🔋The R Word Pt. 2

Are the recession fears that re-emerged because of the Trump tariffs warranted?

If you enjoy, press the heart button on this article! I would greatly appreciate it :)

Last week, Trump announced the largest tariffs since the Great Depression [1,2]. This was a catalyst that continued the correction in stocks by another 10%, to a total of nearly 18% from the highs on the S&P 500. This has been a sharp and violent move, similar in magnitude to the 2022 correction in less time. These tariffs were more extreme than most people expected and weren’t calculated in the way people expected. This has led to many questions, especially considering there were tariffs placed on islands whose only inhabitants are penguins.

Long before Trump implemented his tariffs on the rest of the world, I wrote about the danger in the overpriced stock market. Underneath the hood, there are quite a few fundamental reasons to suspect recession at some point soon. Market valuations are at extreme highs on multiple metrics supported by corporate share buybacks and passive index flows, which have not reversed yet. These have helped fuel stock market concentration on par with some of the biggest bubbles in history.

On the fundamental side, major recession warning signs have been blinking, including negative net national savings, the yield curve, and weakening employment. The net national savings of consumers, businesses, and the government is where the underlying capital for investment comes from. Without it, the current debt has little collateral and new investment becomes riskier and riskier. The employment rate looks good, but under the surface, it is propped up by government and part-time jobs. This is in addition to 10 million able-bodied/working age adults who have given up on employment and don’t show up in the unemployment rate.

I continue to watch credit spreads tick up, a useful indicator of credit health in the economy, by comparing risky loans to safe loans. The proverbial “stuff won’t hit the fan” until some big money goes bankrupt, which isn’t the case yet. They likely need to reach 9-10 on Bank of America’s high yield spread before we know we are in a recession.

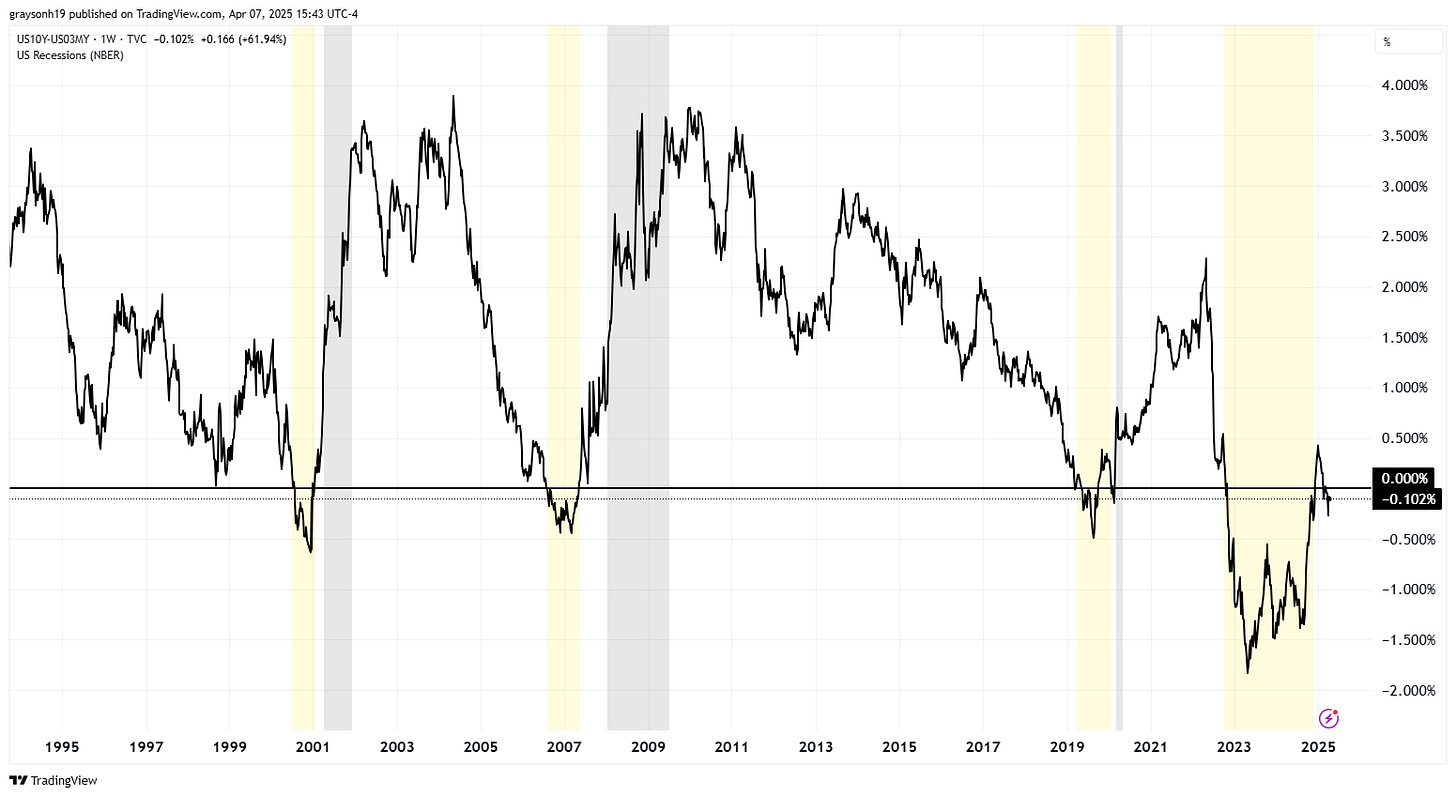

While credit spreads compare bonds of the same duration and different credit quality, the yield curve compares similar credit quality at different durations. Both are useful in their way and give information about the risk in the economy. Credit spreads tell us when the bottom tier borrowers/companies are no longer healthy and lenders are demanding more returns for their investment. The yield curve indicates, on a broad scale, how investors see the risks to the economy over various time frames.

Normally, longer duration bonds have higher yields as there is more uncertainty due to time. The theory goes that an inverted yield curve shows that investors are uncertain about other investments, so they flock to longer bonds providing a safe return in uncertain times. This is the theory for why bonds hedge stocks. As the economy is risky, bonds should increase in demand on top of paying a steady yield.

The past three yield curve inversions have preceded recessions by months. The yield curve has one of the best recession-predicting track records of any indicator. Only when the curve un-inverts back into positive values does the recession begin, typically when short bond yields drop dramatically and the Federal Reserve is cutting interest rates. The un-inversion warning sign has been in the process of unfolding since it is not the initial inversion that you should be worried about, even though that is what gets the attention.

Right now, the yield curve is bouncing around zero, and other durations are already positive, indicating that we are getting closer to a recession. The last two years have marked the longest time the yield curve has ever been inverted. The second longest was before the great depression, and with a soft correlation between inversion length and stock market correction depth, that is not a good record to overtake.

Some have argued that the issuance of short-term debt over long-term debt during the Biden administration distorted the yield curve by creating an artificial scarcity of longer-term debt, causing a longer inversion. While this could be true and a case why the recession won’t be so bad, it doesn’t dismiss the many troubles and high debt burden within the economy.

The recent stock market correction can be scary, but it doesn’t mean that it will keep crashing overnight. History suggests that these oversold areas cause a rebound in the stock price that can be sold into before recession takes hold to a greater extent. The Trump tariffs represent a news event, where bear markets are caused by credit default events and weak corporate profits. Before the 2000 market crash, there were several 10% declines where the all-time high was regained.

Not due to tariffs, but for the fundamental reasons discussed, caution should be taken in the stock market. Until corporate share buybacks and passive flows stop, there will be tremendous upward price pressure on stocks. If you hear co-workers deciding to take money out of 401ks, then there’s a bigger problem on our hands. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

Excellent overview of the current situation!