🔋Debt Pt. 2: Dollar Strength

Commodity producers push back as the US takes advantage of the spoils of cheap debt and negative yields through their dollar hegemony power.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

This is the second of a multi-part series relating to issues associated with our debt soaked world that we’ve been navigating the last ~50 years. Releases likely not all consecutive with the aim to explore a variety of topics.

Last week I discussed the increasing debt service costs of federal debt due to both the ever increasing debt and the recent aggressive interest rate hikes being carried out by the Federal Reserve. This week is about how the government debt issuance is a privilege and used as an exploit by the US. Check out my previous piece, Not Your Average Dollar, where I explain the petrodollar system and how the US benefits greatly from the reserve currency and its partnerships/dominance of the global oil market.

In it, I discuss how the US has reserve currency, backed by faith in the US government, the power of the US military, and also oil (worlds most important commodity whether you like it or not). I also discussed how this petrodollar system has contributed to the large macro downtrend of declining interest rates over the last few decades and how some nations aren’t a fan. In this piece I will discuss why these countries don’t like this.

Like I’ve said before, the government can’t “default” in the traditional sense because they have the money printer and can always fund debts with monetary inflation. However, one (pernicious) method to avoid debt defaults and actually decrease the debt is through negative real yields. What this means is that the inflation rate is higher than government bond (ex. treasuries) interest rates. Effectively the federal debt loaned out (bonds) are devalued more than they pay in interest or yield.

In layman’s terms, say you loan your friend $100 dollars and he agrees to pay you back plus interest, say $110. If your friend is good for it and you don’t desperately need that $100, this seems like a great deal, an easy 10% return, similar to a stock index fund. If however the money supply increased by 50% by the time your friend pays you back, meaning your $100 dollars is worth $75 in real initial value, and you now have $85 real dollars. Technically you have $110, but since it’s worth $85 you basically lost 15% of your initial capital, a very bad return. Would you lend your friend the 100 dollars in this environment or look for a better return elsewhere?

Same goes for buyers of US treasuries or the government bonds I mentioned above. Why would anyone even buy bonds in this environment if they are just losing money? It’s honestly a very good question, but the US is again in a position where people still buy the debt for various reasons.

One, some may not realize that the devaluation is that extreme and are convinced they are getting value when they are actually getting hurt. Two, some see the US assets as the best option in terms of risk/reward as other countries don’t have the same safety and credit worthiness as the US. They can’t default remember. Three, its better than holding cash and getting an even worse return. Four, countries need/prefer dollars to buy oil and other commodities through the petrodollar system. Five, a country risks trouble/sanctions from the US from trying to circumvent the power dominance that this system provides them. I may have missed some other factors, but these come to mind as crucial.

Eventually, as other sovereigns decide to reduce US bond exposure, it lowers the inflow of money to the government via less demand for US debt (US needs buyers of US treasuries to keep increasing the debt). Someone has to buy the bonds unless the government wants to spend less money. Since less spending is not the case, expenditures are increasing, and with a relatively fixed (and I argue slowly decreasing) demand for treasuries, the government has to purchase more of its own debt (printing more money) to cover the difference. This is effectively a debt death spiral that trends down the path to hyperinflation.

Commodity producers are the first to realize this. A commodity like oil is quite valuable and generally retains its value (or goes up) over time. Since commodities are traded in US dollars, the dollar profits from these other countries may go towards US assets where they can be put to productive use instead of just sitting around devaluing. US bonds/treasuries are the most common and safe way since there is less risk than stocks for example. In a negative real yield environment, if you traded a commodity that gains real value for a bond that loses real value, in this case you are technically better off keeping your resources in the ground where the value can be saved and worth more in the future.

Many countries including Russia have been seeing this issues for a while but have not had any leverage to do anything about it. In addition, the US can and arguably already has used its military to defend against other countries moving away from the dollars that get devalued. This scenario however means that countries will gradually begin (or try to begin) to trade in other forms of money that do not devalue at the same rate or hold assets other than US treasuries that may hold more value. They are looking to maintain purchasing power after selling their precious commodity assets.

What can be done about these issues, and are the other options other than the dollar? Other currencies like Ruble, Euro, or Yuan could be options. These have arguably more risk and without the upside of the US financial markets. Trading for other commodities could be an option, however the balance of trade is inevitably an issue which is why we have money to facilitate trade in the first place. Gold, silver and precious metals which have been money for thousands of years are also options. The problem here is it is more difficult to trade with gold in a very global interconnected world with lots of transactions going on. Digital currencies like bitcoin, stablecoins, or central bank digital currencies have been proposed. CBDC’s and stablecoins suffer from the same counterparty risk and devaluation risks as the USD while bitcoin is an immature and not widely trusted asset yet.

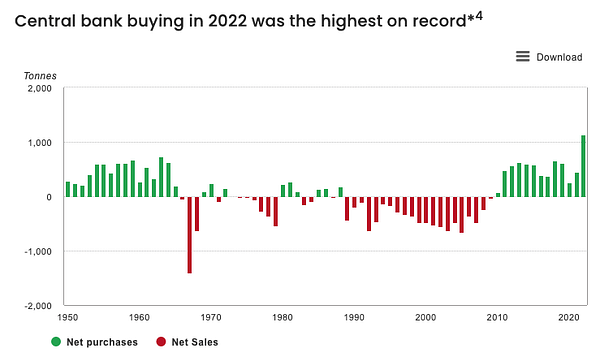

Since the US weaponized the dollar, Russia responded by offering their precious resources for sale in either Rubles or Gold. While the Ruble isn’t “rubble” like the White House predicted, it definitely isn’t an asset with lines of people looking to get there hands on. Many central banks around the world have begun hoarding gold in record amounts. Are other countries looking for the safety and store of value of gold? Certainly looks like it.

Currently there are countries teaming up to move trade away from dollars. This of course is the BRICS nations I have mentioned before. Would you be surprised that Russia and China have been decreasing their exposure to US reserves and have are large hoarders of gold? This is one factor that made Russia less vulnerable to the US sanctions that were thought to be crippling to the nations economy.

Recently Saudi Arabia has been increasingly friendly with China and less with the US. The US has been struggling to exert its dominance over OPEC as it has in the past. The petrodollar system that we have been accustomed is atop shaky ground. QTR has been an early discusser of this topic and has some discussion here. The mainstream is even beginning to pick up on some of these concerning trends for the US government. Saudi Arabia and OPEC at large trading in other currencies would be a huge blow and has been associated with conflicts in the past. There are a number of other potential countries thinking in a similar light around the globe.

“Saudi Arabia is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s finance minister,”

-Bloomberg reported on Tuesday, echoing comments by Mohammed Al-Jadaan.

The debt soaked world that has had no consequence will struggle at some point. If/when the system crumbles I can’t tell, but the signs are in place for the nations being taken advantage of to push back. The more indebted, less productive, and higher inflation the US becomes, the less leverage it will have just at the time it needs it the most. Now the US has great geography, a large military, and a ‘less-bad’ age demographic than some, but it is definitely in an interesting place looking ahead. It looks to me like the hard assets from these commodity producing countries, gold, the resources required for economic activity including battery metals, and maybe bitcoin will be important assets going forward as confidence in countries currencies are waning.

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest posts.

Let someone know about Better Batteries and spread the word!

Socials

Twitter - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Did I read that the number of transactions that Bitcoin can do per unit time is dwarfed by current digital banking capabilities? That , plus it's exorbitant energy consumption and lack of anything concrete to back its value up makes me dubious. But never underestimate humanity to avoid efficiency.