Model Portfolio: December 2025

Metals go crazy and some rebalancing.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

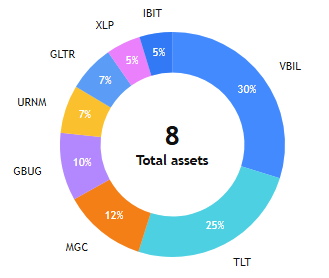

The model portfolio started in July 2025 and has 5 main components: stocks, bonds, cash, precious metals, bitcoin, and a flex option. Based on macro risks and trends, the current construction for December has been: (see more details here). [Updated allocations at the end]

Stocks - MGC, XLP - 10%/5%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 30%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 5%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 10%/10%

Flex - Sprott Uranium Miners ETF (URNM) - 5%

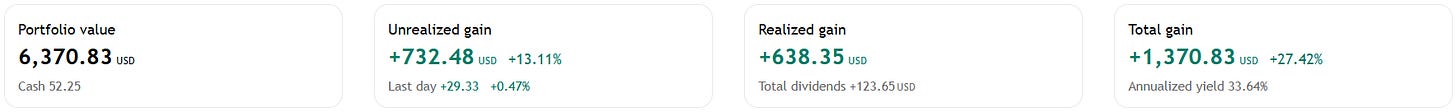

Hope everyone had an amazing time for the holidays! Over the last month, the portfolio is up 1.95% vs 1.05% for our benchmark SPX. As this is the last update of the year, we are up 27.44% for the year (starting in March). We were able to outperform the SPX index, which went up 17.75% over this timeframe!

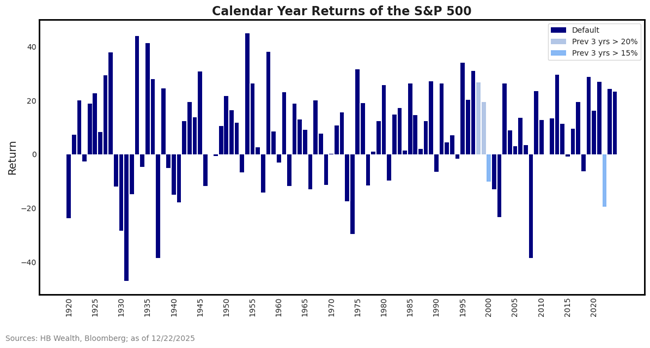

It has been a fabulous time to own stocks over the last three years, with returns of 24%, 24%, and currently 17%, with a few days left. I’ve been saying for a while that the market has more risk than is being priced in, since the economy has been weakening while stock prices rise.

Three consecutive years of 15+% appreciation have only happened twice before: the tech bubble and before COVID. The tech bubble was able to hold onto this pace for two more years before its inevitable crash. COVID was not like that, immediately observing a down year. We are in the same territory now, implying the risk for a disappointing or negative year increase for each exceptional year in a row. Even the 1929 bubble was interrupted by a meager, single-digit year in 1927.

I still think 7000-7100 would be a good target for SPX, so I remain in MGC and XLP. IBIT (Bitcoin) has been mostly flat for the last month. It is still precarious due to seasonality. It could easily sink to the next big resistance at $74k, but if the stock market is still in speculation, there’s still a chance Bitcoin makes a move higher.

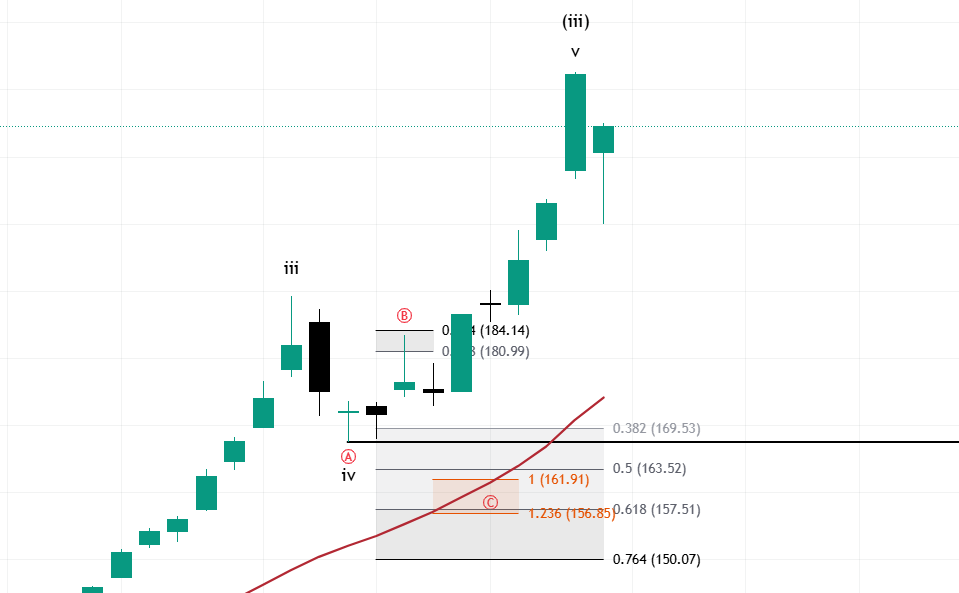

Precious metals are the reason my portfolio has outperformed the general market. GLTR, a basket of Gold, Silver, Platinum, and Palladium, has exploded higher to end the year. Last month, I predicted a pullback from B to C at the 21-week moving average. The sector decided it was already time to go higher, but our sizable 20% position in metals and mining companies meant we were still making money.

URNM was the new entrant into the portfolio last month, increasing slightly. It is still poised for higher in my opinion. The chart shows a 1-2, 1-2 setup, which may lead to a nice wave 3 higher. Initial targets if it impulses higher are 69-73, and longer-term targets over 100 if it plays out.

While I take on risk with precious metals, mining stocks, and Bitcoin, a significant part of my portfolio is treasuries. I keep 30% of the portfolio in VBIL (treasury bills), which is equivalent to holding cash or a money market fund.

Long-duration bond prices will do well in a recession, adding extra hedging. TLT (treasury bonds) are my way of trading this possibility. Until then, the lack of performance is offset somewhat by the dividends it pays. TLT is in a triangle of boredom until it decides to break out one way or the other (higher = recession).

Most retirement funds are not really diversified, holding the S&P 500 index primarily and price agnostic to valuation and recession risk. Given the macro risks I’ve discussed on The Gray Area, and especially for those near retirement years, this allocation is extremely risky. Most are also unable to benefit from real diversification in other assets like metals and Bitcoin. Here, we actively manage risk with cash/bonds and diversify with alternative assets like metals/Bitcoin.

Due to the continued outperformance in precious metals, it is prudent to take some profits at overbought levels. GBUG is rebalanced to 10%, and GLTR is reduced from 10% to 7%. Some of the capital is shifted into bringing URNM from 5% to 7% due to the promising setup, while the rest is moved into VBIL/TLT to rebalance to 30% and 25%.

The new portfolio target allocation:

Stocks - MGC, XLP - 12%/5%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 30%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 5%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 7%/10%

Flex - Sprott Uranium Miners ETF (URNM) - 7%

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView