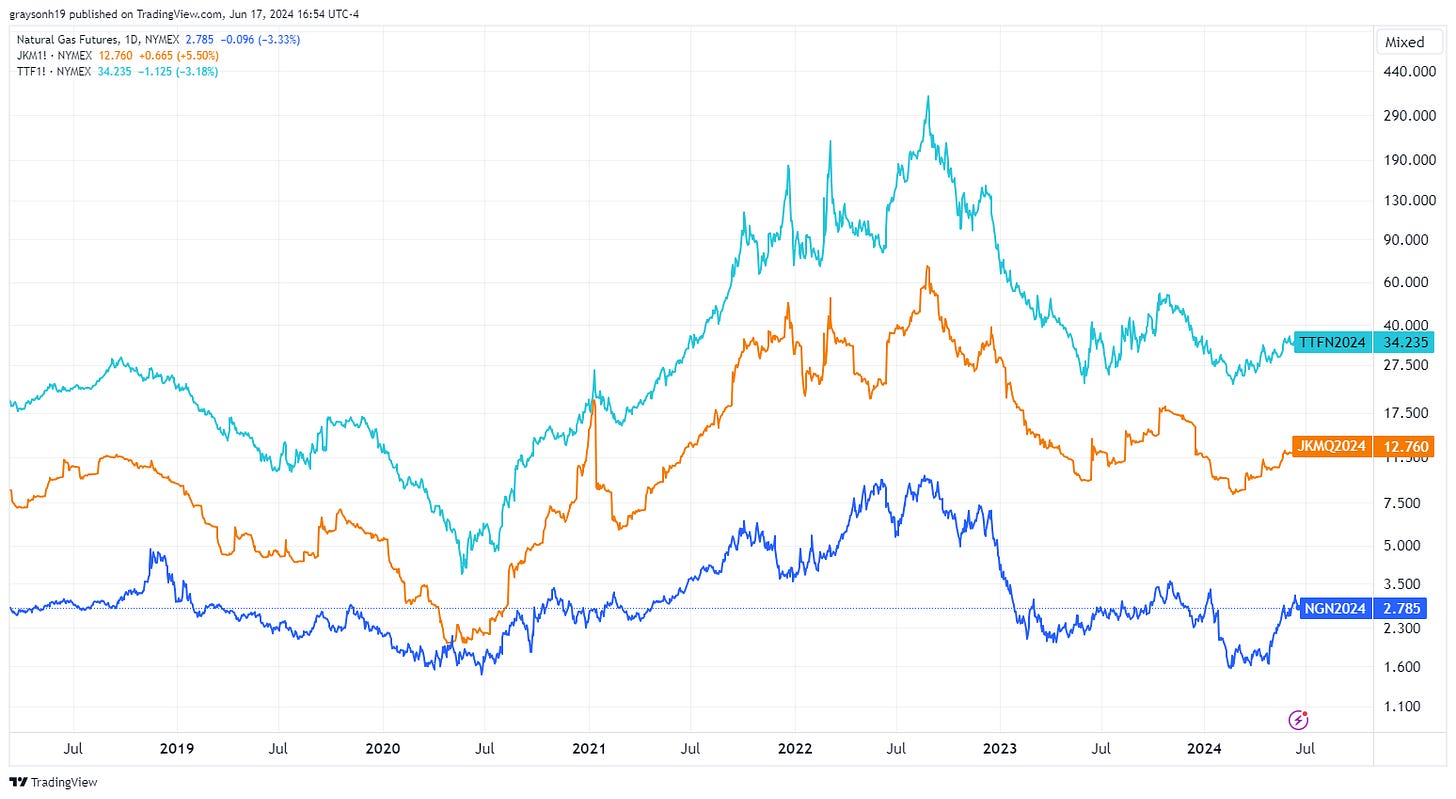

With natural gas consumption worldwide increasing over time and rapid decarbonization unlikely for various reasons, it will likely remain an important resource to keep on your radar. What makes natural gas unique relative to other commodities is the regionality of price. Because methane is a gas at standard pressure and temperature, it takes specific equipment and added costs to transport it over long distances. This is a big disadvantage to coal and crude oil. Because of this, the price of natural gas has wide variation whether in the US, Europe, or Asia.

While energy prices were increasing well in advance, the Russia/Ukraine war intensified fears of an energy crisis for Europe especially and served as a major disruption to their supply chain. Due to the Nordstream pipeline sabotage, the bulk of natural gas could no longer go from Russia to Europe via pipeline. To make up the difference, Europe turned to liquified natural gas (LNG) imports. US exports were the clear winner and maintain a high percentage of current imports today.

Globally, the top natural gas producing countries are the United States, Russia, and Iran. In the LNG market, the top exporting countries are the United States, Australia, and Qatar. The US has low prices because of ample domestic reserves and a glut of supply. Even within the US, there are different types of natural gas formations. Conventional refers to gas found between rock layers, unconventional refers to gas formations within rock pores (most notably shale gas), and associated refers to gas found alongside crude oil deposits.

Why is there a glut in natural gas when oil prices remain at ~$80/barrel? For one, the most prolific oil region in the US known as the Permian Basin holds a lot of associated gas. With companies willing to drill oil at these prices, there is a strong supply of natural gas that is drilled alongside it. This is natural gas that would otherwise not be drilled at these low prices. Certain regions in Texas that do not have adequate pipelines to other US regions have even seen negative natural gas prices recently.

Natural gas is important for many reasons. Domestically, it can replace coal and fuel oil for electricity production to reduce emissions. Further, cheap natural gas exports can help other countries do the same and provide economic benefits to the country at the same time. Those who view all fossil fuels as bad do not support this though, and also have become an issue with pipeline permitting within the US. With cheap and abundant gas, it must be transported via pipeline instead of trucking due to its gaseous nature. Because of environmental pushback, pipelines in the northeast and western parts of the US have not been approved as easily which has contributed to a significant discrepancy in natural gas prices domestically. On top of that, the Jones Act forbids US ships from delivering LNG to other US ports which is problematic. For example, Massachusetts resorts to importing LNG from other countries like Trinidad and Tobago and burning dirtier fuel oil instead of connecting pipelines to adjacent states.

The US currently exports significant amounts of LNG to Europe, China, India, Turkey, and others. If there were no transportation issues Europe would likely buy up even more US LNG considering they could get it for $2.70/Mbtu instead of $34/Mbtu. This arbitrage is not without notice from major oil companies. US LNG export capacity is set to significantly increase over the coming years. As long as the compression, transportation, and decompression costs are lower than the spread between the two prices, it makes sense to export and that’s what companies are trying to do. As of January 2024, the White House paused further considerations for LNG export facilities, citing climate change and potential price increases to US consumers. I would argue that the policy would likely not have the intended consequences over the long term.

Another reason natural gas is important is since long-duration battery storage has not yet served the needs of storing electricity from wind and solar on a large enough scale, combined cycle gas turbines (CCGT) have largely served as energy capacity during intermittent hours. CCGT plants can ramp up and shut down much more efficiently than other sources like coal, nuclear, hydro, or conventional power plants. Natural gas is flexible in that it can provide constant baseload power or ramp up/down depending on the facility. The world is power-hungry for new AI data centers and searching for dependable power sources. Just like nuclear is a clear option, natural gas can also fill the role.

If intercontinental price arbitrage, government restrictions on exports and/or pipelines, and filling voids left by renewables weren’t enough to be bullish on natural gas, perhaps filling the demand for AI will be it. Overall it will take a bit of time for the supply gluts to work themselves out, for export terminals to be built, and for people to find creative ways to use natural gas. This flexible fuel is historically cheap compared to oil and will find its prominence in the coming years as a vital energy source, despite environmental calls for its banishment. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.