Model Portfolio Launch

New model portfolio!

Intro

I’m introducing The Gray Area portfolio. This is a sample retirement-style portfolio that I use for my retirement account (not investment advice). I aim to continually add new content to this blog to keep it innovative and hopefully capture more interest. It’s fun and not too difficult to keep track of, so we’ll see how it goes.

The goal is a simple strategy that allows me to play various sectors of the market, reducing downside stock market risk while taking on more risk in other areas that traditional 60/40 professionally managed portfolios cannot.

The goal is to keep it very simple, with not that many sectors and not requiring micro-management. There are only five key areas of investment that change over time as the outlook on these sectors shifts for various reasons, such as the macro environment and technical signals. I plan to rebalance the portfolio roughly monthly and update the channel with portfolio construction changes. The five key areas are stocks, treasury bills, treasury bonds, bitcoin, and precious metals. SPX is the benchmark that I hope to beat while reducing the max drawdown over time. The target allocation currently is as follows.

Stocks - Vanguard Mega Cap Index Fund ETF (MGC) - 10%

MGK was chosen as it is the top 300 companies instead of the S&P 500 (SPX). The main reason for this choice was because of the passive investing complex. I’ve written about the distortions passive investing is causing markets, originally and excellently articulated by Mike Green. This allows the top 7 (Mag-7) stocks to outperform, reinforced by share buybacks. While still wanting broad exposure and diversification, we cut the bottom 200 companies of the S&P 500 that generate lower earnings.

10% - The market is very overvalued with economic deterioration, warranting the relatively small allocation.

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 25%

VBIL acts as the cash in the account, where we can earn some yield in the process. Cash offers portfolio risk reduction in an overvalued market and an opportunity to allocate capital at attractive valuations. Currently, short-term interest rates offer a nice yield of ~4.5% which makes sitting in cash less painful than years prior when money markets and short-term T-bills offered near-zero yield.

25% - Holding some cash instead of stocks.

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

TLT is an ETF of long-term treasury bonds (20-30year duration). While a terrible long-term investment because of financial repression, they offer safe portfolio diversification and stable income in the short to medium term. Bonds are considered safer than stocks, with less volatility and lower returns (think classic 60/40 portfolio). As the economy slows and the US enters recession, the drivers of long-term interest rates will decrease (IR = GDP + inflation). This causes long-term interest rates to go down and causes the Federal Reserve to lower interest rates.

25% - Should go up when the FED cuts rates aggressively in recession and earns a nice yield in the meantime.

Bitcoin - iShares Bitcoin Trust (IBIT) - 15%

Love it or hate it, Bitcoin has been the best-performing asset in recent years. With higher returns comes higher volatility, which is monitored through halving cycle analysis, technical analysis, and on-chain data. For theoretical reasons, as institutional adoption through ETFs brings passive flows into Bitcoin, and more national political interest arises in crypto, Bitcoin serves as a foundational portfolio asset in the modern era.

15% - Speculation on Bitcoin price

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 12.5%/12.5%

Precious metals have higher volatility, but they traditionally offer a hedge against long-term monetary inflation trends. Fundamental reasons to hold metals are that central banks are purchasing record amounts of gold, geopolitical uncertainty raises the demand for neutral reserve assets, and the continuation of reckless fiscal policy. Mining companies offer diversification against holding the metals themselves, generate cash flow, and historically provide excess returns over the metals themselves during bull markets.

25% - Half in metals, half in miners, sector bull market.

Flex - none

Other niche investments may go here, but would remain relatively small compared to other positions.

Portfolio Status

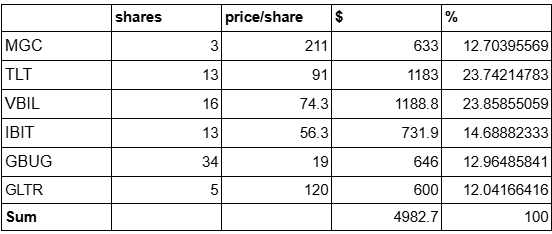

I started this portfolio in February for myself, but for simplicity, I’ll mark the first day of March as the beginning of this $5,000 model portfolio so we have some time to see how it’s fared, and then we can track into the future. Whole shares are required in the TradingView program I use, so here is the breakdown of the actual starting allocation on March 3rd.

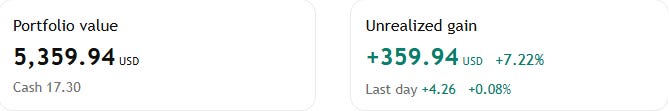

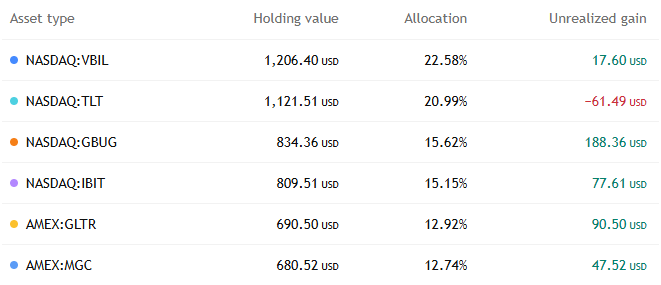

In the first 4 months, it has managed to reduce the max drawdown and return slightly more than the SPX benchmark.

Portfolio Changes

The future is ultimately uncertain, but a good portfolio is prepared for that. Here are the changes I expect to make in the future, so you might know what I’m expecting. It’s meant to be simple in construction and operation, ideally with changes once a month at most.

Sell MGC, buy TLT

As stocks continue higher through 2025, I plan to reduce MGC and replace it with TLT. Labor market deterioration, rising credit spreads, and technical signals will act as indicators of the stock market top.

Sell IBIT

As the bitcoin cycle comes near its end, we will want to capture a bit more upside (120-150k). We will want to avoid the next crypto winter (~50-70% correction).

Sell precious metals

Gold has had tremendous momentum so far, with silver and miners lagging. As this complex continues to trend and outperform, I will slightly reduce its weight in the portfolio.

Buy URNM, REMX

Uranium and rare earth metals are very important geopolitical assets, and their charts look pretty good technically.

Until next week,

Looks like a good balance, all things considered. I have more metals and have the cash in good interest bearing savings accounts. I'm baffled by the general market's optimism so I stay away but you're smart to have a little in there.