Eggcelent Returns

S&P 7, nothing else matters.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

You may have heard the saying, “Don’t put all your eggs in one basket.” This is generic advice that may save you if you are relying too heavily on one outcome. Interestingly, most financial advice goes along the same lines, with diversification being key to a balanced long-term portfolio. Too much in one asset class over time runs the risk of underperforming over the long term. Today, investors own a higher percentage of stocks than of other assets than at any other time in history (dark line in figure). How have we forgotten this important life lesson?

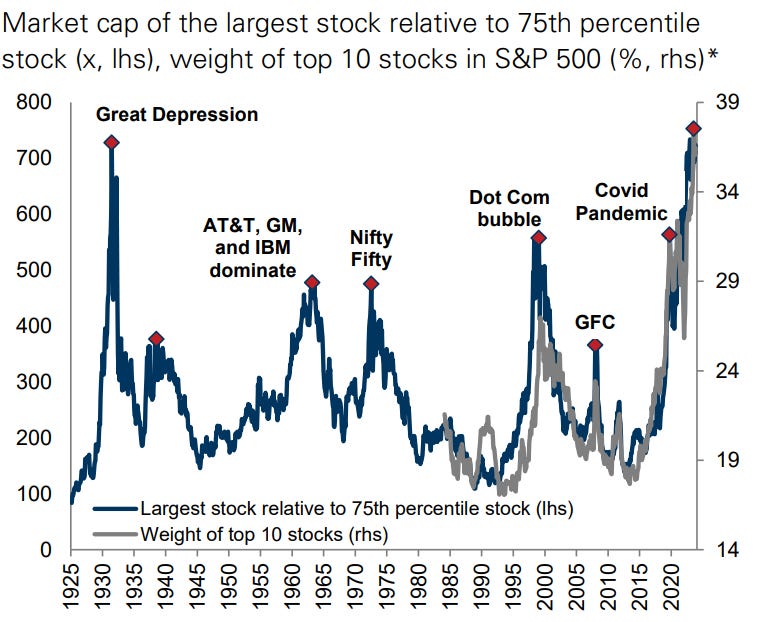

Not only are households racing towards 50% of their assets being stocks, but the market cap of stocks has accumulated in the largest companies. The “magnificent 7” of Apple, Nvidia, Google, Microsoft, Amazon, Meta, and Tesla have grown higher than the rest of the companies in the S&P 500. In fact, we are currently at market concentrations higher than the dot-com bubble, Nifty Fifty bubble, 1950s, and the Great Depression peaks.

Part of this is due to the large and increasing share of passive investing, like retirement fund flows. These funds are not concerned with portfolio management, but rather always invest in the stock market. These funds and most retail investors purchase the S&P 500, which is not an equal share of 500 companies, but an index. Each dollar that comes in is allocated in the percentage below, leading to the “rich getting richer,” so to speak. This drives valuations of the top companies higher and gives an extra bump of capital to perform share buybacks, further boosting earnings per share metrics of the Mag 7.

This has driven returns of the Mag 7 stocks far greater than the rest. In some ways, investors are rewarded for their lack of diversification, and it is not surprising considering the excellent returns they have been rewarded with. In the past three years, over 50% of the returns have been driven by these top seven stocks.

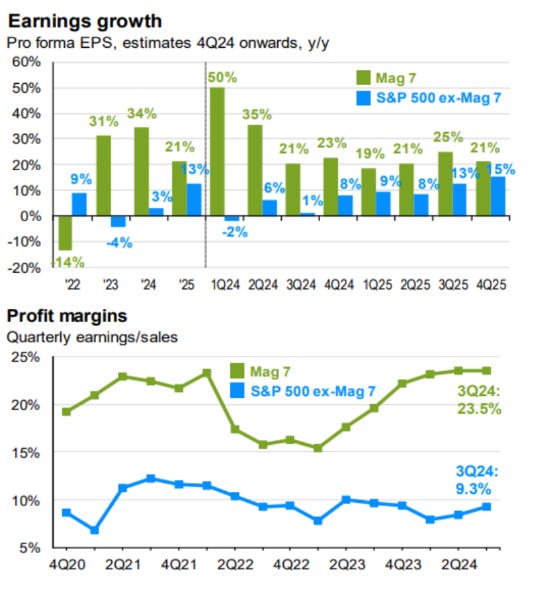

It is not unwarranted either. In the dot-com bubble, it was many fraudulent or unprofitable companies seeing excess returns. This time, the Mag 7 are actually the most profitable companies. The earnings growth and profit margins of these companies far exceed the rest of the index. From that standpoint, there is justification for the concentration, unlike the dot-com bubble.

Still, excess concentration can be a risk. Articles are beginning to comment on the concentration of NVIDIA earnings. In Q2 2025, just two customers accounted for 39% of NVIDIA's revenue. Imagine if one of these players cuts down on purchases? Are two customers propping up NVIDIA, propping up the S&P 500, propping up household assets? To be honest, it is not actually as bad as it sounds. These two customers are direct customers who package NVIDIA chips into circuit boards and other useful applications for resale. These are sold to indirect NVIDIA customers, of which there may be hundreds of buyers.

Still, the lion’s share of indirect purchases is from fellow Mag 7 companies flush with earnings and cash. While not as bad as I exaggerated in the last paragraph, the concentration is still located primarily within the Mag 7. Given a recession or reduced exuberance in AI trends, the earnings that these companies are passing around may slow down a bit.

The risk is the same as we saw in 2022. Just as the Mag 7 dragged the S&P 500 returns up, contributing to over 50% of the positive returns in 2023 and 2024, the same happened in 2022 on the way down. Corrections in these high-flying stocks are higher as well. Investors may find comfort that the biggest companies that drive returns are also the most profitable. According to my calculations, Mag7 earnings as a share of the total S&P500 earnings were 15% in 2020 and are up to 25% in Q2 2025. On top of this, you have a river of capital inflows through passive flows and corporate share buybacks.

Everything may be fine, and it may be wise to ride the wave instead of fighting against it. Just know that the rip current risk gets higher with each passing quarter. We must be cognizant of what could be a risk to corporate earnings, passive flows, or corporate buybacks, and even more to the risk it poses to the average household storing record amounts of wealth in just a few stocks. Are all your eggs in one basket? Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

Was thinking maybe putting a bit of cash on shorting the dollar, but maybe it's too late?

I'm on the sidelines except for metals so I guess what I have in stocks is in one basket(which is doing well currently). If the market really tanks I'll go in on other stocks but I'm kinda thinking Buffet is correct on waiting it out. Savings account rates at 4.5 percent are good and keep the money liquid. Recessions typically start when the Fed starts to cut rates. Indicators are meh either way so I wait.