Model Portfolio: Update #2

November 2025

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

The model portfolio started in July 2025 and has 5 main components: stocks, bonds, cash, precious metals, bitcoin, and a flex option. Based on macro risks and trends, the current construction has been: (see more details here). [Updated allocations at the end]

Stocks - Vanguard Mega Cap Index Fund ETF (MGC) - 10%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 30%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 10%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 12.5%/12.5%

Flex - 0%

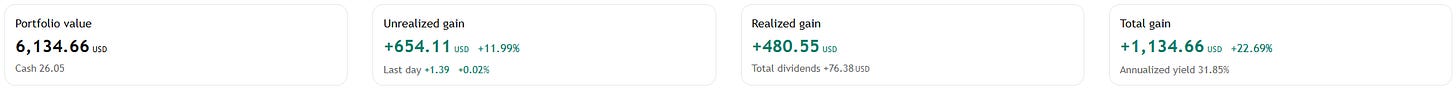

Over the last month, the portfolio is down 0.9%, slightly less than the market. Overall, we are up 22% vs 15% for the S&P 500. Including dividends and appreciation, our starting $5000 is now $6134.

This week, I’ll go over some more detailed technical analysis of each allocation and brief explanations as to the allocation adjustment rationale. Let me know if you like these additions. For more information on Elliot Wave Theory and my long-term technical analysis on the market, I urge you to read, Technically Speaking.

This is mostly thanks to exceptional gains in precious metals early in the year. Metals are in a correction currently. I expect another leg lower in the correction, although it is not necessary. On GLTR, we could see the price drop down to the 21-week moving average (~161), which would coincide with a standard C-wave target in Elliott Wave theory (orange box).

An asset similar to precious metals is Uranium. URNM is an ETF of uranium mining stocks, and may be slightly ahead of the precious metals complex. It already reached the 21-week moving average and finished a standard abc correction. While further downside is possible, strong wave 3 upside up to 85-100 may occur, with a clear stop loss at 37.29. I will take 5% of precious metals and shift to uranium miners.

Bitcoin has gone down 21% in the last month, which has not helped the portfolio. Last month, I reduced the allocation from 15% to 10% due to it now being historically when the asset enters its cyclical bear market, which was a great call. With cyclicality and breaking of some resistance levels, it is time to further reduce the allocation down to 5%. If there is more speculative fervour in the markets and it goes back up, we are still exposed to stocks and some Bitcoin, so we will not fear missing out. Bitcoin presents too great a risk at the moment.

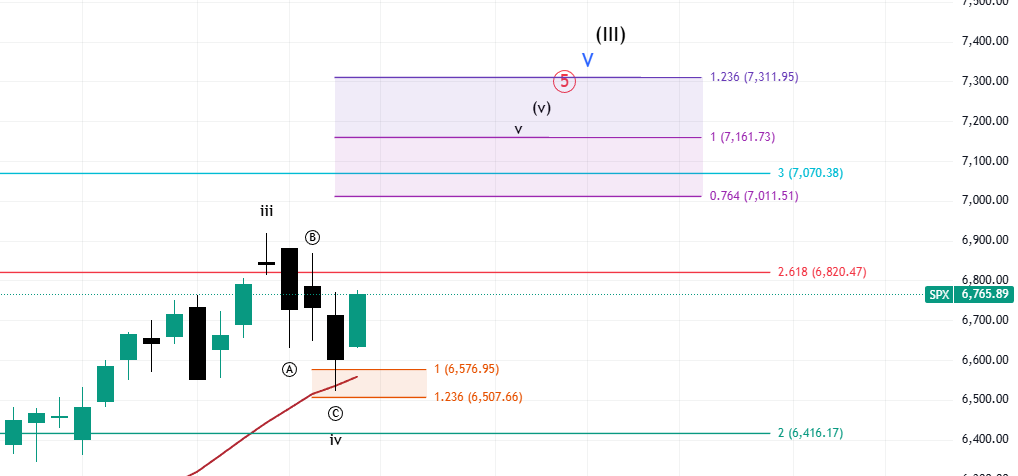

For the general stock market, I expect further upside and new highs as my base case. However, for many of the reasons discussed in the blog, the risk in the market is underappreciated, and upside with respect to that risk warrants a smaller allocation than most retirement portfolios allocate. SPX reached the 21-week moving average and standard C-wave correction. Common targets for the final wave 5 to new highs in the 7000s are 7070-7161. This is my base case, but anything can happen.

I hold MGC because it has a higher percentage of large-cap stocks, which benefit from passive flows and stock buybacks, themes discussed on The Gray Area. One sector that has been underperforming the general market is consumer staples (XLP). This ETF consists of companies like Walmart, Procter and Gamble, Coca-Cola, Phillip Morris, Altria, and more. XLP is a defensive sector that has less risk and downside during a recession. This is because the companies tend to have steady earnings, are less speculative, and retain earnings better during economic slowdowns. I will reallocate 5% of the speculative Bitcoin position into XLP due to the safety/quality and potential sector rotation.

Treasury bonds (TLT) are a staple of the portfolio currently to reduce risk and add dividend income. The downside is offset by dividends, and the upside is attractive given the recession likelihood. TLT has been extremely boring, stuck in sideways price action since 2022. On the chart, this materializes as a triangle formation. As we are nearing the end, a breakdown or breakout is likely. If a recession happens soon, I expect a quick C-wave to 102-110. If we get a melt-up in stocks and recession fears are quelled for some time longer, the alternative case down to 75 is possible. Until then, expect a boring grind sideways.

Last week, I mentioned oil companies (XLE) and rare earth metals mining companies (REMX), which may still be good investments, but the oil market could have some downside if economic conditions further deteriorate. Rare earth metals, like precious metals, may have further in their correction before a great buying opportunity. I am holding off on these for now. I will look to reduce Bitcoin and stock exposure in the future if conditions warrant.

Most retirement funds are not really diversified, holding the S&P 500 index primarily and price agnostic to valuation and recession risk. Given the macro risks I’ve discussed on The Gray Area, and especially for those near retirement years, this allocation is extremely risky. Most are also unable to benefit from real diversification in other assets like metals and Bitcoin. Here, we actively manage risk with cash/bonds and diversify with alternative assets like metals/Bitcoin.

The new portfolio target allocation:

Stocks - MGC, XLP - 10%/5%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 30%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 5%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 10%/10%

Flex - Sprott Uranium Miners ETF (URNM) - 5%

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

Great info, thanks.