🔋A Real Bond

Could this indicator be a useful warning bell for market corrections?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

It can be hard to predict which way the stock market is going. On one hand, your thesis could be right, but if it doesn’t play out for years, is that useful? I’ve discussed several headwinds (valuations, yield curve, net savings) and tailwinds (corporate buybacks, passive flows, economic strength) in the last few months. Through fundamental and technical analysis, there is a strong case for a recession/stock market mean reversion at some point, the only question is when.

We are currently in uncharted territory with the yield curve inverted longer than ever before, surpassing the period preceding the great depression. We are in a weird time and how much longer this could last no one truly knows. To navigate, we must use tools that can tell us of imminent economic weakness before it happens. For that, we turn to the bond market.

Unlike the stock market, which is increasingly plagued by speculators and passive investing that distort fundamentals, the bond market is priced more fairly than the stock market. Everyone from your local bank to the US government has to analyze before determining whether to issue a loan and at what interest rate.

For the same reason your credit score (worthiness) determines your mortgage interest rate, every bond in the world has the same risk analysis. The US treasury is known as the safest asset in the world because the US government cannot go bankrupt nor default on its loans with the power of the printing press and the most powerful central bank in the world. Conversely, corporate bonds have varying degrees of risk from investment grade to high yield/junk bonds. Corporate bonds have a higher interest rate than treasuries because there is a higher default risk with a company. Further, mortgages tend to be even higher, especially for lower-income borrowers.

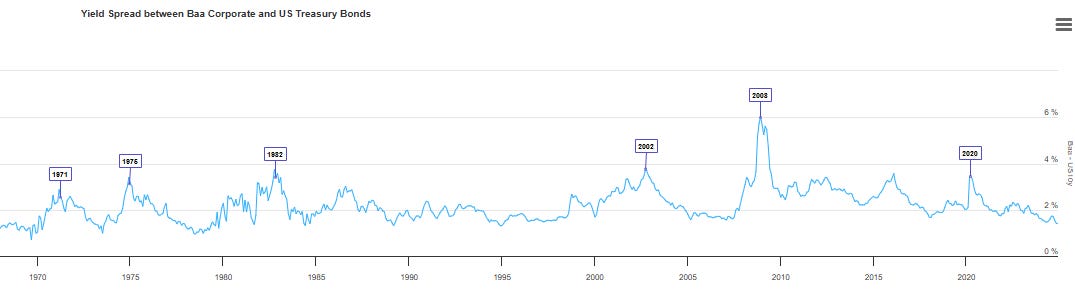

Introducing the credit spread, or in this case the difference between corporate bonds and US treasury bonds. This spread between yields shows the perceived risk in the market. A blowout in credit spreads coincides with major economic events over the lifetime of US equity markets. Peaks in this chart occurred in the 1970s/80s recessions, the dot-com bubble in 2000, the 2008 financial crisis, and COVID.

During economic uncertainty, investors demand higher yields for holding corporate debt relative to the safe US treasury counterpart, causing credit spreads to widen. When credit spreads widen, it not only coincides with recessions and market corrections, but it often leads. Here, the solid line is credit spreads where the bars in the back show if the stock market is going up or down. As you can see, credit spreads began increasing and thus predicted market corrections in the dot-com crash, financial crisis, and the 2015/2018 corrections. Recently, they showed a brief increase before the 2020 and 2022 market corrections.

Credit spreads therefore give us a tool for a more precise timing of market instability. While it cannot call the top to the day or week, a rise in credit spreads means it is time to be more conservative in stock allocations. With this in mind, what is the data telling us today?

Credit spreads are at record-low levels, implying little default and economic risk to corporations. In the short term, there may not be reason to worry about stock market valuations, inverted yield curves, or negative net national savings. The stock market has and could continue to go higher before economic realities that have not disappeared finally catch up. In the meantime, we can party while the music is playing but be mindful when credit spreads increase once again. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.