Model Portfolio: Update #1

October 2025

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

I started the model portfolio back in July 2025 to test the investment themes my research has shown. The portfolio construction has 5 main components: stocks, bonds, cash, precious metals, bitcoin, and a flex option. Based on risks and trends, the current construction is: (see more details here)

Stocks - Vanguard Mega Cap Index Fund ETF (MGC) - 10%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 25%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 15%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 12.5%/12.5%

Flex - 0%

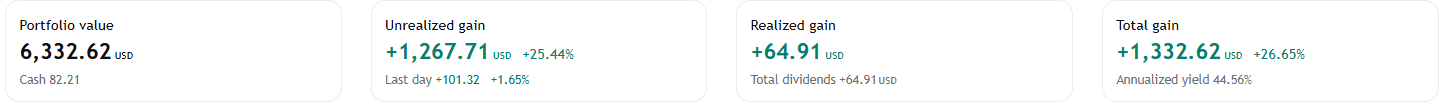

Since July, the portfolio has continued to outperform the S&P 500 benchmark, returning 15% vs 7.1% SPX. Since the March inception, the portfolio has outperformed by 11%.

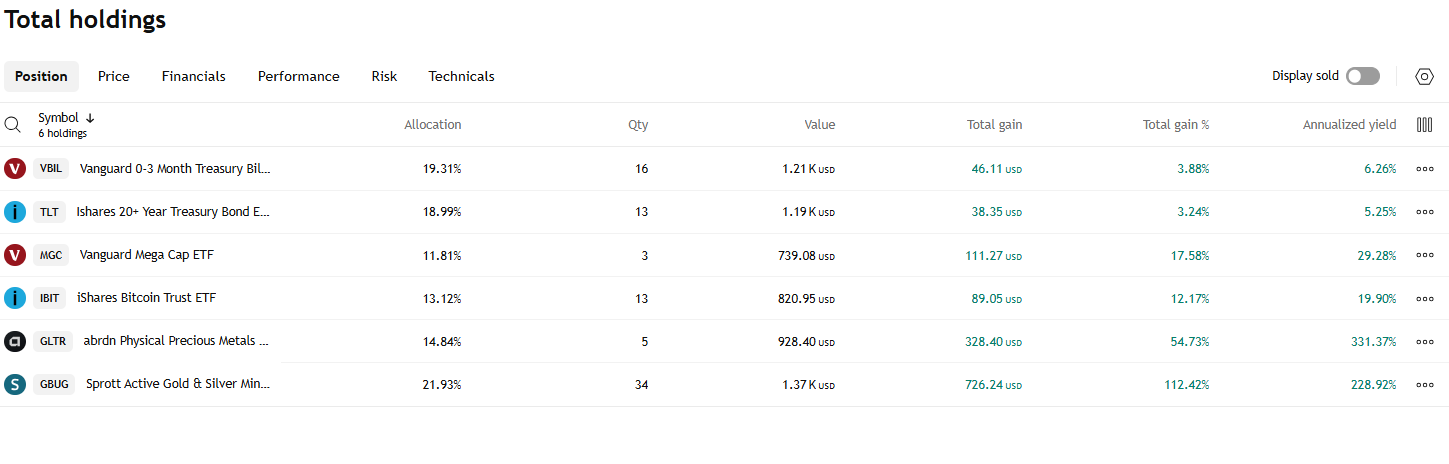

Bonds and cash have only provided modest returns, but they provide stable income and risk management. MGC (stocks) has returned 17% since March, which is very high, so a correction would not be surprising. IBIT (Bitcoin) has provided good returns since March as well. Most risk assets have been going up over the last few months, but precious metals have been exceptional. GLTR (physical metal) has returned 55% and GBUG (mining companies) has returned a whopping 112% since March.

Allocations have become distorted due to this, and it is prudent to rebalance holdings back to the target weight. Further, due to the Bitcoin 4-year cycle coming to a close this month, it is prudent to be cognizant that this is when the “crypto winter” bear market usually starts. This cycle isn’t gospel, but it is still prudent to reduce the allocation to 10%. This will coincide with an increase in cash (VBIL) to 30%. New target weights:

MGC: 10%

VBIL: 30%

TLT: 25%

IBIT: 10%

GBUG/GLTR: 12.5/12.5%

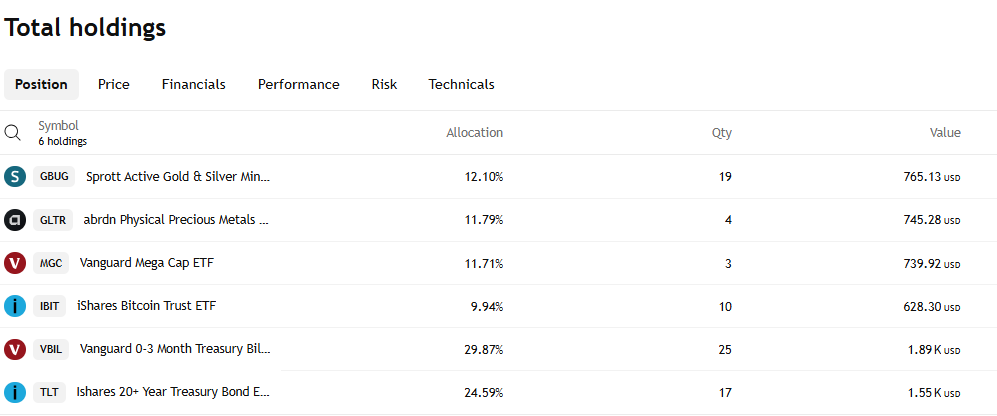

To rebalance to the new target weights, some VBIL and TLT were bought, while some IBIT, GBUG, and GLTR were sold. Here are the updated amounts.

It may feel easy to pat myself on the back, but I know that this is a short timeframe and know that it will be impossible to keep outperforming to this extent forever. In the future, as credit spreads increase and key levels break in the stock market, I will look to rotate more stock exposure into TLT. I will also look to trim back IBIT as well. Precious metals look poised for a correction, but could very easily keep the overall bull trend intact.

I did not add any “flex” portfolio options this time, but things I’m keeping my eye on are uranium miners (URNM) and rare earth miners (REMX) for entry on a pullback. I may add stock sector rotation plays in the future, for example, consumer staples (XLP) or energy (XLE) that are less popular at the moment.

Most retirement funds are not actually diversified, holding mostly stocks and some bonds. The diversification they do is just different sectors of stocks, which often just hampers their returns compared to SPX and leaves the portfolio no better hedged against downside. This portfolio is free from those constraints, gaining real diversification from alternative assets like metals, yielding superior returns from bitcoin, not overinvesting in an overvalued stock market, allowing you to hold long-term treasuries as a recession bet, and holding cash for risk management. Back soon for more portfolio updates.

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView