🔋Moody May

Deficits may be a problem, but does US creditworthiness even matter?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

The US sovereign debt creditworthiness has been downgraded by the rating agency Moody’s. They were the last of the three major rating agencies to downgrade the US, others being Fitch (2023) and S&P (2011). If you or I had the credit history of the US government, we’d get thrown in jail or be homeless, but governments work differently. Is the world starting to wake up to the long-term US debt issues, or is this just another nothingburger?

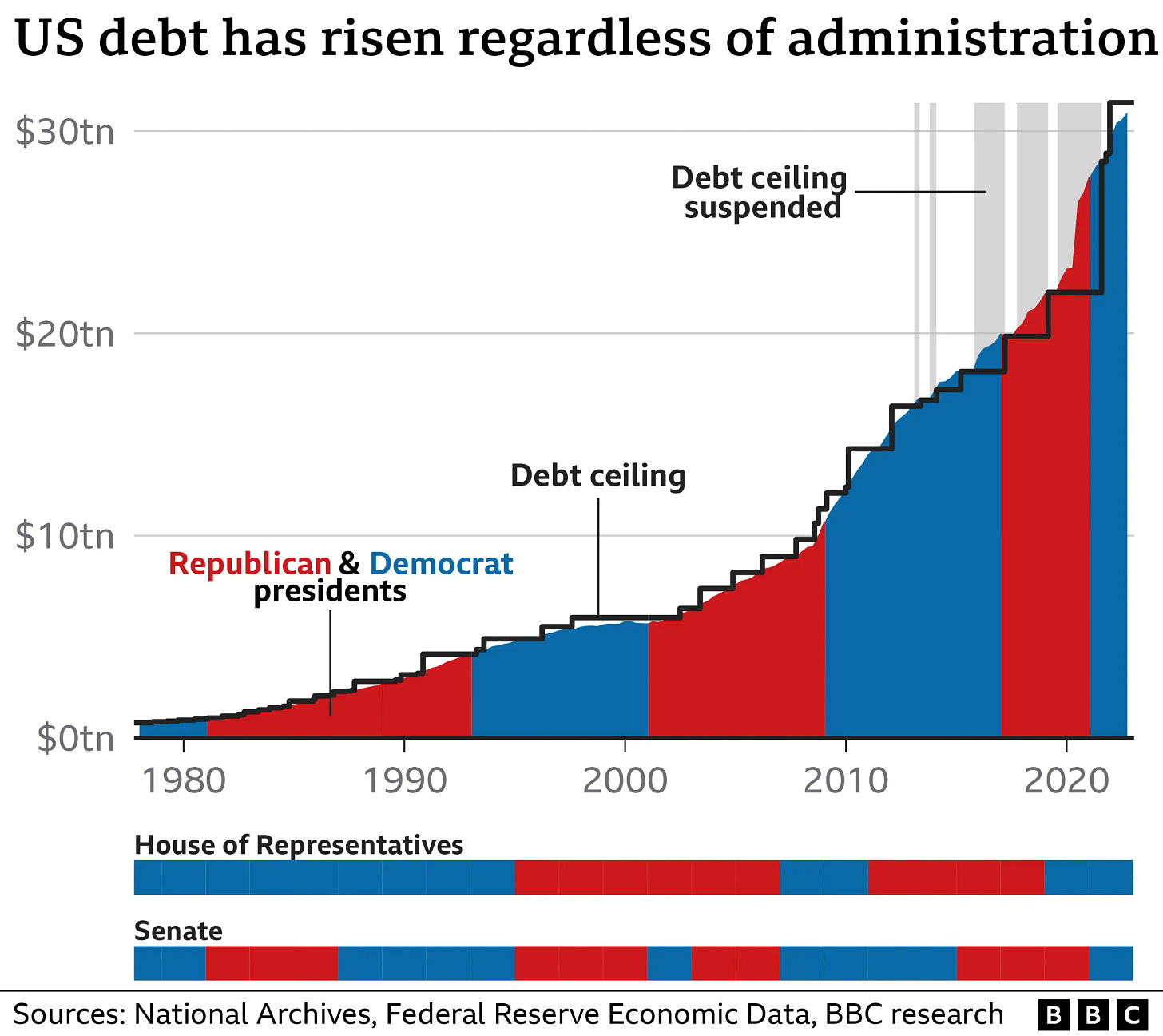

This comes as the extension of the Trump tax cuts is being debated in Congress. While this is being used as political fuel, the last two downgrades came under democratic presidents. To be clear, it doesn’t matter which political party dominates the executive or legislative branch, as both are contributing to an exponentially increasing US debt level.

I’ve written extensively about the issues with the US debt in the past, especially in my Debt series. Back in 2023, it was noticeable that alongside rising interest rates, the interest expense for federal debt would surpass $1 trillion per year as new bonds are issued to fund the government. With tax receipts already barely enough to cover mandatory spending, this has added another source of burden on the US balance sheet. [Debt pt. 1]

The issue with interest rates doesn’t end there, as the US has the great privilege of the biggest bond market in the world. People, companies, and countries hold US debt because it is safe and trustworthy. Unfortunately, the bondholders are getting fooled in real terms because inflation is outpacing nominal interest rates (negative real interest rates). [Debt pt. 2]

This is financial repression, or the real reason interest rates are manipulated lower. It is the most pernicious of the 5 ways to lower a nation’s debt burden. You’ve heard the others, all out of the Trump administration. Reducing spending/austerity is one way to reduce the debt/deficit. With much of the economy dependent on government funding, it could have the opposite effect if done carelessly. Taxation is the next step, which can increase government revenues and reduce the debt. Trump does not plan to raise domestic taxes, but tariffs are nothing but a tax on imports. Raising taxes also runs the risk of decreasing productivity if pushed too high. Increasing productivity is another way to reduce the debt. The Trump administration this week has been discussing how they’re policies are going to help the economy grow faster. Technology improvements and cheaper labor have helped this, but unfortunately, in aggregate, we should expect lower growth going forward despite the Trump administration's claims. These are all the desperate ways to avoid the final way, which is outright default. Owners of assets are wiped out, collateral is returned to creditors, and major historic changes occur (think 2008 financial crisis). [Debt pt. 3]

Other than de-globalization, which was prescient, the last piece my debt series discussed was the rise of populism. Trump is a populist by definition, owing his rise to power to the common folk/domestic working class who have gotten the short end of the stick with real wages not keeping up with inflation and productivity gains over the last few decades. While some may not agree, Trump is not the same as Hitler, Stalin, and other populists that arose out of the post-WWI era. What we may have to worry about is worse populists that may arise around the world, though if political and economic issues aren’t truly resolved. [Debt pt. 4]

The Moody’s debt downgrade doesn’t matter. Yes, there are serious issues with the debt and the solutions proposed to solve them, but that doesn’t mean that anything has changed in the short term. The US still has the biggest and most trustworthy bond market in the world. With the reserve currency, biggest consumer economy, biggest military, best companies in the world, and highly trusted financial institutions, there is no safer bond to park your money.

People worry that bond yields jumped higher on the news, but one day later, they are back down. Bonds will trade according to economic growth and inflation. These are both trending lower and will go faster if we hit recession. As long as the US has the reserve currency and the biggest military, dollar flows will go into bonds even if they are being devalued on a real basis.

You alternatives? Gold, Bitcoin, Euro bonds, Chinese bonds, stocks? Take your pick, but they all come with significantly more risk, which on an institutional/government scale is not realistic. Even if you want to buy Chinese bonds, you can’t. Most people still want to own US bonds regardless of the financial repression and fear caused by debt downgrades like Moody’s. Soon, capital controls could even force you/institutions to own US treasuries. Either way, the debt downgrade is utterly meaningless unless there are some cataclysmic changes to the global financial order. That doesn’t mean it’s right or everything is totally fine; it is just how it is. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

Default or hyper-inflate the economy to reduce the relative debt. We're close to the magic 130 percent of GDP which has historically caused trouble in other nations. I think Japan is way beyond that though so we may be able to kick the can down the road for some time if the world economy doesn't tank another way