🔋Looking Fordward

After years of losses on EV sales, Ford is in a race to avoid repeating history.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

…there is one and only one social responsibility of business - to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game… - Milton Friedman (Capitalism and Freedom)

After a rocky Q1 2024, EV sales as a percent of all vehicles continued to grow in Q2. While behind Tesla, legacy automakers like Ford and GM are eager to join the EV bandwagon. Ford in particular has been struggling to make a profit on their new venture as I last talked about in At A Loss. While I am more neutral on the EV market than most opinionated professionals, the economics of EVs has raised some concerns.

Nobel Prize-winning economist Milton Friedman suggests that the primary motive of a corporation is to make profits. Assuming Ford wants to transition to EVs as they suggest, Friedman might have reservations about their business decisions. Since Ford began EV production, they have lost tremendous amounts of money each quarter. Q2 2024 marks their most successful quarter yet, boasting losses of only $47,585 per vehicle sold. Quite frankly, to stay in business under that model they will have to radically improve their EV business.

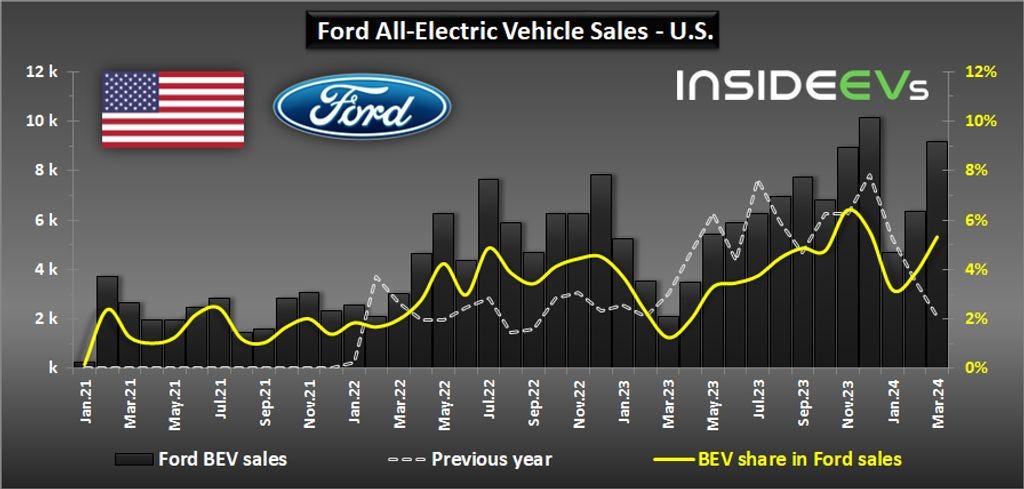

While losses are trending down, it looks as though profitability is a ways off still. GM hoped to be profitable in 2025 and is in a similar boat to Ford. Ford itself had a more conservative 2026 profitability target, however they no longer expect to reach that goal. These companies are planning on losing money on EVs for years to come, which is fine since they only account for a small percentage of their sales. As economies of scale increase, the unit cost decreases and the profitability should improve. Each year, Ford has been growing its EV sales, just like many other automakers.

To reach economies of scale and achieve profitability, Ford needs to increase production which is exactly what it is trying to do with large battery factories in the pipeline. Unfortunately, delays to a large plant in Michigan and less EV demand causing them to reduce EV production and employees are stunting this progress. The lack of profitability is also despite record low battery costs. With cell costs fighting against diminishing returns, it is up to Ford to continue to reduce their costs to make profits in the coming years.

As I mentioned last time, much of this has to do with deteriorating economic conditions, in which all businesses that depend on consumer spending will struggle. This does not mean the end of EVs, especially as long as the government keeps its commitment to the energy transition in its current form. Unless Ford can make money on EVs, their increasing share will be a burden on their business. Depending on when this happens relative to their cars sold will also be important.

During the financial crisis of 2008, the US implemented the Troubled Asset Relief Program (TARP) instead of letting the business cycle take its natural course. This provided a bailout to many companies facing bankruptcy at the time. Two of the “Big Three” automakers at the time, Chrysler and GM, were struggling and took advantage of the program. The other, Ford, took a different loan from the US government just like Nissan and Tesla but was not considered insolvent. Mismanagement and recession led to the emergency assistance/bailout of these companies. I fear unless there are big changes to make EVs more profitable, automakers face a similar future. With heavy losses taking a larger share of sales and looming economic weakness in my view, we very well may see companies getting bailed out by the government once again.

EVs are not “over”, but the reality is that in the short to medium term, it looks like a terrible corporate strategy to make profits. Legacy automakers are in a race against the clock to make EVs more profitable, especially if there is a recession. The only alternative option is to cut EV investment further, which would be a big blow to the current administration’s plan for the energy transition. While this aggressive EV plan is not optimal in my view, government bailouts to these companies or a major pivot in strategy would both confirm major malinvestment took place. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.