🔋Mo Money, Mo Problems

Record corporate profit margins should be a positive sign for the stock market, right?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

In Time To Concentrate, I showed that the US stock market is as concentrated as ever. The top 7 sized companies (Mag-7) make up 33% of the index. This statistic is usually correlated with major bubble peaks like the Great Depression, the Nifty 50, and the 2000 tech bubble. This time around, instead of Pets.com contributing to the bubble, it is mostly blue-chip companies like Apple and Nvidia generating record profits. With record corporate profitability in quality companies, is there still cause for concern?

If you look at corporate profits alongside the S&P 500, the indices should go up in lockstep, as earnings are what drive growth and what investors are willing to pay for companies. Sometimes, there are periods where investors are willing to pay more than normal for companies. Currently, stock prices are extremely deviated from corporate profits, not seen since the 2000 tech bubble. The chart doesn’t go back this far, but I would bet that the Great Depression figure had a similar feature.

While this is a terrible timing device, it is one of those “not everything can go up forever” moments. How long will investors pay a premium over real earnings for stocks?

Mag-7 net profit margin was 25.8% in Q4, nearly double the S&P 500’s 13.4%. One idea could be that the smaller companies who are more sensitive to economic changes with less profits could see issues and cause a problem. This is possible as smaller companies refinance debt at higher levels. It is important to watch for credit issues as bankruptcies would change the market landscape. A great way to watch this and even be warned before major stock market corrections is through credit spreads.

Stock buybacks are another possible explanation for this, as they are set to be over $1 trillion this year. The idea is that the company finds no better investment than to purchase its own company. While perhaps they think this is the case, it is a scheme to pay corporate insiders by boosting earnings per share in the short term. Buybacks increase earnings per share in the short term, whereas investing in the company or other set returns generate longer-term value, and the bump to earnings per share is delayed. These are not some little things to enrich the executives, it has become massive. When you consider pensions & mutual funds, households, and foreign investors, stock buybacks make up 100% of the equity market’s net asset purchases and are done disproportionally by the mag-7.

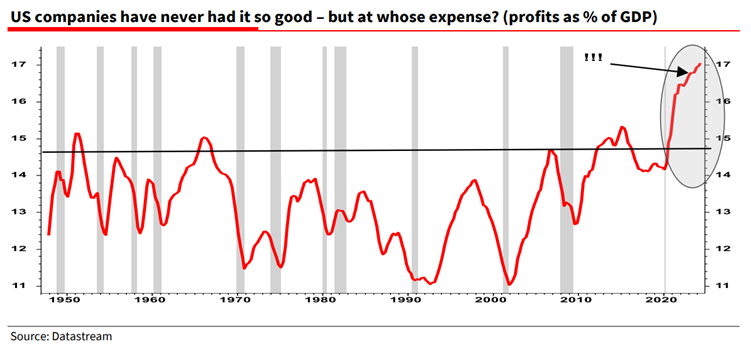

Even with respect to the economy, corporate profits are at historic levels. Profits as a % of GDP are at highs. You can see a trend change in 2000 where, instead of trending lower, the series began trending higher. It is impossible to ignore the increase in fiscal deficits and intervention into the economy that has an effect on corporate profitability as well.

Record corporate profit margins in the US have certainly helped the success of stock prices over the same period, although prices have gone up faster than net profit margins, leaving questions about the dislocation. Fiscal deficits have been exorbitant since 2020, which has been one important driver. Since profits for the Mag-7 have increased faster than the rest of the index, it implies that other factors are at play. One factor is the natural selection that the top companies are the best; the deviation from long-term trend suggests this is not normal. Stock buybacks (boosted by passive flows) boost short-term earnings per share, which is a big portion. Since this represents 1 trillion dollars this year and 100% of net asset purchases, it is certainly contributing to the blowout in earnings.

Instead of investing in research, expansion, or other business ventures, companies are repurhcasing shares at a record pace against a backdrop of record fiscal deficits. This has been a recipe for success for corporate profits. Despite this, stock prices have ballooned even higher than these record net profit margins can support. With overvaluation, buybacks are not likely to provide future growth to the same extent, and with questions about the federal government fiscal spicket, stocks will have to go back to trends at some point. What will cause buybacks to slow, fiscal spending to slow, passive flows to slow, and the overall economy to slow? It is more of a question of why and when, rather than if. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!

Thanks for reading The Gray Area! Subscribe for free to receive new posts and support my work.

The thing that gets me about buybacks is all that wealth vanishing if the stock market crashes for a long period (long recession/depression) when having cash to cushion the business is so important.

I would push back a bit against the point about share buybacks. While I understand the point that they are effectively short-circuiting the hierarchical capital structure and potentially focusing on short-term gains at the expense of long-term profits, there is another way to look at it. If the company cannot generate sufficient returns with its current cash, it is prudent to return that cash to shareholders. This can be done in the form of a dividend, but it can also be done via share buybacks which are more tax efficient than dividends. Considering the people that sold their shares in the buyback program (i.e. the other side of the transaction a la Mises), they are now enable to re-allocate capital in a way that they see as more meaningful for generating long-term value. However, I do appreciate the nuance that those who are most likely to sell in a buyback are probably the most likely to seek out the type of short-term opportunities that result in long-term value destruction and bubbles which are encouraged by artificial interest rates, but nonetheless, the buyback mechanism itself seems to be a well-founded market mechanism.

Let me know if you disagree and if I am missing something.